Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Discover Personal Loans Review

Discover personal loans come with a low minimum APR and flexile repayment terms. Plus there are no fees except for a late payment fee. These loans are also flexible and can be used for virtually any purpose, including home improvement, debt consolidation, and wedding costs.

Founded in 1986 and headquartered in Riverwood, Illinois, Discover is one of the largest credit card issuers in the U.S. In addition to credit cards, the company offers bank accounts, mortgages, student loans, unsecured personal loans, and a number of other financial products. A Discover personal loan is worth considering if you have good credit and are looking for a flexible loan with low rates and minimal fees.

Summarized Rating

This parameter considers loan term lengths, loan minimums and maximums, and the extent of loan use limitations. Each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Discover gets a below average 3.3 for Loan Features, which is attributable to its somewhat flexible term lengths and relatively restrictive loan amounts. The absence of any loan use limitations provides a boost to the score.

Discover Personal Loans Pros and Cons

Discover personal loans pros

Discover personal loans cons

Types of Personal Loans Offered by Discover

Discover personal loans are designed for a variety of purposes. If you have an upcoming home improvement project like a kitchen remodel or roof replacement, for example, a Discover personal loan may come in handy.

You can also use it to cover an emergency expense like a car repair or medical bill. Additionally, if you have high-interest credit card debt, you can take out a Discover loan to consolidate it and improve your financial situation. While Discover personal loans are flexible, you can’t use their proceeds on post-secondary education expenses or the repayment of a secured loan or Discover credit card.

| Common loan uses | Prohibited uses |

| Debt consolidation | Post-secondary education |

| Auto repairs | Secured loan repayment |

| Wedding costs | Discover credit card repayment |

| Vacation expenses | |

| Adoption and fertility costs | |

| Small business expenses |

Discover Personal Loans Features

If you move forward with a Discover personal loan, you’ll be able to choose from five different repayment terms. The 36 month option might make sense if you hope to repay your loan sooner.

On the flip side, the 84 month term may be a good fit if you’d like to take your time paying back your loan and wish to spread out your payments. Just keep in mind that this will cost you more in interest.

Since Discover personal loans only go up to $35,000, you may need to find other funding sources if you have a larger expense that exceeds that amount. Also, if you only need a couple hundred dollars to cover something small, these loans won’t help as the minimum amount is $2,500.

| Loan terms | 36, 48, 60, 72 and 84 months |

| Loan amounts | $2,500 to $35,000 |

| Loan Use Limitations | Can’t be used for post-secondary education or the repayment of a secured loan or Discover credit card |

Discover Personal Loans Interest Rates and Fees

One of the most noteworthy benefits of Discover personal loans is the fact that they don’t charge many of the fees you’ll find elsewhere. While you do have to pay a $39 late fee for any payments you miss after a three-day grace period, you won’t have to worry about origination or application fees. You can also repay your loan early and save on interest as there are no prepayment penalties.

| Borrowing/Origination Fees | None |

| Prepayment Fees | None |

| Late Payment Fees | $39 late fee for missed payments after a three-day grace period |

| Other Fees | N/A |

| Interest Rates | 5.99-24.99% |

Discover Personal Loans Qualification Requirements

To apply for a Discover personal loan, you must be at least 18 years old and a U.S. citizen or permanent resident. You’ll also need good to excellent credit. While Discover states applicants must have a minimum FICO score of 660, the average credit score of its borrowers is around 750.

In addition to solid credit, Discover looks for a household income of at least $25,000. Since Discover personal loans are only offered to individuals, co-borrowers and co-applicants are not accepted. Therefore, if you don’t have the best credit history, you might want to improve it before you apply for a Discover personal loan.

| Membership Requirement | None |

| Minimum Credit Score | 660 |

| Income Requirements | $25,000 annually |

| Co-signer/Joint Application Requirements | Not available |

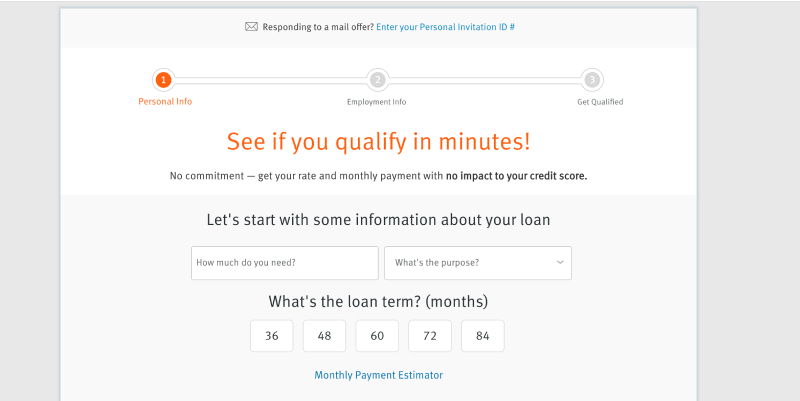

Discover Personal Loans Application Process

To apply for a Discover personal loan, follow these steps.

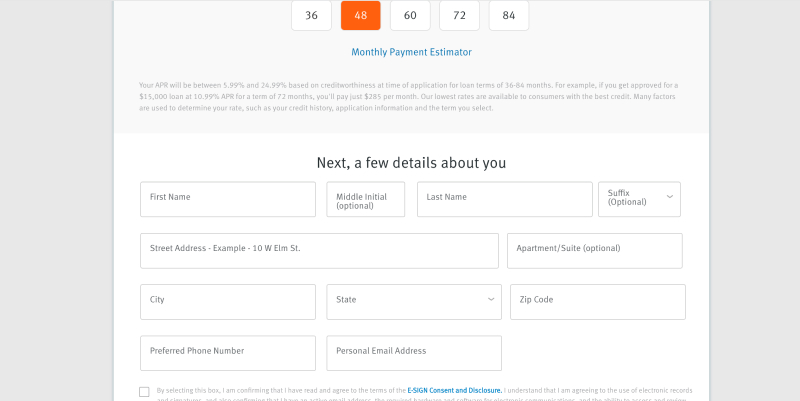

Understand your monthly payments: Use Discover’s loan payment calculator to find out how much your monthly payments might be if you commit to a loan. Enter your loan amount, preferred loan term, and credit score range. Once you do, you’ll receive an estimated APR range and monthly payment range. Remember that these figures are estimates and not guaranteed.

Prequalify: Thanks to Discover’s online prequalification process, you’ll know your actual rate before you formally apply for a personal loan. Since it won’t affect your credit score, prequalifying can help you compare offers with no risk.

Fill out application: If you wish to pursue a Discover personal loan, you’ll need to complete the formal application process online. Note that during this step, a hard credit inquiry will be made and might cause your credit score to dip temporarily. If you’re using your loan for debt consolidation, be prepared to share creditor account balances and numbers.

Wait for a decision: Once you submit your application, you can keep tabs on the status of your application via the Discover online portal. As long as you complete your application accurately and thoroughly, you may receive a decision the same day.

Sign the loan agreement: Upon approval, read your loan agreement closely. Reach out to Discover if you have a question or need clarity. When you accept the terms and conditions of the loan, sign on the dotted line.

Receive funds: While Discover may distribute the funds via direct deposit as soon as the next business day, the funding process may take up to seven days. If you’ve taken out a debt consolidation loan, Discover will pay your creditor directly.

Make payments: Be sure to repay your loan as stated in the loan agreement. You can do so automatically or through the online account center. Payments may also be made via phone and mail. Remember you can change your payment date twice over the life of the loan.

Discover Customer Support

- You can speak to a U.S. based Discover loan specialist via phone seven days a week. Call 1-866-248-1255 any time from 8 a.m. to 11 p.m. ET Monday through Friday and from 9 a.m. to 6 p.m. ET on Saturdays and Sundays.

- If you prefer to connect to a loan specialist online, you can log into your account and send a secure message.

- The Discover website features a frequently asked questions section that can provide you with more information on loan qualification, loan application, verification and funds disbursement, loan repayment, and more.

- There’s also a resource center on the site, complete with useful articles, infographics, polls and quizzes, and videos.

Discover Personal Loans Online Reviews

Discover Financial Services holds a 2.0-star rating on Trustpilot with a little over 130 reviews. It’s important to note that most of the negative reviews are from credit card and banking customers.

Satisfied personal loan borrowers praise Discover’s easy application process, quick approvals, and helpful customer service representatives. Those who are displeased with Discover personal loans mention deceptive lending practices and closed accounts. They also state that they were denied despite having good credit and a stable income.

One reviewer had the following to say about their experience with Discover:

“Even with a FICO score of 793, a pre-approval, and a formal approval, you can be denied during review without any real explanation. However, Discover does offer decent rates if you actually qualify and are willing to risk a hard inquiry on your credit report to find out. Also, the customer support and sales representatives are friendly to talk with by phone.”

| The positive reviews are related to | The negative reviews are related to |

| Convenient application process | Closed accounts |

| Quick approvals | Deceptive lending practices |

| Knowledgeable customer service representatives | Unexplained denials |

Discover Personal Loans Perks and Bonuses

Flexibility

- Discover offers flexible loan repayment terms of 36, 48, 60, 72 and 84 months.

- It also allows you to change your payment due dates to better align with your budget and circumstances. You can do so twice over the course of your loan. The only caveat is that at least one year has passed between these changes.

Transparency

- If you visit the Discover personal loan website, you’ll notice that the lender clearly discloses its rates, fees, and terms.

- There’s also a frequently asked questions section that answers important questions from borrowers.

- In addition, you may prequalify and find out what rates you might qualify for without any impact to your credit.

Technology

- You can manage a Discover personal loan via the secure online portal or mobile app.

- To repay what you borrow, you may enroll in automatic payments, set up wire transfer, or use electronic bill pay through your bank.

Discover Compared to Other Lenders

| Discover | 5k Funds | SoFi | Upgrade | |

| Loan Terms | 3 to 7 years | 3 months – 6 years | 2 to 7 years | 2 to 7 years |

| Loan amount | $2,500-$35,000 | $500 to $35,000 | $5,000-$100,000 | $1,000 to $50,000 |

| Interest Rates | 5.99-24.99% | 5.99% to 35.99% | 5.74-21.78% | 5.94% to 35.97% |

| Min Credit Score | 720 | Depends on the lender | 680 | 580 |

| Co-signers | Not allowed | Depends on the lender | Allowed |

Final Thoughts

As long as you have good to excellent credit, you can reap the benefits of Discover’s competitive rates, flexible terms, and minimal fees. You may use the proceeds of a Discover personal loan to meet almost any short or long-term financial goal.

However, if you have fair or poor credit, you might have to look elsewhere for a personal loan as strong credit is required and joint applications aren’t allowed. Also, if you need to borrow more than $35,000, you may be better off with a personal loan that comes with a higher maximum amount.