Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Fiona Personal Loans Review — A Network of Lenders Working for You

Fiona is a lending marketplace, giving borrowers access to multiple personal loan providers and other financial services. This means more options for personal loans, including competitive rates and favorable terms, which could save borrowers hundreds or thousands of dollars over the life of a loan.

Fiona is not a direct lender for loans but instead acts as a marketplace and matches borrowers with lending options based on the borrower’s credit score and loan needs. This saves time — and possibly money — since several lenders are competing for applicants and have the prequalification information up front. In addition to personal loans, Fiona offers a suite of other financial services, including student and auto loan refinancing, mortgages, and insurance products.

Summarized Rating

This parameter considers loan term lengths, loan minimums and maximums, and the extent of loan use limitations. Each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Fiona gets a best-in-class 5.0 for Loan Features. This reflects the platform’s highly flexible term lengths and loan limits and the absence of any loan use limitations.

Fiona Pros and Cons

Fiona Pros

Fiona Cons

Types of Personal Loans Offered by Fiona

Fiona gives borrowers access to a network of lenders in one place. These lenders have their own rates and terms but provide funding for a variety of uses. When you start the application process you will have the opportunity to choose the purpose of your loan, which will further match you with the appropriate lenders.

Common Loan Uses:

- Debt consolidation

- Credit card refinancing

- Home improvement

- Auto loans

- Medical and dental expenses

- Moving and relocation

Fiona Personal Loans Features

Because Fiona is a marketplace and not a lender, it puts borrowers in front of a wide range of lending options. Currently Fiona acts as a search engine and reviews options from over 30 lenders. This large network means a borrower has a better chance of finding the loan term, repayment period, loan amount, and use for the loan if they meet the criteria of the lender.

| Loan terms | Varies by lender |

| Repayment period | Varies by lender |

| Loan amount | Minimum $5,000, up to $250,000 |

| Loan Use Limitations | Loans can be used for a variety of events, including debt consolidation, large purchases, education, and taxes. |

Fiona Personal Loans Interest Rates and Fees

Fiona is not a direct lender, so this means the terms and fees of the personal loan will vary depending on the lender you select. The good news is there are no application fees or additional charges for using Fiona. Not only are there no additional fees, but using Fiona does not impact your credit score.

| Borrowing/Origination Fees | 1%-6%, depending on the lender |

| Prepayment Fees | Varies by lender |

| Late Payment Fees | Varies by lender |

| Other fees | Varies by lender |

| Interest Rates | Varies by lender |

Fiona Personal Loans Qualification Requirements

Fiona asks for your credit score and income information up front, to better match you with potential personal loan lenders. If you do move forward in the loan process with one of the suggested lenders, you are required to fill out further information. Each lender has a specific set of criteria, including credit score and minimum income requirements

| Membership Requirement | Varies by lender |

| Minimum Credit Score | Varies by lender |

| Income Requirements | Varies by lender |

| Co-signer/Joint Application Requirements | Varies by lender |

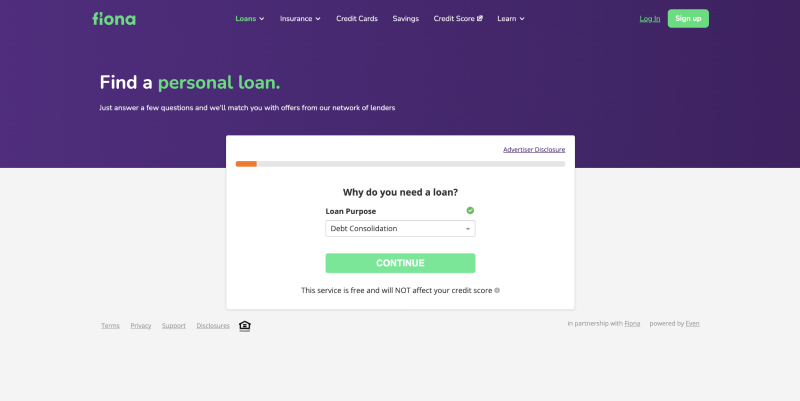

Fiona Personal Loans Application Process

One of the biggest advantages Fiona offers to someone is the easy navigation process to compare loans. Instead of searching each of these lenders and filling out an application one-by-one, you can input all the information in one form with Fiona and let Fiona do the marketing for you. The process is simple and straightforward.

First you select the loan purpose. The drop-down menu gives you several options to choose from, or you can select “other” if you don’t see the exact purpose listed.

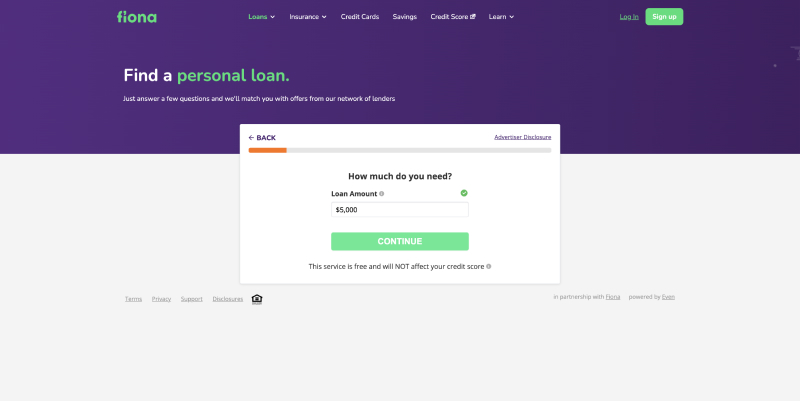

Next, enter the loan amount you need. The minimum amount is $5,000 and the maximum is $250,000.

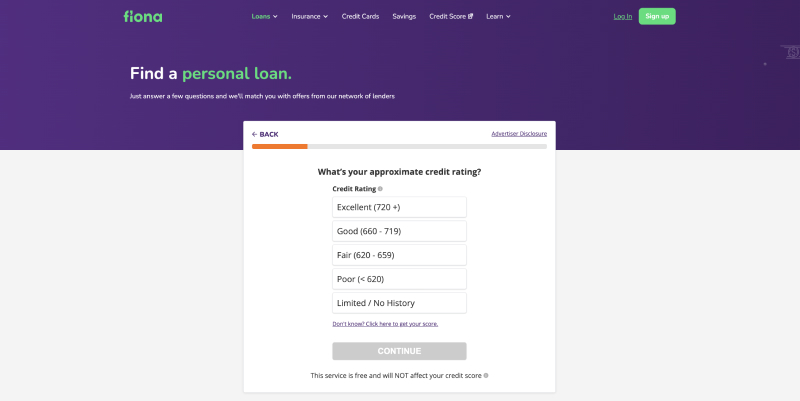

Next, you are asked to choose your credit score range. You want to select the range as accurately as possible so you’ll receive the best results based on your personal information.

Again, the advantage with Fiona is that using the search engine will not impact your credit score. The only time your credit report will be impacted is when you go through the loan process with the lender.

The next steps include submitting your email address, date of birth, first and last name, and home ownership or rental information. You will have to provide other personal details too, including your phone number and physical address.

Once all the information is entered, you’ll be sent any lenders you pre-qualify for. This does not guarantee approval, but it gives you a smaller network of lenders to compare multiple loan options with.

Fiona Customer Support

Fiona offers a few options for customer support to help you in case you need assistance during the inquiry process. The first option is to use the contact form online. Fiona adds it tries to respond to all inquiries within 24-48 hours. You can also email customer support at help@hifiona.com or reach them by phone by calling 1-(800) 614-7505 (the hours of availability are not listed).

| Fiona customer support options |

| Contact form |

| Contact form |

| Contact by phone: 1-(800) 614-7505 |

Fiona loan reviews, specifically with customer service, through Trustpilot are generally highly favorable. Most Fiona reviews comment on how responsive the customer service is and helpful throughout the initial inquiry process.

“The customer service was excellent, they helped navigate through the process and every second was accounted for. Smooth process, no lengthy paperwork and very easy.” - Walker, TrustPilot review

“Great customer service from start to end!! Thanks” - Mary, TrustPilot review

Fiona Personal Loans Online Reviews Fiona Personal Loans Online Reviews

TrustPilot not only summarizes the customer experience of Fiona users, but other aspects too. There are several reviews available and Fiona receives a 4.4 out of 5 star rating. The positive reviews mostly center around how simple the website is to use. Users found they were able to get results within minutes in some cases.

However, it’s possible Fiona worked a little too well for some people. The negative reviews were mostly about the amount of solicitations from the lenders once the information was submitted

Some users might find the number of calls, text messages, emails or letters overwhelming, which some people were not expecting. On the other end of the spectrum, some users were unable to match with any lenders, which left them disappointed that Fiona was unable to provide any results.

| The positive reviews are related to | The negative reviews are related to |

| Quick and easy process, received results in minutes | Volume of solicitations you might receive from lenders, including texts, calls, letters, and emails |

| Convenient | Some users were unable to match with any lenders |

| Easy to use website | |

| Received quality recommendations |

Fiona Personal Loans Perks and Bonuses

Because Fiona is using your personal information to match you with lending options, it’s important the process is as user friendly and transparent as possible. Examples of transparency include:

- Professional website that is informative and intuitive to use

- No misleading advertising or conflicting information on the site

- The user is told how their personal information is used in the process

- Customer service information is easily accessible and offers a response time

Fiona Compared to Other Lenders

There are a multitude of options for personal loans, but how does Fiona compare to other online-only lenders?

| Fiona | Upstart | OneMain Financial | Payoff |

| Loan Terms | 3 year or 5 year | 24, 36, 48, or 60 Months | 2 to 5 years |

| Loan amount | $1,000 - $50,000 | $1,500 - $20,000 | $5,000 - $40,000 |

| nterest Rates | 5.22% - 35.99% | 18.00% – 35.99% | 5.99% - 24.99% |

| Min Credit Score | None | Not specified | 550 |

| Co-signer Requirement | No | No | No |

Final Thoughts

Searching for a personal loan lender can be downright exhausting. The sheer number of online lenders means hours spent filling out online applications and inquiries, only to find out a lender may not meet your needs or you might not meet their requirements. Fiona takes some of this guesswork out of it and lets you present your information to a network of lenders. From there you can fastrack through the prequalification process and find the right lender for your personal loan preferences. Fiona personal loans offers an easy solution to work through the overwhelming number of online options for lending.

FAQs

This app literally changed my like. It provides a great experience. I absolutely love it!