Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

FreedomPlus Review: Debt Consolidation Made Easy

Online lenders have made the process of applying for a loan quick and easy. But one thing is missing from the experience. Some consumers still prefer to work with an expert when they’re considering a loan.

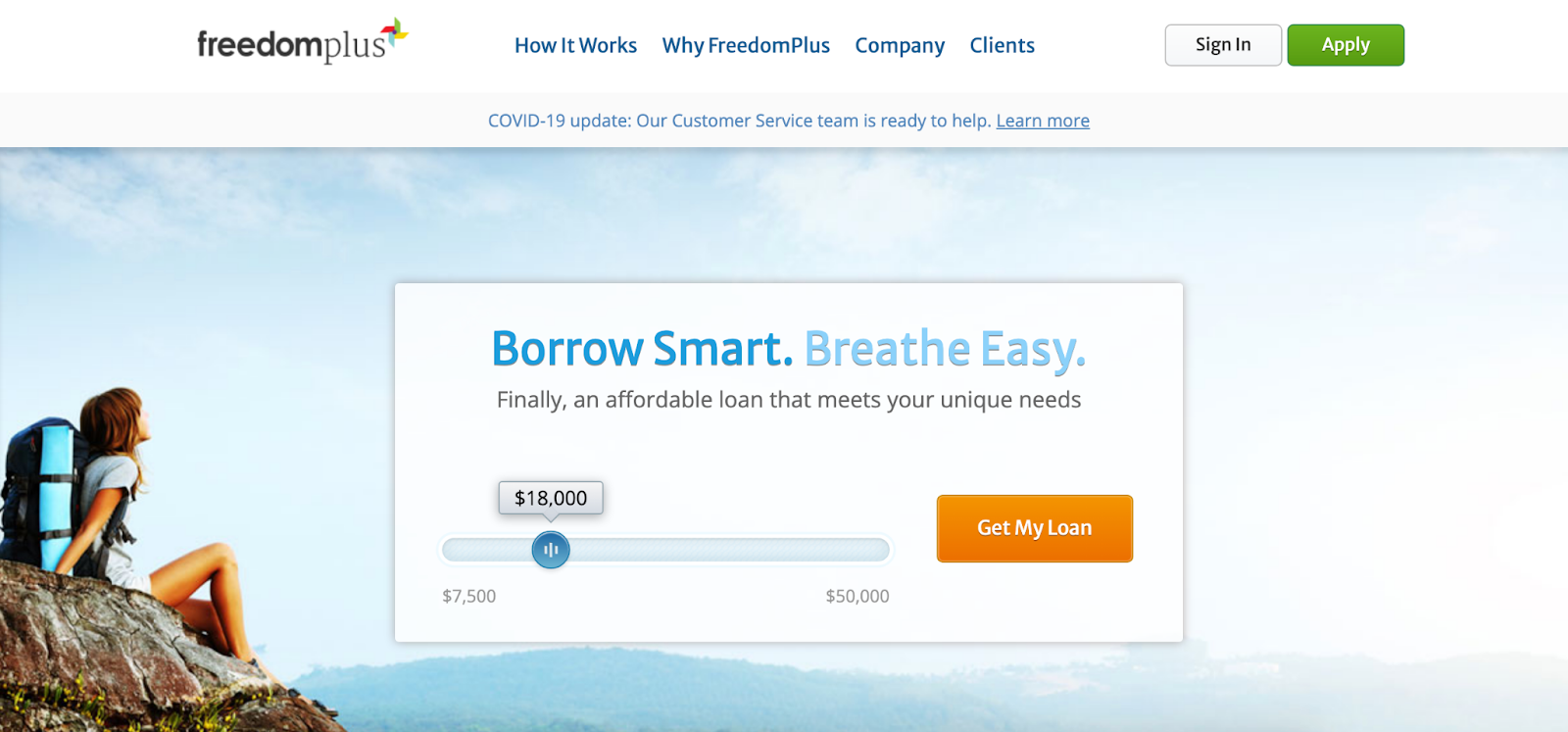

FreedomPlus offers personal loans in amounts up to $50,000, making it ideal for those seeking high-dollar loans for debt consolidation or home improvement projects. But FreedomPlus isn’t for everyone. This FreedomPlus Review will go over its top features to help you decide if it’s the right choice for you.

Summarized Rating

This parameter considers loan term lengths, loan minimums and maximums, and the extent of loan use limitations. Each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

FreedomPlus gets a subpar 2.5 for Loan Features. This reflects the lender’s average term lengths and somewhat restrictive loan limits.

FreedomPlus Pros and Cons

FreedomPlus Pros

FreedomPlus Cons

Types of Personal Loans Offered by FreedomPlus

FreedomPlus personal loans are available for a variety of purposes, but the $7,500 to $50,000 range makes it more popular for high-dollar activities like debt consolidation.

Common Loan Uses

- Credit Card Refinancing

- Debt Consolidation

- Home Improvement

- Wedding

- Travel/Vacation

- Medical Expenses

- Auto Purchase

FreedomPlus Features

Flexibility sets FreedomPlus loans apart from others. You pick the day of the month your payment is due, and if you ever want to change it, you can easily do so, with a limit of six changes per year. FreedomPlus doesn’t offer loans for lower dollar amounts, and you have to fill out a quick preliminary application and wait for a call from a loan consultant to learn what your rates will be.

| Loan terms | 24 to 60 months |

| Repayment period | Monthly with adjustable dates |

| Loan amount | $7,500 to $50,000 |

| Loan Use Limitations | Can’t be used for student loans |

FreedomPlus Interest Rates and Fees

FreedomPlus offers competitive interest rates, ranging from 7.99% to 29.99%. These rates are competitive, but it’s tough to know what your exact rate will be until you speak to a loan officer after your initial application. There’s also a loan origination fee ranging from 1.99% to 4.99%, taken from the loan amount.

One of the best things about FreedomPlus’s loans is that you can set your payment due date and even change it from time to time. FreedomPlus offers autopay to help you ensure your payment is made on time each month. If your FreedomPlus loan payment is ever late, you’ll pay either $15 or 5% of the amount due, whichever is higher.

| Borrowing/Origination Fees | 1.99% to 4.99% |

| Prepayment Fees | None |

| Late Payment Fees | The greater of 5% of the amount due or $15 |

| Other fees | None |

| Interest Rates | 7.99% to 29.99% |

FreedomPlus Qualification Requirements

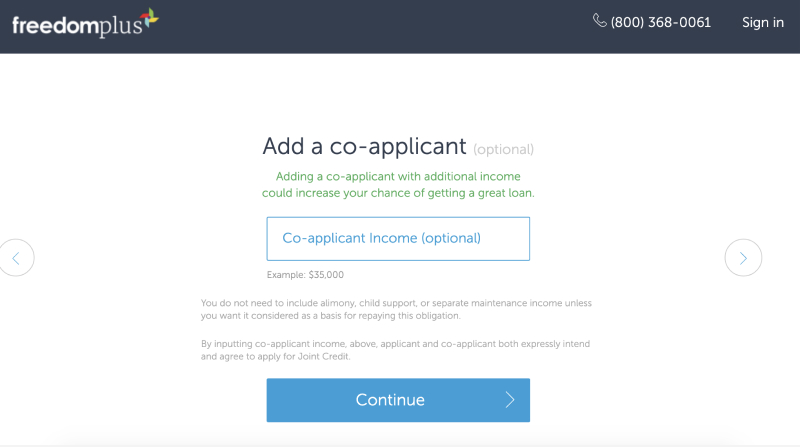

When it comes to FreedomPlus loan requirements, you’ll find it’s easier to qualify than with many other lenders. As long as you have a credit score of 620 and your debt is only 45% of your income, you can qualify. However, you’ll boost your chances of getting a better rate if you take advantage of another feature not commonly offered by lenders. You can use either a co-borrower or a co-signer with FreedomPlus loans.

One great thing about FreedomPlus loans is that they prioritize loans that are being used for debt payoff. If at least 85 percent of the funds will be used for debt consolidation or credit card payoff, you could qualify for a lower rate than someone with the same qualifications who doesn’t specify that loan purpose.

| Membership Requirement | None |

| Minimum Credit Score | 620 |

| Income Requirements | Minimum debt-to-income ratio of 45% |

| Co-signer/Joint Application Requirements | Joint applicants and co-signers allowed |

FreedomPlus Application Process

To start your prequalification with FreedomPlus, head to their homepage and click Apply. You can also toggle the slider in the center of the page to the amount you want to borrow and choose Get My Loan to skip the borrow amount question on the first page.

If you didn’t choose the income amount on the main page, you’ll need to toggle the slider to the amount you want to borrow. You can request between $7,500 and $50,000. You can select your loan purpose from a long list. There is an “Other” option, but the list includes everything from debt consolidation to moving expenses.

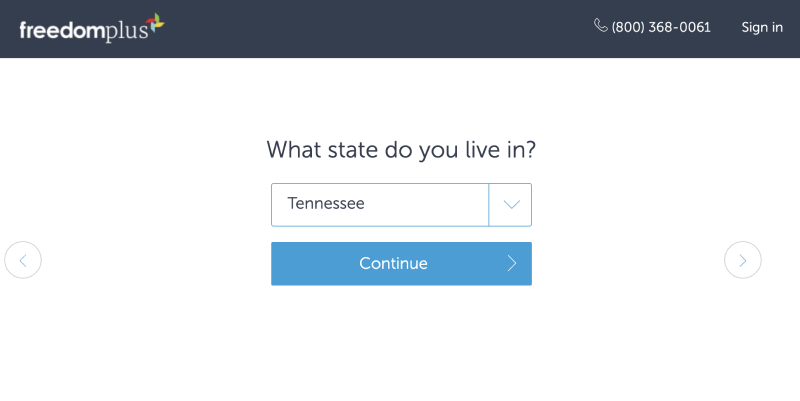

Next, you’ll pick your state from the drop-down box. Freedom Loans aren’t available in Colorado, Connecticut, Hawaii, Kansas, New Hampshire, North Dakota, Oregon, Vermont, West Virginia, Wisconsin, or Wyoming.

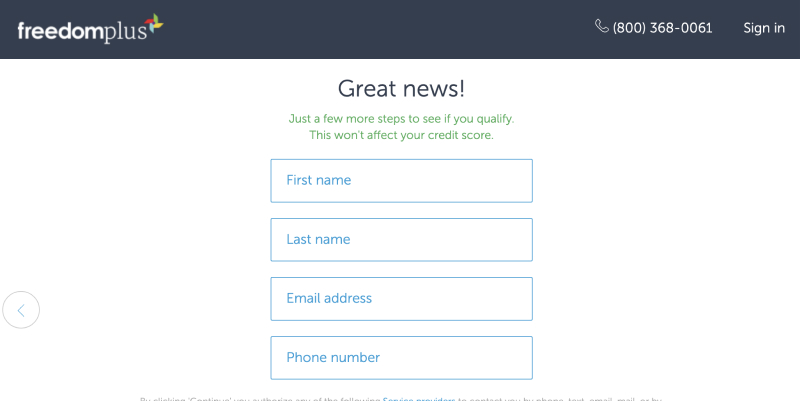

You’ll then be asked for your contact information. Be sure to read the fine print. By inputting your phone number, you authorize FreedomPlus to contact you using an automatic dialing system, even if you’re on a do-not-call list. FreedomPlus will then ask for your employment status and verifiable income.

You’ll next need to enter the part of your annual income that can be verified. If you need to boost your income to qualify, include alimony or child support in addition to your employment income.

Applying with a co-applicant can increase your chances of qualifying at a lower interest rate. If you have a co-borrower, input that person’s income in the next step.

You’ll need to enter your zip code and birthdate. Hitting “continue” authorizes FreedomPlus to obtain credit information on you from Experian. At this point, your information will be reviewed and a FreedomPlus loan consultant will call you to discuss your application.

FreedomPlus Customer Support

At first glance, FreedomPlus reviews make it clear that customer support is where FreedomPlus stands out. After a quick application, you’re put in touch with a loan consultant who will give you one-on-one support throughout the process. In fact, most online reviews single out specific consultants by name.

“Had the pleasure of speaking with Lara S.,”

Another reviewer wrote on Trustpilot. “It was breathtaking how much time she took to understand my situation, dig deep into the numbers, and find stuff that I mistakenly left out to ensure I got the best rate for my loan.”

Your loan officer will contact you soon after your preliminary loan application is submitted. If you need customer support, you can call 1-800-455-6829 between the hours of 9 a.m. and 5 p.m. Arizona time, Monday through Friday.

FreedomPlus Online Reviews

FreedomPlus reviews are overwhelmingly positive, with customers especially praising the customer support they received from loan consultants. Many of the negative reviews relate to confusion over the interest rate customers will pay. In a few isolated incidents, negative reviewers reported that a full credit check was completed before they’d even been quoted a rate. Fast loan turnaround and ease of closing are also often cited in 5-star reviews.

Some of the negative online reviews can possibly be attributed to spammers. One reviewer reports being called out of the blue by FreedomPlus for a loan and having a credit check done anyway, despite turning down the offer. The Better Business Bureau reports, “FreedomPlus has learned that its company name, logos and trademarks—along with BBB’s logo—have been misappropriated and are being used by online criminals to facilitate a fraudulent loan scam.” When in doubt, call (800) 368-0061 to verify a loan offer has actually been extended.

| The positive reviews are related to | The negative reviews are related to |

| Friendly and thorough customer service | Confusion over rate quotes |

| Fast funding turnaround | Hard credit check before rate quote |

| Quick and easy closing process | Inadequate support after loan issued |

FreedomPlus Perks and Bonuses

Flexibility

Flexibility is where FreedomPlus stands out most. You set the date for your monthly FreedomPlus loan payment and if you ever want to change it, you can. In fact, you can change it up to six times a year. This is rare for a lender. But there are no autopay discounts or rewards with a FreedomPlus loan.

Transparency

Negative FreedomPlus reviews are few and far between, but transparency is a common theme among them. At issue is the fact that you have to complete a brief application and speak on the phone to a loan officer before getting a rate quote. But being able to discuss your loan with a consultant and answer questions about missing information is a big benefit for some people.

Technology

Although you can apply online, technology isn’t FreedomPlus’s forte. Their specialty is a more personal approach to lending. You can complete the full application process online, but there is no mobile app for managing your account later. You’ll go to an online portal to manage payments and view your balance.

FreedomPlus Compared to Other Lenders

There are plenty of options for personal loans, but FreedomPlus stands out for a few reasons. One is the lower credit score requirement, along with the option of adding a co-borrower or using a co-signer. These features are rare. You also can borrow a larger amount through FreedomPlus than you can other lenders, making them great for debt consolidation. If you’re using at least 85% of the proceeds for loan payoff, you may be quoted a lower interest rate than if you were taking a loan for home improvements or a vacation.

| FreedomPlus | Rocket Loans | Prosper | Upgrade | |

| Loan Terms | 24 to 60 months | 36 or 60 months | 6 or 60 months | 36, 48, 60, 72, or 84 months |

| Loan amount | $7,500 to $50,000 | $2,000 to $45,000 | $2,000 to $40,000 | Up to $50,000 |

| Interest Rates | 7.99% to 29.99% | 5.970% (with auto-pay discount) to 29.99% | 7.95% to 35.99% | 5.94% to 35.97% |

| Min Credit Score | 620 | 640 | 640 | 620 |

| Co-signer Requirement | Co-signers and co-borrowers allowed | No co-signers | No co-signers, but co-borrowers allowed | No co-signers, but co-borrowers allowed |

Final Thoughts

FreedomPlus is a great option for those looking for a debt consolidation loan. The higher loan limits and lower APRs for those using the funds for debt payoff make it a great choice. For other loan types, though, it’s important to compare quotes and make sure you’re getting the best rate available.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!