Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

NetCredit Personal Loans Review

NetCredit offers personal loans with flexible terms to borrowers with poor credit. With fast funding, NetCredit is tempting for many with bad credit. Other lenders with lower APRs might be a better fit for many with higher credit scores, but for those in an emergency, NetCredit is available.

NetCredit offers personal loans of up to $10,000 and lines of credit of up to $4,500. Both borrowing options come with sky-high APRs. Although the company works with bad credit borrowers, be prepared to pay extensive interest for the privilege.

If you are backed into a financial corner with no other options, borrowing from NetCredit is a quick way to get the cash you need. But the high interest rates could wreak havoc on your finances for years to come.

Summarized Rating

This parameter considers loan term lengths, loan minimums and maximums, and the extent of loan use limitations. Each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

NetCredit gets a below average 3.3 for Loan Features. This reflects the lender’s relatively unremarkable term lengths and loan limits. The absence of any loan use limitations provides a boost to the rating.

NetCredit Pros and Cons

NetCredit Pros

NetCredit Cons

Types of Personal Loans Offered by NetCredit

NetCredit offers personal loans and lines of credit. Essentially, a personal loan is an installment loan for a set amount that you pay back in regular increments. In contrast, a personal line of credit allows you to pull out funds when you need it.

Here’s how you can use NetCredit personal loan funds:

| Common loan uses | Prohibited uses |

|

Debt consolidation An unexpected expense A car repair A home repair |

Down payment on a home Paying college tuition |

NetCredit Loan Features

Before you consider any personal loan, it’s important to understand what you are getting yourself into. The exact details of your personal loan with NetCredit will depend on where you live and your financial situation. But in most cases, you can expect to be approved for a loan of $1,000 to $10,000.

The company offers repayment terms that range from 6 to 60 months. A nice feature of NetCredit is that you can customize your loan amount and duration to better fit your budget.

| Loan terms | No collateral required |

| Repayment period | 6 to 60 months, but varies widely by state |

| Loan amount | $500 to $20,000, but varies widely by state |

| Loan Use Limitations | No specific limitations. But regular personal loan restrictions still apply. For example, you can’t use the money for a home down payment or to fund college tuition. |

NetCredit Interest Rates and Fees

NetCredit operates in dozens of states. Its available terms, rates and fees will vary based on your location. No matter where you live, expect a very high interest rate if working with NetCredit. As a bad credit borrower, you might not find a better rate elsewhere, but it’s important to comparison shop to make sure you are getting the best deal.

Although there are minimal fees, regular late payments could add up to significant late fees.

| Borrowing/Origination Fees | 0% |

| Prepayment Fees | None |

| Late Payment Fees | $15 - $25 |

| Cash advance fee | 10% of each cash advance from your line of credit will be deducted from your request |

| Interest Rates | 19.5% to 155% |

NetCredit Qualification Requirements

In order to work with NetCredit, you must be at least 18 years old. In Alabama and Delaware, you must be at least 19 and in Mississippi, you must be at least 21. Additionally, you must have a valid personal checking account, active email address, a Social Security Number and a verified source of income.

Here’s a closer look at the NetCredit loan requirements:

| Membership Requirement | In most states, you must be at least 18 years old. |

| Minimum Credit Score | None |

| Income Requirements | Income source must be verifiable |

| Co-signer/Joint Application Requirements | No co-signers allowed |

NetCredit Application Process

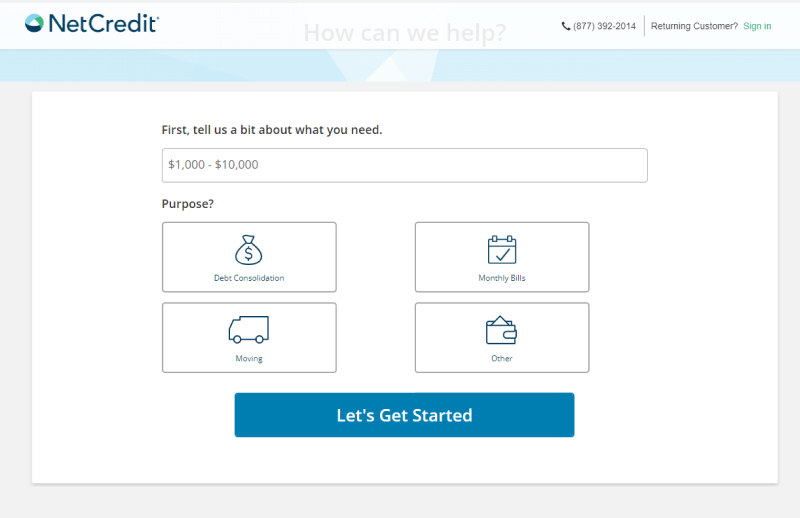

NetCredit’s loan application process is quick and easy. Here’s how you can apply for a loan with NetCredit:

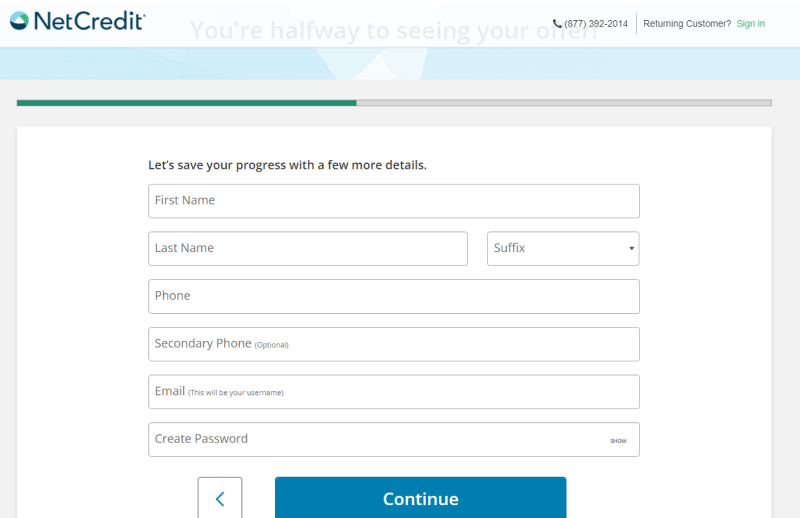

Start at the home page and select ‘Check Your Eligibility.’

Let NetCredit know what size loan you are seeking along with how you want to use the money.

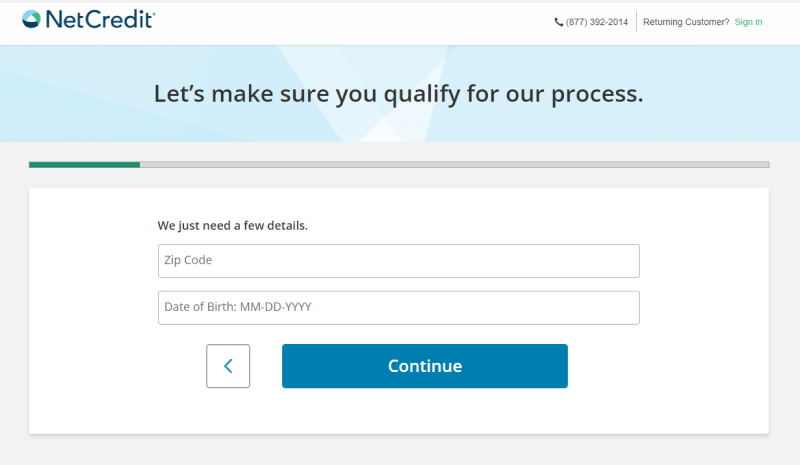

Next, NetCredit will ask for your Zip Code and birthday.

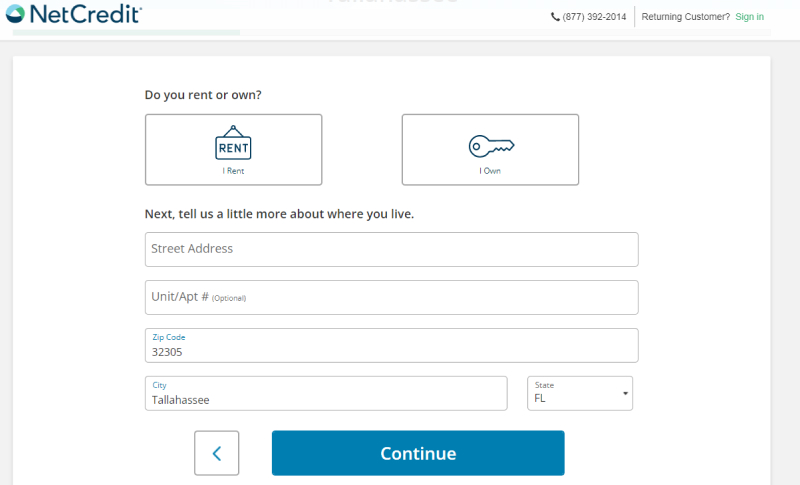

Now, you’ll need to share a bit about your living situation, specifically your address and whether you own or rent your residence.

Next you’ll need to provide your name, phone number, and email. Additionally, you will create a password to set up your account.

After you make your account, NetCredit may ask for additional information and documentation. They might ask for things like an identification card, social security card, proof of residence, and proof of income.

Also needed are the details of your valid checking account; without this, NetCredit cannot send you the loan funds.

Finally, you will have the chance to review your offer. If you like what you see, you can move forward and accept it. Once approved, you may qualify for same-day fund delivery, otherwise you’ll have to wait until the next business day to receive your funds.

NetCredit Customer Support

If you need to get in touch with NetCredit, their team is available Monday through Friday from 8 AM to 8 PM CT and Saturday through Sunday from 9 AM to 5:30 PM CT. If you need to get in touch with NetCredit, their team is available Monday through Friday from 8 AM to 8 PM CT and Saturday through Sunday from 9 AM to 5:30 PM CT.

Depending on your needs, you can call:

- Customer support: 877-392-2014

- Loan processing: 877-392-2015

- Collections: 877-392-2016

If you don’t want to call, you can email feedback@netcredit.com, support@netcredit.com, or collections@netcredit.com.

Based on the customer feedback, most have had a pleasant experience with NetCredit. Helpful support staff may make your life easier as you pay back a loan.

Here’s what Lynne, one satisfied customer, had to say, “Wonderful and quick! However [I] wish [the] rate would be much lower! But when in absolute need you were able to provide me with the loan I was in need of! I am grateful.”

Another reviewer, ADVIA, says, “NetCredit was a great Blessing! My credit score was not the best but I applied anyway. Net Credit approved me quickly and the money was in my bank account the next day. This will also help me rebuild my credit back. Thank you so much NetCredit. You were a blessing in an emergency situation when I didn't see a way out.”

NetCredit Online Reviews

If you ask yourself, ‘is NetCredit legit?’ The answer is a resounding yes.

The company has earned 4.6 out of 5 stars on Trustpilot with over 6,000 reviewers. Over 80% of reviewers left a 5-star review.

Most reviewers are happy that the lender was able to help them out of an emergency financial situation. Although many mentioned that the rates were very high, the ability to meet their immediate financial need was worth the cost.

For those unhappy with the lender, the negative comments centered on the high cost of the loan.

If you are worried about the high rates raining on your parade, it’s best to work with another lender. You won’t find affordable rates with NetCredit. Before starting the application process, you will need to decide for yourself if having access to the funds now is worth taking on a loan with an incredibly high interest rate.

| The positive reviews are related to | The negative reviews are related to |

| Quick and easy loan approval process | High cost of the loan |

| Helpful support staff | Different rules for different states |

| Loans for a financial emergency | Long term financial consequences |

NetCredit Perks and Bonuses

NetCredit isn’t the right fit for everyone, but it might be an option for you. Here’s what sets NetCredit apart as a loan company.

Flexibility:

- NetCredit doesn’t allow you to pick a payment due date when applying, however you can change the payment due date later if proof of a changed paycheck date is provided.

- They offer COVID-19 hardship options, including adjusting your due date.

- NetCredit’s products are available in nearly all states, except: Colorado, Connecticut, Iowa, Maine, Maryland, Massachusetts, Nevada, New Hampshire, New York, North Carolina, Pennsylvania, Vermont, Virginia and West Virginia.

Transparency:

- NetCredit is very straightforward with its loan terms, rates and fees for each state.

- The loan APRs are high – but NetCredit isn’t hiding them.

Technology:

- You can repay a loan with a debit card, prepaid card, paper check, money order, MoneyGram payment, Western Union payment, or bank transfer.

- You can set up an automatic bank transfer to pay off a loan.

- You can apply online via a desktop or mobile phone.

NetCredit Compared to Other Lenders

Here’s how NetCredit stacks up against other lenders.

| NetCredit | Avant | SoFi | Upgrade | |

| Loan Terms | 6 to 60 months | 24 to 60 months | 24 to 84 months | 24 to 84 months |

| Loan amount | $500 to $20,000, but varies widely by state | $2,000 to $35,000 | $5,000 to $100,000 | Up to $50,000 |

| Interest Rates | 19.5% to 155% | 9.95% to 35.99% | 6.99% to 21.78% | 5.94% to 35.97% |

| Min Credit Score | N/A | 580 | 680 | 580 |

| Co-signer Requirement | No co-signers allowed | No co-signers allowed | Co-signers allowed | No co-signers allowed |

Final Thoughts

NetCredit offers a fast way for bad credit borrowers to get their hands on the cash they need to solve an immediate financial problem. But the high interest rates can place a significant burden on most budgets for years to come.

If you have a financial emergency that requires an influx of cash, NetCredit should only be considered as a last resort. If you have the time, make sure to shop around for lower APRs.

Even if you have bad credit, there might be another lender out there willing to offer a slightly better interest rate.

NetCredit can help in a pinch, but only work with this lender in case of emergency.