Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Oportun Loans Review: Expert Analysis & User Insights for 2024

Oportun is a direct lender that can help you get the personal loan funds you need quickly and efficiently. If you need money fast to cover emergency expenses, Oportun can help you get prequalified online and in no time even if your credit score is not the best.

Oportun is highly rated and has helped more than 2 customers and funded more than 4.3 million in personal loans since the company’s inception in 2005. This company is a great alternative to payday lenders, but loan interest rates are still higher for borrowers with subprime credit scores.

In this Oportun loans review, we’ll go over the core features of this company’s loan products along with how to qualify and get the funds you need.

Summarized Rating

This parameter considers loan term lengths, loan minimums and maximums, and the extent of loan use limitations. Each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Oportun gets a respectable 3.5 for Loan Features. This reflects the loan aggregator’s fairly standard term lengths and loan limits, along with the absence of any loan use limitations.

Oportun Pros and Cons

Oportun Loans Pros

Oportun Loans Cons

Types of Personal Loans Offered by Oportun

The main reason why people choose a personal loan is to cover unexpected costs and emergencies. Oportun understands this is and is pretty flexible with its approved uses for loan funds, but there are a few unapproved reasons to keep in mind. Knowing what you plan to use your personal loan for is key before applying so you can confirm whether Oportun is right for your situation.

| Common loan uses | Prohibited uses |

| Unexpected expenses | Education/tuition-related expenses |

| Home improvements | Home down payment |

| Car repairs | |

| Medical bills | |

| Vacations | |

| Rental deposits |

Oportun Loans Key Features

Oportun offers both a secured and unsecured personal loan. With their secured personal loan, you can use the title for your vehicle as a security deposit to help ensure you’ll repay the loan on-time. Secured personal loans through Oportun are only available in California, Texas, and Florida.

| Feature | Personal Loan | Secured Personal Loan |

| Loan terms | No higher than 35.99% APR | No higher than 35.99% APR |

| Repayment period | 24 - 60 months | 24 - 60 months |

| Loan amount | $300 - $10,000 | $2,525 - $20,000 |

| Loan Use Limitations | Few limitations for personal (non-educational) expeneses | Few limitations for personal (non-educational) expeneses |

Oportun Loans Interest Rates and Fees

There are some fees associated with an Oportun personal loan although you will not be charged any application or prepayment fees. Since this company operates in various states, your fee amounts such as the origination fee will vary depending on your state and tax rate.

The origination fee is also calculated as part of your annual percentage rate (APR) as well as the amount of loan interest you will owe. Keep in mind that Oportun also charges late payment and returned check fees. Below is a summary of their fees.

| Borrowing/Origination Fees | Varies by state |

| Prepayment Fees | None |

| Late Payment Fees | $35 |

| Other fees | $35 returned payment fee |

| Interest Rates | No higher than 35.99% |

Oportun Loans Qualification Requirements

If your credit score is in the 600s or low 500s, it can be difficult to find a personal loan lender willing to accept your application. However, Oportun is available to people who have few borrowing options due to their credit score.

Oportun does allow co signers in some instances. Cosigners should understand that they are fully responsible for repaying the loan if their co-borrower fails to make payments. With their secured personal loan, you must use your car’s title for collateral and your name must be on the title.

Here’s a summary of Oportun loan requirements to consider.

| Membership Requirement | Not disclosed | |

| Minimum Credit Score | 580 | |

| Income Requirements | Income Requirements | |

| Co-signer/Joint Application Requirements | Yes (case-by-case basis) |

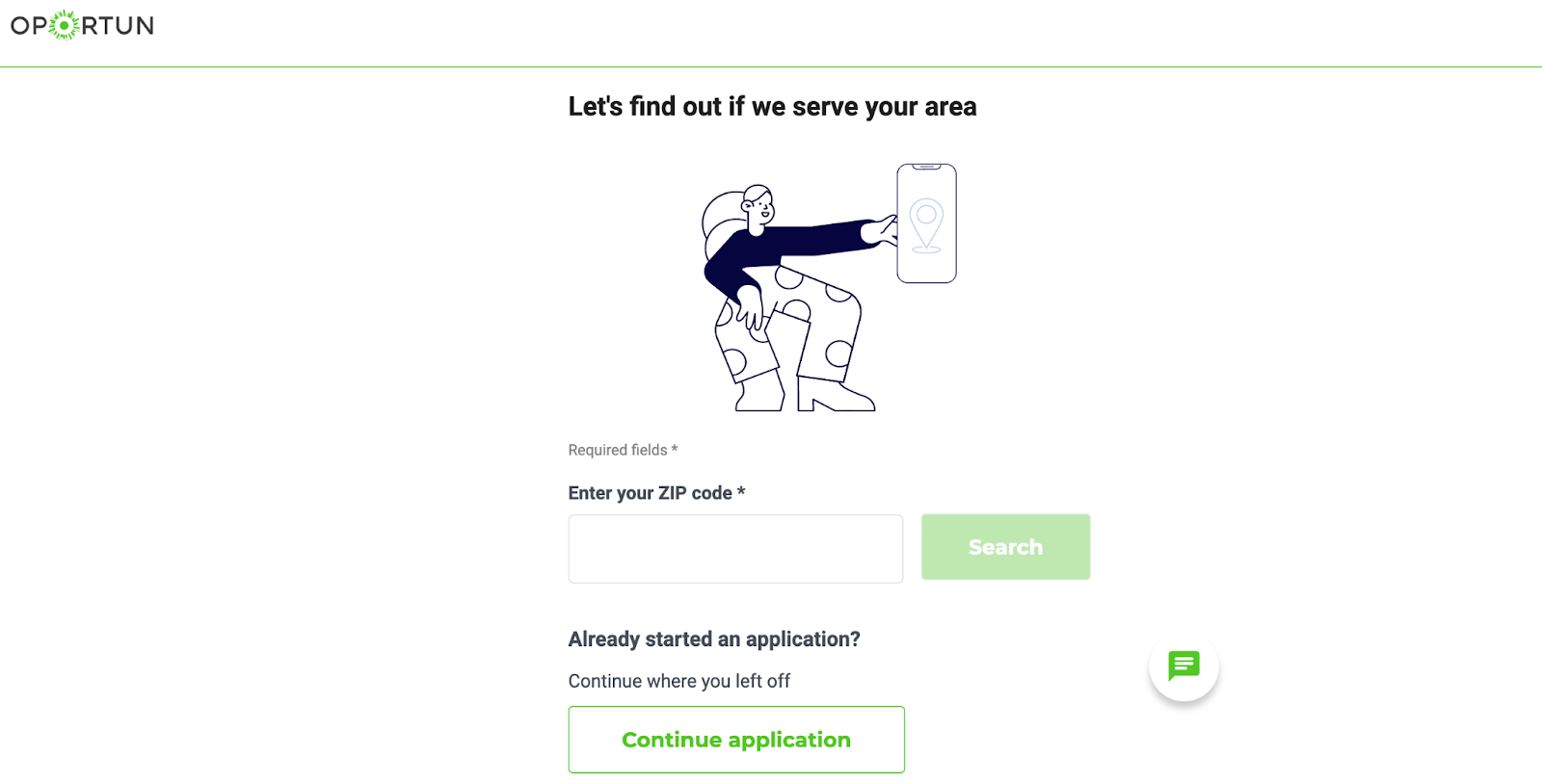

Oportun Loans Application Process

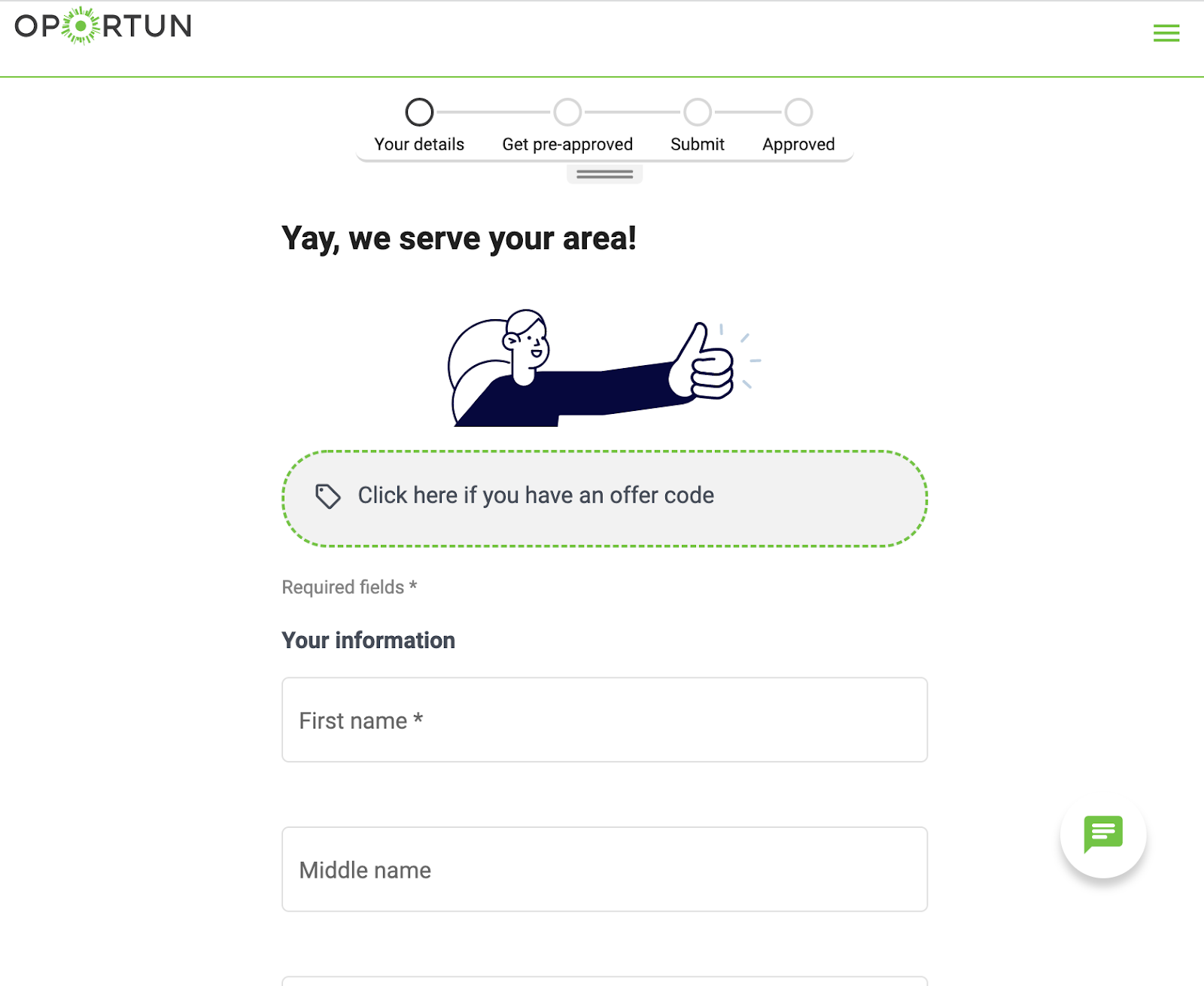

Oportun has a very user-friendly online prescreening and application process. If you’re interested in getting a personal loan, and Oportun services your state, you can fill out a pre approval form online first.

This initial form won’t result in a hard pull on your credit. You’ll just need to submit some basic information such as your:

- Full name

- Home address

- Phone number

- Amount you wish to borrow

- Purpose for the funds

- Monthly income

- Credit score estimate

So long as you meet the basic requirements, it’s likely you’ll be preapproved and you can move forward in the Oportun loan application process. Oportun requires applicants upload important verification documents such as:

- A valid photo ID

- Proof of income (current paystubs or bank statements)

- Address verification

- Up to 4 personal references (can include family, friends, or employers)

If you wish to apply for a secured personal loan, you’ll need:

- The original vehicle title

- Vehicle registration

- Driver’s license

- Proof of income and proof of residence

- Pictures of your car

- Bank account and routing number for instant verification

Once you submit all your supporting documents, Oportun will process your loan application and this process usually takes around one business day.

If you’re approved, they can disperse funds to your account in as little as 24 hours. You can choose whether you’d like to receive a check or direct deposit into your bank account. If you select direct deposit, you’ll receive your loan funds in about three business days.

Oportun Loans Customer Support

Oportun has a dedicated customer service team available to answer all your questions during the week and even on weekends. You can reach customer service with questions about your personal loan or loan application by calling (866) 488-6090 during these hours:

- Monday - Friday: 8 am - 8pm PT

- Saturday - Sunday: 9 am - 7 pm PT

For general inquiries, you can also email hello@oportun.com and for any troubleshooting or complaints you can email complaints@oportun.com. The company also has a chat bot feature available on the website or you can even text them at (650) 425-3419.

Credit Karma users have rated Oportun’s customer service at 4 stars out of 5. Most say customer service was nice and helpful which is what you want to experience with any personal loan servicer. The fact that Oportun is available by phone on weekends and during the evening is an added bonus since many customers may need to get a hold of someone after traditional business working hours.

Here’s what some people are saying about Oportun’s level of customer support.

“Oportun is a great financial company. Their products are really good, especially if you are new to the US, building or rebuilding credit, plus their customer service is excellent.” - AL

“Absolutely amazing customer service! The agent went above & beyond. Thank you Oportun, for being there when I needed you the most!” - Oportun Customer

“Everyone I talked to throughout the whole process was professional and conveyed everything in a simplistic manner and took time to explain the process step-by-step. Really great customer service here!” - Oportun Customer

Oportun Loans Online Reviews

Customers have a lot of great things to say about Oportun’s personal loan. Out of nearly 7,000 reviews on Trustpilot, customers have given Oportun 4.8 out of 5 stars. When reviewing Oportun loan reviews, customers say the loan process is generally easy and efficient which makes up for the higher interest rate in many cases.

One particular customer said the entire process from applying to getting their loan funded took about 48 hours. This customer also said they’ve struggled with their credit in the past and was denied by other banks for loans which is why Oportun was so helpful to them.

It’s true that Oportun does tend to give borrowers with fair credit scores another chance to obtain a personal loan. However, there are a few negative reviews regarding the company’s fees and lower loan amounts. Also, one reviewer mentioned how they had a credit score around 700 but was still asked to get a cosigner. It’s unclear what Oportun’s credit score thresholds are when it comes to being able to qualify for the loan on your own vs. getting a cosigner. So this is something to keep in mind if your credit score is on the lower side.

| The positive reviews are related to | The negative reviews are related to |

| Quick and easy loan approval process | High cost of the loan |

| Flexible payback options | Extra Fees |

| Soft credit pull prequalification | May be required to get a cosigner |

Oportun Loans Perks and Bonuses

Oportun is well known for its flexible loan options and process. This is in addition to staying up-to-date with all the technical features customers prefer to apply and manage their loan online or from a mobile device. Here are some perks and bonuses you could gain by using Oportun for your next loan.

Flexibility:

- Oportun offers a personal loan and a secured personal loan also known as a title loan

- Flexible repayment options up to 60 months

- Not available in most U.S. states (currently only available in 12)

- No option to change loan payment date

- Offers payment deferrals due to financial hardship

Transparency:

- No prepayment penalty fees

- Not all fees and rates are clearly listed on the website (origination fee)

- Income requirements are not displayed on the website

- Website includes an FAQ section

Transparency:

- Virtual chat feature on the website

- Online preapproval process and application form

- Ability to set up auto-pay or pay your bill online

Oportun Loans Compared to Other Lenders

Oportun is just one of several personal loan providers that can help out borrowers with subprime credit scores. Here’s what you can expect in regards to terms and rates from other loan companies with similar offerings:

- SoFi - SoFi offers lower interest rates, longer repayment terms and a high maximum borrowing amount limit for personal loans. They allow you to prequalify online and you can get your loan funded within the same day in some cases. SoFi, does have higher credit score requirements and they also offer unemployment protection if borrowers need to temporarily modify their payment.

- Avant - With Avant, you can qualify for a personal loan with a lower credit score and also borrow much more than Oportun allows. Avant is also available in more states than Oportun but does not allow cosigners.

- Marcus by Goldman Sachs - Marcus offers loan terms up to 72 months but does require an average credit score. There are also no hidden loan fees and you can save on your interest rate when you enroll in auto-pay. Another unique feature with this personal loan is that that you can also skip a monthly payment when they make on-time loan payments for at least 12 months.

| Oportun Loans | SoFi | Avant | Marcus |

| Loan Terms | 24 to 84 months | 24 to 64 months | 36 - 72 months |

| Loan amount | $5,000 to $100,000 | $2,000 to $35,000 | $3,500 - $40,000 |

| Interest Rates | 6.99% to 18.50% | 9.95% to 35.99% APR | 6.99% to 19.99% |

| Min Credit Score | 680 | 580 | 660 |

| Co-signer Requirement | No-borrower allowed if living in the same home | No cosigners | No cosigners |

Final Thoughts

If you’re looking for a quick and easy way to get funds through a personal loan despite having an average credit score, Oportun is well worth considering. This Oportun loans review explained how this company is easy to work with and can get your loan funded fast. However, you may be subject to fees and a higher interest rate.

Also, keep in mind that Oportun does not report your loan payments to all three major credit bureaus. Still, if you are low on options and need money to cover an important expense, it’s great to know how Oportun can help. Consider getting prequalified online which will not hurt your credit since it’s a soft pull. From there, you can assess the loan terms and offer to see if it’s a fit for you.