Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Payoff Personal Loans Review

Payoff personal loans focus on debt consolidation. They come with competitive rates and a variety of credit improvement tools. There’s also the Direct Card Payoff service, which applies the loan funds to your balances directly.

Founded in 2009 and headquartered in Tustin, California, Payoff is a financial wellness company and part of Happy Money, Inc., which combines psychology and money to help people live happier lives. Payoff is unique in that it helps borrowers consolidate debt and improve their finances. It could be a great option if you have fair to good credit and high-interest credit card debt.

Summarized Rating

This parameter considers loan term lengths, loan minimums and maximums, and the extent of loan use limitations. Each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Happy Money gets a subpar 2.8 for Loan Features. This reflects the loan aggregator’s below average term lengths and restrictive loan limits. The absence of any loan use limitations provides a boost to the rating.

Payoff Personal Loans Pros and Cons

Payoff personal loans pros

Payoff personal loans cons

Types of Personal Loans Offered by Payoff

Payoff loans can only be used for credit card consolidation. This means they’re not an option if you’d like to renovate your home, make a large purchase, or cover emergency expenses. Compared to other personal loan lenders, Payoff is less flexible.

| Common loan uses | Prohibited uses |

| Debt consolidation | Home improvements |

| Emergency expenses | |

| Large purchases |

Payoff Personal Loans Features

Payoff offers debt consolidation loans ranging from $5,000 to $40,000. If you move forward with one, you can choose a loan term between 24 and 60 months. This is great news whether you’d like to pay off your credit card debt fairly quickly or take your time so you can focus on other financial goals.

The most noteworthy limitation of Payoff personal loans is that they can’t be used for anything other than debt consolidation. If your goal is to pay for a kitchen remodel, car repair, or college education, for example, you’ll need to look elsewhere.

| Loan terms | 24-60 months |

| Loan amounts | $5,000-$40,000 |

| Loan Use Limitations | Only debt consolidation |

Payoff Personal Loans Interest Rates and Fees

You can pay off a Payoff personal loan early without worrying about prepayment fees. Also, if you make a late payment, you won’t be on the hook for any late fees. Payoff doesn’t charge returned check fees either. However, you may be responsible for an origination fee of up to 5%. This will be deducted from the total amount at the time of funding.

| Borrowing/Origination Fees | 0% and 5% of the total loan amount |

| Prepayment Fees | None |

| Late Payment Fees | None |

| Other Fees | N/A |

| Interest Rates | 5.99% and 24.99% |

Payoff Personal Loans Qualification Requirements

To be eligible for a Payoff personal loan, you must have a minimum FICO score of 640 and no delinquencies on your credit report. In addition to your credit, Payoff will consider your debt-to-income ratio, how long you’ve been using credit, and your credit utilization or the amount of credit you’re using divided by the amount available to you.

Payoff will also look at your open and satisfactory trades or the number of credit lines you have open and are paying on time. Since Payoff does not offer joint applications, you can only use your credit score and annual gross income when you apply for a loan.

| Membership Requirement | None |

| Minimum Credit Score | 640 |

| Income Requirements | Not disclosed |

| Co-signer/Joint Application Requirements | Not available |

Payoff Personal Loans Application Process

To apply for a Payoff personal loan, follow these steps:

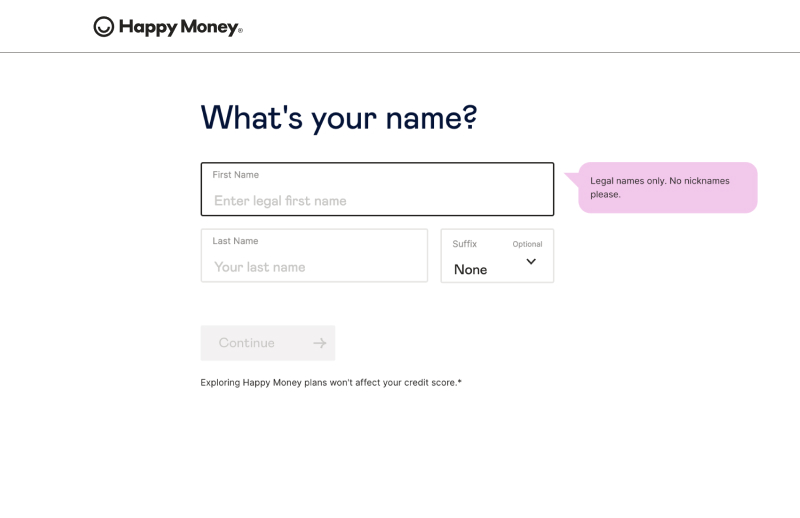

Prequalify: Click on “Check My Rate” on Payoff’s homepage so you can get an idea of what rate you might qualify for. You can do so without impacting your credit or paying any application fee. Be prepared to share basic personal details like your name, birthday, address, and phone number. You’ll also be asked to provide your personal annual income and monthly housing payment.

Complete a Formal Application: If you receive an offer that appeals to you, Payoff will ask you to complete the application process, which will involve a hard credit check. At this point, you’ll need to reveal your Social Security number, employment details, and bank account information. Additionally, you’ll be required to upload documents like your government-issued ID, pay stubs, and banking statements.

Wait for a Decision: The amount of time it takes for Payoff to review your application and approve you for a debt consolidation loan depends on a number of factors, such as how accurate your information is and how quickly you submit the documents. You can expect this process to take up to seven days.

Receive the Funds: Upon approval, you may use the funds to pay off credit balances on your own. Or you can opt for Payoff’s Direct Card Payoff and allow the lender to apply the funds to your balances directly.

Payoff Customer Support

- Payoff has a Member Experience team which you can contact via phone Monday through Friday from 6 a.m. to 6 p.m. PT, and Saturday through Sunday from 6 a.m. to 3 p.m. PT. You may also send an email or use the online chat feature. Payoff has a Member Experience team which you can contact via phone Monday through Friday from 6 a.m. to 6 p.m. PT, and Saturday through Sunday from 6 a.m. to 3 p.m. PT. You may also send an email or use the online chat feature.

- The Payoff website features a library full of handy articles that explain the loan process and benefits of debt consolidation. There’s also a search tool to help you easily find answers to your questions.

Payoff Personal Loans Online Reviews

Payoff has about 100 reviews on TrustPilot and an overall 4.5 star rating. Most of the reviews praise its exceptional customer service and quick, easy application. They also appreciate Payoff’s commitment to helping them reduce their debt and improve their finances.

Of course, there are several negative reviews as well. Unsatisfied customers complain about high interest rates and deceptive loan offers. Some of them report issues with the identity and income verification process. Long customer service response times and inexperienced agents were also mentioned.

One reviewer had the following to say about their experience with Payoff:

“I received an offer in the mail to consolidate my debts. I was skeptical at first, but applied anyway "just in case". (I had Googled the company at this point and they seem "legit"). Long story short, I got a loan and was able to pay off my credit card debts. I'm so thankful for the help they gave me. I'm not so heavily burdened with debts anymore! Thanks Payoff Team!”

| The positive reviews are related to | The negative reviews are related to |

| Quick, easy application | High APRs |

| Excellent customer service | Long response times |

| The debt resources | Issues with income verification |

Payoff Personal Loans Perks and Bonuses

Flexibility

- Payoff borrowers can log into their online account and change their payment due date once every 12 months

- They may also enjoy FICO credit score updates once a month for free.

Transparency

- The Payoff website clearly reveals its rates, fees, qualification requirements, and more.

- It also gives you the chance to prequalify and find out what types of rates you may be eligible for without any impact to your credit score.

- In addition, there is a list of frequently asked questions that you might find useful.

Technology

- To access your account as a Payoff borrower, you can log into your online portal on the Payoff homepage

- The online portal will allow you to review your loan documents, change payment dates, check your balance, and find out your FICO score.

- While there is an automatic payment feature, you can make manual payments via the online portal if you prefer.

- Currently, Payoff does not offer a mobile app.

Payoff Compared to Other Lenders

| Payoff | Prosper | Figure | Avant | |

| Loan Terms | 24 to 60 months | 36 or 60 months | 36 or 60 months | 24 to 60 months |

| Loan Amount | $5,000 to $40,000 | $2,000 to $40,000 | $5,000–$50,000 | $2,000 - $35,000 |

| Interest Rates | 5.99% and 24.99%. | 7.95% to 35.99% | 5.75%–22.94% | 9.95% - 35.99% |

| Min Credit Score | 640 | 640 | 680 | 580 |

| Co-signers | Not allowed | Not allowed | Not allowed | Not allowed |

Final Thoughts

If your goal is to consolidate high-interest credit card debt, you may find a Payoff personal loan to be a solid pick. Not only does Payoff offer competitive interest rates, it also provides tools like free FICO credit reporting to help you monitor your credit score.

Since Payoff has a prequalification feature, it can't hurt to take advantage of it and find out what rates and terms you may qualify for. If you’re only eligible for a high APR or want to avoid paying an origination fee, you might want to look for debt relief options elsewhere.