Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

PenFed Personal Loan Review

PenFed is a credit union that offers personal loans to its members. Anyone can become a member and its loans come with low rates and no origination fees, making it a strong choice of lender for people who want a cheap loan.

PenFed is a credit union, which means it works for the benefit of its members instead of outside shareholders. That is visible in its personal loan offerings, which come with low interest rates and no origination or early repayment fees.

The loans are flexible, with PenFed offering loans that range from $600 to $50,000. That makes them a good choice for any need, large or small. You can even check your rate and monthly payment without a hard pull impacting your credit score.

This PenFed personal loan review will tell you everything you need to know about the lender.

Summarized Rating

This parameter considers loan term lengths, loan minimums and maximums, and the extent of loan use limitations. Each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

PenFed gets an above average 3.8 for Loan Features, which is attributable to its fairly flexible term lengths and loan amounts. The absence of any loan use limitations provides a boost to the score.

PenFed Personal Loans Pros and Cons

PenFed’s loans can be a good choice for many borrowers but it’s important to consider both the pros and cons of its loans.

PenFed Personal Loans Pros

PenFed Personal Loans Cons

Types of Personal Loans Offered by PenFed

One of the best aspects of personal loans is that you can use them for almost any purpose. Lenders don’t typically place restrictions on how you use the funds in the same way that a mortgage or auto loan has a single, specific use.

PenFed will ask why you want to apply for a loan during the loan application but it doesn’t explicitly prohibit you from getting the loan for other reasons than the ones it provides.

| Common loan uses | Prohibited uses |

| Debt consolidation | None disclosed |

| Home improvement | |

| Transportation | |

| Medical and dental expenses | |

| Life events |

PenFed Personal Loans Features

PenFed’s personal loans are quite flexible. Borrowers can choose to apply on their own or with a co-borrower and have lots of options when it comes to the repayment period. The low loan minimum and high maximum also make it easy to borrow exactly the amount that they need.

| Loan terms | Fixed rate |

| Repayment period | 1 to 5 years |

| Loan amount | $600 to $50,000 |

| Loan Use Limitations | None disclosed |

PenFed Personal Loans Interest Rates and Fees

One of the benefits of PenFed’s personal loans is that they’re relatively cheap if you have strong credit. PenFed loan rates are low and the credit union doesn’t charge an origination fee. You can even repay the loan ahead of schedule without worrying about a penalty or fee.

However, the loan does carry typical fees like late payment fees that you need to consider.

| Membership Requirement | Yes, become a member during the application |

| Minimum Credit Score | Not disclosed |

| Income Requirements | Not disclosed |

| Co-signer/Joint Application Requirements | Co-borrower permitted, not required |

PenFed Personal Loans Qualification Requirements

Potential borrowers have to consider the qualification requirements before applying for a loan. Even if a loan has appealing terms, you shouldn’t waste the time it takes to apply if you have no chance of getting the loan.

One of the PenFed personal loan requirements is that you have to be a member of the credit union. However, anyone can become a member and you can sign up for a credit union membership during the loan application. While the company doesn’t disclose a minimum credit score to qualify for a loan, its rate estimator only lists credit scores 650 or above.

| The positive reviews are related to | The negative reviews are related to |

| Good customer support | Poor IT |

| Easy application | Customer support issues |

| Fast loan funding | Unclear underwriting standards |

| Variety of banking services offered |

PenFed Personal Loans Application Process

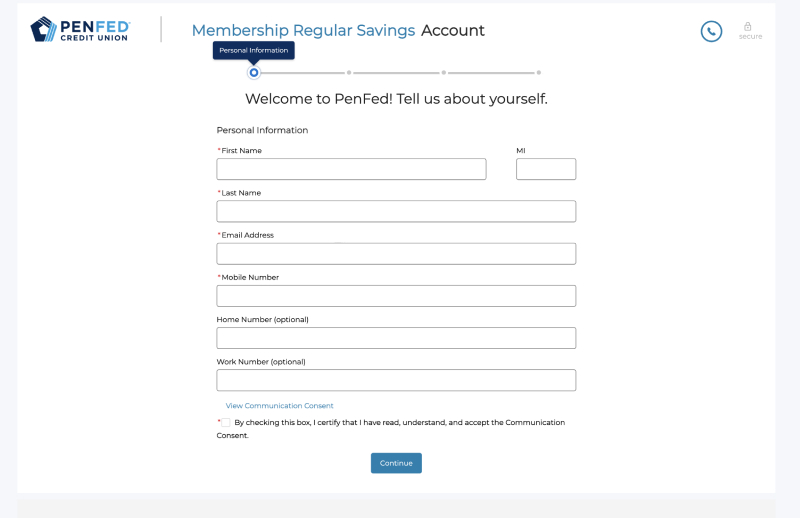

PenFed’s application process is very simple, involving just five pages.

The first page asks for your basic personal information, like your name, contact info, annual income, and monthly housing costs. You’ll also enter whether you’re applying with a co-borrower and, if you are, provide their information on this page.

Next, the application will ask about your employment history. You can enter information about your job and how much you make. Make sure that you can back up the job history and income you claim here because PenFed might ask for proof before it funds your loan.

Once you’ve provided that information, PenFed will give you some disclosures and notices to read. This is all of the fine print of the loan you’re applying for, so make sure to read it carefully to make sure you know how your loan will work.

After PenFed reviews your application, it will make a lending decision. If you’re approved, PenFed will let you choose from different loan funding options, such as sending the money to your PenFed account or to another bank. Finally, you can set up repayment, including signing up for automatic payments or paperless billing.

PenFed Personal Loans Customer Support

One of the most important things to look for when choosing a new bank or lender is its customer support. If you’re having trouble making a loan payment or with something else related to your finances the last thing that you want is to get stuck waiting for help.

PenFed has customer support available seven days a week and makes its support team available in multiple ways.

The simplest way to get help is with a phone call at 724-473-6333. PenFed’s support team is available from 7 AM to 11 PM Eastern Time on weekdays, 8 AM to 11 PM on Saturdays, and 9 AM to 5:30 PM on Sundays.

If you already have an account with PenFed, you can also use the secure messaging feature in your account portal to get help when you need it.

Customers are happy with the support they receive and have given PenFed a rating of 4.6 out of 5 on TrustPilot.

PenFed Personal Loans Online Reviews

When you’re applying for a loan, you want to work with a company that is trustworthy and easy to work with. Looking at professional reviews like this one is a great way to learn more about a lender but it’s also helpful to read about the experience of other customers.

PenFed has strong reviews from the popular customer review website TrustPilot. It has a 4.6 rating out of 5 and 84% of customer reviews rank the company as “Excellent.” The credit union has an A + rating from the Better Business Bureau, though its customer ratings there are noticeably worse. The average customer rating at the BBB is 1.19 out of 5.

The positive reviewers appreciate the speed and ease of working with PenFed and the fact that the credit union was willing to work with them despite unusual circumstances.

One reviewer states “ID Theft hurt me but I took the chance expecting another rejection, but PenFed welcomed me in with open arms. The online application process for their loans are simplified with a very fast approval (or denial) response.”

Negative reviews mostly discuss poor IT infrastructure and issues with getting help from customer support.

| The positive reviews are related to |

The negative reviews are related to |

| Good customer support |

Poor IT |

| Easy application |

Customer support issues |

| Fast loan funding |

Unclear underwriting standards |

| Variety of banking services offered |

PenFed Perks and Bonuses

PenFed aims to make it easy for its customers to apply for and receive a loan. You can apply in just a few minutes and get money to your bank account in a matter of days.

Flexibility and transparency are essential when it comes to getting a loan. Thankfully, PenFed offers many features that make it appealing.

Flexibility

PenFed is a credit union that offers a huge variety of banking services. On top of its personal loans, you can use the company for checking or savings accounts and other loans. That can be helpful if you want to get more than one type of loan.

Even if you’re only looking for a personal loan, PenFeds loans are highly flexible. You can borrow as little as $600 or as much as $50,000, which makes it easy to borrow exactly the amount that you need.

You also have the flexibility to repay the loan ahead of schedule. Though some lenders charge a fee if you pay the loan off too soon, PenFed gives you the freedom to do that without worrying about a penalty.

Transparency

PenFed is relatively transparent about its loan terms. You can view the lowest rates and payments the lender offers and use a quick payment estimator to get an idea of the rates and payments you’ll deal with based on your credit score and loan.

A major benefit is that you can get a customized rate quote by submitting your personal information. PenFed can give you a more exact estimate of your loan’s rate and fees without impacting your credit.

While some customers have had issues with customer support, most reviews state that the lender is easy to work with so you can always call if you have questions about the loan.

Technology

PenFed’s online application is easy to complete and involves just a few pages. You can fill it out in just a few minutes. Once you’ve applied, you can manage your account purely through the credit union’s website and mobile app.

PenFed’s app is well-reviewed with 4 stars out of 5 on the Apple App Store. You can use the app to check your loan balance, make payments, and contact customer support. The credit union’s website also contains numerous calculators you can use to determine the cost of your loan and potential savings from paying it off early.

Some customer reviews negatively mention PenFed’s technology, stating that it’s hard to work with but the majority of customer reviews are positive.

PenFed Compared to Other Lenders

There are many personal lenders out there. PenFed is just one option available to you. It’s a good idea to shop around and get multiple loan offers so you can find the one that’s best for you.

| PenFed | Upstart | OneMain Financial | SoFi | |

| Loan Terms | Fixed rate | Fixed rate | Fixed rate | Fixed rate |

| Loan amount | $600 - $50,000 | $1,000 - $50,000 | $1,500 - $20,000 | $5,000 - $100,000 |

| Interest Rates | 4.99% - 17.99% | 5.22% - 35.99% | 18% - 35.99% | 6.99% - 21.78% |

| Min Credit Score | Not disclosed | 300 | Not disclosed | None |

| Co-signer Requirement | Co-applicant permitted, not required | No co-signer permitted | Permitted, not required | Permitted, not required |

Final Thoughts

PenFed is a good choice of lender for people who have relatively good credit. It has low interest rates and a lot of flexibility when it comes to how much you can borrow.

It does take a few days to disburse loan funds which means it may not be the best choice for people who need cash in an emergency. If you’re in a bind, you should compare offers from multiple lenders to see who can give you the best deal.

FAQs

This app literally changed my like. It provides a great experience. I absolutely love it!