Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Prosper Review: A New Kind of Lending Model

Prosper is a peer-to-peer lender that lets investors loan funds directly to borrowers. This lending model makes it easier to qualify, even if your credit isn’t perfect. The application process is quick and easy, letting you see whether you qualify within minutes.

You can use your Prosper loan for a variety of purposes, including home improvements, vacations, and debt consolidation. It’s a great loan option for those looking for just a little extra money who might not qualify for a personal loan through a traditional lender. This Prosper review will discuss the pros and cons of this peer-to-peer lending model.

Summarized Rating

This parameter considers loan term lengths, loan minimums and maximums, and the extent of loan use limitations. Each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Prosper gets a below average rating of 3.3 for Loan Features. This reflects the lender’s average term lengths and fairly restrictive loan limits. The absence of any loan use limitations provides a boost to the rating.

Prosper Pros and Cons

Prosper Pros

Prosper Cons

Types of Personal Loans Offered by Prosper

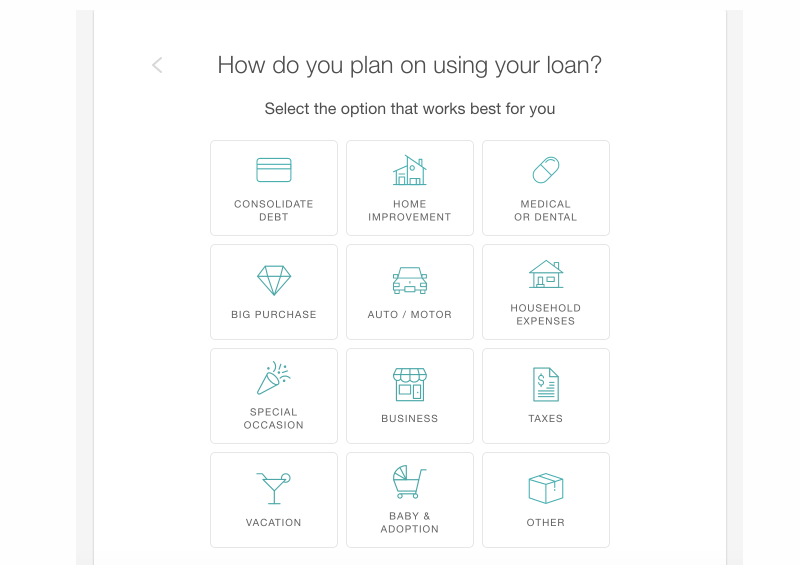

Unlike loans from some other lenders, Prosper personal loans can be used for luxury purchases like vacations and special events. However, keep in mind that investors decide whether to fund your loan or not. If you choose debt consolidation or medical expenses, your funding might go through faster than if your loan is funding something they consider less essential. Prosper also offers home equity loans.

| Common Loan Uses | Prohibited Loan Uses |

|

Debt Consolidation Home Improvement Medical and Dental Big Purchase Auto Household Expenses Major Purchases Special Occasion Business Taxes Vacation Baby and Adoption |

Student Loans Educational Expenses |

Prosper Loan FeaturesProsper Loan Features

Prosper’s variety of loan uses set it apart. LIn a Prosper review, it’s important to look at the features that set it apart. Prosper loans are given at the discretion of investors, so your options for how you’ll use the money are more varied than with some other lenders. As long as you aren’t using the funds for educational expenses or to pay off student debt, you can qualify for a personal loan through Prosper.

| Loan terms | 36 and 60 months |

| Repayment period | Starts 30 days after payment sent to bank account |

| Loan amount | $2,000 to $40,000 |

| Loan Use Limitations | Can’t be used for educational purposes |

Prosper Interest Rates and Fees

Prosper loan rates have a broad range that depends on your credit history, the repayment term you choose, and how you plan to use the funds, and your debt to income ratio.s, along with other factors. Each borrower is assigned a “Prosper score” that rates their risk level. The score heavily weighs your credit activity, looking at your credit utilization, credit card utilization, delinquint accounts, and credit inquiries. Rates go as low as 7.95% APR, but some borrowers pay as much as 35.99%. The rate you’ll pay can fall anywhere within that range.

Prosper also charges an origination fee that’s 2.4%-5% of the borrowed amount. The exact percentage is also based on your qualifications. As long as you pay your loan balance on time each month, you won’t have to pay a late fee, which is 5% of the payment amount or $15, whichever is greater. One downside to Prosper is that you won’t get a discount for autopay. Some lenders offer that perk, and it can reduce your monthly payment a little.

| Borrowing/Origination Fees | 2.4% to 5% |

| Prepayment Fees | None |

| Late Payment Fees | The greater of 5% or $15 |

| Other fees | None |

| Interest Rates | 7.95% to 35.99% |

Prosper Qualification Requirements

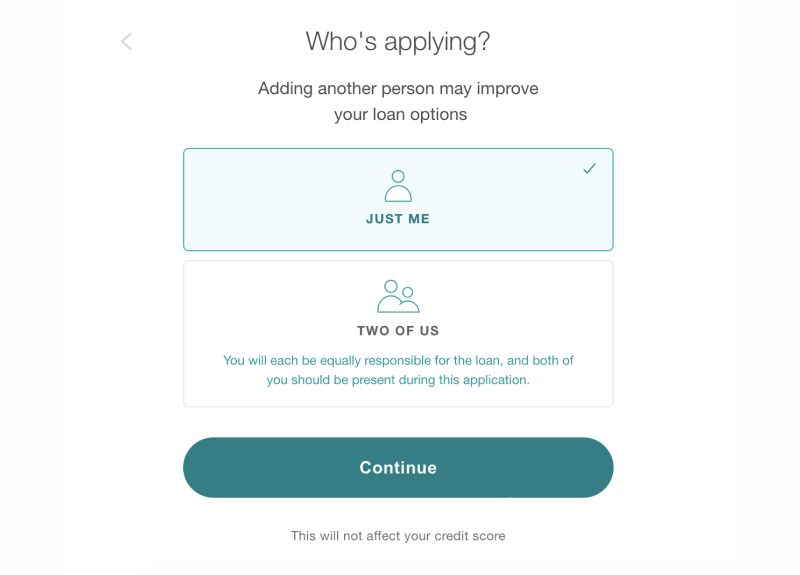

To qualify for a Prosper loan, you’ll need a FICO 08 score of at least 640. A FICO 08 score of 700 or above is considered good. Prosper doesn’t publicly disclose any minimum income requirements, but you’ll need a debt-to-income ratio of at least 50% to qualify. Although Prosper doesn’t allow co-signers, you can apply with another person as joint borrowers to boost your qualification chances.

| Membership Requirement | Free account required to prequalify |

| Minimum Credit Score | 640 |

| Income Requirements | Debt-to-income ratio of at least 50%Not disclosed, but debt |

| Co-signer/Joint Application Requirements | Joint applications allowed |

Prosper Application Process

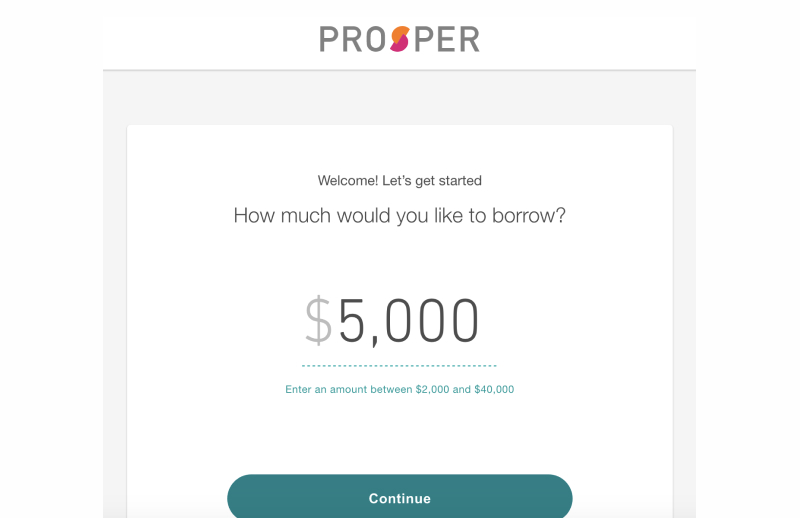

Prosper walks you step by step through the application process, which will do a soft credit pull to let you know whether you qualify. This prequalification process takes just a few minutes. To get started, simply go to Prosper and click Check My Rate. You’ll be prompted to input the amount you want to borrow. Choose an amount between $2,000 and $40,000.

Next, you’ll be asked the purpose of your loan. Prosper loan requirements are fairly loose when it comes to loan purpose, but keep in mind that your reason for the loan could influence whether investors agree to let you borrow the money.

You can choose to apply alone or with a co-borrower. Multiple borrowers improve your chances.

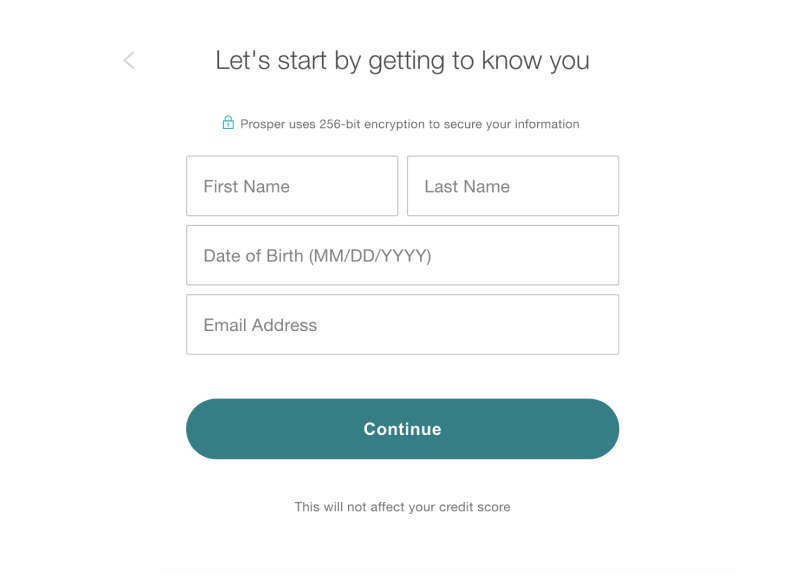

You’ll just need to input some preliminary information to get preapproved, including your name, mailing address, and source of income.

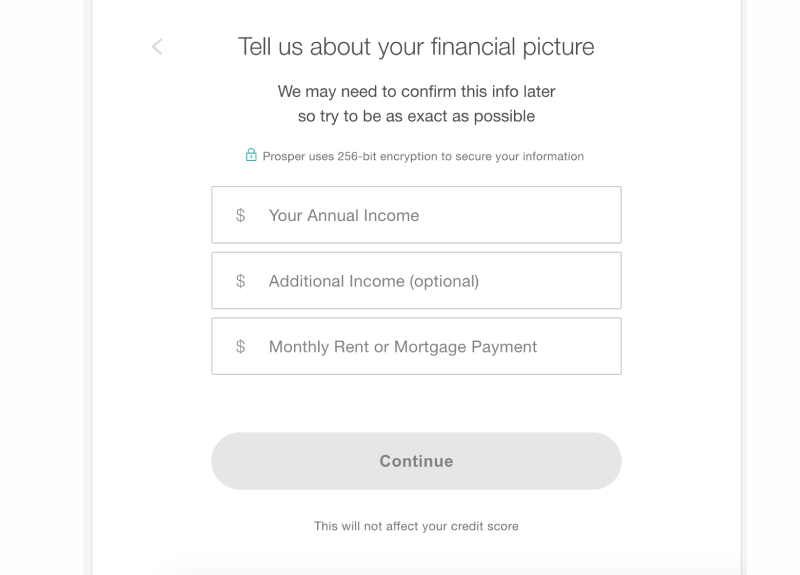

Prosper needs to know your annual income and rent or mortgage amount to prequalify you.

You’ll then just need to input your phone number and Social Security number to get an instant rate quote. If you like what you see, you can proceed to a full application, at which point, Prosper will run a hard credit pull. Once investors agree to fund your loan, you’ll receive the money as early as the next day.

Prosper Personal Loans Customer Support

Although Prosper loan customer service lands it an A+ Better Business Bureau rating, the company does have some negative reviews on the site. Many of the reviews mention being unable to get through to a customer service representative. Once contact was made, some customers were unhappy with the interactions.

You won’t get around the clock support from Prosper, whatever your experience ends up being. You can get phone support by calling (866) 615-6319 Monday through Friday from 6 a.m. to 5 p.m. (PT). Phone support is also available on Saturday from 6 a.m. to 2:30 p.m. (PT). You can also get support via email at support@prosper.com.

Prosper Online Reviews

There is a common thread in many of the Prosper reviews on both Trustpilot and Credit Karma. Customers praise the quick and easy application process, as well as the fast turnaround on loan funds. Some were even repeat customers. One customer wrote, “This is my third loan from Prosper. It helps me get out of credit card debt at a lower interest rate and monthly payments are manageable.”

One complaint that appears multiple times in Prosper reviews is that there are no rewards for repeat business. Customers also expressed unhappiness with the origination fee, which totals in the hundreds of dollars. Despite Prosper being up front about the fee, some were surprised to see hundreds of dollars added to the loan.

Customer service is a recurring theme throughout the negative reviews. Most happy customers reported a seamless process, but those who did experience rough spots seemed to have a tough time getting help. Some customers were also turned down for loans and not given a reason or recourse, but this is common practice with lenders.

| The positive reviews are related to | The negative reviews are related to |

| Quick and easy process | Unresponsive customer service |

| Fast funding turnaround | High original fee |

| Automated funds deposit and payments | Prepayment is not easy |

Prosper Perks and Bonuses

Flexibility

Flexibility is one area where Prosper falls short. There are only two terms, three and five years, and payments are due once a month. You lock in your interest rate when you finalize your loan, so there’s no option to change those terms during your payoff period. You can pay your loan off early without penalty, but you’ll still pay the same interest rate on the remainder of the loan until it’s completely paid off.

Unlike some other online lenders, Prosper doesn’t build in rewards for on-time payments. In fact, you’ll be charged a late fee if your payment isn’t made on time each month. They do offer a 15-day grace period, though. One perk you’ll get with Prosper, if you choose it, is the option of a credit card. There’s no annual fee for the first year, no security deposit required, and no charge for ATM withdrawals. After the first year, you’ll pay a $39 annual fee.

Transparency

Prosper is fully transparent about its process and fees, as well as the requirements for qualifying for a loan. It’s important to note, though, that the promise of funds as soon as the next business day comes with a caveat. You apply and wait for investors to agree to fund your loan, and that process can take time. The good news is, most reviews seem to indicate funds are in the bank within a few days of loan approval.

One thing to note is that Prosper is only licensed in 31 states. You’ll only be able to use the service if you live in one of these states: Alaska, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, New York, Oregon, Rhode Island, South Carolina, South Dakota, Utah, Virginia, Washington, Wisconsin and Wyoming.

Technology

The entire application process is online, but there’s also a mobile app you can use to apply for your loan. Once approved, that mobile app lets you pay your bill or set up automatic payments, make additional payments, and view your loan balance.

Prosper Compared to Other Lenders

Prosper’s quick, easy application process puts it ahead of some competitors, but they aren’t the only lender offering those benefits. One of the best things about Prosper is that you can use it for loan amounts as low as $2,000. The minimum for many other lenders is higher. The lack of discounts for autopay can make the APR higher than what you might pay with competitors, so it might help to get rate quotes from at least one other lender before you sign on the dotted line.

| Prosper | Rocket Loans | Freedom Plus | SoFi | |

| Loan Terms | 36 or 60 months | 36 or 60 months | 24 to 60 months | 24, 36, 48, 60, 72, or 84 months |

| Loan amount | $2,000 to $40,000 | $2,000 to $45,000 | $7,500 to $50,000 | $5,000 to $100,000 |

| Interest Rates | 7.95% to 35.99% | 5.970% (with autopay discount) to 29.99% | 7.99% to 29.99% | 5.74% (with all discounts) to 21.78% APR |

| Min Credit Score | 640 | 640 | 620 | 680 |

| Co-signer Requirement | No co-signers | No co-signers | Cosigners allowed | Cosigners allowed after invite from SoFi |

Final Thoughts

Although this Prosper Loans review has detailed the pros and cons, the flexibility in the uses for your loan makes Prosper stand out. If you’re interested in borrowing money for a wedding or vacation, Prosper might bring loan opportunities you wouldn’t have otherwise. The lower-than-typical credit score requirements and ease of application make Prosper an option worth considering.

FAQs

This app literally changed my like. It provides a great experience. I absolutely love it!