Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Rocket Loans Review: Convenient, Fast Personal Loans

If you’re looking for fast, easy access to loans, Rocket Mortgage can help. With a lower credit score requirement than some competitors and instant prequalification, it can be a great alternative to traditional lenders.

Rocket Loans specializes in personal loans for big expenses like home improvement, debt consolidation, medical expenses, business expenses, and car purchases. If you have a credit score of 640 or higher and need help with personal or business expenses, this Rocket loans review will go through the pros and cons of this online lender.

Summarized Rating

This parameter considers loan term lengths, loan minimums and maximums, and the extent of loan use limitations. Each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Rocket gets a respectable 3.5 for Loan Features. This reflects the lender’s fairly standard term lengths and loan limits, along with the absence of any loan use limitations.

Rocket Loans Pros and Cons

Rocket Loans Pros

Rocket Loans Cons

Types of Personal Loans Offered by Rocket Loans

Rocket Loans asks you to specify the purpose of your loan during your prequalification application. However, you can use your loan for other purposes like vacations and large purchases. If you need a loan to purchase a house, Rocket Loans Mortgage has a quick preapproval and application purchase, as well.

| Common Loan Uses | Prohibited Loan Uses |

|

Debt Consolidation Credit Card Payoff Mortgage Payoff Mortgage Payoff Home Improvement Home Repairs Medical Expenses Business Auto Other |

Student Loans Illegal Activities |

Rocket Loans Features

As long as you’re not trying to fund education or illegal purchases, you can apply for a Rocket Loan. You’ll only get your choice of a 36- or 60-month term, but you can borrow as much as $45,000 as long as you qualify. Perhaps the best thing about Rocket Loans, though, is that you can get the money right away, but you’ll also deal with a first payment being due within 30 days.

| Loan terms | 36 and 60 months |

| Repayment period | Begins within 30 days |

| Loan amount | $2,000 to $45,000 |

| Loan Use Limitations | Can’t be used for student loans |

Rocket Loans Interest Rates and Fees

When you agree to borrow money from Rocket Loans, you’ll pay a loan origination fee of between 1 and 6 percent. This could be anywhere from $20 on a $2,000 loan to $2,700 on a $45,000 loan. This is taken from the loan funds before they’re transferred to your bank account. You’ll also pay $15 on each late payment and $15 for any returned or rejected ACH payment or check.

Setting up autopay can be a big help with a Rocket loan. Not only will you reduce your risk of a late payment fee, but you’ll get a better interest rate. Rocket Loans offers interest rates as low as 5.970% with autopay. Rates can go as high as 29.99% without autopay, but the exact interest you pay depends on your credit history, income, borrow amount, and terms.

| Borrowing/Origination Fees | 1% to 6% |

| Prepayment Fees | None |

| Late Payment Fees | $15 |

| Other fees | $15 returned ACH/check fee |

| Interest Rates | 5.97% to 29.99% |

Rocket Loans Qualification Requirements

Although Rocket Loans requirements aren’t too strict, you will need a credit score of at least 640. You’ll also need an annual income of at least $24,000 to qualify. One downside of Rocket Loans is that you can’t borrow with a joint applicant or use a co-signer. This means you’ll need to have the minimum income and credit score on your own before you apply.

| Membership Requirement | None |

| Minimum Credit Score | 640 |

| Income Requirements | $24,000 a year or more |

| Co-signer/Joint Application Requirements | Not allowed |

Rocket Loans Application Process

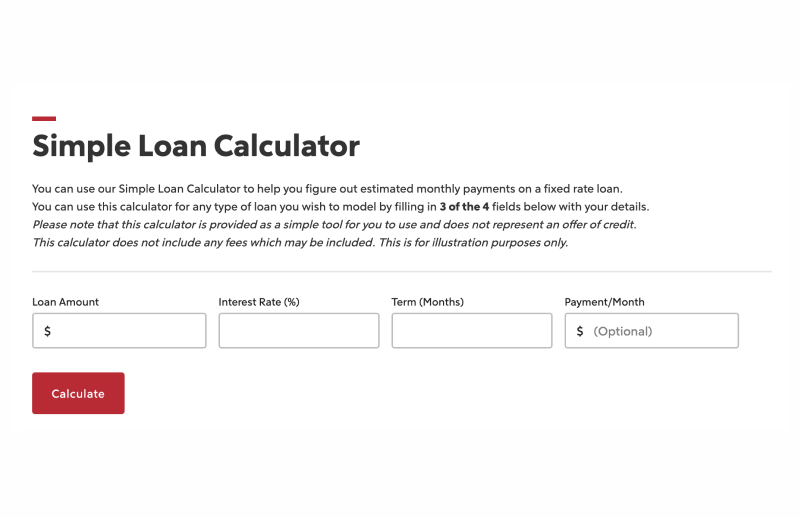

Before you even apply for a loan through Rocket Loans, look at your budget and decide how much of a monthly payment you can afford. You can then go straight to Rocket Loans’ Simple Loan Calculator to forecast the right APR and terms to arrive at a monthly payment you can afford.

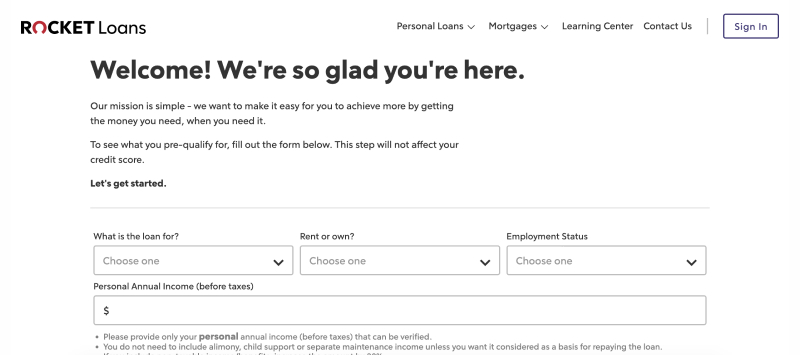

Applying for Rocket personal loans begins with a preauthorization. For this, click Apply Now on any page of the Rocket Loans site.

Rocket will first need to gather information about the purpose of your loan, your employment status, whether you rent or own your home, and your annual pretax income. You’ll need to only include income you can verify through documentation. Although there is an “Other” category, the provided loan purposes are debt consolidation, pay off credit cards, pay off other loans, pay down mortgage, home improvement, home repairs, medical expenses, business, and auto.

From there, Rocket Loans runs a soft credit check. This does not hurt your credit score. It only takes a few seconds for Rocket Loans to show you the rate and types of loans available to you.

If you like the offerings, you’ll choose a loan type and rate and proceed to the full application. This is where you’ll provide bank account information and your income sources will be verified. In some cases, you’ll be asked to submit supporting documentation, so be sure you have paperwork like pay stubs and tax records on hand.

Rocket Loans Customer Support

Overall, online Rocket Loans reviews praise the company’s customer support team. They’re accessible and professional, according to reviews on both Trustpilot and the Better Business Bureau website. “I got a real person almost immediately who had all information in front of her to quickly answer my questions,” one Trustpilot reviewer wrote. “So refreshing to work with such a high caliber firm.”

Rocket Loans has two separate channels for support. If you’re a new applicant looking for advice or assistance with the application, you can email Support@RocketLoans.com or call (800) 333-7625. For existing customers, you can get help through your loan dashboard, by email at Servicing@RocketLoans.com, or by calling (800) 333-7625. You can also reach out directly to the loan servicing team at (313) 230-5233.

Customer service hours are limited to business hours and one weekend day. The support team is staffed from Monday - Friday, 9 a.m. to 7 p.m. ET or Saturday from 9 a.m. to 6 p.m. ET.

Rocket Loans Online Reviews

On sites like TrustPilot and Credit Karma, Rocket Loans reviews highlight the quick application process and the funding time. “Applied online early afternoon,” one Credit Karma reviewer wrote. “Had to submit a couple items via their online system. In all, application to approval was about 3 hours (if that). Funded and in my bank account the very next morning.”

Rocket Loans’ credit score requirement is the center of most negative reviews, as well as the lack of recourse after denial. Rocket Loans doesn’t mention the 640 minimum on its website, so this could be a surprise to some customers. In fact, there seems to be a clear delineation in reviews between those who experienced immediate approval with very little effort and those who were denied a loan. There are, however, some reviews from customers who felt the interest they were charged was higher than it should have been.

| The positive reviews are related to

|

The negative reviews are related to |

| Quick and easy application process | Minimum credit score requirement |

| Fast funding turnaround | No appeals process after denial |

| Responsive, professional customer service | High interest rate |

Rocket Loans Perks and Bonuses

Flexibility

Although Rocket personal loans do come with some late fees, their perks can offset this a little. If you set up autopay, not only will you protect against that $15 late payment fee, but you’ll also get a discount on interest. Rocket doesn’t disclose the autopay discount amount, but instead simply states that the best rates are available with autopay. You must select autopay when you apply for the loan to be eligible. Shifting to autopay later will not qualify you for the discount.

Transparency

To get detailed information about Rocket Loans’ services, you do have to do a little digging on the website. The homepage focuses on the benefits of their personal loans and where to sign up. Only in the fine print at the bottom of the page do you find the APR ranges, term options, and a link to the Fee Schedule. However, Rocket Loans quotes an interest rate before you officially apply, so you’ll just need to be aware of the late fee, origination fee, and autopay discount.

Technology

You can get rates, apply, and set up autopay completely online, with no need to pick up the phone and speak to a representative. The funds will be automatically transferred to your bank account once your loan is finalized. As a borrower, you’ll have access to a dashboard to access your account. There, you can manage all the loans you have through Rocket. There is not a mobile app for Rocket Loans, although there is one for Rocket Mortgage.

Rocket Loans Compared to Other Lenders

When it comes to funds availability speed, Rocket Loans beats out many other lenders, but there are some other options to consider. Since Rocket offers only two term choices, you might find other lenders have a repayment term that works better for your budget. Rocket Loans’ lowest interest rate also trends higher than some other lenders, so it might be worth doing some comparison shopping. The biggest downside of Rocket Loans when compared to other lenders, though, is its failure to let you add a co-signer or co-borrower to your application. That can save you money if your own credit score and income aren’t quite where they need to be to get the best rates.

| Rocket Loans | SoFi | Prosper | Upgrade | |

| Loan Terms | 36 or 60 months | 24, 36, 48, 60, 72, or 84 months | 36 or 60 months | 36, 48, 60, 72, or 84 months |

| Loan amount | $2,000 to $45,000 | $5,000 to $100,000 | $2,000 to $40,000 | Up to $50,000 |

| Interest Rates | 5.970% (with autopay discount) to 29.99% | 5.74% (with all discounts) to 21.78% | 7.95% to 35.99% | 5.94% to 35.97% |

| Min Credit Score | 640 | 680 | 640 | 620 |

| Co-signer Requirement | No co-signers | co-signers allowed after invite from SoFi | No co-signers, but co-borrowers allowed | No co-signers, but co-borrowers allowed |

Final Thoughts

Although this Rocket Loans review shows all the benefits and features, it’s important to compare the offerings to other lenders. Rocket Loans does offer a discount for autopay and higher loan maximums than some competitors, but you’ll pay a loan origination fee and have limited term options. Still, if you’re looking for fast funds turnaround and an easy application process, Rocket Loans might be the right option for you.

FAQs

This app literally changed my like. It provides a great experience. I absolutely love it!