Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Universal Credit Personal Loans Review

Universal Credit is a personal loan provider that specializes in quick funding for loans. You can borrow as little as $1,000 or as much as $50,000 and get the money in one day. The speed to funding the loan is what sets this company apart.

Universal Credit offers personal loans for consolidating debt, paying off credit cards home improvement, or making a large purchase.

The lender offers loans from $1,000 to $50,000 and has no listed qualification requirements. so it is a good choice for almost anyone who wants to get a personal loan. You can even pay the loan off early without paying a penalty.

The lender’s application process takes just a few minutes and it can fund loans in just a day, making it appealing to those who need cash fast.

Summarized Rating

This parameter considers loan term lengths, loan minimums and maximums, and the extent of loan use limitations. Each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Universal Credit gets a solid 3.8 for Loan Features. This reflects the lender’s somewhat flexible term lengths and loan limits and the absence of any loan use limitations.

Universal Credit Personal Loans Pros and Cons

Universal Credit Pros

Universal Credit Cons

Types of Personal Loans Offered by Universal Credit

One of the benefits of personal loans is that you can use them for almost any purpose. They aren’t like mortgages or auto loans where you’re tied to buying a specific thing with them.

Universal Credit asks for the purpose of your loan when you apply but doesn’t specifically list any reasons that it prohibits.

| Common loan uses | Prohibited uses |

| Pay off credit cards | None disclosed |

| Debt consolidation | |

| Start a business | |

| Home improvement | |

| Making a large purchase |

Universal Credit Features

Universal Credit only offers unsecured personal loans with no option for adding a cosigner. However, its loans are relatively flexible. You can borrow small or large amounts, choose from multiple repayment periods, and don’t have to worry about an early repayment penalty.

| Loan terms | Fixed-rate |

| Repayment period | Three or five years |

| Loan amount | $1,000 - $50,000 |

| Loan Use Limitations (i.e. only home improvements or only debt consolidation) | None disclosed |

Universal Credit Interest Rates and Fees

Universal Credit lends to a wide variety of borrowers, so there is a large range of interest rates that you could wind up. To qualify for the best rates, you’ll need to get a debt consolidation loan, let Universal Credit pay off your creditors directly, and sign up for automatic payments.

There are also fees to look out for. All of the company’s loans come with an origination fee and there are some other fees to consider.

| Borrowing/Origination Fees | 4.25% - 8% |

| Prepayment Fees | None |

| Late Payment Fees | Not disclosed |

| Other fees | Not disclosed |

| Interest Rates | 8.93% - 35.93% |

Universal Credit Loan Qualification Requirements

Universal Credit doesn’t allow borrowers to offer collateral or apply for a co-signer, which means you have to qualify for the loan based on your own merit. The company doesn’t list any specific requirements to qualify.

| Membership Requirement | No |

| Minimum Credit Score | Not disclosed |

| Income Requirements | Not disclosed |

| Co-signer/Joint Application Requirements | Cannot apply with a co-signer |

Universal Credit Loan Application Process

One of the selling points of a Universal Credit personal loan is that the application process is relatively quick and easy. You’ll start by entering the amount you’d like to borrow and selecting the purpose of your loan. For example, you might want to borrow money to pay off your credit cards, consolidate debt, or fund a home improvement project.

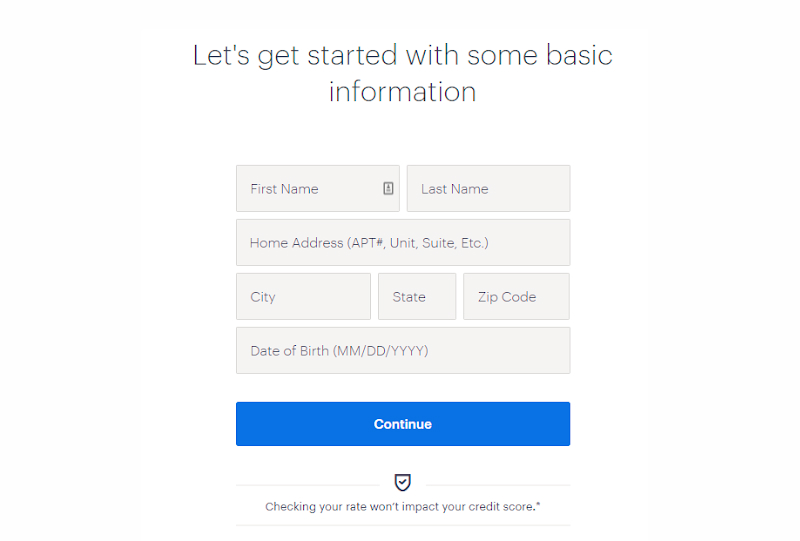

Next, you’ll have to enter your personal info. One perk of working with Universal Credit is that filling out the basic application and checking your rate won’t impact your credit score.

The application will ask for your name, address, and birth date so it can identify you. Later on, you’ll also have to provide a Social Security number.

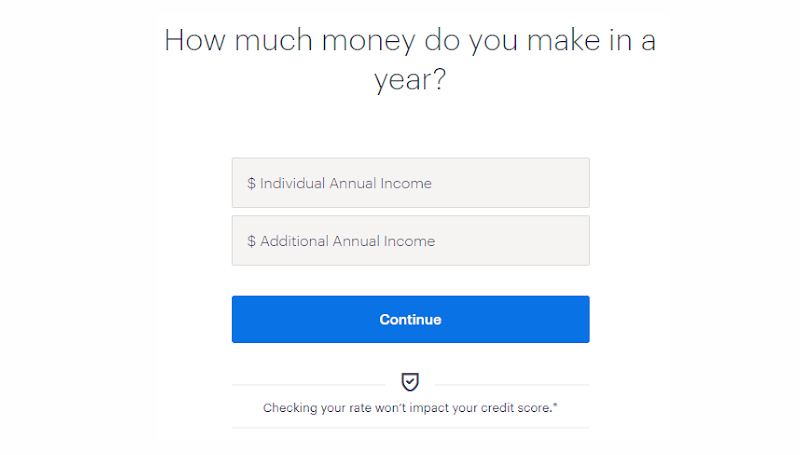

Next, the application asks for your income. You can provide your personal income as well as other income you may use to pay off the loan, such as a spouse’s income or alimony payments.

Make sure that you can provide proof of the income that you enter. Your earnings play an important role in your ability to repay a loan and Universal Credit might ask you to prove your income before it funds your loan.

Finally, you’ll provide your email address and create an account. You’ll use this account to view your loan documents and make payments on the loan if you do decide to accept the loan that Universal Credit offers.

Once you create an account, enter your Social Security number. Universal Credit reviews all of the information you provided and will come up with a loan offer for you. Once you’ve entered your Social Security number, you can see your loan offer, including any fees and the interest rate.

You can use that information to determine the total cost of the loan and decide whether it will fit in your monthly budget. If you decide that you like the loan offer, you can go ahead and start signing the paperwork. The company claims it can fund your loan in just one day, so you’ll get your money quickly.

Even if you can’t get approved by Universal Credit, the company will try to match you to another lender that might be able to help you. It will tailor the recommendation to you based on the info you provided, so it might send you to a lender that works with people who have poor credit or low incomes.

Universal Credit Customer Support

Sometimes, you need a hand when filling out your loan application or reviewing documents from the lender. Universal Credit beats some other online lenders when it comes to customer support, making it relatively easy to get help.

If you want to get email support, you can email the company’s support address at any time. For more urgent requests, there is a phone support line that is open from 6 AM to 6 PM Pacific Time on weekdays and 6 AM to 5 PM Pacific Time on weekends.

Customers are generally satisfied with the support they receive and the process of getting a loan from the company. Universal Credit has a 4.7 out of 5 rating from TrustPilot with customers leaving reviews saying “Quick response, very professional and helpful customer service.”

Universal Credit Online Reviews

When you’re doing anything involving money and credit, you want to make sure that you’re working with a company that is trustworthy. It’s important to consider not only professional reviews but also the experiences of other customers.

The good news for Universal Credit is that it has received strong reviews from independent user review sites. The company has a 4.7 out of 5 rating from TrustPilot and an A+ rating from the Better Business Bureau with a 4.82 rating out of 5 from BBB users.

Common themes from positive reviews tend to mention the speed and ease of the application process, how quickly Universal Credit funds loans, and the ease of getting customer support.

The negative reviews mostly covered miscommunications with customer support and the high rates and fees for borrowers with poor credit

| The positive reviews are related to | The negative reviews are related to |

| Quick online application | High rates and fees |

| Fast loan funding | Miscommunications with support |

| Easy to contact support |

Universal Credit Perks and Bonuses

Universal Credit tries to be as easy to work with as possible. It makes its application process simple and gives you a rate and fee estimate without impacting your credit. It will even refer you to another lender if it doesn’t want to extend a loan to you.

There are also some features that borrowers can use to make the company’s loans cheaper or easier to repay.

Flexibility:

While Universal Credit is inflexible in the sense that it offers one type of loan, it does have some flexibility perks within its personal loan offerings.

Once you’ve received your loan and started making payments, Universal Credit will give you the option to adjust your payment due date. This can be helpful if you want your payments to come right after payday for example.

You also have the freedom to pay off the loan early without facing any kind of prepayment penalty. Some lenders charge you a fee if you pay the loan off early, but Universal Credit appreciates borrowers who pay their loans off quickly.

You can also qualify for some interest rate discounts. Automatic payments will help you lower your rate. You can also get a discount if you use your loan for debt consolidation and choose to have Universal Credit disburse your loan funds directly to your creditors.

Transparency:

Universal Credit is transparent about how its loans work and keeps things easy to understand. While the rates aren’t advertised in bold, you can easily find the interest rate and origination fee ranges in the fine print of the website’s home page.

Another benefit of working with the lender is that you can start the application process and get a quote for your loan’s interest rate and fees without going through a hard credit pull. That means there’s no risk and no damage to your credit when checking your interest rate.

Universal Credit has strong customer reviews with most people praising its customer service, so you can always reach out to support if you have questions about the loan.

Technology:

Universal Credit has a very quick online application that most people can complete in five minutes or less. If you’re looking for an easy application, it’s hard to find one that’s simpler to deal with.

Because Universal Credit is an online lender, you’ll interact with your loan solely through its website. There isn’t an app to use, but you can easily view your account statements and make payments online.

Another technology perk is that you get access to credit monitoring tools that you can use to track your credit score. You can also model improvements in your credit based on paying off your personal loan or other changes to your credit profile.

Universal Credit Compared to Other LendersUniversal Credit Compared to Other Lenders

If you’re looking for a personal loan, Universal Credit isn’t your only option. Take the time to compare multiple lenders to make sure you can find the best loan for your needs.

| Universal Credit | Upstart | OneMain Financial | SoFi | |

| Loan Terms | Fixed rate | Fixed rate | Fixed rate | Fixed rate |

| Loan amount | $1,000 - $50,000 | $1,000 - $50,000 | $1,500 - $20,000 | $5,000 - $100,000 |

| Interest Rates | 8.93% - 35.93% | 5.22% - 35.99% | 18% - 35.99% | 6.99% - 21.78% |

| Min Credit Score | Not disclosed | 300 | Not disclosed | None |

| Co-signer Requirement | No co-signer permitted | No co-signer permitted | Permitted, not required | Permitted, not required |

Final Thoughts

A Universal Credit loan is a good choice for people who need cash and need it quickly. Most people can apply in minutes and get their loan funded in as little as a day, making it one of the quicker online lenders out there.

However, the rates and fees the lender charges are a bit higher than other personal loan providers. That means that people who have more time available will want to shop around and compare their options. Taking the time to look at multiple offers could help you save a lot of money. Still, it’s worth checking your rate from Universal Credit because it only takes a few minutes and won’t impact your credit score.