Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Zippyloan Review

Zippyloan is an online loan marketplace that matches you with lenders that can offer quick loans. You can use the site to borrow between $100 and $15,000 and get the money as soon as tomorrow. This Zippyloan review will tell you everything you need to know about the lender.

Zippyloan is a website offering personal loans. While Zippyloan isn’t a lender itself, it works with a large network of lenders and can help match you to a lender that is willing to work with you. Its personal loans can be used for a wide variety of purposes, unlike more specialized loans like a mortgage or auto loan.

With Zippyloan, you can borrow as little as $100 and you can qualify even if you don’t have good credit. The site prides itself on speed, claiming that you can apply and get money in as little as 24 hours.

Summarized Rating

This parameter considers loan term lengths, loan minimums and maximums, and the extent of loan use limitations. Each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Zippyloan gets a fairly strong 3.8 for Loan Features. This reflects the loan aggregator’s competitive term lengths and loan limits and the absence of any loan use limitations.

Zippyloan Pros and Cons

Before using Zippyloan to apply for a personal loan, consider its advantages and disadvantages.

Zippyloan Pros

Zippyloan Cons

If you are struggling with substantial amounts of debt, a debt relief company such as National Debt Relief could be your lifeline. The company can help you save an average of 30% of your total amount owed..

Types of Personal Loans Offered by Zippyloan

Zippyloan matches applicants with lenders that offer basic, unsecured personal loans. Personal loans are highly flexible. You can use them for almost any purpose, such as paying an unexpected bill, funding a home improvement project, or buying something expensive.

Given that Zippyloan works with lenders that focus on loans ranging from $100 to $15,000, it’s likely targeting people who need some extra cash to cover an unexpected bill or to consolidate a small amount of debt. The site does not explicitly list any prohibited reasons for getting a loan.

Common Loan Uses

- Auto repair

- Baby adoption

- Debt consolidation

- Paying off credit cards

- Emergency

- Vacation

- Wedding

Zippyloan Features

Zippyloan is an online personal loan marketplace. It doesn’t offer loans directly. Instead, it uses the information you provide in your application to match you to lenders that work with borrowers like you. During the application, you’ll provide your financial and credit information as well as the amount of money you want to borrow.

Zippyloan can match you with many different lenders, each with their own rates, fees, and loan features.

| Loan terms | Fixed rate |

| Repayment period | 6 - 72 months |

| Loan amount | $100 - $15,000 |

| Loan Use Limitations | Not disclosed |

Zippyloan Interest Rates and Fees

The fact that Zippyloan works with many lenders is an advantage because it makes it easier for applicants to qualify for loans. There’s a higher chance that Zippyloan can match you with a lender that will approve you.

However, it also means that it’s hard to predict the fees and interest rates of the loans you can get through the site. Each lender is free to set its own rates and fees.

| Borrowing/Origination Fees | Varies by lender |

| Prepayment Fees | Varies by lender |

| Late Payment Fees | Varies by lender |

| Other fees | Varies by lender |

| Interest Rates | Varies by lender |

Zippyloan Qualification Requirements

Zippyloan does not list any specific requirements for borrowers looking to apply for a loan. Instead, it aims to match you with lenders based on the information you provide during the application process

Zippyloan claims that you can qualify even if you have poor credit, which means it works with some lenders that focus on subprime borrowers.

| Membership Requirement | None |

| Minimum Credit Score | None |

| Income Requirements | Varies by lender |

| Co-signer/Joint Application Requirements | Varies by lender |

Zippyloan Application Process

Zippyloan is all about helping people borrow money quickly, so it makes sense that its application process is simple and easy to complete.

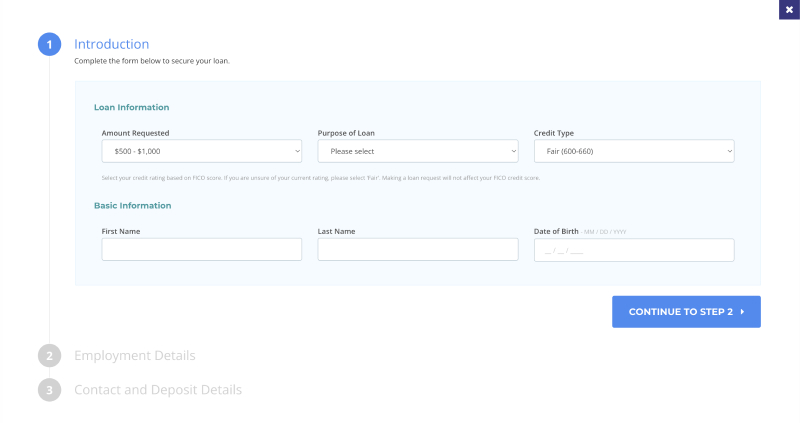

When you first open the site, you’ll see a form that asks how much you want to borrow, your ZIP code, and your email address. Once you submit those details, the site will bring you right to the application.

The full application is a simple, three-step process. First, you need to provide an estimate of your credit, your reason for applying for the loan, and your personal info. The site uses all of this information to match you with lenders, so make sure that you provide an accurate estimate of your credit score.

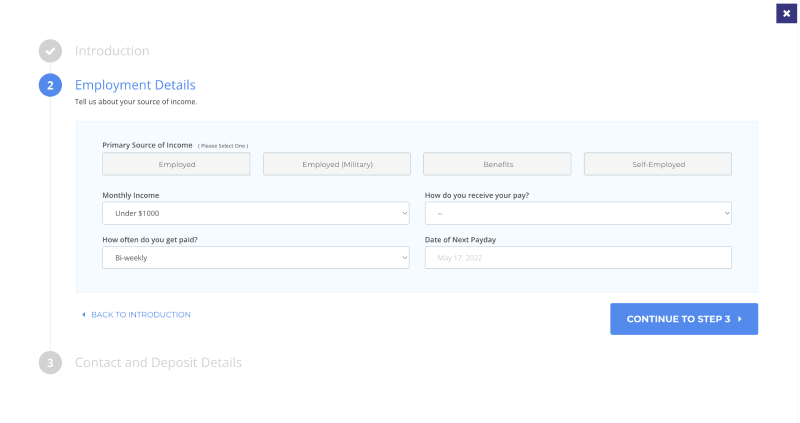

Next, the application asks about your financial situation, including how you receive income, how much you make, how frequently you receive income, and the date of your next paycheck.

Some of the lenders that Zippyloan works with are short-term lenders that specialize in lending small amounts with the expectation that you repay the loan out of your next paycheck. That’s why the form asks for specific information about your pay dates.

Keep in mind that lenders will verify the information you provide here, so be sure to tell the truth about how much you make and how frequently you get paid.

If employment is your primary source of income, the form will also ask for some details about your employer and work history.

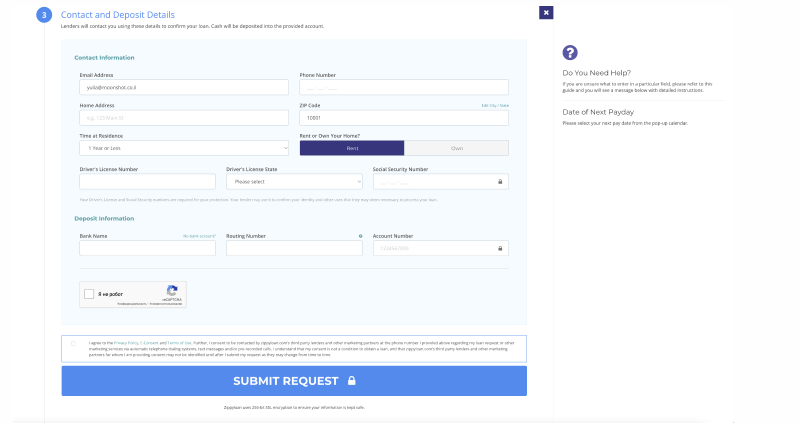

Finally, the application asks for your home address, some identifying information like your driver’s license number and Social Security number, and your bank information, including your bank’s routing number and account number.

This information helps the lender check your credit report to make sure you have sufficient credit to get a loan. Providing your bank account info is somewhat unusual for this point in an application, but helps lenders fund your loan quickly.

Once you submit your application, Zippyloan will try to match you with a lender that is willing to give you a loan. If you’re approved, you can get cash to your bank account as soon as the next day.

Zippyloan Customer Support

One of the biggest drawbacks of Zippyloan is that it lacks a good way of getting support. There isn’t a phone number or email address you can use to contact the site if you need to get help.

The ZippyLoan site has some helpful FAQs and pages that outline the application process and give you basic information about personal loans but if those pages don’t answer your question, you’re largely out of luck. If you run into problems during your application or have a question, you won’t be able to get assistance.

Keep in mind that you do give Zippyloan your email address and phone number during the application. Zippyloan and lenders might reach out to you by phone, but you can’t be the one to make the first call.

Customers tend to agree that this lack of support is an issue. There are no reviews on popular customer review site TrustPilot and customer reviews from the Better Business Bureau also mention the lack of support negatively.

Zippyloan Online Reviews

One of the best ways to learn about a company is to look at customer reviews. While professional reviews can be very helpful, learning about the issues that regular customers face can give you a deeper understanding of how easy a company is to work with.

Zippyloan has overwhelmingly negative reviews on popular customer review sites. There are no reviews for the lender on TrustPilot. The Better Business Bureau notes that the business is not accredited and awards it a B- rating. However, customer ratings on the BBB site are universally negative and the company has received an average rating of 1 out of 5.

The reviews state that after applying for a loan through Zippyloan, customers begin to receive a massive number of phone calls and emails soliciting them to apply for loans. One reviewer said “Constantly receiving unsolicited emails from zippyloans.com - even after repeatedly requesting I be removed from mailing list and it's same ol same ol - 2or 3 a day.”

Another claimed “I get on average 25 to 30 unsolicited emails a day advertising this business. I have asked to be unsubscribed multiple times without any change.”

There are no positive reviews to serve as a counterpoint to the negative reviews on the Better Business Bureau website.

| The positive Zippyloan reviews are related to | The negative Zippyloan reviews are related to |

| None | Lack of customer support |

| Customers receive a large volume of spam after using the site | |

| No way to unsubscribe from messages |

Zippyloan Perks and Bonuses

When you apply for a loan, you need to consider things like whether the lender will approve you and the cost of the loan. However, you should also think about things like how easy it will be to work with a lender and how flexible the lender is.

Zippyloan doesn’t offer loans directly, so it’s hard to get a sense for whether the lender you get matched to will be easy to work with.

Flexibility

Every lender works differently when it comes to how it funds loans and how it expects repayment. Some lenders will give you the freedom to choose from different repayment terms or to choose your own payment due date while others won’t.

The primary flexibility benefit of Zippyloan is that it lets you apply for a loan for as little as $100. Beyond that, it’s hard to know how flexible your loan will be because Zippyloan could match you with so many different lenders.

Transparency

Zippyloan’s website is relatively opaque. It tells you how much you can borrow but doesn’t provide any information about loan interest rates or fees. That makes it hard to predict the cost of your loan before applying.

The site also lacks any way to get in touch with customer support. There is no contact email address or phone number that you can use to get help. The fine print on the site also lacks any information about the loans you can receive.

Technology

The Zippyloan website is relatively basic, featuring a few pages with FAQs and a loan application.

Depending on the lender that Zippyloan matches you to, the tech experience after you get your money can vary widely. Some will have an easy-to-use website that lets you manage your loan and make online payments while others will be harder to work with.

Zippyloan Compared to Other Lenders

Before applying for a loan, it’s important to compare all of your options to make sure you’re getting the best loan for your needs.

| Zippyloan | Earnest | Payoff | Upstart | |

| Loan Terms | Fixed rate | Fixed rate | Fixed rate | Fixed rate |

| Loan amount | $100 - $15,000 | $1,000 - $250,000 | $5,000 - $40,000 | $1,000 - $50,000 |

| Interest Rates | Varies by lende | As low as 2.49% | 5.99% - 24.99% | 5.22% - 35.99% |

| Min Credit Score | Varies by lende | Not disclosed | Not disclosed | 300 |

| Co-signer | Varies by lender | Not permitted | Not permitted | No co-signer |

Final Thoughts

Zippyloan is an online loan marketplace that claims to offer quick loans for small amounts of money. The fact that you can borrow as little as $100 is nice, especially if you’re facing just a short-term need.

However, there are a lot of drawbacks to consider before working with Zippyloan. The website is basic and doesn’t provide much information about the loans you can get. Additionally, customer reviews are universally negative and talk about receiving massive amounts of spam email and phone calls after using the site to apply for a loan.

Given that there are many other personal loan websites and lenders that you can work with, you have to consider whether dealing with all those headaches is worth applying through Zippyloan. Most people will be better off considering an alternative.