CommonBond offers undergraduate, graduate, MBA, dental, and medical student loans along with student loan refinancing. The lender also offers student loan employee benefits to businesses. CommonBond is a great fit for creditworthy borrowers looking to refinance at a low rate while making an impact or borrowers who want the option of removing a cosigner. Learn more about all that CommonBond has to offer in our CommonBond review.

CommonBond Review: Student Loans and Refinancing

CommonBond offers student loans and refinancing with flexible terms and options for forbearance. Borrowers have access to a well-reviewed care team, and CommonBond loans also have a social impact — with every loan borrowed or refinanced, CommonBond pays for a child’s education in the developing world.

Summarized Rating

This parameter considers loan term lengths, loan limits, and loan structure optionality (fixed and variable rate offerings). For each loan type offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

CommonBond gets a stellar 4.7 for Loan Features, which is attributable to its highly flexible term lengths, loan amounts, and loan structure optionality (fixed vs. variable).

CommonBond Pros

CommonBond Cons

What Types of Student Loans Does CommonBond Offer?

CommonBond issues loans for undergraduate and graduate students and offers refinancing for existing borrowers hoping to get a lower rate. The lender offers the following products:

CommonBond Student Loans

- Undergraduate Student Loans

- Graduate Student Loans

- MBA Student Loans

- Medical Student Loans

- Dental Student Loans

CommonBond Student Loan Refinancing

CommonBond Student Loan Review

Student Loan Features

You’ll need to borrow a minimum of $2,000 when applying for a CommonBond student loan, and the lifetime borrowing limit is $500,000. CommonBond student loans come with either fixed or variable APRs. CommonBond offers flexible terms of 5, 10, or 15 years, so choose the shortest term with a monthly payment you can afford in order to save money on interest. You can defer repayment of the loan for up to 6 months after graduation or begin repayment in school.

Loan terms |

5, 10, or 15 years |

Repayment period |

Up to 6 months deferment after graduation |

Loan amount |

$2,000 to $500,000 |

Loan Structure Flexibility |

Fixed or Variable |

CommonBond Interest Rates and Fees

CommonBond doesn’t charge any origination fees or maintenance fees. There’s no prepayment penalty, either, so you’re free to make extra payments at any time or pay off your loan early. If you’re late with a payment, CommonBond will charge you 5% of the past due balance or $10, whichever is less. CommonBond offers fixed or variable APRs that start higher than some other lenders but are capped relatively low. It’s worth running a rate check to see if CommonBond can offer you a lower rate than other lenders. Note that CommonBond rates include a 0.25% Autopay discount.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Lesser of 5% or $10 |

Maintenance Fees |

None |

Fixed Rates |

Undergraduate: 3.74% to 10.74% Graduate: 3.74% to 10.74% MBA: 4.09% to 6.95% Medical: 5.56% to 6.76% Dental: 5.79% to 7.16% |

Variable Rates |

Undergraduate: 3.91% to 9.48% Graduate: 3.91% to 9.48% MBA: 5% to 6.69% Medical: 3.52% to 4.7% Dental: 6% to 7.37% |

CommonBond Student Loan Qualification Requirements

All student loan applicants with the exception of students in one of 29 MBA programs must apply with a creditworthy cosigner who has a FICO score of at least 660. However, you can apply to release your cosigner after 24 months of consecutive full payments. While there’s not a disclosed minimum income or maximum DTI, CommonBond will evaluate your debt and income when making a decision.

To be eligible for a CommonBond student loan, you must also be a U.S. citizen or permanent resident enrolled at least half-time in a school that’s in CommonBond’s network. Loans are not available in Mississippi or Nevada.

Institution Type & Course Load Requirements |

At least half-time enrollment in an in-network school |

Minimum Credit Score |

660 |

Minimum Income |

Undisclosed |

Maximum Debt-to-Income |

Undisclosed |

Co-signer/Joint Application Requirements |

Requires cosigner |

CommonBond Student Loan Refinancing Review

CommonBond Student Loan Refinancing Features

You can refinance up to $500,000 with CommonBond and choose a repayment term of five, seven, 10, 15, or 20 years. However, bear in mind that rates increase with longer terms. Repayment begins 30 to 60 days after the funds are disbursed, unless you graduated this year and your loans are still in deferment. You can defer repayment if you go back to school, and forbearance is available in times of hardship.

You also have the option to choose a fixed, variable, or hybrid structure when refinancing your student loans with CommonBond. The hybrid loan offers a low fixed APR for the first five years and a variable APR for the remaining five years, which makes it a good option for borrowers who hope to make extra payments early on but still want flexibility.

Loan terms |

5, 7, 10, 15, or 20 years |

Repayment period |

30-60 days after disbursement, unless currently in deferment |

Loan amount |

$2,000 to $500,000 |

Loan Structure Flexibility |

Fixed, variable, or hybrid |

CommonBond Student Loan Refinancing Interest Rates and Fees

CommonBond doesn’t charge any origination fees or maintenance fees, and you can pay off your loan early without incurring a penalty. There’s a late fee of $10 or 5% of the past due balance, whichever is less. CommonBond offers very competitive APRs for refinancing, but note that rates vary depending on the term you choose. For example, the starting fixed rate for a 10-year loan is 2.99%, so the hybrid rate is lower on 10-year loans. Rates include Autopay.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Lesser of 5% or $10 |

Maintenance Fees |

None |

Fixed Rates |

2.49% to 6.74% |

Variable Rates |

2.00% to 6.86% |

Hybrid Rates |

2.85% to 6.57% |

CommonBond Student Loan Refinancing Qualification Requirements

To refinance a student loan with CommonBond, you must be a U.S. citizen, permanent resident, or visa holder — CommonBond doesn’t offer refinancing to international students. You also must have graduated from an eligible school in CommonBond’s network. Cosigners are allowed but not required, and you can apply for cosigner release after 36 consecutive months of full payment.

You or your cosigner will need a FICO score of at least 660, and while the minimum income and DTI are undisclosed, CommonBond will evaluate your debt and income when making a decision. Refinancing isn’t available in Mississippi or Nevada.

Institution Type & Course Load Requirements |

Graduate of a Title IV school in CommonBond’s network |

Minimum Credit Score |

660 |

Minimum Income |

Undisclosed |

Maximum Debt-to-Income |

Undisclosed |

Co-signer/Joint Application Requirements |

Cosigner allowed; cosigner release available |

CommonBond Application Process

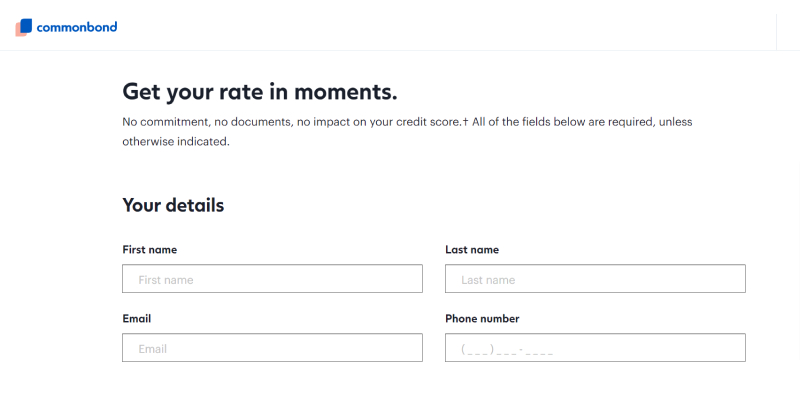

The first step is to prequalify with CommonBond. For refinancing, click “See My Rate” on the CommonBond refinancing page and enter your personal information on the following page. You’ll need details like your contact information, address, education, and employment information.

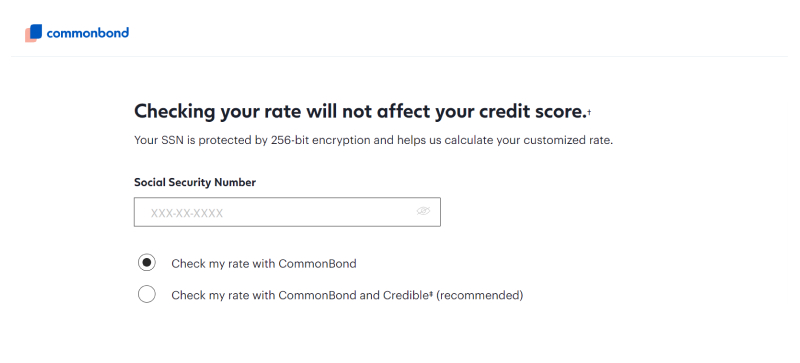

At the end of the page, you’ll enter your social security number. Checking your rate in this step will only result in a soft credit pull, which won’t impact your credit score. If you decide to formally apply, CommonBond will run a hard credit check, which will cause a temporary dip in your credit score.

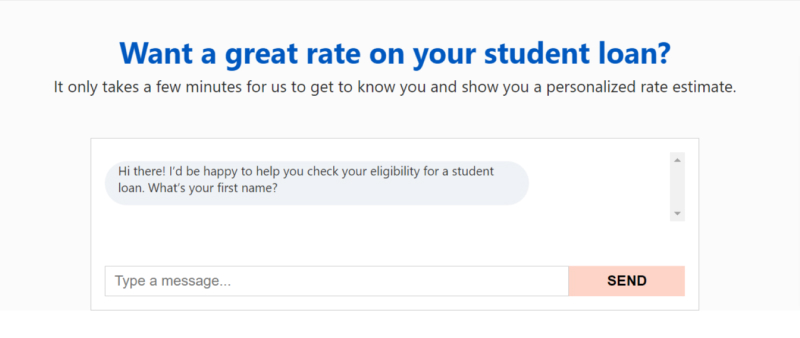

To check your rate on a student loan, go to CommonBond’s prequalification page. You’ll see a chat box that will ask you for your first name. CommonBond will walk you through all the necessary information you’ll need to provide, one question at a time.

If you’re happy with your rate estimate, you’ll need to formally apply. CommonBond will ask what type of loan you’re applying for and how much you need. At this point, your cosigner will also need to authorize a hard credit inquiry.

Refinancing has a formal application process as well, which will require a hard credit check. You’ll also need to provide proof of employment, proof of residency, and a recent statement from each loan you plan to refinance.

Once you’re approved for a loan, you’ll select your term and repayment plan. Your school will then need to certify the loan, which can take up to three weeks. The money will then be disbursed to your school. Refinancing can happen faster, since CommonBond won’t need certification. Once you’re approved, the money will be sent to your current lenders.

CommonBond Customer Support

CommonBond offers extended customer service hours that make it convenient to get in touch with their U.S. based support team. You can call 800-975-7812 on weekdays from 9am to 8pm EST, and emails are welcome anytime at care@commonbond.co. There’s also a live chat feature that can answer common questions, and if you click “Talk to an Agent” you will be connected with a human.

Borrowers have great things to say about CommonBond’s customer service team on the lender’s reviews page. As one reviewer put it, “Extremely helpful customer service. Never had a long wait to speak to someone on the phone, and made refinancing my student loans a breeze. I can’t thank commonbond enough or their team for all they have done for me!” Most complaints were not related to customer service but instead regarded denials or higher rates than expected.

CommonBond Customer Reviews

CommonBond has excellent customer reviews on the lender’s website, but unfortunately, third-party review sites like Trustpilot lack enough reviews for consensus. On the lender’s review page, which is powered by Yotpo, CommonBond has about a 4.5 out of 5 star rating from over 360 reviewers.

Positive reviews referenced both the cost-saving aspect of refinancing as well as the experience interacting with customer service. For example, one reviewer said, “My experience so far with Commonbond has been wonderful. They've saved me money and taken years off the length of my student loan, while providing an easy to understand, concise process. They also help provide education for students in Ghana through a non-profit called Pencils of Promise, which frankly is what made me choose them over a competitor with an otherwise similar offer. I look forward to partnering with Commonbond throughout the process of paying off my loan.”

However, some people had complaints about the website and others were unhappy with the rate they were offered. As one reviewer said, “I get great teaser information about rates lower than my current rate. After taking the time to apply, I find rates that are significantly higher than my current rate. I have a credit score above 750.”

The positive reviews are related to… |

The negative reviews are related to… |

|

|

CommonBond Perks and Bonuses

Flexibility

CommonBond offers deferment for six months after graduation, and you can also defer payments if you go back for a second degree. CommonBond also has excellent hardship protection — you can request forbearance for things like military deployment, unexpected job loss, illness or injury, bankruptcy, and more. For student loans, you can pause your payments for a total of 12 months over the life of your loan. If you’re refinancing, you get up to 24 months over the life of the loan.

Mentorship

CommonBond doesn’t offer any career counseling or financial education, but the lender does offer assistance with managing your loan. You can request forbearance or discuss refinancing or cosigner removal. You can even ask to change your due date. Loans are serviced by Firstmark Services, which you can reach at 844-318-0166 if you have questions about your loan.

Technology

CommonBond doesn’t offer credit card payments, but you can pay online or by phone using a debit card or set up an auto debit from your checking or savings account. You’re also welcome to mail a paper check. There’s no mobile app, so you’ll need to set up online payments in your browser.

Final Thoughts

CommonBond is a lender you should consider when comparing student loan rates. The repayment flexibility and forbearance options make the lender a wise choice, because unexpected circumstances can come up at any time over the life of your loan. Refinancing rates are also very competitive and CommonBond’s Social Promise gives you the chance to do something good with your loan. While the cosigner requirement may preclude some borrowers, and APRs may not be the lowest for student loans, it’s definitely worth prequalifying with CommonBond.

Frequently Asked Questions (FAQs)

This app literally changed my like. It provides a great experience. I absolutely love it!