Launched in 2013, Earnest offers both private student loans and student loan refinancing, and has a Client Happiness team available to assist you with the application and repayment process. Earnest doesn’t charge fees on either of its products, and starting APRs on private loans are low for creditworthy borrowers. Also, Earnest is best for borrowers who want to customize their repayment terms and anticipate the need for flexibility. Read on for our full Earnest review.

Earnest Review: Student Loans and Refinancing

Earnest is a lender that takes an individualized and supportive approach to offering student loans. The lender reviews more than just your credit score when determining your rate and offers payment flexibility and a unique pricing model that can save you money.

Summarized Rating

This parameter considers loan term lengths, loan limits, and loan structure optionality (fixed and variable rate offerings). For each loan type offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Earnest scores a slightly below average 3.8 for Loan Features, which is reflective of a high degree of loan structure optionality (fixed vs. variable) on the upside and fairly restrictive loan amounts on the downside.

Earnest Pros

Earnest Cons

What Types of Student Loans Does Earnest Offer?

Earnest provides both private student loans, which are available with and without a co-signer, and student loan refinancing. We’ll go over the features, fees, and eligibility requirements for each product, so you can decide if Earnest is the right lender for you.

- Earnest Private Student Loan

- Earnest Student Loan Refinance

Earnest offers its private student loans for a variety of purposes, including:

- Undergraduate Student Loans

- Graduate Student Loans

- Cosigner Student Loans

- Parent Student Loans

- MBA Private Student Loans

- Medical School Loans

- Law School Loans

Earnest Private Student Loan Review

Earnest Private Student Loan Features

With any Earnest student loan, whether graduate or undergraduate, you can borrow up to the full cost of your education. That also includes housing, meals, books, and supplies. With Earnest loan deferment, you’ll get up to a nine month grace period after graduation before you need to start repayment, which is 50% longer than what most other lenders offer.

You can choose whether you want a variable or fixed rate loan and pick your monthly payment or loan term as well. Earnest allows you to choose the exact term you can afford, whereas traditional lenders might make you choose between a 10, 15 or 20-year term. Since rates are typically higher with longer terms, choosing an in-between term (like 11 years) can save you money.

Loan terms |

5-20 years |

Repayment period |

Begins 9 months after graduation |

Loan amount |

$1,000 up to total cost of attendance |

Loan Structure Flexibility |

Variable or fixed-rate loans |

Earnest Private Student Loan Interest Rates and Fees

Earnest doesn’t charge any fees, including late payment fees, and it’s perfectly acceptable to pay off your loan early without penalty. You can even skip one payment per year, which can be helpful if unexpected expenses come up. If you enroll in Autopay, you’ll get a 0.25% rate discount.

You can choose between a variable APR, which will start between 0.94% and 11.69% and vary with the market, or a fixed rate, which will be set between 2.94% and 13.03% depending on your creditworthiness, term, and other factors. For reference, the average student loan interest rate across all borrowers is 5.8%, and typical undergraduate federal loans have a 3.73% fixed interest rate, although federal relief is currently in-force.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

None |

Maintenance Fees |

None |

Fixed Rates |

2.94% (with Autopay) to 13.03% |

Variable Rates |

0.94% (with Autopay) to 11.69% starting |

Earnest Private Student Loan Qualification Requirements

To apply for an Earnest student loan, you must be the age of majority in your state and be a U.S. citizen or permanent resident. You can’t reside in Nevada. You must be enrolled full-time (or at least half-time as a Senior) in a Title IV-qualified, not-for-profit, four-year institution pursuing a bachelor’s degree or graduate degree.

You or your co-signer must have a minimum credit score of 650, have at least three years of credit history, and earn at least $35,000 annually. You and your co-signer cannot have any bankruptcies or accounts in collections and must have a history of on-time payments on any accounts reported to the credit bureaus. Earnest doesn’t specify a hard limit for debt-to-income ratio, but too much non-mortgage debt could disqualify you.

Institution Type & Course Load Requirements |

Title IV-qualified, not-for-profit, four-year, full-time (or at least half-time for seniors) |

Minimum Credit Score |

650 |

Minimum Income |

$35,000 |

Maximum Debt-to-Income |

Not specified |

Co-signer/Joint Application Requirements |

Co-signers allowed |

Earnest Student Loan Refinance Review

Earnest Student Loan Refinance Features

To refinance your loans with Earnest, you must request a $5,000 minimum loan amount (or $10,000 if you are a California resident). You can consolidate multiple loans, refinance them at a fixed or variable interest rate, and repay Earnest over the course of five to 20 years. You’ll be able to pick the exact term that is affordable for you. Repayment begins one month after you receive the loan proceeds. Earnest offers refinancing for Parent PLUS loans as well. Earnest loan consolidation isn’t currently available — consolidation is different from refinancing.

It’s important to keep in mind that if you refinance your federal student loans with Earnest, you won’t be eligible for certain income-driven repayment plans, federal relief, or other benefits that come with having a federal student loan.

Loan terms |

5-20 years |

Repayment period |

Begins one month after disbursement |

Loan amount |

$5,000 to $500,000 |

Loan Structure Flexibility |

Fixed or Variable |

Earnest Student Loan Refinance Interest Rates and Fees

Earnest doesn’t charge any fees for refinancing your student loans. You can pay off your loan early without penalty. You also won’t be charged a late fee, but you should still make your payments on-time to maintain good credit. Earnest allows you to skip one payment a year, which can be helpful during times of hardship.

You can choose a fixed rate, which will fall between 2.44% and 7.24%, or a variable rate, which will fall between 1.74% and 7.24% (although variable rates are not available in select states). You also have the option of making bi-weekly or monthly payments.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

None |

Maintenance Fees |

None |

Fixed Rates |

2.44% to 7.24% (with Autopay) |

Variable Rates |

1.74% to 7.24% (with Autopay) starting |

Earnest Student Loan Refinance Eligibility Requirements

To qualify for refinancing, you must be 18 and be a U.S. citizen or permanent resident. You can’t reside in Kentucky or Nevada. You must have begun student loan repayment. If you’re still in school, you need to be enrolled less than half-time or you need to complete your degree by the end of the semester. The debt must have come from a Title IV-accredited school in the U.S. To refinance an Earnest student loan, you’ll need at least four months of consecutive, on-time payments.

You’ll also need a minimum credit score of 650 and consistent and sufficient income. You can’t be behind on mortgage or rent payments or have any bankruptcies, and your student loan accounts must all be in good standing.

If your degree is incomplete, you must meet a few additional requirements. You’ll need a minimum credit score of 700, debt from a not-for-profit institution, and a last attendance date that was at least six years ago.

Institution Type & Course Load Requirements |

Title IV-accredited school |

Minimum Credit Score |

650 (700 if degree is incomplete) |

Minimum Income |

Not specified |

Maximum Debt-to-Income |

Not specified |

Co-signer/Joint Application Requirements |

Co-signers and joint applications not allowed |

Earnest Application Process

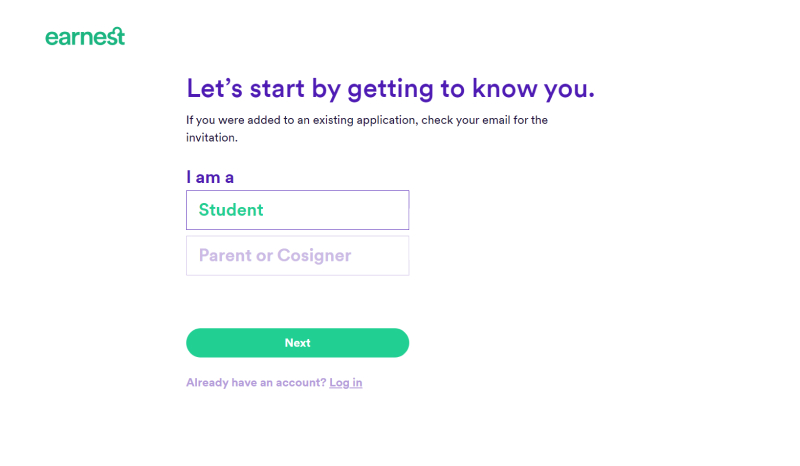

Earnest only accepts online applications. To start an Earnest application, select whether you are a student or parent/co-signer.

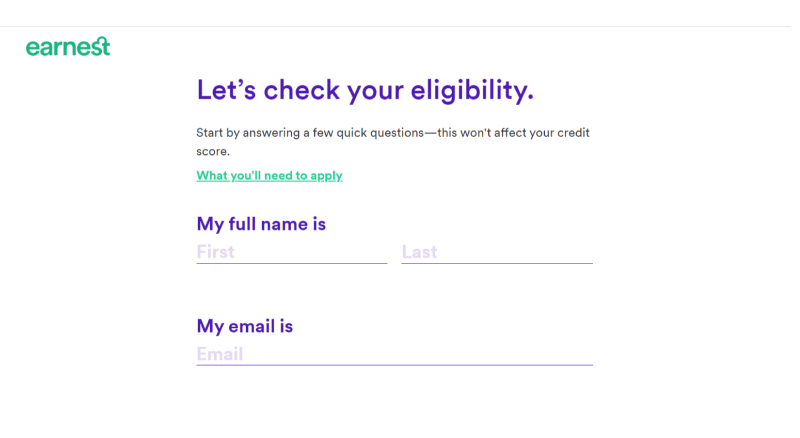

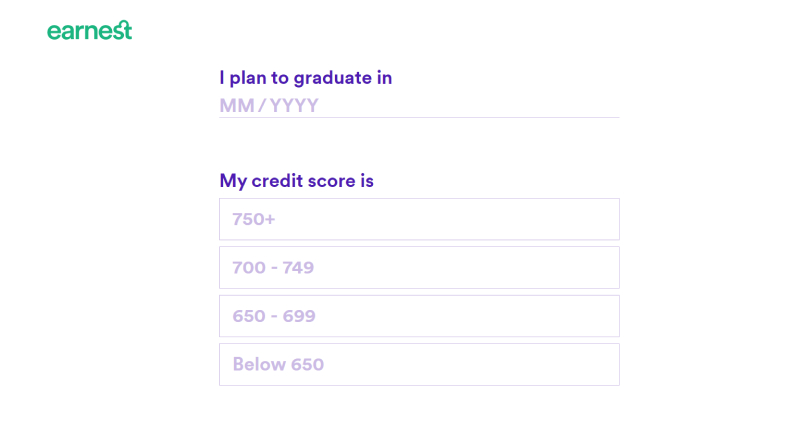

The next step is to check your eligibility. You’ll need to enter information like your name and email, address, date of birth, citizenship, school, degree, enrollment status, and intended graduation year.

You’ll also need to estimate your credit score. Checking your eligibility in this step won’t impact your credit score, but Earnest will do a hard credit check later in the application process.

If you are deemed eligible, you’ll be shown an estimated rate. Should you choose to move forward with the application, you’ll need to link your financial accounts to your Earnest profile for evaluation. Earnest also uses LinkedIn to verify your identity. You may also need to verify your identity by phone, in which case Earnest will email you to set up a time.

After submitting your financial and employment/income information, Earnest will run a hard credit check, which may cause a small and temporary decrease in your credit score. It typically takes three to six business days to get an answer from Earnest. If you’re refinancing, it will take two to five business days to receive a decision.

Once you’re approved, you’ll see your final rate and will have 30 days to accept your offer. You’ll be able to pick the term and monthly payment that you can afford. Certifying your private student loan with your school typically takes 1-3 weeks, and then there is a mandatory cooling period of 3 business days before your institution can receive the funds. The whole process takes two to five weeks on average. Refinancing can happen faster.

You can also use Earnest’s rate check feature without beginning an application, and you can use the live chat feature to get assistance with any questions you may have.

Earnest Customer Support

You can contact Earnest via live chat, online request, or by phone at 888-601-2801. Hours are weekdays from 8am to 5pm PST, except for holidays. Some lenders offer 7-day customer support, so this was a drawback to Earnest.

Customer service reviews on third-party websites like Trustpilot are very favorable. While a few people report misinformation or conflicting information from customer service representatives, most customers were happy with the friendliness and responsiveness of the customer service team.

As one customer put it, “Earnest has been a wonderful company to handle my student loans. I have been able to really make a dent in debt thanks to consolidating and competitive rates. They are also proactive about helping their customers get lower rates when interest rates fall. I felt cared for and Earnest kept my business! Customer service is always stellar.”

Earnest Online Reviews

Earnest has a 4.7 out of 5 star average rating on Trustpilot, and 86% of reviewers rated the lender as “excellent.” Happy customers cited low rates, an easy process that was relatively fast, and a responsive and friendly team as reasons for their glowing reviews. On the other hand, customers who had complaints were either not happy with their rate, confused by the website, or disappointed by poor communication from customer service representatives.

One reviewer had the following to say about their experience with Earnest:

“I received a pre-qualification letter and decided to check the rate online via a soft credit pull. With a favorable rate and terms I decided to apply for a college loan re-fi. The process was smooth and simple and I was able to supply all requested materials in a short time. The underwriting and approval process was quick and easy. The entire process from application to approval to loan payoff occurred in a short 2 week span. I would definitely recommend this lender and consider using them again for my own future loans.”

The positive reviews are related to |

The negative reviews are related to |

Fast and easy process |

Noncompetitive interest rates |

Low rates |

Low rates |

Friendly and responsive customer support |

Poor communication from customer service |

Earnest Perks and Bonuses

Flexibility

Earnest offers borrowers a ton of flexibility when it comes to loan repayment. They offer both a short-term interest only program and a temporary rate reduction program that can lower your monthly payment. If you’re struggling, you can also skip one payment per year or request forbearance if you can document a verifiable hardship. For example, you may have incurred medical bills that have made it impossible to afford your loan payment. That might be a situation in which Earnest would be willing to work with you.

Going back to school may also make you eligible for deferment, as would military service. And if you die or become totally and permanently disabled, Earnest will discharge your student loans. Earnest also offers extra flexibility for co-signed loans — you can start making interest-only or full payments during school to save money over the life of your loan.

Mentorship

Earnest doesn’t offer any career or financial mentorship, but you can get assistance with managing your loan from the customer service team. You can also login anytime to change your payment due date, set up bi-weekly payments, or make an extra payment.

Technology

Earnest doesn’t accept credit card payments, but you can set up a payment from your checking or savings account, mail a paper check, or send an ACH payment.

Final Thoughts

Earnest has a few competitive features that make it a great choice for student loans and student loan refinancing. The longer deferment period and the opportunity to skip a payment each year make student loans through Earnest easier to manage. What really sets Earnest apart is the way the lender prices loans based on the term. Rather than forcing you to choose a longer term than you need, Earnest lets you set a specific term based on the monthly payment you want. This can save you money in the long run.

Still, you should prequalify with a handful of lenders to compare your Earnest interest rate. Earnest’s rates are competitive, but we’ve seen lower starting refinance rates at other lenders. And if you need a co-signer to help with refinancing, you’ll need to look elsewhere. But overall, our Earnest review found that Earnest is a highly reputable lender offering excellent payment flexibility, and we recommend that you consider Earnest on your path to finding the best loan for you.

Frequently Asked Questions

This app literally changed my like. It provides a great experience. I absolutely love it!