Funding U student loans are designed for current students attending eligible schools who need smaller private student loans to fill a funding gap. Funding is available for full-time freshmen and sophomores, but juniors and seniors may have an easier time qualifying. This Funding U review explores the qualifications requirements for these loans, and examines the reviews of borrowers that already secured a loan.

This Funding U Review Considers this Unique Student Loan Option

Funding U was created to differentiate itself from other student loan lenders. Most lenders emphasize credit scores, credit history and cosigners only to qualify borrowers for private student loans. While Funding U does review credit information, it also considers grades and future income prospects.

Summarized Rating

This parameter considers loan term lengths, loan limits, and loan structure optionality (fixed and variable rate offerings). For each loan type offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Funding U scores a worst-in-class 2.0 for Loan Features. This is reflective of average term lengths, below average loan limits, and very limited loan structure optionality (fixed vs. variable).

Funding U Pros

Funding U Cons

What Types of Student Loans Does Funding U Offer?

Funding U offers one type of private student loan and it's for current undergraduate students only. Students must be enrolled full-time at an accredited four-year institution that meets Funding U’s graduation-rate requirements. For-profit schools are not eligible either.

Undergraduate Funding U Student Loans Review

Undergraduate Student Loan Features

Funding U offers one type of loan- a private school loan for undergraduate students - with one loan term option of 10 years. Although there are repayment options, such as interest-only payments and forbearance, the interest rate is fixed only. The amount of the loans range from $3,000 to $15,000 per school year, making it ideal for students who need smaller amounts of funding where other loans or income may fall short.

Loan terms |

10 years |

Repayment period |

Varies |

Loan amount |

$3,000 to $15,000 per school year |

Loan Structure Flexibility |

Fixed only |

Undergraduate Student Loan Interest Rates and Fees

Funding U is noted as having a small amount of fees associated with the loans. There are no application, borrowing, origination fees, or maintenance fees. Where loan recipients will see a difference though is with the interest rate. The current fixed interest rates, 7.49%-12.99%, are higher than what you might find with other lending institutions, however you can earn a 0.50% discount for enrolling in AutoPay.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

None |

Maintenance Fees |

None |

Fixed Rates |

7.49%-12.99% |

Variable Rates |

N/A |

Undergraduate Student Loan Qualification Requirements

To qualify for a Funding U loan, you must be enrolled full-time in an eligible four-year Title IV school and pursue a bachelor’s degree as an undergraduate. Recipients of the loans must also be either U.S. Citizens, Permanent Residents or qualify under DACA. Currently Funding U is available to lend in 30 states, so you will need to confirm eligibility when you start the application process. All years in college are permitted to apply for loans, but freshmen and sophomores have the most strict requirements from Funding U.

Institution Type & Course Load Requirements |

Undergraduate school students only, must be enrolled full-time |

Minimum Credit Score |

Not disclosed |

Minimum Income |

Not disclosed |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

No cosigner allowed |

Funding U Application Process

Funding U loans may not have the traditional qualifications and requirements like most other student loan lenders but the application process still deserves special attention.

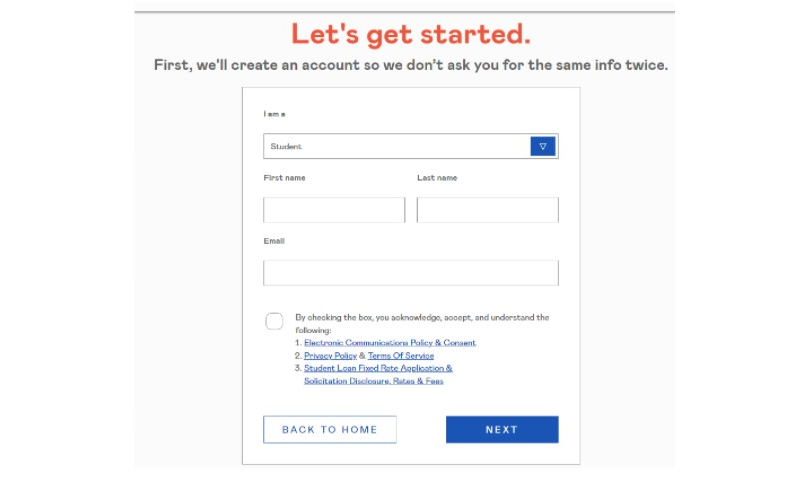

To get started you need to create an account, including agreeing to the terms and conditions for consent.

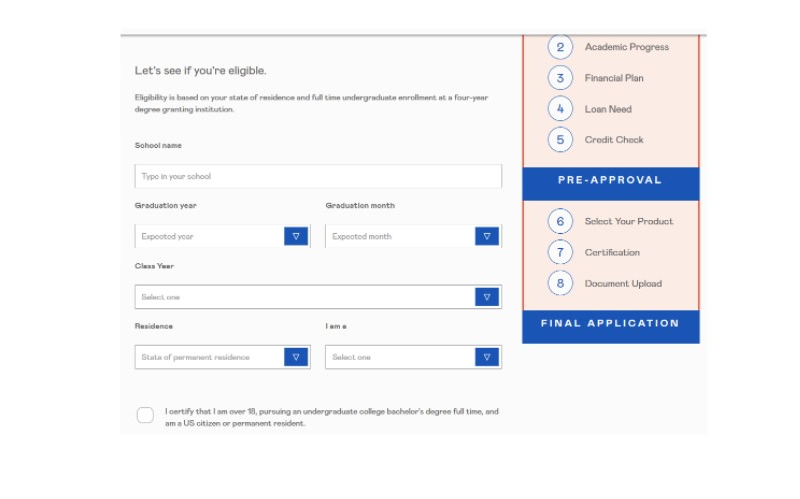

Before proceeding with the application, Funding U will verify your eligibility. This includes your permanent residence (Funding U is currently available only in 30 states), the four-year institution you attend, full-time status and your year in school.

Once these details are verified, there are further questions regarding your grades, finances and amount of funding needed. To see your rate, a soft credit check is required. This is good news because some institutions require hard checks during the qualification process.

A soft credit check will show as an inquiry on your credit report but it will only be visible to you—other lenders won’t see it on your credit report. It will eventually “fall off” your report too and won’t cause any impact to your score.

If you’re pre-approved and want to proceed, a hard credit check and supporting documentation will be required. A hard credit check will show up on your report and other lenders will see it too. It could potentially decrease your score by a few points but will be removed within two years.

Funding U Customer Support

Funding U customer support is available, although you may have to work with two different companies depending on your inquiry.

During the application process if you have questions then you will need to contact Funding U via email which is INFO@FUNDING-U.COM.

Funding U loans are serviced by Scratch. Once you become a borrower then you will need to contact Scratch for specific questions related to your loans. Scratch offers phone support Monday through Thursday, 9 a.m. to 8 p.m. and 9 a.m. to 5 p.m. on Fridays by calling 1-844-727-2684.

You can also login to your account and use the chat feature.

Lastly, you can always mail correspondence (not your payments) to P.O. BOX 411285, San Francisco, CA 94141-1285

Scratch Financial is accredited by the Better Business Bureau (BBB) and receives an A+ rating.

Funding U Online Reviews

Currently, Funding U receives an A+ rating with the BBB, although it is not accredited. It has one complaint filed in the last three years and it was closed within the last year.

Other online Funding U reviews show generally positive experiences. The company has only been in business since 2016, so the amount and variety of reviews may not be as great as other student loan providers with longer lending histories.

The positive reviews are related to |

The negative reviews are related to |

No cosigner required |

Higher interest rates |

Fast application process |

Meeting eligibility requirements |

Funding U Perks and Bonuses

Funding U may not offer a wide range of loan options, but it does provide some repayment flexibility — especially for those who are having trouble making payments.

Payment Flexibility

In addition to the 0.50% AutoPay discount, there are promotions for referring friends to Funding U. Currently you can earn a $200 Amazon gift card if you have a successful referral.

For payment flexibility, Funding U has a few perks in place. Full payments begin six months after graduation to give you time to establish a higher income. Although the loans are not deferred during school, there is an option for $20 per month interest-only payments to help ease the burden of making full payments.

Forbearance options

If you’re experiencing financial hardship, post-graduate forbearance options are available up to 24 months but are typically not available during school. This 24-month forbearance is generous compared to many other student loan lending options available.

Other Resources

Resources with Funding U does appear more limited. There are not any other financial management options available. It does offer a comprehensive library of articles online providing guidance for everything from landing your first job out of college to answering questions surrounding student loans.

Final Thoughts

Funding U offers a unique qualification process for smaller private school loans. While it is lacking features you may find with other providers, such as full customer support or a mobile app, the funding decision takes a more holistic approach. Funding U looks at other qualities, such as GPA, your institution and ability to earn future income when making its decision. This may be ideal for those students who need smaller loans and don’t have a well-established credit history. But this will also come at a price — the fixed interest rates are higher than what you’ll find with other lenders.