Laurel Road not only offers graduate school loans for healthcare students, but it opens up its student loan refinancing options to thousands of other borrowers. Since 2013, Laurel Road has offered competitive rates for both refinancing rates and graduate school funding.

Laurel Road Review: Fund Your Healthcare Degree or Refinance Your Student Loans

Laurel Road offers healthcare graduate school loans and refinancing options for both federal and private student loans. The company offers competitive rates and terms, and a quick and easy application process.

Summarized Rating

This parameter considers loan term lengths, loan limits, and loan structure optionality (fixed and variable rate offerings). For each loan type offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Laurel Road gets a perfect 5.0 for Loan Features, which is attributable to its highly flexible and best-in-class term lengths, loan amounts, and loan structure optionality (fixed vs. variable).

Laurel Road Pros

Laurel Road Cons

What Types of Student Loans Does Laurel Road Offer?

Laurel Road offers

- Federal and private student loan refinancing

- Private loans for healthcare graduate student loans

In addition to these two Laurel Road loans, the company offers mortgage loans, credit cards, checking accounts and personal loans, all geared towards student loan borrowers.

Laurel Road Refinancing Review

Student Loan Refinancing Features

Whether you’re refinancing federal or private student loans, Laurel Road offers flexible loan term options, with both fixed and variable rates. You can choose between 5, 7, 10, 15 and 20 years options.

Loan terms |

5 to 20 years |

Repayment period |

Variable |

Loan amount |

Minimum of $5,000 and a maximum of the full loan balance (Associate Degree loans are a maximum of $50,000) |

Loan Structure Flexibility |

Fixed and variable rates |

Student Loan Refinancing Interest Rates and Fees

The Laurel Road student loan refinancing rates are highly competitive compared to other loan service providers. There are also opportunities for rate reduction, including a 0.25% discount for enrolling in AutoPay. Not only are there no origination fees or prepayment penalties, there’s also no application fee.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Up to 5% of payment, maximum of $28 |

Maintenance Fees |

None |

Fixed Rates |

2.55%-5.75% |

Variable Rates |

1.64%-5.65% |

Student Loan Refinancing Qualification Requirements

Laurel Road does have more strict requirements for borrowers, including a minimum credit score of 660. Refinancing requires the borrower to have graduated from an accredited Title IV school, unless it’s a refinance of a federal parents PLUS loan. Although no minimum income is disclosed, income and employment does have to be verified and the debt-to-income ratio is evaluated. It may be necessary to add an eligible cosigner to receive approval for the refinancing.

Institution Type & Course Load Requirements |

Must have graduated from an accredited Title IV U.S. school |

Minimum Credit Score |

660 |

Minimum Income |

Not disclosed |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Not required but could request if you do not meet eligibility requirements on your own |

Healthcare Graduate Student Loan Review

Healthcare Graduate Student Loan Features

Healthcare graduate student loans are available to nursing, physician’s assistant, medical and dental schools. Like refinancing, the loans are available in 5, 7, 10, 15 and 20-year options. You must be a U.S. citizen and enrolled at least half-time to apply for a graduate student loan.

Loan terms |

5 to 20 years |

Repayment period |

Variable |

Loan amount |

Minimum of $5,000 and a maximum of the amount of the total cost of attendance |

Loan Structure Flexibility |

Fixed and variable |

Graduate Student Loan Interest Rates and Fees

In addition to the 0.25% interest rate reduction for enrolling in Autopay, graduate students may earn another 0.25% rate reduction once they graduate and have received a full-time employment offer. For some students, once you graduate, Laurel Road extends further interest rate reductions to medical students and physician assistants and allows you to roll your loan into a refinanced option.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Up to 5% of payment, maximum of $28 |

Maintenance Fees |

None |

Fixed Rates |

3.10%-7.26% |

Variable Rates |

3.00%-7.16% |

Graduate Student Loan Qualification Requirements

Like the refinancing portion, the graduate student loan requirements are strict too. The minimum credit score accepted is 660, but other factors are evaluated such as credit history.

Institution Type & Course Load Requirements |

Graduate degree only and must be enrolled in an approved healthcare degree program. Must be enrolled in half-time or more. |

Minimum Credit Score |

660 |

Minimum Income |

Not disclosed |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Not required but is allowed to help meet eligibility requirements |

Laurel Road Application Process

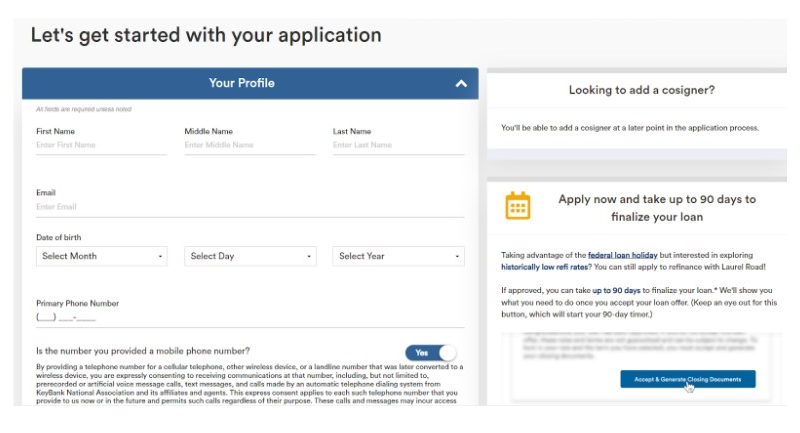

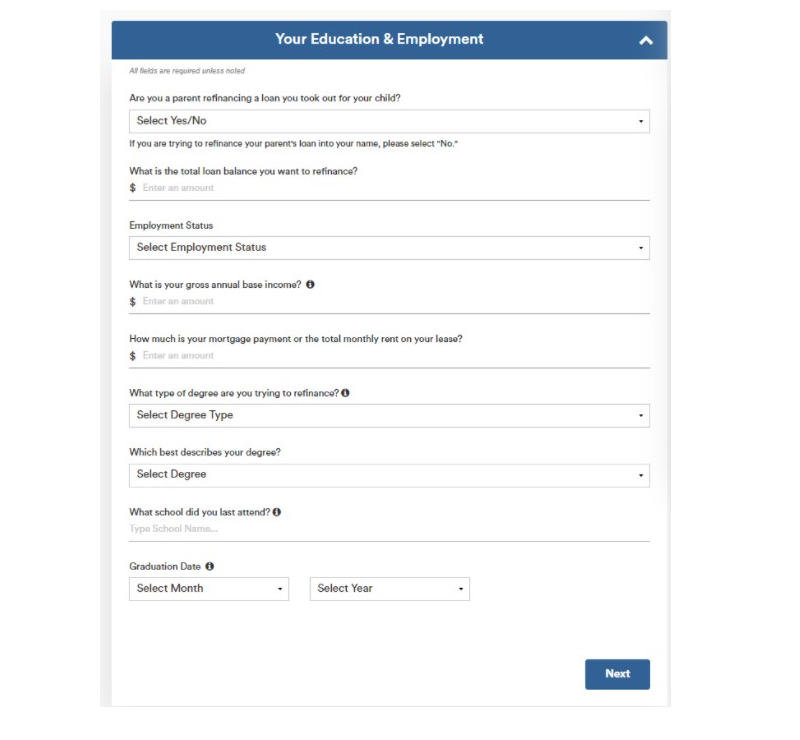

One of the features for the Laurel Road student loan refinance or graduate school loan application process is the borrower’s ability to complete everything online. When applying online, you will need to enter personal information, income and employment documentation and any relative student loan information.

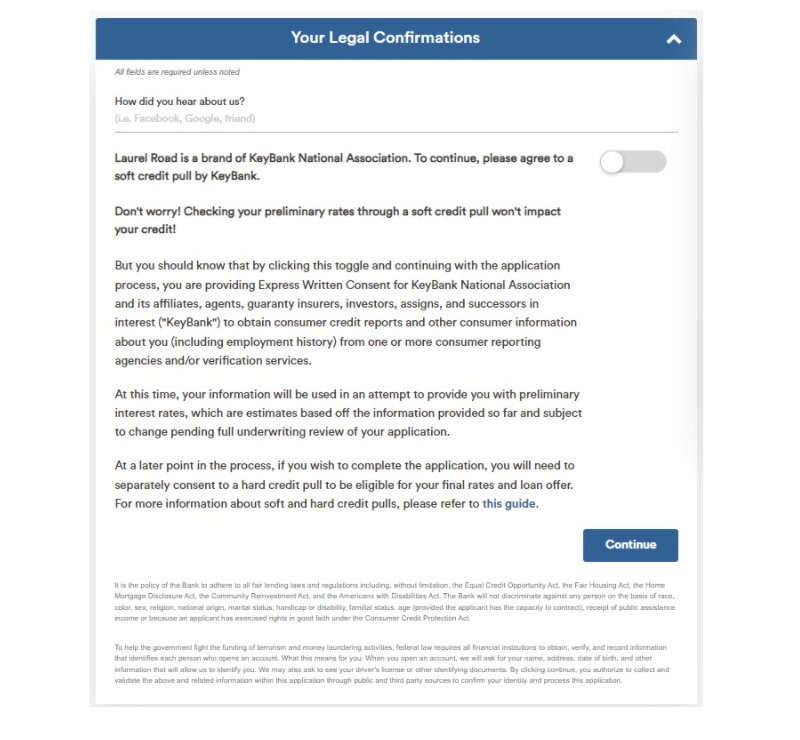

The good news with Laurel Road qualifications is that only a soft credit check is used. This means the inquiry will only be visible to you on your credit report and will have no impact on your credit score. You should note however, this is for the application process only. If you move forward with the loan then payment information will be reported to the credit bureaus.

To get started, you first enter your personal information.

Then your education and income information is requested.

One of the last steps is to agree to the legal terms and conditions for qualification. This is where you authorize KeyBank (the parent company of Laurel Road) to perform a soft credit check.

If you need to add a cosigner, you’ll have the opportunity towards the end of the application.

Once you submit and are quoted the interest rates based on your profile and officially approved, you have up to 90 days to complete the refinancing or new student loan process.

Laurel Road Customer Support

The Laurel Road customer service offers greater accessibility to help compared to other student loan providers. For starters, the customer support team is available seven days a week, from 7 a.m. to 11 p.m. ET by calling 1-833-HCP-BANK.

Other communication channels include an email address, help@laurelroad.com, plus live chat agents available seven days a week also. The customer support tools include:

- Live customer support, seven days a week

- Online inquiries

- Live chat

- FAQs online addressing numerous topics

The online reviews regarding customer service are mixed, which is typical of student loan providers. However, the general response to customer service is favorable and there are multiple positive reviews regarding help with issues. Here’s an example of one review:

“I recently refinanced my student loans. I did an extensive search with multiple lenders and they consistently had the lowest rates. Their customer service which I used many times through the process is very responsive and helpful. I have already recommended them to multiple colleagues and friends.” - Review from TrustedPilot.

Laurel Road Online Reviews

Like the customer service portion, general online reviews are mixed, but tend to be more positive versus negative. One of the most consistent Laurel Road reviews is how quick and easy the online application process is. Because Laurel Road is a digital loan company, this is not too surprising to find that borrowers respond well to the online user experience and speed of the entire process.

Other positive reviews comment on the lower rates Laurel Road was able to offer compared to other companies and the overall communication from beginning to end. Laurel Road earns an overall score of 3.8 with Best Company and a 4.1 with TrustPilot. Additionally, it earns an A rating from the Better Business Bureau, although it is not accredited through the site.

The positive reviews are related to |

The negative reviews are related to |

Quick and easy loan approval process |

Mistakes with the loan applications |

Friendly, knowledgeable customer service |

Difficulty getting approved, even if minimum requirements are met |

Lower and more competitive interest rates |

Laurel Road Perks and Bonuses

The perks and bonuses Laurel Road offers its customers may be what sets it most apart from other competitors in the crowded student loan refinancing marketplace. From digital tools to generous discounts, there’s a range of added value for borrowers.

Flexibility

Everyone loves discounts and Laurel Road offers two for student loan borrowers. In addition to the AutoPay discount, healthcare students may receive further discounts on their rates than what’s published online. You would have to go through the application process to determine the exact discount, but it is available for the graduate student loans.

If you choose to open up a Laurel Road checking account, you’ll be eligible for further discounts on your student loan interest rates too. There are several conditions that must be met, but you could also earn up to a $300 bonus in the process. You could also apply for the Laurel Road credit card and 2 percent of your purchases will earn cash back paid directly to your student loans.

For graduate student loan borrowers, there are flexible repayment options. This includes interest-only payments, a $50 flat payment grace period while in school and full deferment options. Grace periods last for six months and keep in mind interest does accrue during this.

For all student loan borrowers, Laurel Road offers a forbearance option for economic hardship. This amount of time depends on how long you’ve had the loan, but it will be a minimum of three months. You may be eligible for multiple forbearance periods.

Technology

In addition to online management tools for both the application and payments, Laurel Road offers a highly-rated app. This lets you view your balance and manage your student loan account while on-the-go.

Laurel Road also provides a multitude of resources for better personal financial management, including a podcast, online articles and videos to further develop your financial literacy.

Final Thoughts on Laurel Road Student Loans and Refinancing Options

Laurel Road offers a comprehensive approach to refinancing existing student loans or graduate student loans for those seeking a healthcare degree. Not only are competitive rates and terms offered, but the application process is quick and easy and the company provides a multitude of resources throughout the life of your loan.

Frequently Asked Questions (FAQs)

This app literally changed my like. It provides a great experience. I absolutely love it!