LendKey partners with hundreds of banks and credit unions. In turn, these financial institutions use LendKey’s digital platform to process the student loan and LendKey becomes the servicer. Working through LendKey you have access to two options - refinancing into a private loan or obtaining funding for a new private student loan. Because LendKey is introducing borrowers to numerous financial institutions, it allows the banks to compete for your business by offering the most competitive rates.

LendKey Review: Connecting Student Loan Borrowers to Lenders

LendKey is a student loan company, but it operates differently than most loan servicers in the marketplace. LendKey connects potential borrowers to community banks and credit unions, to help borrowers find the best interest rates and student loan terms for their needs.

Summarized Rating

This parameter considers loan term lengths, loan limits, and loan structure optionality (fixed and variable rate offerings). For each loan type offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

LendKey scores a near average 4.0 for Loan Features, which is reflective of standard term length offerings and highly flexible loan structure optionality (fixed vs. variable).

LendKey Pros

LendKey Cons

What Types of Student Loans Does LendKey Offer?

LendKey offers two types of student loans:

- Student loan refinancing

- Private student loans

For those who want to refinance, you can either do so with a federal or private student loan. Bear in mind you will lose all federal student loan benefits if you refinance into a private student loan.

Private student loans are available to cover the costs of tuition and expenses, but you are responsible for making payments while you’re in school

Student Loan Refinancing Review

Student Loan Refinancing Loan Features

Although LendKey is not the student loan lender, but rather the servicer, LendKey has several options for those who are considering refinancing. Repayment options include both fixed and variable payments, with terms ranging from 5 to 20 years.

Loan terms |

5 to 20 years |

Repayment period |

Variable |

Loan amount |

Undergraduate loans - $5,000 to $150,000 Graduate loans - up to $175,000 Medical school loans - up to $300,000 |

Loan Structure Flexibility |

Fixed and variable rates |

Student Loan Refinancing Interest Rates and Fees

One of the benefits of LendKey loans is the lack of fees. You will not have to pay any borrowing or origination fees or maintenance fees. You don’t have to worry about prepayment penalties either. You should be aware your loan is subject to a late fee if you’re behind on a payment. The amount actually depends on the financial institution you’re working with, so be sure to confirm various fees, since the exact amounts can vary from one to the other. The interest rates quoted also include a 0.25% AutoPay discount.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Yes, depends on the lender |

Maintenance Fees |

None |

Fixed Rates |

2.49% - 7.75% |

Variable Rates |

1.90%- 5.25% |

Student Loan Refinancing Qualification Requirements

Current federal and private loan holders will be approved for refinancing as long as qualification requirements are met. In addition to having loans from attending an accredited Title IV institution, you must be a U.S. citizen or a permanent resident. You must have graduated with at least an associate’s degree and meet minimum income and credit score requirements.

Institution Type & Course Load Requirements |

Any eligible Title IV institution with at least an Associate’s Degree |

Minimum Credit Score |

660 |

Minimum Income |

Does not disclose |

Maximum Debt-to-Income |

Does not disclose |

Co-signer/Joint Application Requirements |

Not required but encouraged if there is a problem with the applicant meeting the minimum qualifications |

Private Student Loan Review

Private Student Loan Features

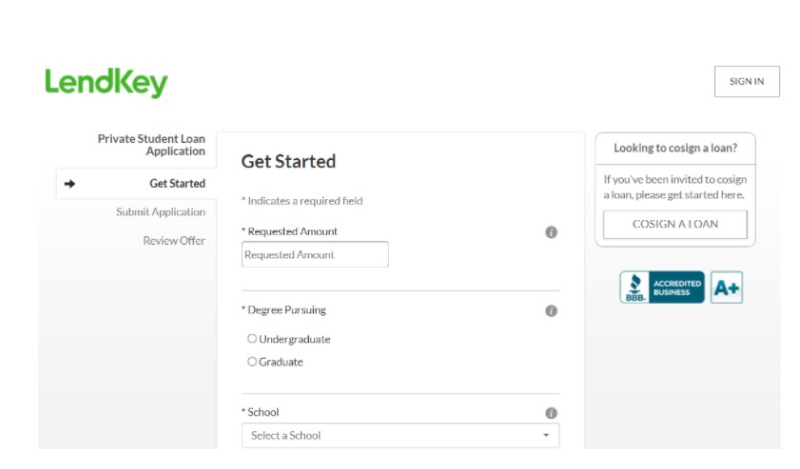

For current students, a LendKey private student loan may be an ideal option for funding your education. LendKey offers fixed and variable loans for current students up to the amount of the cost of attendance. One important point to consider with LendKey is you must make monthly payments while you are in school. While this helps you pay off your student loans sooner, it could be an issue with limited income.

Loan terms |

5 to 15 |

Repayment period |

Variable |

Loan amount |

Minimum $1,000 and maximum is cost of attendance |

Loan Structure Flexibility |

Fixed and Variable |

Private Student Loan Interest Rates and Fees

Like the Lendkey refinance loan option, there are no application, prepayment or origination fees with a private student loan. The interest rates are competitive and could be lower than what you find with other lenders, but all interest rates are based on your creditworthiness and income.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Varies |

Maintenance Fees |

None |

Fixed Rates |

3.99% to 7.66% |

Variable Rates |

1.49% to 7.66% |

Private Student Loan Qualification Requirements

For private student loans, you must be a U.S. citizen or Permanent Resident to apply and enrolled at least half-time in an approved school. The minimum income requirement is $24,000, which may be tougher for current students. Because of this, LendKey strongly recommends using a cosigner, which can eventually be removed from the loan after at least 24 payments.

Institution Type & Course Load Requirements |

Enrolled in at least half-time and from an approved school |

Minimum Credit Score |

660 |

Minimum Income |

$24,000 |

Maximum Debt-to-Income |

Does not disclose |

Co-signer/Joint Application Requirements |

Not required but encouraged to help meet qualifications |

LendKey Application Process

The application process for both the Lendkey loan refinance and new private student loan is straightforward and simple to navigate. It’s important to keep in mind LendKey is not an actual lender. While the company will ultimately be servicing your loan, the application is meant to match you with a student loan lender.

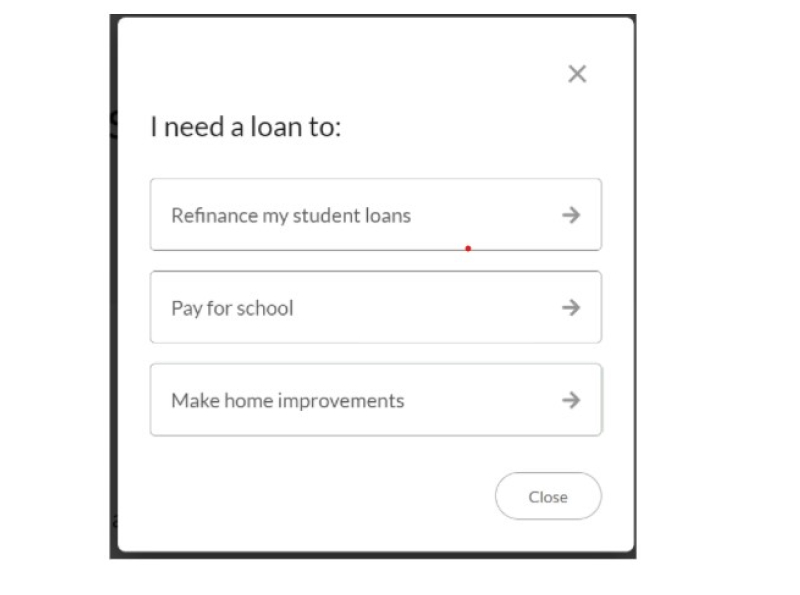

When you begin the application, you will first select which loan product you’re interested in qualifying for.

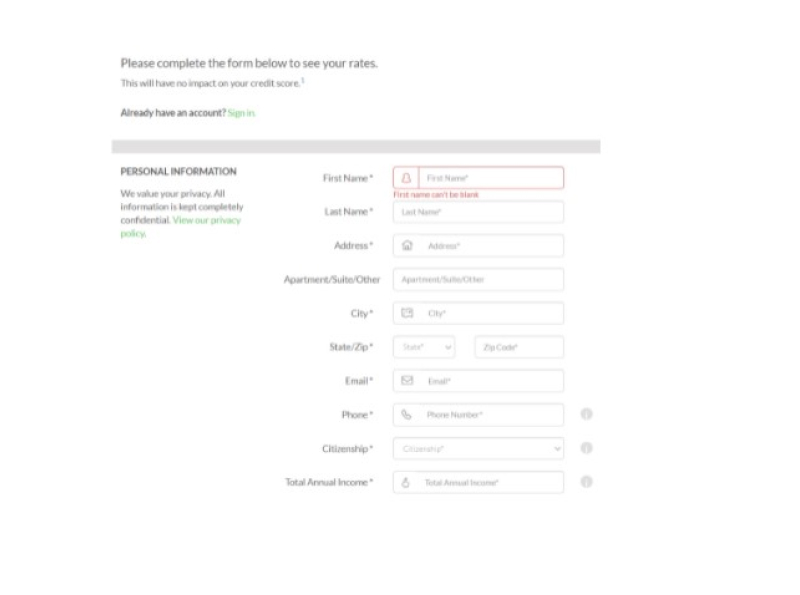

The questionnaires look different depending on the product you’re selecting. For refinancing, you will answer personal questions and input information related to income, employment and your education.

When you hit submit, a soft credit check will be performed, which means there is no impact to your credit score and only you will have visibility to the inquiry on your credit report. Once your information is received and the soft credit check is performed, you’ll get a snapshot of the interest rate you’re applying for.

You must answer questions regarding the degree you’re pursuing and your income. There’s also a section for the cosigner to fill in, if you’re using one. You should note, to see your rate you will have to submit to a hard credit check. This will mean the inquiry is visible to anyone who pulls your credit report and could lower your score by a few points for up to two years.

LendKey Customer Support

LendKey customer service is focused mainly on call centers. Customer service representatives are available Monday through Friday, from 9 a.m. to 8 p.m., ET. These hours are comparable to other loan servicers although there is no live support over the weekend.

Email and written correspondence is also available, but there are no live chat options and there is no app available for connecting to anyone either. To summarize, LendKey has the following customer support options available:

- Live customer service hours Monday through Friday

- Written correspondence

LendKey reviews online show mixed customer service reviews. There are numerous positive remarks made about customer service being responsive while going through the application and quote process. The negative reviews mostly revolve around a lack of help when there are specific issues with a student loan. Some examples of reviews include:

“My experience with LendKey has been efficient and super easy. Customer service answered any questions I had and provided great, reasonable solutions. I would definitely recommend them to family and friends.”- Review from TrustPilot

“Amazing customer service! So easy to work with and so kind over the phone. Email communication is a little delayed as compared to the website but I have zero complaints!” - Review from TrustPilot

LendKey Online Reviews

When researching LendKey online reviews, one aspect that really stands out is the number of comments on the quick loan process. From the application, to approval, to disbursement of funds, most borrowers have a very positive experience with this aspect.

Overall, LendKey receives a 4.4 rating with TrustPilot, which is significantly higher than many other loan servicers. LendKey also receives an A rating through the Better Business Bureau and it’s an accredited business. Of the 18 customer complaints, six have been closed over the last 12 months.

The positive reviews are related to |

The negative reviews are related to |

Quick and easy loan approval process |

Some borrowers complain of higher interest rates |

Many borrowers were happy with the lower interest rates |

Numerous issues related to payment relief during COVID-19 |

LendKey Perks and Bonuses

When you become a LendKey customer, either by way of refinancing or obtaining a new private student loan, you have access to several benefits. Some are related to the actual loan itself,and some are resources you might find helpful.

Flexibility

For both new and refinanced loans, LendKey offers grace periods and forbearance options, but the exact length of time depends on the circumstances. Economic hardships may qualify for a six month forbearance, but you can apply to extend this time if necessary.

Technology

LendKey offers a unique digital platform which has helped it connect lenders to borrowers for years. This technology has made the application and funding process much quicker and easier versus what you might find with other sites. As advanced as LendKey is though, it does not currently offer a mobile app for account management.

Bonuses

In addition to the 0.25% AutoPay rate reduction, there are other ways to earn bonus money through LendKey. For example, if you refer a friend and they sign up for a loan, not only do you receive a $200 bonus, but so does your friend. There are also promotional bonuses available, ranging from $100 to $700, simply for completing the loan process or taking advantage of special offers through email.

Final Thoughts on Lendkey Student Loans

LendKey loans offer competitive interest rates, flexible repayment terms and customer service reviews are favorable. Because LendKey presents your information to hundreds of lenders, it gives smaller community banks and credit unions a chance to bid on your business. As a result, the consumer wins because you have companies competing for you. While LendKey has less fees versus other servicers, you do have to make payments on private student loans while in school, which could be an obstacle for many students.

Frequently Asked Questions (FAQs)

This app literally changed my like. It provides a great experience. I absolutely love it!