MPower Financing was born from the idea of providing funding for global citizens who are seeking mobility through education. The company now offers private student loans for current students plus refinancing options for those who’ve already graduated. Not only does this provide much needed resources for students attending over 350 U.S. or Canadian universities, but it does so without the requirement of a cosigner.

MPower Financing Pros and Cons

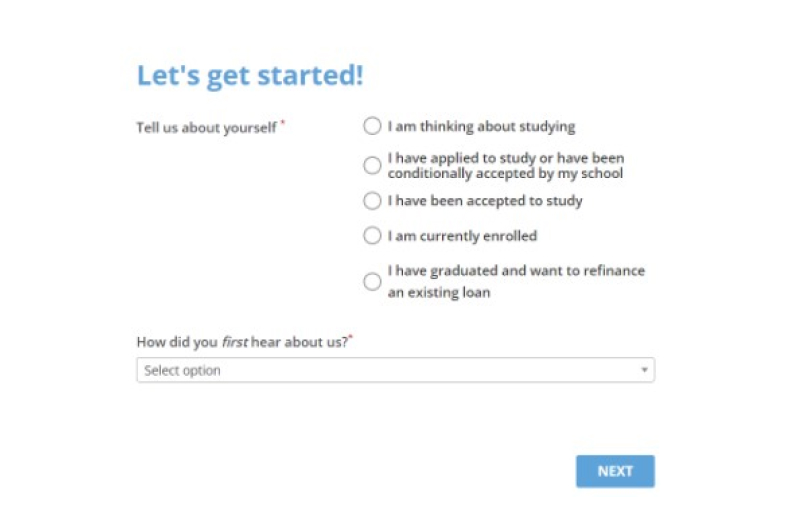

An MPower Financing review reveals the positives and potential drawbacks of financing through this provider.