NaviRefi is a division of Navient, which is a federal and private student loan servicer. The company offers an opportunity for student loan borrowers to refinance their existing loans into new payment terms and interest rates while avoiding costly fees associated with other student loan providers. Whether your goal is to lower your monthly payment or reduce the length of years on your loan, our NaviRefi review looks closely to see if this company is worth consideration.

NaviRefi Review — Student Loan Refinancing with Flexibility

NaviRefi offers refinancing options and payment restructuring for both federal and private loans, without charging extra fees or prepayment penalties. For those searching for new loan options with their existing student loans NaviRefi could offer refinancing and repayment solutions where other lenders fall short.

Summarized Rating

This parameter considers loan term lengths, loan limits, and loan structure optionality (fixed and variable rate offerings). For each loan type offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Navient gets a perfect 5.0 for Loan Features, which is attributable to its highly flexible and best-in-class term lengths, loan amounts, and loan structure optionality (fixed vs. variable).

NaviRefi Pros

NaviRefi Cons

What Types of Student Loans Does NaviRefi Offer?

NaviRefi focuses solely on refinancing of both federal and private student loans. Once your application is approved, the loans are serviced by Earnest, which is a part of the Navient family. The refinanced loans automatically fall under the Standard (Level) Repayment plan.

However, borrowers do have other options for their loans once approved, including:

- Rate reduction

- Deferment

- Forbearance

- Loan forgiveness and discharge

Standard repayment plan review

Standard Repayment Loan Features

NaviRefi offers a wide range of loan terms, including how many years you have to make fixed monthly payments. Although the refinance option is fairly flexible in both terms and amounts, you can only use it for student loans of qualifying programs. This means credit cards, mortgages or other loans can not be wrapped into the refinance. It should also be noted not all loan features are available in every state, such as in California, which has a limit on the total loan amount that can be refinanced.

Standard Repayment Interest Rates and Fees

A NaviRefi review will show potential borrowers a big emphasis on the lack of fees. Unlike other lenders, there are no prepayment penalties, late payment or origination fees. The interest rates posted on the NaviRefi website do fluctuate and the rate will be based on your creditworthiness and profile.

Borrowing/Origination Fees |

$0 |

Prepayment Fees |

$0 |

Late Payment Fees |

$0 |

Maintenance Fees |

Undisclosed |

Fixed Rates |

2.44%-7.44% |

Variable Rates |

1.74%-7.24% |

Standard Repayment Qualification Requirements

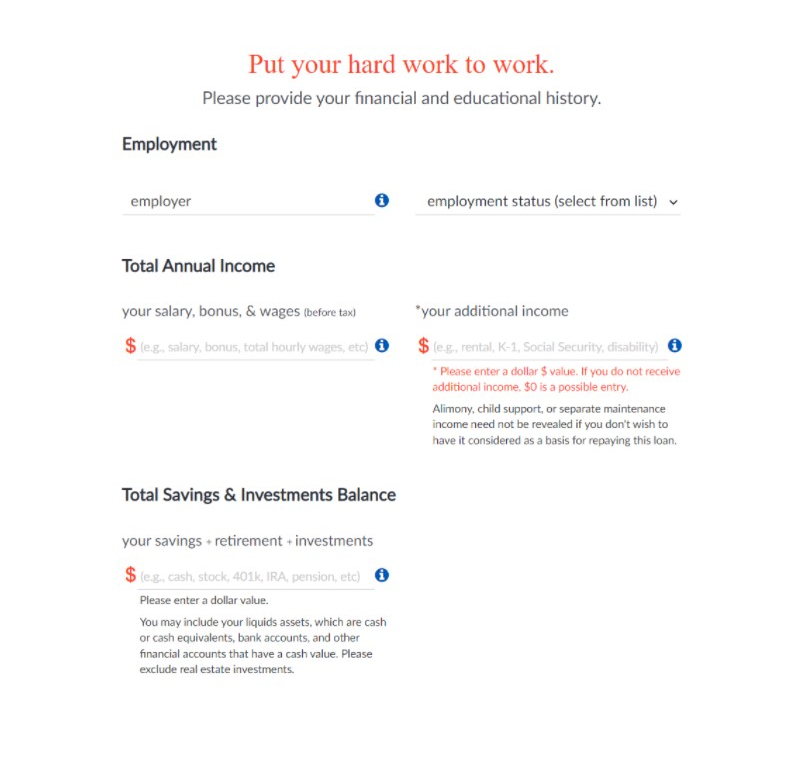

When you apply for any type of refinancing from NaviRefi, you are required to verify your income. Fortunately, NaviRefi considers both employment and non-employment income. Examples of employment of these include salary, wages, commissions, bonuses and earnings from self-employment. Non-employment examples include earned interest, dividends, investment income, social security benefits, alimony and child support and disability.

Institution Type & Course Load Requirements |

Both undergraduate and graduate loans and with a school eligible for federal aid. You do not have to graduate to be eligible. |

Minimum Credit Score |

650 |

Minimum Income |

Does not disclose but does allow multiple sources of income |

Maximum Debt-to-Income |

Does not publish |

Co-signer/Joint Application Requirements |

Co-signers are not allowed |

NaviRefi Application Process

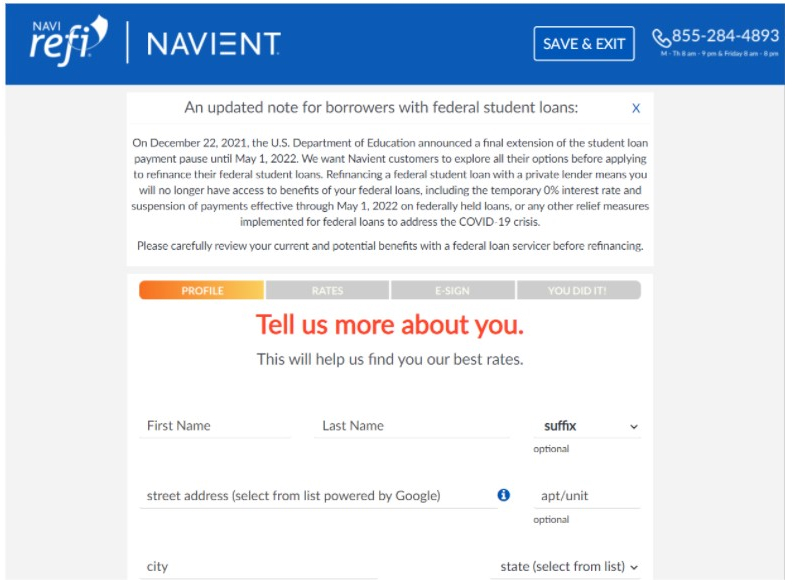

The application process with NaviRefi is slightly different from what you might experience with other lenders. For starters, you need to have an invitation code to even apply and this is only sent to you if you are a current Navient customer. If you do not have an invitation code, you can click on the site and input personal information and someone from NaviRefi will contact you to discuss eligibility.

It’s also very important to realize when you fill out this form, whether you have an invitation or not, you are authorizing NaviRefi to run a hard credit check. This means the inquiry will be visible on your credit report and could potentially affect your score (it generally decreases it by a few points and will drop off the report within two years).

You will have to enter your social security number and personal details.

Next comes the information request for both education, employment and income details.

The information needed to start the application process is fairly straightforward. The last step is to authorize NaviRefi to check your credit history and consent to communications.

Once you’ve agreed to the terms, you will be notified of the potential interest rate and how to finalize the application process from there. The good news is, all steps of the application process are completed online. If you are approved, the funding of the loans are handled online as well.

NaviRefi Customer Support

NaviRefi offers extended customer support hours to answer questions and walk through the application and approval process if necessary. You can reach the customer support team Monday through Thursday, from 8am to 9pm ET, and Friday from 8am to 8am ET by calling 1-844-381-6621.

At this time, the phone is the preferred method of communication. There is no email address or chat bot offered. There is no app available for further support either.

You do have the option to correspond through mail with NaviRefi and the address is: NaviRefi, P.O. Box 8000, Fishers, IN 46038-8000.

Reviews with various organizations, such as Consumer Affairs and the Better Business Bureau are generally mixed in regards to customer service. It should be noted most reviews online are under the parent company Navient, so keep this in mind as you’re researching to find what works best for you. When you read through reviews, you’ll see comments related to customer service and how other applicants felt they were treated.

“Love working with Navient, ease of use, guided steps and helpful all the way. Also they are really good at keeping the user updated not just on anything pertaining to one's loan, but also any information that they see useful or that could have an impact on the user.” — Patricia, Alexandra, VA

NaviRefi Online Reviews

Navient student loans receive quite a bit of attention online, including independent sites such as Consumer Affairs. The BBB gives Navient a B- rating overall, although Navient is not accredited with the BBB. In the last three years the site has received 820 complaints against Navient, witn 233 now closed.

While there are some positive reviews to be found, the majority are negative. Many of these complaints are likely related to the numerous complaints officially filed against Navient.

The positive reviews are related to |

The negative reviews are related to |

Discount on rate for enrolling in AutoPay |

Errors with loan reporting to the credit agencies |

Lower interest rates |

Slow website and hard to navigate |

Customer service willing to help resolve issues |

Conflicting information online regarding interest rate versus actual rate locked in |

Navient has also been in the news and received negative press regarding lawsuits and complaints, which has further fueled the negative online reviews naturally. In a nutshell, 39 states filed a lawsuit against Navient. The basis of the lawsuit was a mismanagement of payments, issues with forbearance plans and unclear information. A settlement was reached and as a result over 400,000 borrowers were released of over $1.7 billion in student loans with Navient.

The lawsuit was filed in 2017 but the Navient lawsuit was recently settled with the states. There is another separate lawsuit, filed by the Consumer Financial Protection Bureau that is still ongoing and alleges many of the same issues named in the previous lawsuit.

NaviRefi Perks and Bonuses

If you’re looking for what might set NaviRefi apart from other lenders you’re considering, then you may find the following perks and bonuses helpful with your decision.

Flexibility:

- NaviRefi offers a 0.25% rate reduction if you enroll in Autopay. You’ll be sent this information within two months of approval for your loan.

- NaviRefi offers a temporary, six-month rate reduction program but you need to apply and show proof of income and financial documentation for approval. You must also have completed three qualifying payments on your current loan for consideration.

- Forbearance is also available to temporarily suspend or reduce loan payments, although the interest will continue to accumulate and will be tacked on to the end of the loan.

- Postponing payments may be an option for those who go back to school, enter a training program or are in the military. Interest on these loans will capitalize and added to the end of the loan term.

- Term and rate modifications may be another option for private loans through NaviRefi. You can extend the repayment terms with approval.

Technology:

- You can either pay online or set up the Autopay option.

- View your loan details online for account management.

- The application process is completed entirely online and your loan is funded online.

Final Thoughts

NaviRefi provides numerous refinancing options for a variety of financial situations. Whether you simply need to try to find a lower interest rate or better repayment terms, or need a temporary loan solution such as deferment or forbearance. A NaviRefi review may reveal multiple refinancing options but it also shows us there are potential shortcomings with this company too.

With NaviRefi there are limited payment options, either on the web or through Autopay, and the digital tools, like an app, are lacking. Plus, to go through the qualification and application requires a hard credit check. If you know these potential roadblocks up front, you may still think its worth it to work with NaviRefi and find a loan better suited for your financial needs.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!