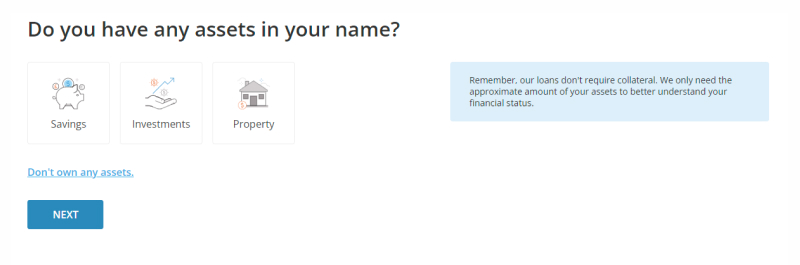

Prodigy Finance is a lender focused on international students who want to pursue a master’s degree. It offers loans with no co-signer and collateral with a quick and easy online application. It has funded $1 billion in loans across 850 different schools and 20,000 students.

If you’re looking for a low-cost master’s degree loan, this Prodigy Finance student loan review will tell you everything you need to know.