If you're looking for funding for a non-traditional educational program, Sallie Mae student loans may be your best bet. In addition, it’s important to note that this company charges lower fees than some of its competitors. Specifically, it doesn't charge an origination fee or a prepayment penalty on any of its loan products, including undergraduate student loans, graduate student loans, or its flexible educational funding programs.

Sallie Mae Review: Everything You Need To Know Before Applying

For the last 50 years, Sallie Mae has been providing educational funding to borrowers looking to advance their careers. In that time it has made a name for itself by providing a wide variety of funding options that aren't typically considered by other lenders, such as a loan option for financing professional training and certificate programs.

Summarized Rating

This parameter considers loan term lengths, loan limits, and loan structure optionality (fixed and variable rate offerings). For each loan type offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Sallie Mae gets a 5.0 for Loan Features. This top tier score reflects the loan aggregator’s high degree of flexibility on loan structure optionality (fixed vs. variable), but is somewhat misleading due to a lack of information on the term length and loan amount fronts.

Sallie Mae Pros

Sallie Mae Cons

What Types of Student Loans Does Sallie Mae Offer?

One of Sallie Mae’s strong points is its wide variety of loan offerings. Borrowers can get funding for undergraduate courses, graduate courses, or professional training and certificate programs.

- Undergraduate student loans

- Graduate student loans

- Professional training and certificate course student loans

Undergraduate student loans review

Smart Option Student Loan Features

Sallie Mae’s Smart Option Student Loan Is the company’s undergraduate student loan offering. This loan allows you to finance the full cost of their education, including tuition, books, housing, meals, travel, and even school related expenses such as laptops.

In addition, It also offers flexible repayment options. While the available loan terms are only 10-15 years, you can choose between a variable-rate or fixed-rate loan and when you start repaying. Notably, those who opt to start repaying their loan while still in school are often offered better interest rates.

Loan terms |

10-15 years |

Repayment period |

Borrowers have the option to start repaying while in school. However, their deferred repayment period begins 6 months after graduation. |

Loan amount |

$1,000 - 100% of your school-certified expenses. |

Loan Structure Flexibility |

Variable-rate or fixed-rate loans |

Smart Option Student Loan Interest Rates and Fees

One of the things that sets Sallie Mae’s Smart Option Student Loan apart is that it has fewer fees than some of its competitors. For example, there is no origination fee, no monthly maintenance fee, and no early period payment fee. There is, however, a late payment fee. Although, it’s capped at a $25 charge per late payment.

You can also choose between a variable-rate loan, which offers interest rates between 1.13% - 11.23% APR or a fixed-rate option, which ranges between 3,.50% - 12.60% APR. To give you a better idea of how those rates stack up, undergraduate student loans have a typical fixed interest rate of 3.73%, according to Federal Student Aid, an Office of the U.S. Department of Education.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

5% of the payment amount, capped at $25 |

Maintenance Fees |

None |

Fixed Rates |

3.50% - 12.60% APR (with Autopay Discount) |

Variable Rates |

1.13% APR - 11.23% APR (with Autopay Discount) |

Smart Option Student Loan Qualification Requirements

It’s worth learning that Sallie Mae chooses not to disclose most of its eligibility requirements, which may make it hard to figure out if you are a good candidate for one of their loans. Still, if you do qualify for a loan, The options are flexible. Loans are available to students who are going to school on either a part-time basis

Plus, If your credit history is not the best or you don't have much of one at all, Sally Mae gives borrowers the option to apply with a cosigner. However, if you show diligence at keeping up with your loan payments, the company also offers borrowers the option to release their code designer after 12 months of on-time payments.

Institution Type & Course Load Requirements |

Borrowers must be pursuing a degree, but can attend school full-time or part-time. |

Minimum Credit Score |

Not specified |

Minimum Income |

Not specified |

Maximum Debt-to-Income |

Not specified |

Co-signer/Joint Application Requirements |

Co-signers are allowed, but they must be a U.S. citizen or permanent resident |

Graduate student loans review

Sallie Mae Graduate School Loan Features

Similar to their undergraduate option, the Sallie Mae Graduate School Loan allows borrowers to finance up to 100% of their school certified expenses, including tuition, books, housing, meals, travel , and certain school-related expenses, such as laptops. It also provides you with a choice between a few different repayment and interest rate options. That said, this loan only offers one repayment term, which is 15 years.

Loan terms |

15 years |

Repayment period |

Borrowers can start repayment while in school or they can receive up to a 6-month grace period after graduation. |

Loan amount |

$1,000 - 100% coverage of your school-certified expenses |

Loan Structure Flexibility |

Fixed-rate or variable-rate loan options |

Sallie Mae Graduate School Loan Interest Rates and Fees

Sallie Mae’s graduate student loan comes with relatively few fees compared to other major lenders. Specifically, The company does not charge an origination fee and you won't have to worry about paying a maintenance fee on an ongoing basis or planning for a prepayment penalty if you decide to pay off your loan early. Although, they do charge a fee for late payments.

For this loan, if you elect to take advantage of Sallie Mae’s autopay discount, you can choose from a fixed-interest-rate loan, which will range from 4.75% - 12.11% APR or you can select an adjustable-rate loan, which will have an interest rate ranging from 2.12% to 11.64% APR.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

5% of the payment amount, up to $25 |

Maintenance Fees |

None |

Fixed Rates |

4.75% - 12.11% APR (with Autopay Discount) |

Variable Rates |

2.12% - 11.64% APR (with Autopay Discount) |

Sallie Mae Graduate School Loan Qualification Requirements

Sallie Mae has decided not to publicize its eligibility requirements, which can make it difficult to determine if you are a good fit for one of their loans. But, The requirements that they do share are fairly flexible. For one, borrowers can go to school on either a full-time or part-time basis and you have the option of using a co-signer when applying for one of their loans.

Institution Type & Course Load Requirements |

Borrowers can attend school either full-time or part-time, but they must be pursuing a degree. |

Minimum Credit Score |

Not specified |

Minimum Income |

Not specified |

Maximum Debt-to-Income |

Not specified |

Co-signer/Joint Application Requirements |

Co-signers are allowed, but they must be a U.S. citizen or permanent resident |

Professional training and certificate course loan review

Career Training Smart Option Student Loan Features

While The two other loans on this list require that you go to a degree-granting institution, it's important to note that Sally Mae also offers an option for students who are completing professional training or certificate programs.

Their Career Training Smart Option Loan Is a bit different Then their graduate or undergraduate loans. In particular, epayment on this loan starts while you're still in school. However, Students still have the option to cover 100% of their school related costs

Loan terms |

Not specified, but the company does note that, in some cases, loan terms may be less than 10 years |

Repayment period |

Repayment on this loan starts while the borrower is completing their program. However, borrowers can choose between a fixed or interest-based repayment option |

Loan amount |

$1,000 up to 100% of your school-certified expanses |

Loan Structure Flexibility |

Fixed and variable-rate loans are available. |

Career Training Smart Option Student Loan Interest Rates and Fees

Even If you're not pursuing a degree, Sally Mae presents some flexible loan options. While there is a late fee associated with all of their loan products, you don't have to worry about a fee when taking out the loan or if you decide to pay your loan off early.

With interest rates ranging from 4.12% - 11.52% for it’s variable-rate loan options and 6.62% - 13.83% for fixed-rate loans, you can expect to pay a little bit more for this type of financing. Still, since few lenders offer a similar student loan product, it may be worth considering.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

5% of the payment amount, up to $25 |

Maintenance Fees |

None |

Fixed Rates |

4.12% - 11.52% APR (with Autopay Discount) |

Variable Rates |

6.62% - 13.83% APR (with Autopay Discount) |

Career Training Smart Option Student Loan Requirements

Again, Sallie Mae has opted not to publicize their eligibility requirements for this loan, making it hard to determine if you meet the criteria. Yet, for borrowers who do, this loan can be used for a wide variety of educational curriculum. You can Go to school full-time, part-time, less than half the time, or just take a few classes.

Like their other loans, borrowers are encouraged to apply with a cosigner to increase their chances of approval. Yet, There are restrictions on who can be a co-signer. Beyond needing a strong financial profile, the co-signer must be an American citizen or permanent resident.

Institution Type & Course Load Requirements |

This program is available to students who are attending school full-time or part-time. In addition, it’s also available to students who are taking prerequisite classes, summer classes, or continuing education classes. |

Minimum Credit Score |

Not Specified |

Minimum Income |

Not Specified |

Maximum Debt-to-Income |

Not Specified |

Co-signer/Joint Application Requirements |

Co-signers are allowed, but they must be a U.S. citizen or permanent resident |

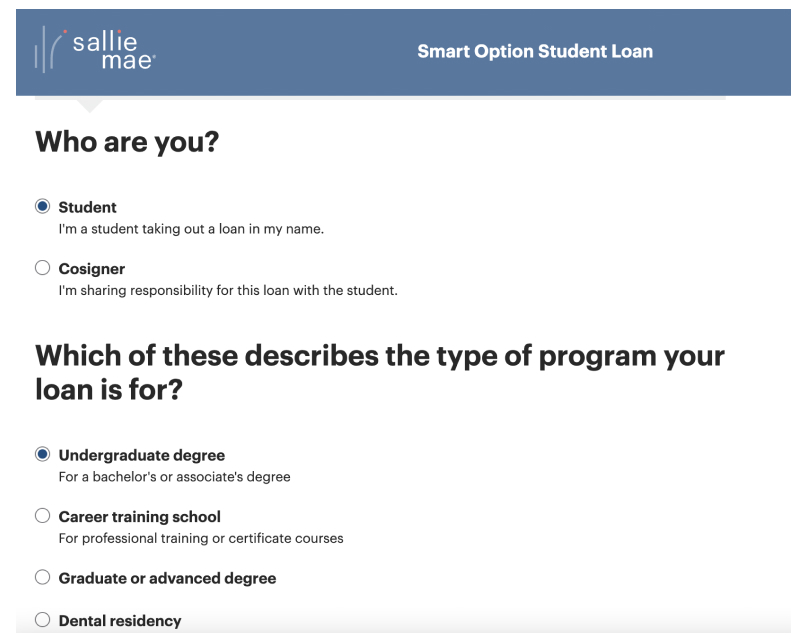

Sallie Mae Application Process

The Sallie Mae application process is fairly similar to the process for taking out any other unsecured loan.Since these loans are not tied to any particular asset, approval is based largely on The strength of your credit score and financial profile. With that in mind, here is an overview of what you can expect when you're ready to apply for a student loan.

- Fill out an application: The first step in applying for a loan through Sallie Mae Is to fill out an application. The application asks for information about you, such as your address and social security number, as well as your employment status, income, and assets. In addition, you’ll be asked to provide information about the program you’re planning to attend and its costs. You'll also need to provide the names and contact information for two references, other than your co-signer.

- Undergo a credit check: Next, a lender from Sallie Mae will pull a copy of your credit report, as well as a copy of your co-signer’s if you're using one. This is a hard pull, which means it will be recorded on your credit report and can affect your score.

- Receive a decision on your application: Once they have all of your financial information in hand, Sallie Mae says that they can provide you with a loan decision in as little as 15 minutes. Although, in some cases, they may ask for additional documentation before making a final determination.

- Choose your loan terms: If your application is approved, you'll be given the option to choose your interest rate and repayment options.

- Sign the loan agreement: Once you've selected your options, your lender will draw the paperwork, you'll be given a chance to review everything, and you will sign on the dotted line. If you're using a co-signer, your co-signer will need to sign the documents too.

- Wait for them to verify your education information: Finally, Sallie Mae will reach out to your school or certificate program to verify your enrollment and any tuition information.

Sallie Mae Customer Support

You can contact Sallie Mae customer support via phone or live chat. The company provides separate numbers based on The product that you're calling about. New student loan applicants should call 855-756-5626 (855-SLM-LOAN) while existing borrowers can call 800-472-5543 (800-4-SALLIE).

In general, You can expect to be put in contact with an agent if you call between the hours of 8:00 AM. and 8:00 PM EST Monday through Friday. However, the company offers extended support, including weekend hours support for those trying to fill out a Sallie Mae loan application for the first time.

Unfortunately, customer service reviews of Sallie Mae from Trustpilot indicate that the loan servicer has a long way to go before providing quality customer service. Most of the reviews on the site are either one or two stars and the Sallie Mae customer service team seems to play a key role in borrowers’ unhappiness. They report getting hounding phone calls from the billing department when they’re late on payment, but not being able to get a response when they have a question of their own.

Sallie Mae Online Reviews

Sallie Mae has a 3.7 out of 5 star average rating on Consumer Affairs. The majority of the positive reviews revolved around Sallie Mae's flexible loan options and The wide range of educational programs that they will fund. However, The negative reviews report that there is a lack of transparency to the company’s loan terms and collection policies.

One reviewer had the following to say about their experience with Sallie Mae:

“They have exorbitant rates, no loan forgiveness or rate reduction paths for hardship, and generally use aggressive tactics to force uncomfortable payments. They claim to ‘work with you’ on modifications or relief, but in reality, they do nothing. This behavior is very similar to the mortgage market during the 2008-2010 recession.”

The positive reviews are related to |

The negative reviews are related to |

Loan options to fit a variety of educational needs |

Lack of transparency about loan terms and collection policies |

Quick and easy approval process |

Lack of options for those experiencing financial hardship |

Poor customer service |

Sallie Mae Perks and Bonuses

Flexibility:

Although Sallie Mae offers plenty of flexibility In terms of their financing options, It seems that they are less flexible Once you've actually been approved for the loan. Notably, they do offer a 0.25% interest rate reduction for setting up auto pay and they offer to defer your loans for up to 48 months if you start another educational program or an internship. However, there is no option for payment deferral or forbearance if you're experiencing hardship and you won't have the opportunity to take advantage of Sallie Mae student loan refinancing.

Mentorship:

Sallie Mae does post a variety of educational content on its blog. That said, the blog content is the extent of the company’s educational services. There are no formal counseling or loan management assistance services available. If you're thinking of borrowing from them, it will be up to you to do your own research and to make sure that you understand the terms and conditions of your loan before signing on the dotted line.

Technology:

Lastly, Sallie Mae does have an app that works for both IOS and Android, making it so that it has more convenient payment options then some other lenders on the market. Alternatively, you can also make payments by automatic debit, online, by mail, or over the phone.

Final Thoughts

Sallie Mae's biggest benefit is its wide array of loan options. While many lenders shy away from lending to those who are considering certificate programs, Sallie Mae offers programs that make attending those programs a possibility. That said, borrowers who decide to go with one of Sallie Mae’s loan programs need to be sure to do their homework. This lender does not offer much in terms of educational content nor does it offer many options in the way of loan modification or forbearance options for those who are going through financial hardship. With that in mind, tread carefully before deciding to sign on the dotted line.

Frequently Asked Question (FAQs)

This app literally changed my like. It provides a great experience. I absolutely love it!