100,000 accounts and $6 billion in refinancing requests, Splash Financial is a leading loan refinancing marketplace. They offer three types of loans for students including student loan refinancing, medical school loan refinancing, in-school student loans. These loans are offered through their network of banks, credit unions, and other lenders. Students who have higher interest federal or private student loan debt may want to consider Splash as an option for their refinancing needs.

Splash Financial Review

Splash Financial is an online marketplace that allows individuals interested in refinancing their student loans to browse different types of loans, rates, and consolidation offers. Instead of taking the time and effort to compare rates on their own, individuals can use Splash Financial to do the work for them.

Summarized Rating

This parameter considers loan term lengths, loan limits, and loan structure optionality (fixed and variable rate offerings). For each loan type offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

<Splash Financial gets a perfect 5.0 for Loan Features, which is attributable to its highly flexible and best-in-class term lengths, loan amounts, and loan structure optionality (fixed vs. variable).

Splash Financial Pros

Splash Financial Cons

What Types of Student Loans Does Splash Financial Offer?

With Splash Financial you can refinance private, federal direct and indirect, and Parent PLUS loans for both current and former students. They offer four different types of refinancing options including:

- Student Loan Refinancing

- In-school Student Loans

- Medical School Loan Refinancing

Student Loan Refinancing Review

Student Loan Refinancing Features

For students that are finished with college and looking to lower the rate on their student loans, Splash Financial student loan refinance is an option. Most lenders through Splash require a minimum loan amount of $5,000 to refinance, and customers can choose a repayment period of 5 years to 20 years. With fixed and variable rates available, it’s possible borrowers can find a lower rate for their student loans.

Loan terms |

Between 5 and 20 years for fixed, up to 25 years for variable |

Repayment period |

5 years minimum with 20 years maximum for fixed and 25 for variable |

Loan amount |

Typically a minimum of $5,000 |

Loan Structure FlexibilityLoan Structure Flexibility |

Fixed and variable rates available |

Student Loan Refinancing Interest Rates and Fees

When an individual looks to refinance their student loans they will want to consider how fees will impact their potential savings. With Splash Financial loans there are no application or borrowing/origination fees. Customers can also enjoy zero prepayment fees. With fixed rates as low as 1.99% and variable rates as low as 1.74%, students may be able to find a lower rate on Splash’s marketplace than their current student loan rates.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Depends on lender |

Maintenance Fees |

Depends on lender |

Fixed Rates |

Starting at 1.99% |

Variable Rates |

Starting at 1.74% |

Student Loan Refinancing Qualification Requirements

In order to be eligible for a Splash Financial student loan refinance individuals must meet certain requirements. Students must have completed their bachelor’s or associate’s degree to be eligible for Splash Financial student loans.

Institution Type & Course Load Requirements |

Must have bachelor’s or associate's degree |

Minimum Credit Score |

Not disclosed |

Minimum Income |

Not disclosed |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Not required but may help eligibility |

Medical School Loan Refinancing Review

Medical School Loan Refinancing Features

For medical students looking to refinance their student loans, Splash Financial offers options through their partner banks, credit unions, and other lenders. Borrowers can choose a repayment period of at least 5 years to at most 20 years, as long as they are refinancing a minimum of $5,000. Splash Financial offers both fixed and variable rates, with the option to pay $100/month for 84 months maximum while a postgraduate trainee.

Loan terms |

Up to 240 months |

Repayment period |

5 years minimum, 20 years maximum |

Loan amount |

Typically a minimum of $5,000 |

Loan Structure Flexibility |

Fixed and variable rates available |

Medical School Loan Refinancing Interest Rates and Fees

Borrowers of a Splash Financial loan can rest assured knowing that Splash has no borrowing/origination fees, no application fees, and no prepayment fees. For those looking to refinance, Splash’s fixed rates for medical school loan refinance start at 3.06%, with variable loans starting at 2.53%. The combination of no fees plus lower rates can help medical students save on their hefty student loans.

Borrowing/Origination Fees |

None |

Prepayment Fees |

None |

Late Payment Fees |

Depends on lender |

Maintenance Fees |

Depends on lender |

Fixed Rates |

Starting at 3.06% up to 6.47% |

Variable Rates |

Starting at 2.53% up to 6.37% |

Medical School Loan Refinancing Qualification Requirements

In order to refinance medical student loans through Splash Financial, borrowers must be in a fellowship or residency program. While a cosigner is not required, some applicants with unfavorable credit may need one to be eligible.

Institution Type & Course Load Requirements |

Must be in a fellowship or residency program |

Minimum Credit Score |

Not disclosed |

Minimum Income |

Not disclosed |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Not necessary but may help eligibility |

In-School Student Loan Refinancing Review

In-School Student Loan Refinancing Features

Splash Financial has refinancing options for potential borrowers while still in school. Like their other loans, the repayment period can be from 5 years to 20 years and they offer both fixed and variable rates.

Loan terms |

5 to 20 years |

Repayment period |

5 years minimum, 20 years maximum |

Loan amount |

Typically minimum of $5,000 |

Loan Structure Flexibility |

Fixed and variable rates available |

In-School Student Loan Refinancing Interest Rates and Fees

A Splash Financial student loan comes with zero borrowing/origination fees as well as zero prepayment fees. Other fees, such as late payment and maintenance fees, will depend on the individual lender.

Borrowing/Origination Fees |

None |

|

Prepayment Fees |

None |

|

Late Payment Fees |

Depends on lender |

|

Maintenance Fees |

Depends on lender |

|

Fixed Rates |

Not disclosed |

|

Variable Rates |

Not disclosed |

In-School Student Loan Refinancing Qualification Requirements

While Splash doesn’t offer a minimum credit score or income needed on their website, applicants can inquire through the application process. If the student has a lower credit score, they may need a cosigner.

Institution Type & Course Load Requirements |

N/A |

Minimum Credit Score |

Not disclosed |

Minimum Income |

Not disclosed |

Maximum Debt-to-Income |

Not disclosed |

Co-signer/Joint Application Requirements |

Not needed but may help eligibility |

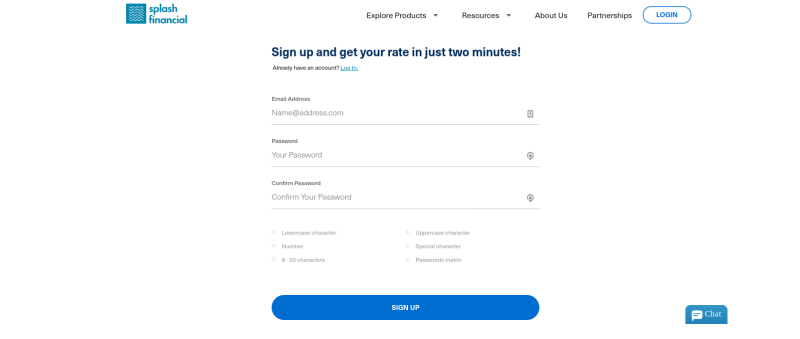

Splash Financial Application Process

This Splash Financial review discovered how easy it is to start an application. To start, potential borrowers can click on a “Get Started” anywhere on the home page or within one of the product pages from the “Products'' dropdown:

From there you will be able to select the “Check My Rate” button:

Next you will need to create an account to get started:

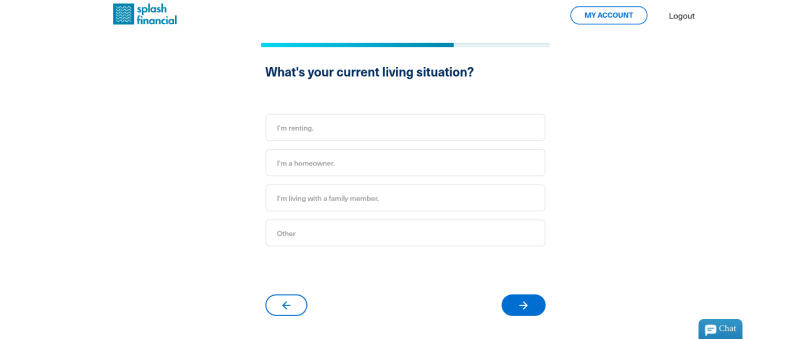

From there, Splash Financial will ask you for different information including your income, work status, housing status, and the loan amount you want to refinance:

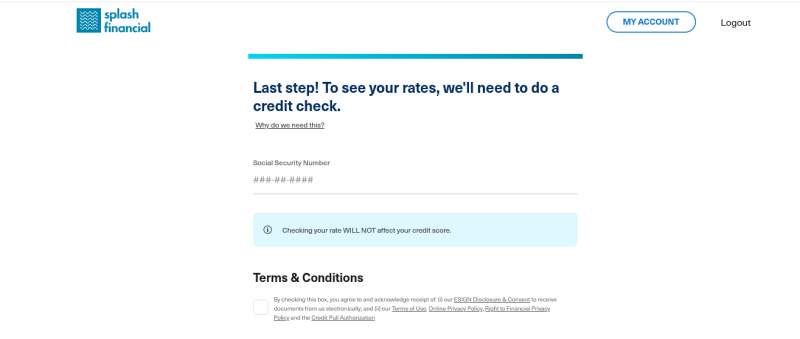

After you’re done answering all the required questions, Splash Financial will ask for your social security number in order to pull your credit and provide you with rates:

Your social security number is required so that Splash can pull your credit. This is a soft pull, however, meaning that the check will not affect your credit score. When you choose a product and continue on with the application process, a lender will request a full credit report from one or more of the credit reporting agencies. This is considered a hard pull and may affect your credit.

Splash Financial Customer Support

This Splash Financial review found that Individuals looking to contact Customer Support can do so in a number of ways:

- By phone: 1-800-349-3938 Monday - Friday, 9am - 9pm ET and Saturday - Sunday, 10am - 4pm ET.

- By email: contact@splashfinancial.com

- Through an online chat feature on their website

Splash Financial also has a FAQ section on their website, with topics such as understanding student loans, student loan refinancing, plus more.

The company has many positive online reviews, including an excellent rating on Trustpilot, with 4.8 stars out of 377 reviews. Here’s what users had to say about Splash Financial’s customer support:

“Very easy process and never had to speak with anyone. They had an online tool to match my current lender and everything was done in less than a week.” - Craig S.

“Great experience! Super fast and thorough and easy to contact and speak to someone. And the loan terms and rates are great too!” - Chin

Splash Financial Online Reviews

Customers love how quick and easy the Splash Financial loan approval process is. While many touted the benefits of being able to refinance their loans all online, others loved that they were able to call to speak to a representative to help them with their application. Many reviewers quoted the lower rates, saving them thousands of dollars in interest over the course of their loan payments.

Negative reviews include the fact that individuals had their application denied before all of their supporting documents, such as income verification, were turned in. Also mentioned was how long processing times could take, sometimes up to several months. Some potential borrowers who were looking at Splash Financial loans were upset that their quoted rate was much higher than the advertised rate, or that the final rate through a partner was higher than their quoted rate.

The positive reviews are related to |

The negative reviews are related to |

Quick and easy loan approval process |

Advertised rates can be deceiving |

Smooth online process |

Quick denial |

Lower rates |

Long processing times |

Splash Financial Perks and Bonuses

Flexibility:

Because Splash Financial is a loan refinance marketplace, the terms and conditions of the loan repayment are determined by the company chosen for the refinance. This includes payment deferral or payment skipping and forbearance of loans. Splash Financial does offer a .25% autopay discount, however, and for medical student loans there is an optional 84 month deferral period during residency or fellowship.

Mentorship:

Splash Financial doesn’t offer direct guidance, counseling, financial education, advice, or loan management assistance, but they do have a blog that includes articles on the following topics:

- Career advice

- Educational materials

- Financial advice

- Medical student loans

- Student loan debt

Technology:

Although Splash Financial does not have a mobile app there is the ability to log onto their site. Once logged in users can apply to check their rate, submit or check application status, and view messages.

Final Thoughts

For current or former students wanting to shop around in order to lower their student loan rates, Splash Financial is a solid choice. With strong customer service, an easy and free application process, and a large network of banks, credit unions, and other lenders to choose from, there are many pros to refinancing with Splash. On the other hand, users of the site stated longer than average processing times, quick denials before supporting documentation were given, and rates higher than advertised. Because it’s free to check rates and apply, Splash Financial is worth considering to see if borrowers can lower their rates and save themselves thousands of dollars in the long run.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!