With a Stride income share agreement, you agree to pay Stride a percentage of your earnings if you earn above a minimum threshold. Stride Funding is best for juniors, seniors, and graduate students with a strong GPA pursuing a career with high earning potential. Not everyone will be eligible for Stride’s unique program, but it’s easy to get a quote online and find out if you qualify. Plus, Stride income share agreements come with exclusive career benefits. We’ll cover everything you need to know about Stride Funding, so you can decide if the provider is right for you.

Stride Income Share Agreement (ISA) Review

Stride Funding offers income share agreements, which are student loan alternatives that do not require you to have good credit or apply with a cosigner. There are several benefits to working with Stride, including a shorter repayment period and downside protection.

Summarized Rating

This parameter considers loan term lengths, loan limits, and loan structure optionality (fixed and variable rate offerings). For each loan type offered, each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Stride scores a worst-in-class 1.5 for Loan Features, which is attributable to its decidedly below average term lengths and loan limits.

Stride Pros

Stride Cons

What Types of Student Loans Does Stride Offer?

Stride Funding only offers income share agreements, which are an alternative to traditional student loans. With an income share agreement, you agree to pay Stride a percentage of your income (provided you earn above the minimum threshold) for 60 months or until you hit the defined payment cap. The percentage of your earnings that you will be required to pay Stride in exchange for funding your education depends on individual factors like your chosen career.

Stride Income Share Agreement Features

You can borrow a maximum of $25,000 per year from Stride, and you’ll begin repayment three months after graduation. However, you won’t be required to pay a cent if you earn below the minimum income threshold specified in your agreement. This helps protect you from default. You’ll pay Stride a percentage of your income for 60 months or until you hit the defined payment cap.

Loan terms |

5 years |

Repayment period |

3 months after graduation |

Loan amount |

$5,000 to $25,000 annually |

Loan Structure Flexibility |

Downside protection |

Stride ISA Interest Rates and Fees

Stride Funding doesn’t charge any application or origination fees, but there is a $10 late payment fee. Rather than paying a traditional interest rate, you’ll pay 2% or more of your salary for every $10,000 you borrowed. While Stride doesn’t charge prepayment penalties, the only way to pay off your loan early is to hit the defined payment cap, which is twice the amount borrowed. For most borrowers, it will be more cost-effective to make payments for the full 60 months.

Borrowing/Origination Fees |

None |

Prepayment Fees |

N/A |

Late Payment Fees |

$10 |

Maintenance Fees |

None |

Fixed Rates |

2%+ per $10,000 funded |

Variable Rates |

N/A |

Stride ISA Qualification Requirements

To be eligible for Stride Funding, you need to be enrolled at least half time at a Title IV college or university in a Bachelor’s, Master’s, or Doctorate program of study. You’ll also need to be a U.S. citizen or permanent resident attending a U.S. institution, and you can’t live in Alabama, Colorado, Iowa, South Carolina, or Washington.

You must be within 24 months of your expected graduation date. You’ll also need a GPA of at least 2.9. Furthermore, Stride will evaluate your program to determine if the projected outcomes meet its criteria. Essentially, Stride is best for students in programs with high earning potential relative to the cost of their degree.

Institution Type & Course Load Requirements |

At least half time and no more than 2 years from graduation at a four-year Title IV school |

Minimum Credit Score |

None |

Minimum Income |

None |

Maximum Debt-to-Income |

None |

Co-signer/Joint Application Requirements |

None |

Stride Funding Application Process

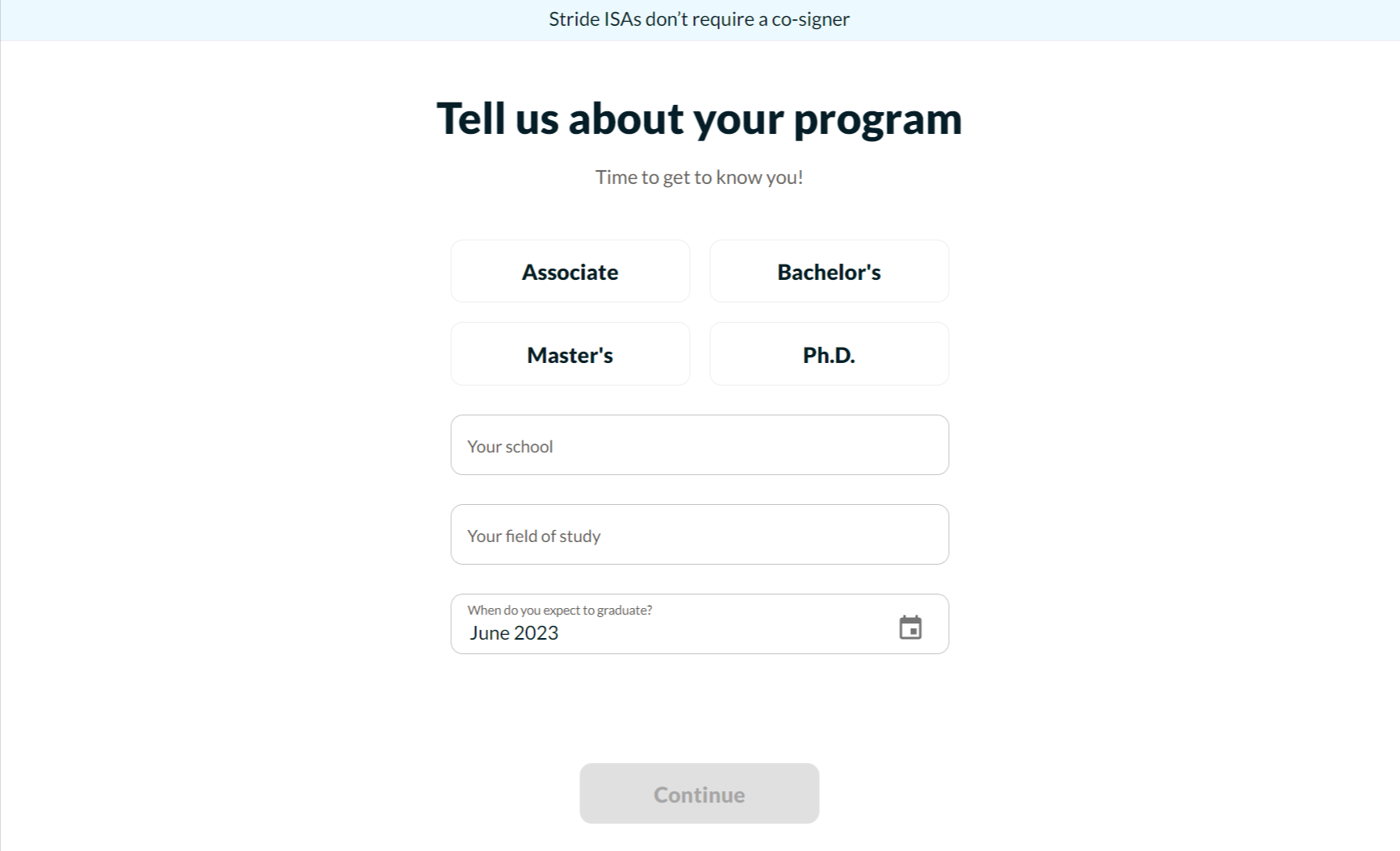

The first step is to check your rate with Stride’s quote tool. A credit check is not required to review your rate. You’ll start by telling Stride about your school, program, and field of study.

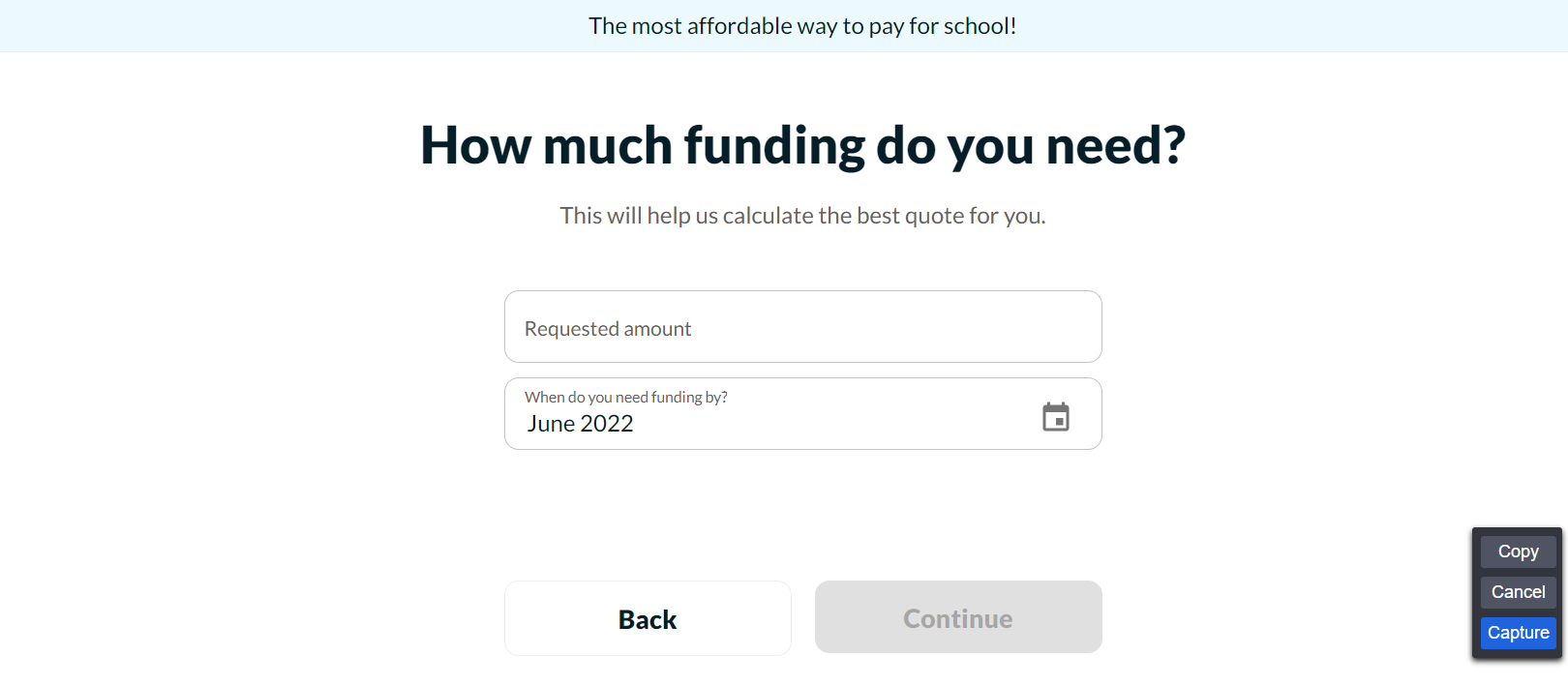

Next, you’ll enter how much you need for school and when you’ll need the funding.

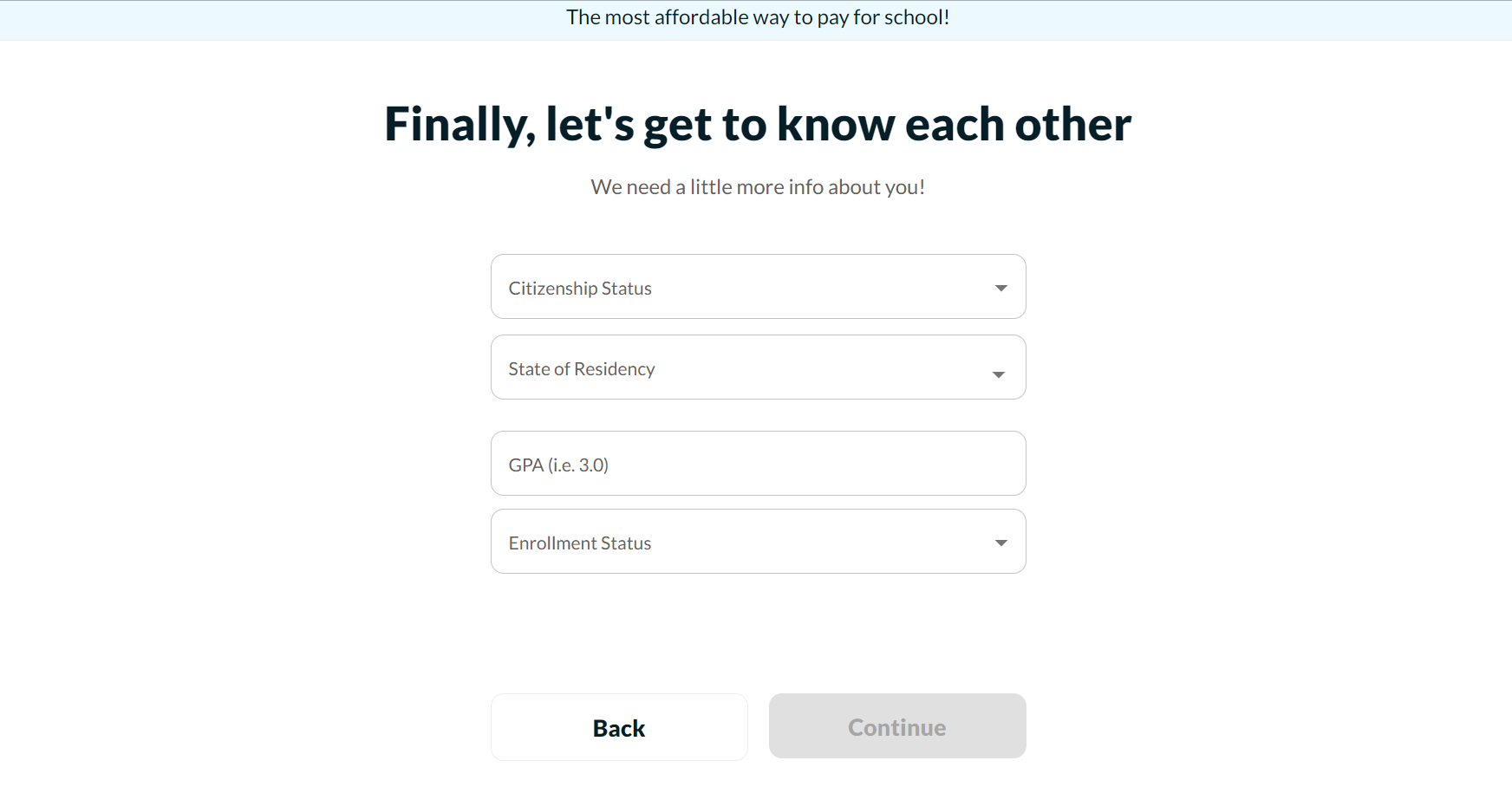

After that, Stride will ask for a few more details. Enter your citizenship status, state of residency, GPA, and enrollment status.

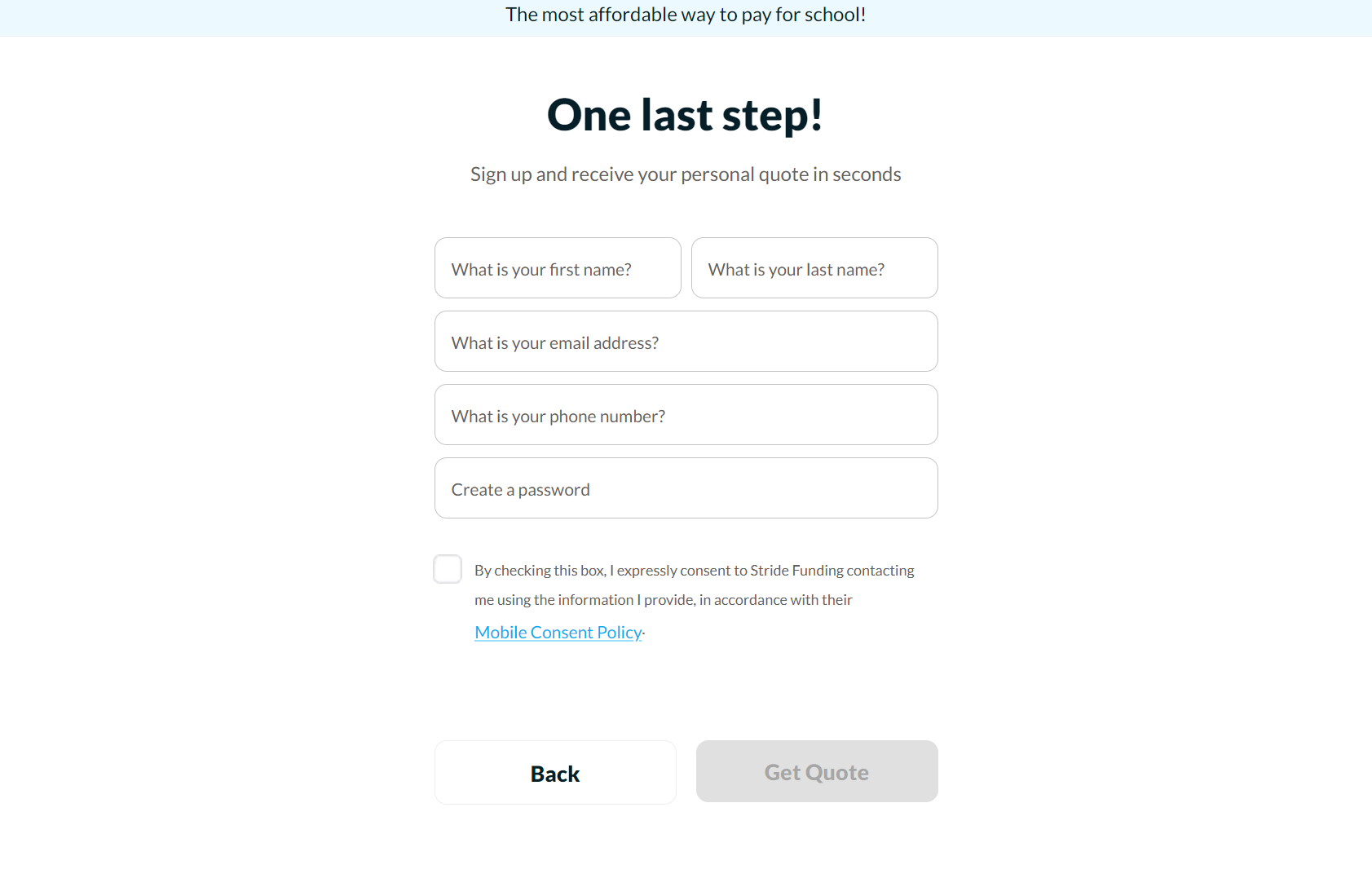

At the end, provide your contact information and create a password so you can revisit your quote at any time.

Be aware that getting a quote authorizes Stride to contact you about its income share agreements. Stride will send you an email so you can continue your application and upload any additional requested documents, such as your transcript. They’ll also check your credit for major issues that might disqualify you. If you’re approved, your funding will be distributed to your school directly, which can take several weeks. You’ll also gain access to the Stride career support portal.

Stride Funding Customer Support

You can reach Stride in one of two ways:

- Email: hello@stridefunding.com

- Phone: (214)-775-9960

Stride Funding doesn’t have a presence on third-party customer review sites like Trustpilot. But one testimonial on the Stride website reads: “I chose Stride because it made sense financially and felt like I was gaining a supportive network of individuals who had my best interests in mind.”

Stride Funding Online Reviews

It’s difficult to evaluate how students feel about Stride when the company does not have a presence on online review sites. But another testimonial on the Stride website echoes the positives of having Stride’s support network behind you: “The opportunity to do an ISA was appealing to me for a few reasons. It offered the ability to broaden my network outside of strictly my alumni network. You don’t get that support from any other lending company.”

Stride Funding Perks and Bonuses

Flexibility

One of the best features of Stride Funding is the ability to pause payments during any month that you make less than the minimum income threshold specified for your program, which is typically $30,000 or $40,000. Your obligation is complete after 60 months of payments or once you hit the defined payment cap of two times the loan amount. But repayment can extend up to 10 years with forbearance. In addition to receiving a break when your earnings are low, you can apply for short-term forbearance if you become ill or are the victim of certain natural disasters.

You can’t save by paying off your loan early — in fact, you might end up paying more than you need to if you repay your loan in fewer than 60 months. That’s something we wish Stride Funding would change. However, the minimum income threshold is a great feature that can protect you from default.

Mentorship

When you’re approved for funding from Stride, you’ll also get access to an online portal packed with career resources, perks, and discounts. You can receive career counseling and guidance through your program and after graduation, attend networking events and skill workshops, and more.

Technology

Stride offers students the ability to make payments online through its student portal. However, the company does not have a mobile app or a live chat, which are two additions we think would be helpful for students.

Final Thoughts

Stride Funding is a great alternative to traditional student loans for juniors and seniors who don’t want to apply with a cosigner and haven’t built credit of their own. We encourage students to explore the student loan simulator or other online calculators to understand the cost of different methods of borrowing.

If you borrow from Stride, the most you’ll repay is double the loan amount, which equates to about a 16% interest rate on a $25,000 loan with a traditional 10-year repayment term. Most private student loans come with lower rates than that, but they also don’t come with downside protection. And depending on your rate with Stride and your job, you could end up fulfilling the agreement long before you hit the defined payment cap. As long as you understand that there’s a risk your ISA will cost you more than a private student loan, you can weigh that risk with the advantages, which include career support and hardship protection.