Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

5k Funds Reviews: Expert Analysis & User Insights for 2024

5k Funds is a personal loan marketplace that makes it easy to borrow money. Whatsets it apart is that you can borrow very small amounts and qualify with poor credit. This 5k Funds review will tell you everything you need to know about the lender.

5k Funds keeps things simple by focusing on one type of loan – personal loans. These are unsecured loans that you can use for pretty much any purpose. They’re not tied to a specific use the way an auto loan or mortgage is.

Many banks and lenders offer personal loans, but most won’t let you borrow less than a few thousand dollars. 5k Funds targets people who only need a bit of extra cash, connecting them with lenders that give them a chance to borrow just a few hundred dollars and pay it back in as little as a few months.

Summarized Rating

This parameter considers loan term lengths, loan minimums and maximums, and the extent of loan use limitations. Each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

5kFunds gets a very strong 4.0 for Loan Features. This reflects the loan aggregator’s competitive term lengths and loan limits and the absence of any loan use limitations.

5k Funds Pros and Cons

5k Funds Pros

5k Funds Cons

Types of Personal Loans Offered by 5k Funds

5k Funds reviews your application and will help match you with banks and other lenders that offer personal loans. The benefit of personal loans is that they’re very flexible: you can use them for almost anything.

| Common loan uses | Prohibited uses |

| Consolidate other debt | Not disclosed |

| Pay an unexpected bill | |

| Buy something expensive | |

| Home repairs |

If you are struggling with substantial amounts of debt, a debt relief company such as National Debt Relief could be your lifeline. The company can help you save an average of 30% of your total amount owed.

5k Funds Loan Features

One of the benefits of 5k Funds is that it helps match borrowers with lenders that offer loans that fit their needs. As part of the application process, you can specify how much you need to borrow and how long it will take to pay it back.

5k Funds works with a wide range of lenders, meaning it can match borrowers to loans with a variety of features and terms.

| Loan terms | Fixed rate |

| Repayment period | 2 months – 72 months |

| Loan amount | $100 - $35,000 |

| Loan Use Limitations (i.e. only home improvements or only debt consolidation) | Not disclosed |

5k Funds Interest Rates and Fees

One drawback of 5k Funds’ model of matching borrowers to lenders is that the cost of the loans can vary widely depending on your credit and the lender that you work with.

Each of the company’s lending partners can set its own rates and fees, so 5k Funds isn’t able to advertise specific interest rates, costs, or other fees for its loans.

On the other hand, you’ll get offers from multiple lenders when you use the site to apply, giving you a chance to compare offers and choose the best deal.

| Borrowing/Origination Fees | Varies by lender |

| Prepayment Fees | Varies by lender |

| Late Payment Fees | Varies by lender |

| Other fees | Varies by lender |

| Interest Rates | Varies by lender |

5k Funds Qualification Requirements

5k Funds uses the information included in your application to match you with lenders who are most likely to work with you. That can make it easier to qualify for a loan because you don’t have to find a lender and hope that they work with customers with your credit profile.

While 5k Funds doesn’t list a minimum credit score requirement to apply, the better your credit, the more likely you are to find a willing lender.

| Membership Requirement | None |

| Minimum Credit Score | None |

| Income Requirements | Varies by lender |

| Co-signer/Joint Application Requirements | Varies by lender |

5k Funds Application Process

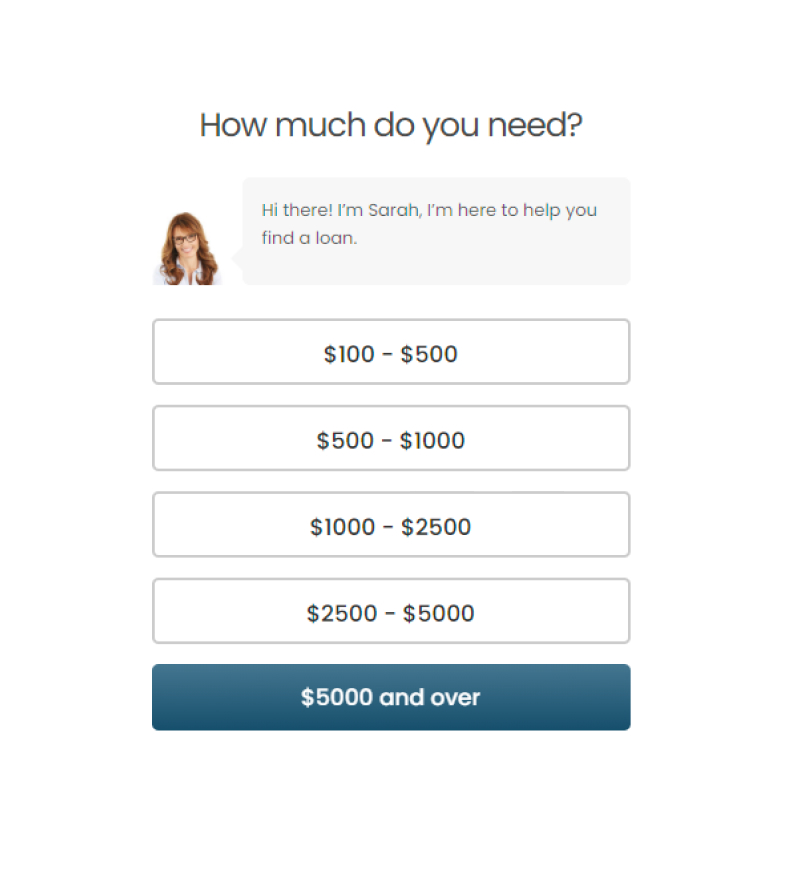

The 5k Funds application process is relatively easy. The first thing you see on the site is the beginning of the application, asking you how much you want to borrow and how long you need to pay it back.

After those two questions, you have to provide some personal information to help the site match you with lenders:

- Your address

- Your name

- Contact information

- Your birthday.

- Type of debts that you currently have

- Whether you can meet certain minimum payment amounts based on the loan you’d like to receive

- Whether you serve in the military, own a home, or own a car

- How long you’ve lived in your current home

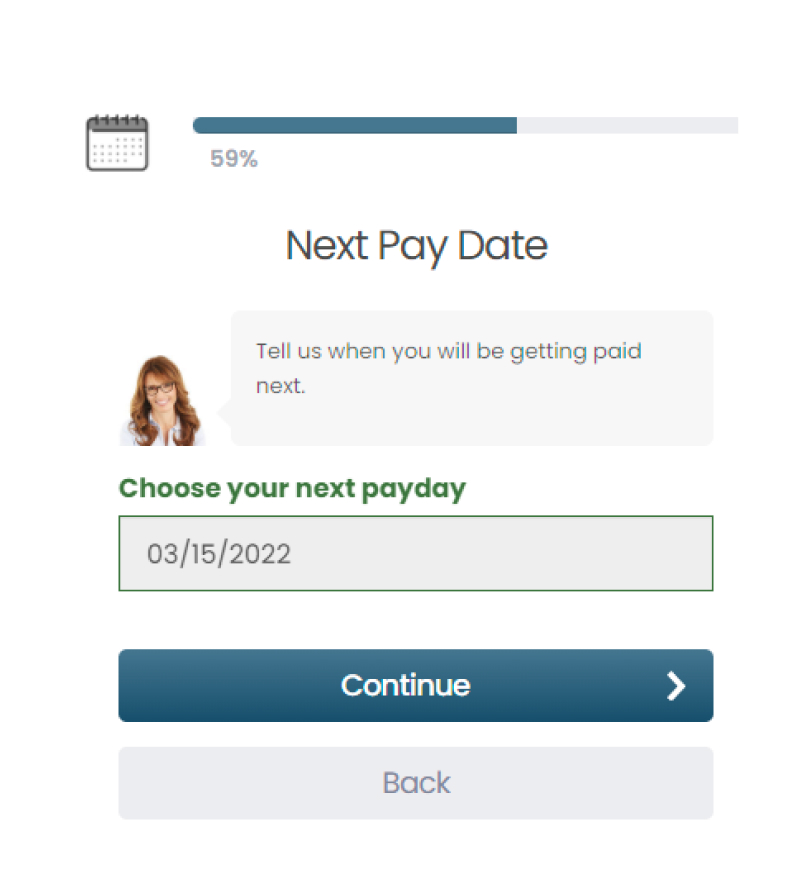

Next up are questions about your sources of income and how you’ll repay the loan. This includes whether you’re employed, how long you’ve worked for that company, how much and how frequently you get paid, and how you receive your paychecks.

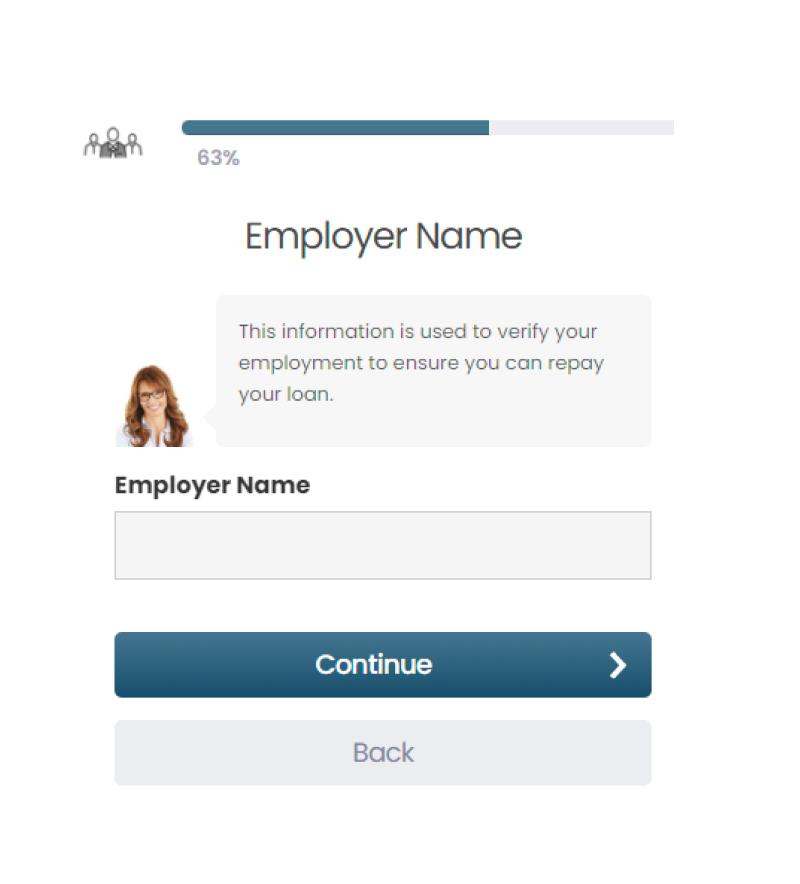

Lenders will want to make sure that you actually are employed and earning the amount you say you earn, so you’ll have to provide information about your employer and a way to contact them.

Lenders will want to check your credit before offering a loan, so you have to provide your driver’s license number and Social Security number.

After that, 5k Funds will ask you to estimate your credit and provide information about your financial accounts. This info can help it match you to the best lenders for your situation.

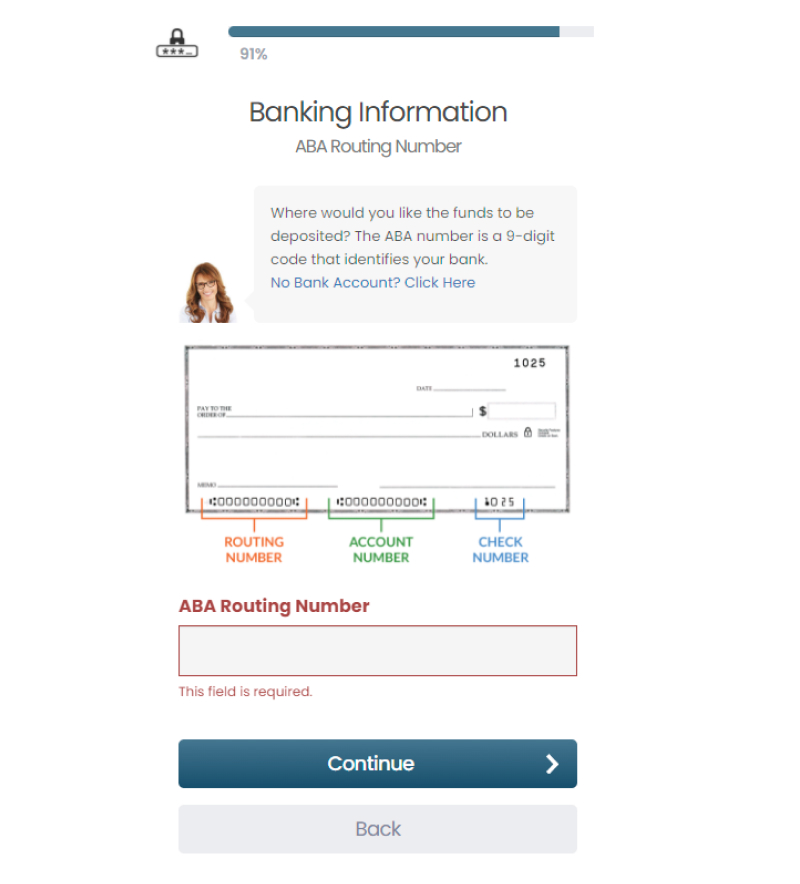

One thing that is unusual is that 5k Funds will also ask for your banking information. This includes both your bank’s routing number and your bank account number. Few other loan comparison sites will ask for this info, but it can help speed up the process down the line because lenders will already know where you want your loan sent.

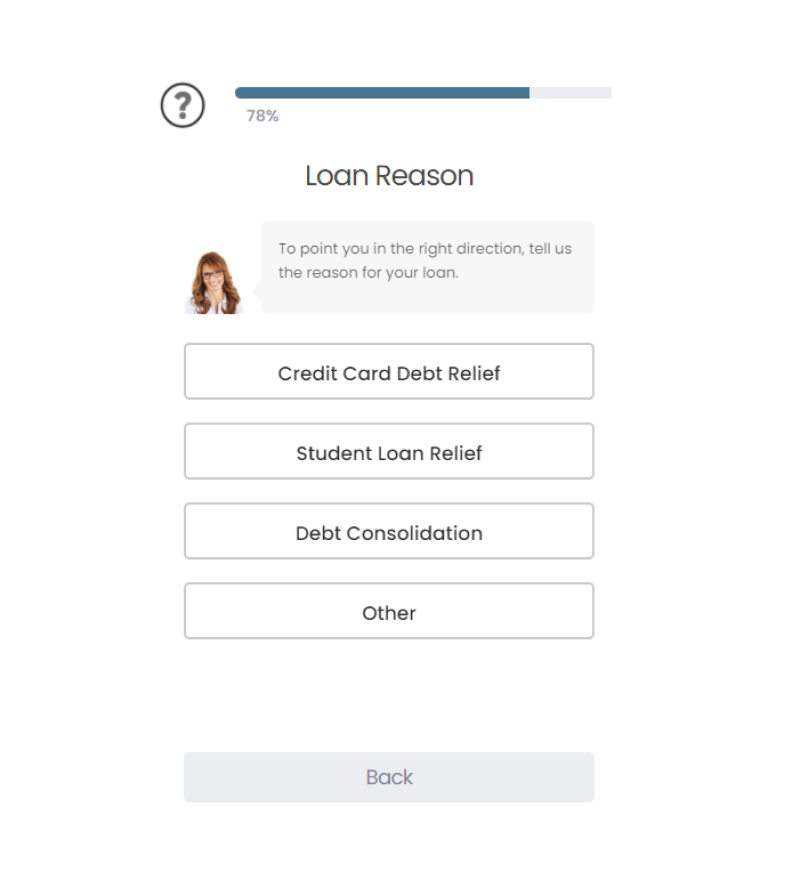

The final question is about why you’re getting the loan. Some lenders prefer to give loans to people who are applying for a specific reason, so this helps 5k Funds match you to appropriate lenders.

The biggest drawback of the process is how much personal information the site asks for before it starts matching you with lenders. You have to be willing to provide your Social Security information, contact information for your employer, and details about your bank account to submit the application.

This is more information than many similar sites ask for before they can match you with other lenders and some people may be unwilling to provide so many details upfront.

Another thing to note is that some reviewers claim that this initial application can result in a hard pull on your credit, which drops your score by a few points.

5k Funds Customer Support

One place where 5k Funds loans fall far short of the competition is with its customer support. There is barely any assistance available.

5k Funds’ website consists of a single page that has very limited details about the loans that it helps match people to. For the most part, there is the application and a few links that direct you back to the application. The bottom of the page has a few links to loan details and privacy policies.

As far as customer support goes, there is no phone number or email address listed if you want to reach out to 5k Funds for assistance. You do provide your contact information during the application so 5k Funds can contact you, but you have no way to contact 5k Funds.

Many customers agree that 5k Funds’ support is lacking. It is not accredited by the Better Business Bureau and it has a score of 2.4 out of 5 on Trustpilot. Some reviewers even accused the site of being a scam.

5k Funds Online Reviews

As mentioned, 5k Funds is seriously lacking when it comes to positive customer reviews online. The Better Business Bureau doesn’t have a rating for the lender and Trustpilot’s rating is just 2.4 out of 5.

Many reviewers claim that they never received a loan through 5k Funds and that the site simply took their data and sold it off to other companies. Some even say that the lenders 5k Funds connected them to are unsavory, charging them fees and ultimately failing to offer a loan.

One Trustpilot reviewer commented, “5K Funds is a Scam. I applied for a loan online and paid for a credit report. A short time later I was asked to pay a second time for a credit report. No loan was addressed.”

Another reviewer stated, “They do nothing but sell your data once they have it. You get redirects for days all with 3rd party fee crooks. Don't give them any data.”Another reviewer stated, “They do nothing but sell your data once they have it. You get redirects for days all with 3rd party fee crooks. Don't give them any data.”

While some reviewers appreciate the site for not having a minimum credit score to apply and for its quick application process, the negative sentiments seem to far outweigh the positives.

| Positive reviews | Negative reviews |

| No minimum credit score requirement | The initial application can lead to a hard credit pull |

| Fast application | Loan terms and fees vary widely by lender |

| Some lenders charge high fees and may not offer loans | |

| 5k Funds may not find a lender to connect you to | |

| Large amounts of personal information required during the initial application | |

| No customer support is available |

5k Funds Perks and Bonuses

When you get a loan, some lenders go out of their way to make the borrowing process smoother or to offer perks. This can come in the form of things like loyalty discounts for borrowing from the bank you keep your checking account at or rate discounts for setting up automatic payments.

Lenders might also have phone apps that make it easy to manage your loan or that offer tools you can use to help budget or learn about managing your finances.

5k Funds personal loans keep it simple and don’t offer any of these perks or bonuses automatically. The lenders that it connects you with may have some of these benefits, but there’s no guarantee that you’ll get matched to a lender with flexible loans or a good website or app.

Flexibility:

- Varies by lender

Varies by lender

- 5k Funds is very opaque, loan fees and rates are not disclosed or advertised

- No customer support is available

Technology:

- Basic, one-page website and no app available

5k Funds Compared to Other Lender

There are many banks and lenders out there that offer personal loans to borrowers with good credit, poor credit, or credit somewhere in between. There are also plenty of sites that work to match you with lenders that like to work with borrowers like you.

If you’re thinking about applying for a personal loan, it’s in your best interest to shop around to find the lender with the best rates and fees. You can also look for lenders that offer nice perks or tools that you can use to help manage your loan.

| 5k Funds | LightStream | LendingTree | Upgrade |

| Loan Terms | Fixed rate | Varies by lender | Fixed rate |

| Loan amount | $5,000 - $100,000 | $1,000 - $50,000 | $1,000 - $50,000 |

| Interest Rates | 2.99% - 19.99% | As low as 2.49% | 5.94% - 35.97% |

| Min Credit Score | 660 | Varies by lender | Not disclosed |

| Co-signer Requirement | No | Varies by lender | No |

Final Thoughts

5k Funds offers to match borrowers with lenders that like to offer loans to people with their credit profiles. While there is no minimum credit score required to apply for a loan through 5k Funds, that is pretty much the sole benefit of working with the site.

Ultimately, 5k Funds falls short for a number of reasons. It is very opaque when it comes to the rates and fees of the lenders it works with and it offers no way for customers to get in touch if they need customer support. Its application, while fast, also asks for far more information than many similar services request.

That, combined with the almost universally negative 5k Funds reviews you’ll find from customer review sites like Trustpilot, means that borrowers should be wary about working with 5k Funds and consider a competitor where possible.