Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Credible Personal Loans Review: Loan Shopping Made Easy

Credible is an easy-to-use lending marketplace that allows you to view prequalified options from vetted lenders without harming your credit score. Though Credible doesn’t lend any money, they do make it possible for borrowers to find loans that match their needs.

Credible works with 17 lenders to provide potential borrowers with a wide range of options. APRs span anywhere from 2.49% to 34.99% on loan amounts that range between $600 and $100,000. Loans can be used for a variety of purposes including education, mortgage, large purchases, and debt consolidation. Repayment terms are also flexible, with lending partners allowing anywhere from 12 months to seven years to pay off the loan.

Summarized Rating

This parameter considers loan term lengths, loan minimums and maximums, and the extent of loan use limitations. Each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Credible gets a stellar 4.5 for Loan Features, which is attributable to its highly flexible term lengths and loan amounts and the absence of any loan use limitations.

Credible Personal Loans Pros and Cons

Credible Pros

Credible Cons

Personal Loans Offered by Credible

Credible offers a variety of loan types including student loans, student loan refinancing, home loans, mortgage refinancing, credit cards, and personal loans. Through Credible, you can find personal loans to cover a variety of expenses including vet bills, car purchase, car repairs, business startup expenses, weddings, funerals, home. Keep in mind that some of Credible’s lending partners may limit how loans are used.

| Common loan uses | Prohibited uses |

|

Mortgage Refinancing Personal Loans Credit Cards Debt Consolidation Car Purchase Home Improvements |

Restrictions on loan usage vary by lender |

Credible Loan Features

As an online lending marketplace, Credible provides access to loans from a variety of lenders with a wide range of terms. Borrowers can take out loans in any amount from $600 to $100,000. Restrictions on loan usage vary from lender to lender; the only blanket prohibition is you can’t borrow money for any illegal activity. The minimum repayment period for most loans offered on Credible is two or three years, though one of its lenders provides a one-year repayment period. The maximum time permitted for repayment on most loans through Credible is seven years; however, one lending partner allows 12 years for repayment of home improvement loans. To receive more personalized information on repayment, please refer to Credible’s personal loan calculator.

| Loan terms | Vary depending on the lender |

| Repayment period | 12 months to 7 years |

| Loan amount | $600 to $100,000 |

| Loan Use Limitations | Varies by lender |

Credible Interest Rates and Fees

Because Credible is a marketplace for loans, interest rates and fees will vary considerably depending on which lender the borrower chooses. Most of the lenders on Credible charge an origination fee, which can range between 0.99% to 6.00%; out of Credible’s 17 partner lenders, five of them currently do not charge any origination fees. None of the lenders available through Credible charge prepayment, application, or disbursement fees. All interest rates are fixed and range anywhere from 2.49% to 35.99% depending on the lender, loan amount, and borrower qualifications.

| Borrowing/Origination Fees | Charged by most lenders on Credible, ranging from 0.99% to 6.00% |

| Prepayment Fees | None |

| Late Payment Fees | Charged by at least seven out of Credible’s 17 lending partners |

| Other fees | No application or disbursement fees. Some lenders charge a fee for insufficient funds or dishonored payments |

| Interest Rates | 2.49% to 35.99% |

Credible Qualification Requirements

Loan applicants must either be a U.S. citizen or permanent resident with a valid social security number. The minimum credit score required by Credible’s partners is typically between 560 and 660; one of the marketplace’s lenders offers loans with no minimum credit score required.

Many of Credible’s lending partners do not publicly disclose income requirements for borrowers. Of those that do provide income guidelines, four lenders have no minimum requirement with other partners requiring between $1,000 and $2,500 per month. Joint applications are generally accepted with at least five of Credible’s lending partners allowing co-signers

| Membership Requirement | None |

| Minimum Credit Score | Between 560 and 660 for most lenders |

| Income Requirements | Not published by most lending partners. Between $1,000 and $2,500 per month for those who did disclose. Several lenders offer no minimum income requirements. |

| Co-signer/Joint Application Requirements | Allowed by at least five of Credible’s lending partners. |

Credible Application Process

Getting prequalified rates through Credible is simple. The website is easy to navigate with clear instructions, walking you step-by-step through the entire process.

On the homepage, all you need to do is click on the type of financial product you’re looking for—student loan refinancing, student loans, personal loans, home loans, mortgage refinancing, or credit cards.

On the next page, you’ll enter how much money you want to borrow. This can be any amount between $600 and $100,000.

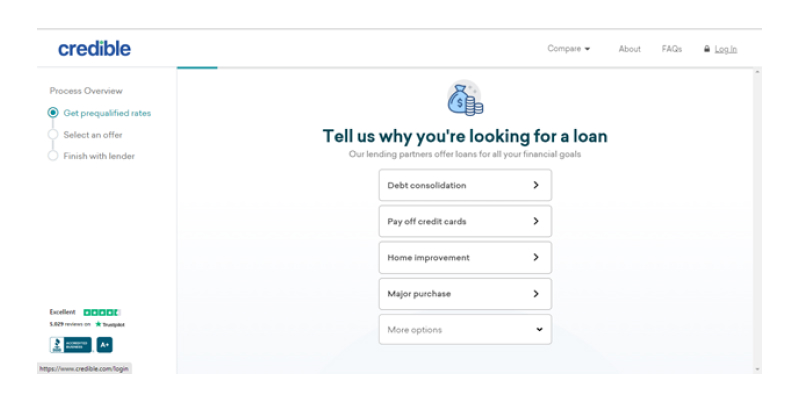

After that, you’ll provide information on how the loan will be used: debt consolidation, to pay off credit cards, home improvements, or a major purchase. If none of these choices accurately describe your intended loan use, click on “More options” to find a better match.

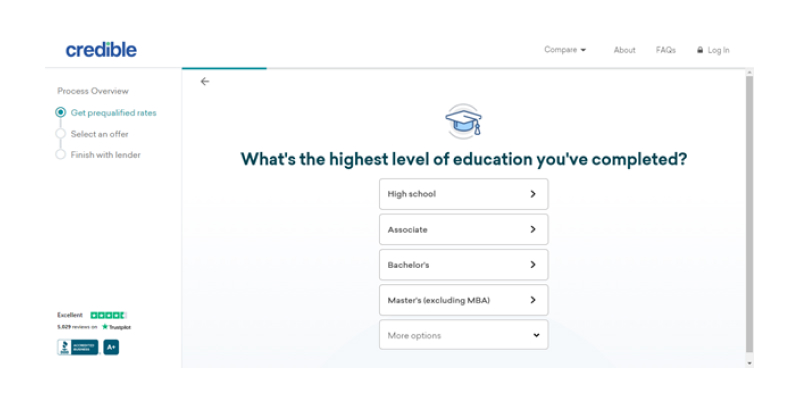

The next step is to indicate your highest level of education. The primary options provided are high school, an associate degree, a bachelor’s degree, or a master’s

degree. There are also additional choices available under the “More options” button including a certificate, Ph.D., less than a high school education, MBA, etc.

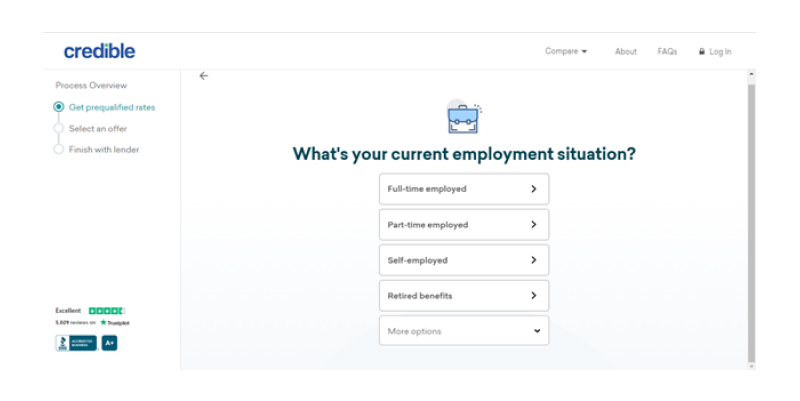

On the following page, you’ll be asked to describe your current employment situation. The options given are full-time employment, part-time employment, self-employment, retired, military, unemployed, or “other.”

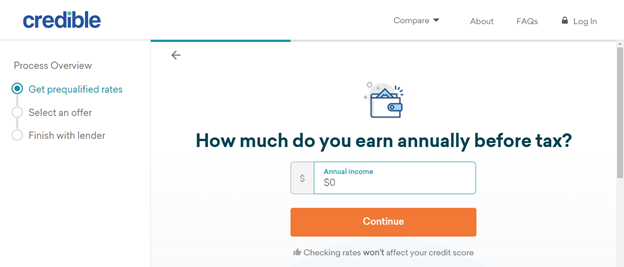

You’ll then need to enter your annual income. Make sure to include all personal income including wages, investments, retirement payouts, and income from rental property.

The earnings listed should be for the applicant only; do not include income from a spouse or other household members. Also keep in mind that applicants aren’t required

to disclose information regarding alimony, child support, or other maintenance payments, but they can be included if you’d like that income taken into account.

On the next few pages, you’ll start to enter personal information so Credible’s lending partners can verify your identity before offering prequalified rates; this will not affect your credit score. To prequalify applicants, Credible uses a soft credit pull so you don’t have to worry about it negatively affecting your credit.

The information you need to provide is:

- Your name

- Your date of birth

- Your home address

- If you own or rent your home and whether you have a mortgage

- The amount you pay per month for housing

- Whether or not you’re a citizen of the United States

- Your social security number

- Your phone number

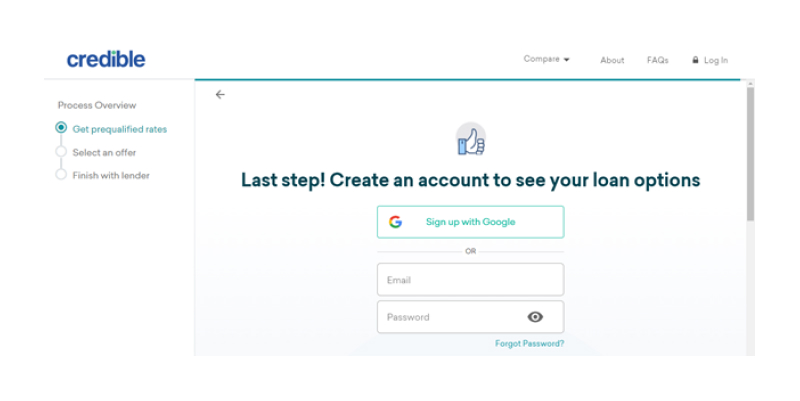

You’ll then need to create an account to view your prequalified rates. You can either sign up with your Google account or create one by entering your email and providing a password.

From there, Credible will review the information you provided, search for personal loans matching your needs, and present you with various options to choose from. Each option includes detailed loan information such as monthly payment, APR, origination fee, how much interest you’ll pay over the lifetime of the loan, how long it takes for funds to be deposited into your account, etc.

The amount of time it takes to process your application and receive funding will depend on which lender you choose. For most of Credible’s partners the time to fund is typically between one to three business days from approval.

It's important to note that monthly payments quoted on the offer screen reflect autopay discounts whenever offered by lenders. The rates you receive are guaranteed by Credible to be the best personal loan rates available; if you find and close with a lower rate elsewhere within eight days of receiving your prequalified rates, Credible will give you a $200 gift card. For more details, review Credible’s personal loan best rate guarantee.

Credible Customer Support

There are several ways to contact Credible’s customer service team. You can either

- Call 1-866-540-6005 to talk to a customer service representative

- Chat online with a CSR through their website or

- Contact their Client Success Team by emailing support@credible.com

Live customer service agents are available during Credible’s regular business hours, which are Monday through Thursday 9:00 AM to 9:00 PM, Friday and Saturday 9:00 AM to 7:00 PM ET, and Sunday 10:00 AM to 7:00 PM (Hours listed are in Eastern Standard Time.) You can send an email at any time but are unlikely to receive an immediate response outside of business hours.

The vast majority of reviews on Trustpilot are favorable towards Credible’s customer service team, with one borrower commenting,

“I was very happy with their customer service as I had several questions along the way. They were very easy to reach and always courteous.

And another saying,

“Every time I've had to contact Credible, I have been pleasantly surprised with the level of customer service. They're knowledgeable and helpful and patient. Thank you!!!”

You can also find answers to your questions through Credible’s informative FAQ page and blog posts.

Credible Online Reviews

Credible has received more than 5,000 reviews on Trustpilot earning an average rating of 4.7 stars out of 5. They’re also accredited by the Better Business Bureau with an A+ rating

Many of the positive reviews mention how Credible’s prequalification process is seamless from start to finish. Reviewers like that Credible makes it easy for them to compare rates from various reputable lenders without it affecting their credit score. They’re also impressed by the fast turnaround time and how quickly they can receive financing once they’ve been approved through the lending partner.

Though most experiences with Credible are overwhelmingly positive, there are some reviewers with complaints about the service. One of the biggest issues mentioned by customers is that there can be discrepancies between prequalifying rates and loan terms that are offered once a hard credit inquiry has been performed through the lender. A few of them mention not receiving a bonus for making a referral or finding a better rate. There are also a handful of reviewers who experienced a delay in the application or disbursement process.

| The positive reviews are related to | The negative reviews are related to |

| Ease and simplicity of the application process | Not receiving a referral bonus |

| Makes it easy to compare rates between reputable lenders | Discrepancies between prequalifying rates and actual loan offer on lender website |

| Receiving multiple options that match borrowers’ criteria | Delays in receiving funding |

| Fast turnaround time | Hard pulls on credit after applying with lending partner |

| Soft credit pull | Not receiving $200 for finding a better rate elsewhere |

Credible Perks and Bonuses

Flexibility:

- Credible works with 17 vetted lending partners to offer loans that meet a variety of needs

- Several loan options are available to borrowers with low credit scores

- Applicants receive several prequalified offers to choose from with various loan terms

- Several of Credible’s lending partners offer autopay discounts

- You might be able to modify loan terms or defer payments in times of hardship depending on the lender

Transparency:

- Credible’s website is informative, accurate, and easy to navigate

- The prequalification process is straightforward and noninvasive

- The Credible customer service team is professional, polite, and helpful

- Credible provides a detailed security page to help users understand how their information is protected

- Many of customers’ most commonly asked questions are answered through Credible’s FAQ page and blog.

Technology:

- Credible does not have a mobile app; prequalification must be done on its website

- The Credible website is optimized for mobile devices so usability is not affected

- Creating an account with Credible is easy thanks to integration with your Google account

- Many of Credible’s lending partners offer mobile apps where customers can conveniently make payments

- Some lenders offer the option to have payments automatically deducted from your bank account

Credible Compared to Other Lenders

| Credible | LightStream | Upstart | LendingTree | |

| Loan Terms | 12 to 84 months | 24 to 240 months | 36 to 60 months | Typically 24 months and up |

| Loan amount | $600 to $100,000 | $5,000 to $100,000 | $1,000 to $50,000 | $1,000 to $50,000 |

| Interest Rates | 2.49% to 35.99% | 2.99% to 19.99% with Autopay | 4.37% to 35.99% | 2.49% to 35.99% |

| Min Credit Score | None | Not disclosed (Good or Excellent) | 580 | 600 |

| Co-signer Requirement | Co-signers allowed with some lenders | No co-signers allowed (joint applications allowed) | Co-signers not permitted | Some of their associated lenders allow co-signers |

Final Thoughts

Credible makes it easy for potential borrowers to compare loan rates from various reputable lenders without damaging their credit score. Because Credible works with a variety of lending partners, customers are more likely to find loans that meet their unique set of needs.

The prequalifying process is simple, fast, and straightforward. If applicants run into trouble along the way, Credible’s professional Client Success Team is on hand to help via phone, chat, or email during regular business hours.

Applicants should be aware that prequalifying rates may not match the loan terms they’re offered after applying with a lender. Lending partners get a clearer picture of borrowers’ finances after conducting a hard credit pull, which can alter what loan terms are available.