Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Figure Personal Loans Review: Expert Analysis & Insights for 2023

Figure is an online provider of home equity loans, personal loans, and crypto-backed loans. Using blockchain technology, Figure has streamlined the loan application, approval, and disbursement process, making it virtually seamless from start to finish. Their rates are highly competitive, especially for well-qualified borrowers.

Figure offers personal loans up to $50,000 or home equity loans up to $300,000. These funds can be used for practically anything, including home improvements, educational expenses, large purchases, debt consolidation, and travel. Figure is best suited to borrowers with a high credit score and low debt-to-income ratio, which are needed to qualify for low APRs. Want to know if Figure’s loan products are right for you? Then read our detailed Figure review provided below.

Summarized Rating

This parameter considers loan term lengths, loan minimums and maximums, and the extent of loan use limitations. Each of these features was evaluated using the five-point scoring system. Then, the various scores were aggregated and averaged to establish an overall loan features score.

Figure gets a subpar 3.0 for Loan Features. This reflects the lender’s standard term lengths and somewhat restrictive loan limits. The absence of any loan use limitations provides a boost to the score.

Figure Personal Loans Pros and Cons

Figure Pros

Figure Cons

Types of Personal Loans Offered by Figure

Figure’s primary financial products are home equity loans and personal loans. Figure personal loans can be used for practically any purpose—as long as it’s not illegal—including medical treatments, large purchases, debt consolidation, educational expenses, and travel. Figure also offers mortgages and mortgage refinancing through their partnership with Homebridge. One unique feature of Figure is they allow customers to borrow against their cryptocurrency assets (BTC and ETH) through crypto-backed loans.

Common Loan Uses:

- Mortgage Refinancing

- Home Improvements

- Debt Consolidation

- Wedding

- Medical Treatments

Figure Personal Loans Features

Figure offers home equity lines of credit (HELOC) up to $300,000. Repayment on these loans can be scheduled for 5, 10, 15, or 30 years. The limit on personal loans is $50,000 with repayment terms of either 3 or 5 years. On both types of loans, repayment begins approximately 30 days after the loan has been disbursed with following payments due on the same date every month. The only limitation on Figure’s home equity and personal loans is they can’t be used for anything illegal.

| Loan terms | Between 5 to 30 years for home equity loans. Either 3 or 5 years for personal loans. |

| Repayment period | Repayment begins a month after disbursement. |

| Loan amount | Home equity loans up to $300,000. Personal loans capped at $50,000. |

| Loan Use Limitations | Not to be used for illegal activity |

Figure Personal Loans Interest Rates and Fees

Figure offers competitive interest rates on their home equity and personal loans. The typical APR for personal loans ranges between 5.75% and 22.87% while home equity lines of credit can be acquired for as little as 3.25%. Figure does not require any fees for loan maintenance, late payment, or prepayment. However, they do charge origination fees, which can reach up to 4.99% of the original loan amount. The origination fee doesn’t need to be paid in advance; instead, it’s added to your principal balance to be repaid over the life of the loan.

| Borrowing/Origination Fees | Up to 4.99% |

| Prepayment Fees | None |

| Late Payment Fees | None |

| Other fees | None |

| Interest Rates | 5.75% to 22.87% for personal loans. As low as 3.25% for home equity loans. |

Figure Personal Loans Qualification Requirements

Figure requires applicants to be employed to qualify for home equity or personal loans. While they don’t provide specific income requirements, they do recommend having a debt-to-income ratio of less than 50%. To get the best interest rates, you’ll need a FICO score of 680, though it is possible to get approved with a lower credit score. Figure does not allow co-signers or joint applicants.

| Membership Requirement | None |

| Minimum Credit Score | 600 FICO Score minimum, though 680 or higher is preferred. |

| Income Requirements | No dollar amount specified; a debt-to-income ratio under 50% is recommended. |

| Co-signer/Joint Application Requirements | Not Permitted |

Figure Personal Loans Application Process

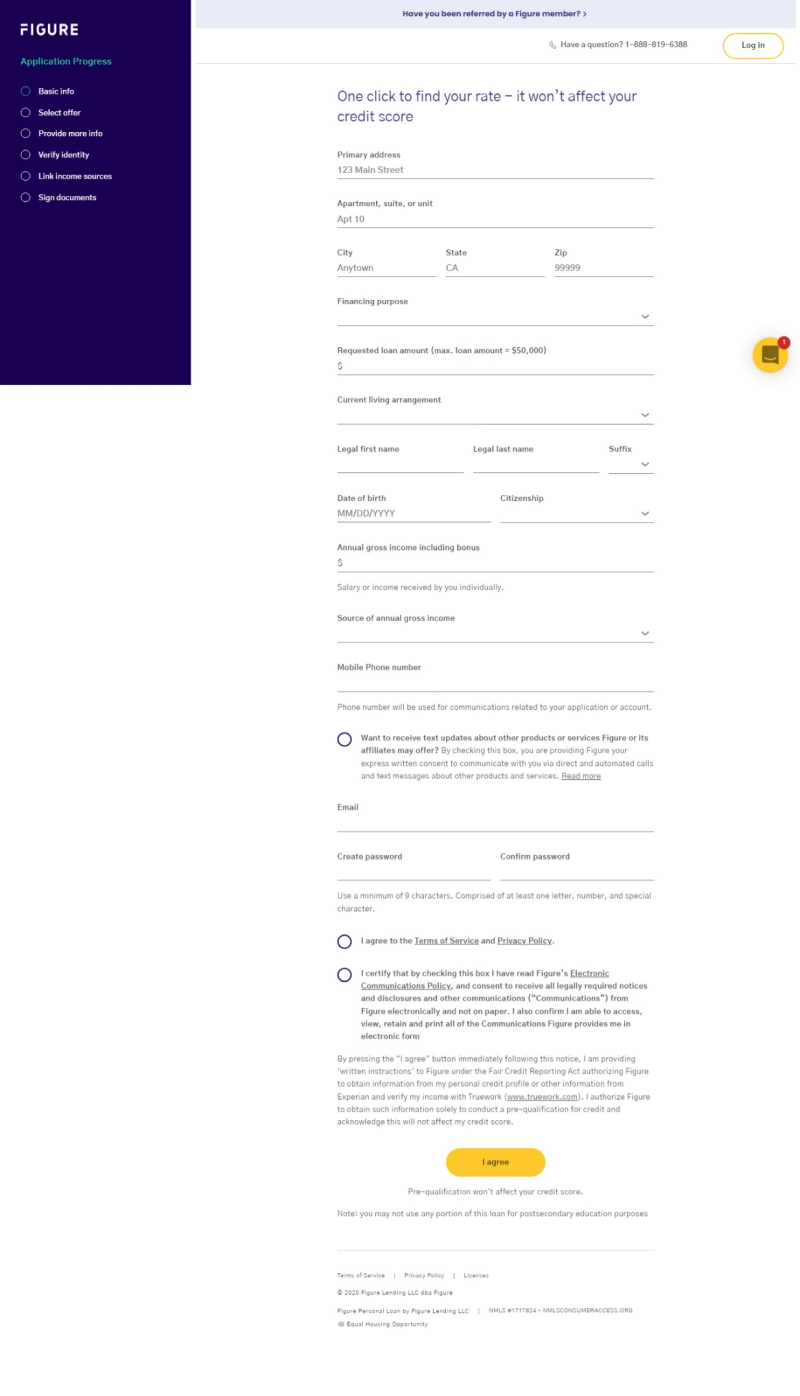

Applying for a loan through Figure is simple—just answer a few basic questions and you’ll have a prequalified offer within minutes. Here’s what the process looks like.

Navigate to Figure’s home page then chose which type of loan you’re interested in by clicking the “Find my rate” button. Loan options include a home equity line of credit, personal loan, crypto-backed loan, or mortgage. For this example, we’ll look at the application process for a personal loan.

At the top of the page, you’ll see there’s information about a referral bonus. If a current Figure customer has referred you to the site, you both can earn a $150 gift card if your loan is approved. All you have to do is provide the member’s email address during the application process to be eligible for the bonus.

The entire preliminary application is contained on one page, which makes it easy to navigate. On this page, you’ll enter basic personal information plus information about what type of loan you’re seeking.

Personal Information

The personal information you’ll need to disclose is your:

- Name

- Address

- Telephone number

- Date of birth

- Citizenship status

- Annual income

- Employment status

You’ll also need to indicate your living situation—whether you own a home, rent, or live with your parents.

Loan Information

In addition to your personal information, you’re also asked to enter your requested loan amount and select the purpose of the loan from a drop-down menu. Options provided for loan purpose are:

- debt consolidation

- home improvement

- major purchase

- medical expenses

- moving/relocation

- vacation

- special occasion (like a wedding)

- other personal use.

You’re also required to create an account, which can be done by entering your email and setting a password for the site.

Once you’ve entered all that information, click on the bubbles indicating you’re aware of the privacy policy, terms of service, and electronic communications policy then press the “I agree” button at the bottom of the page. Keep in mind this is for prequalification only; completing this step will not affect your credit score.

You’ll then be taken to a screen displaying the loan offers you qualify for. Once you select an offer, you’ll need to provide more detailed information, verify your identity, link to income sources, then sign the appropriate documents before your loan is approved. Funding typically occurs within five business days of approval.

Figure Customer Support

Figure has an exceptional customer service team that’s easy to reach. Figure offers a live chat feature on their website that’s available every day between 6:00AM and 6:00PM Pacific Time. If you need help with your loan application, you can also contact customer service by calling 888-819-6388 during their regular business hours. For after-hours assistance, you can send an email to help@figure.com

Not only is Figure’s customer service team easy to contact, but they’ve also developed a reputation for excellence. According to one reviewer on Trustpilot,

Another reviewer had this to say:

Please note Figure has different customer service contact methods after you take out a loan. You can still use the website’s chat feature for support on an active loan, but Figure has a separate phone number and email dedicated to current customers: myaccount@figure.com and 1-888-527-1950. You can find a comprehensive list of their contact methods near the bottom of Figure’s FAQ page.

Figure Online Reviews

The vast majority of reviews that Figure receives are positive; more than 90% of customers gave Figure 5 stars on Trustpilot. Many of the positive reviews describe the application, approval, and disbursement process as quick and easy. One borrower said,

Another customer commented,

Borrowers are clearly impressed by how seamless the entire process is from start to finish, especially when compared to traditional lenders. Many of the positive reviews also mention Figure’s easy-to-navigate website and competitive interest rates.

Though the positive reviews far outweigh the bad ones, there are a few recurring complaints. Several people complained that they received unsolicited marketing material from Figure. Others were unhappy that they didn’t qualify for the lowest advertised APR. A few users mentioned they had trouble with inaccurate home appraisals because Figure relies on 3rd party valuations while others report occasional website bugs during the application process, difficulty verifying income, and applications denied due to insufficient collateral.

It's important to note that Figure quickly responds to most negative reviews, asking customers to contact the company to resolve the issue—another reason Figure receives high marks for customer service.

| The positive reviews are related to | The negative reviews are related to |

| Easy application process | Receiving unsolicited offers by mail |

| Prequalified rates provided without harming your credit score | Occasional bugs on website |

| Receive offer quickly | Prequalified rates don’t match marketing materials |

| Helpful, courteous customer service | HELOCs fully disbursed at loan origination |

| Fast loan disbursement | Difficulty verifying income |

| Website that’s easy to navigate | Use of 3rd party valuations |

| Competitive rates | Applications denied due to insufficient collateral |

Figure Perks and Bonuses

Flexibility:

- No fees for appraisal, prepayment, loan maintenance, or late payment

- Loan assistance and forbearance offered in case of financial hardship

- Loan terms can be modified

- $150 referral bonus for both referring member and new customer

- Payment due date can’t be changed

- Not all home types are eligible for home equity loan

Transparency:

- Clear, informative, easy-to-navigate website

- In-depth information on FAQ pages

- Regularly updated blog answering common financial questions

- Rates, fees, and loan terms clearly displayed on Figure’s website

- Helpful, knowledgeable customer service team

- Easy prequalification process with soft credit inquiry

- On-time payments reported to multiple credit bureaus

- Does sell loans to other lending companies

- Sends unsolicited offers to potential borrowers

Technology:

- Uses blockchain technology

- Borrowers can easily pay online

- Figure website is optimized for mobile devices

- Offers autopay with .25% discount

- Online accounts are easy to navigate

- Customers report occasional website bugs

Figure Personal Loans Compared to Other Lenders

| Figure | Best Egg | SoFi | Upgrade | |

| Loan Terms | Between 5 to 30 years for home equity loans.Either 3 or 5 years for personal loans. | 2 to 5 years | 2 to 7 years | 2 to 7 years |

| Loan amount | Home equity loans up to $300,000. Personal loans up to $50,000. | $2,000 to $50,000 | $5,000 to $100,000 | $1,000 to $50,000 |

| Interest Rates | 5.75% to 22.87% for personal loans. As low as 3.25% for home equity loans. | 4.99% to 35.99% | 5.74% to 21.78% with Autopay | 5.94% to 35.97% with Autopay |

| Min Credit Score | 600 FICO Score minimum, though 680 or higher is preferred | 600 | Not disclosed (third-party sources say 680) | Not disclosed |

| Co-signer Requirement | Co-signers not permitted | Co-signers not permitted | No co-signers allowed (joint applications allowed) | Co-signers and joint applications allowed but not required |

Final Thoughts

Figure is highly regarded for their seamless application and approval process that can be completed 100% online. Those who aren’t tech-savvy may struggle to link the necessary accounts, but customer service will gladly help walk them through the process.

Though Figure is best known for their home equity loans, they also offer personal loans with competitive APRs. To assure approval, potential borrowers should have a relatively high FICO credit score (680 is recommended) and a low debt to income ratio of less than 50%.

Figure is also an excellent option for those who need to receive their loan quickly; disbursement typically occurs in five business days or less. Anyone who wants to use their cryptocurrency (BTC and ETH only) as leverage for a loan should also check out Figure; they’re one of the few financial institutions that provide crypto-backed loans.