Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Uncapped Review: Expert Analysis & User Insights for 2024

If you run an ecommerce business and are in need of capital, Uncapped can give you the funding you need to accelerate growth and keep your business moving. Uncapped offers both fixed-term loans and revenue-based financing, allowing you to choose which works best for your business.

Expert Reviewer Verdict

With Uncapped revenue-based financing, you repay the funds as a percentage of your sales. This prevents defaulting during periods when revenue slows. Their fixed-term small business loans give you the full amount upfront with fixed repayment terms.

Uncapped is ideal for established ecommerce businesses with an online model that make at least $10,000 in monthly revenue. If your business sounds like a fit, read on. In this review, our team of expert reviewers has thoroughly analyzed and evaluated Uncapped small business loans. We will share our findings and provide our expert recommendations on whether Uncapped small business loans are worth considering.

Uncapped User Reviews

Uncapped is a new company and reviews about the lender are limited. While Uncapped currently has a 4.2 out of 5 star review on Trustpilot, that’s an average across only 10 reviews. Most customers had positive things to say about the lender.

For example, one customer wrote, “Uncapped has enabled me to grow my webshop. Great staff who provide prompt and adequate service. 10/10 would recommend!” However, one customer complained of poor communication from customer service.

| The positive reviews are related to | The negative reviews are related to |

| Quick and easy application process | Incompetent staff |

| Prompt and adequate customer service | Poor communication |

| Practical loan product | Not the cheapest financing option |

Summarized Ratings

This parameter considers the scores achieved from independent user review sites, such as Trustpilot. Ideally, each platform’s rating reflects scores from three distinct user review sites. However, this isn’t always possible. Ultimately, the various scores were aggregated and averaged to establish an overall user reviews score.

Uncapped has a peer leading User Reviews rating of 4.9, which is reflective of the independent user reviews posted on Trustpilot.

What is Uncapped?

Uncapped was founded in 2019 and has helped fund more than 500 businesses in 18 different countries. They are an alternative to traditional forms of financing - such as small business loans and venture capital. Instead, they offer funding through a revenue-shared agreement. Uncapped doesn’t charge interest rates, but rather charges a flat fee with repayments based on monthly revenues.

Uncapped is ideal for established businesses with an online model that make at least $10,000 in monthly revenue. If your business sounds like a fit, read on. You can learn about how funding from Uncapped works and how much it costs, as well as the unique benefits the lender provides.

Uncapped Pros and Cons

Uncapped Pros

Uncapped Cons

Uncapped Loan Features

Fixed-Term Loan

You can borrow between $10,000 and $10 million from Uncapped. Terms range from three to 24 months, and you have the option to make daily, weekly, or monthly payments.

| Term length | 3 to 24 months |

| Repayment | Daily, weekly, or monthly payments |

| Min - Max loan amount | $10,000 to $10 million |

Revenue-Based Financing

Revenue-based loans also come in amounts ranging from $10,000 to $10 million, but there’s no fixed repayment date, so the term will depend on your revenue. Uncapped will set an individual revenue share rate for your business, which will be between 5% and 25%. If revenues come to a halt, so will repayment. You’ll finish paying off the loan when you’ve paid back the entire balance in addition to the fee.

| Term length | Varies |

| Repayment | 5% to 25% of revenue earned |

| Min - Max amount | $10,000 to $10 million |

Uncapped Interest Rates and Fees

Fixed-Term Loan

Uncapped doesn’t charge any hidden costs on its fixed-term loans. Those include origination fees, prepayment fees, late fees, and maintenance fees. Instead of an interest rate, Uncapped charges a flat fee on its capital that ranges from 2% to 12% of the principal.

| Origination Fees | None |

| Prepayment Fees | None |

| Late Payment Fees | None |

| Maintenance Fees | None |

| Interest Rates | None |

| Fixed Fee | 2% to 12% |

Revenue-Based Financing

Revenue-based financing from Uncapped doesn’t come with any hidden costs, either. You’ll pay a flat fee between 2% and 12% of the loan amount, but you won’t have to worry about compounding interest, late fees, origination fees, or prepayment penalties.

| Origination Fees | None |

| Prepayment Fees | None |

| Late Payment Fees | None |

| Maintenance Fees | None |

| Interest Rates | None |

| Fixed Fee | 2% to 12% |

Uncapped Qualification Requirements

Fixed-Term Loans and Revenue-Based Financing

The qualifications for fixed-term loans and revenue-based financing from Uncapped are similar. You’ll need to be a business with an online model, such as direct-to-consumer, SaaS, subscription, mobile app, or ecommerce. More than 40% of your payments must be processed online. Sole proprietors don’t qualify, and neither do businesses based in California. Additionally, fixed-term loans aren’t available in North Dakota, South Dakota, or Vermont.

Uncapped doesn’t have a minimum credit score requirement, but your business will need to bring in at least $10,000 in average revenue per month. You’ll also need to be established with six months in business — startup capital isn’t available from Uncapped. If you’re unsure if your business qualifies, you can take a brief survey to find out if you’re eligible.

| Minimum Credit Score | None |

| Minimum Annual Revenue | $120,000 |

| Minimum Time in Business | 6 months |

Is your business a start-up? Check out these best loans for startups

Uncapped Loan Application Process

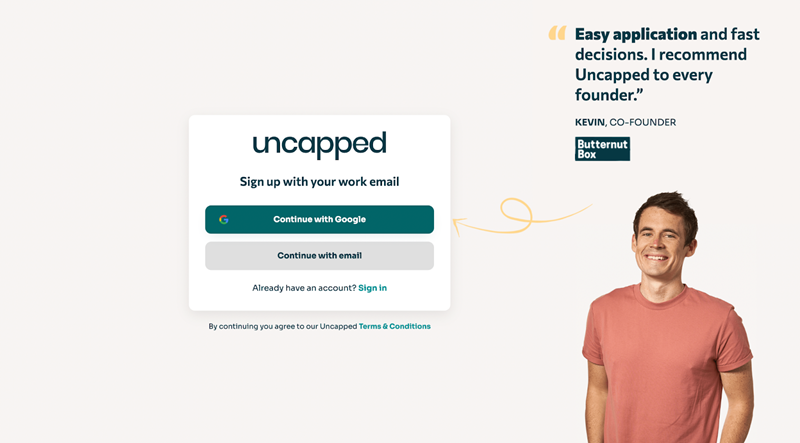

You’ll start by signing up for an account with your full name, email address, and chosen password. You’ll then verify your account with your mobile phone.

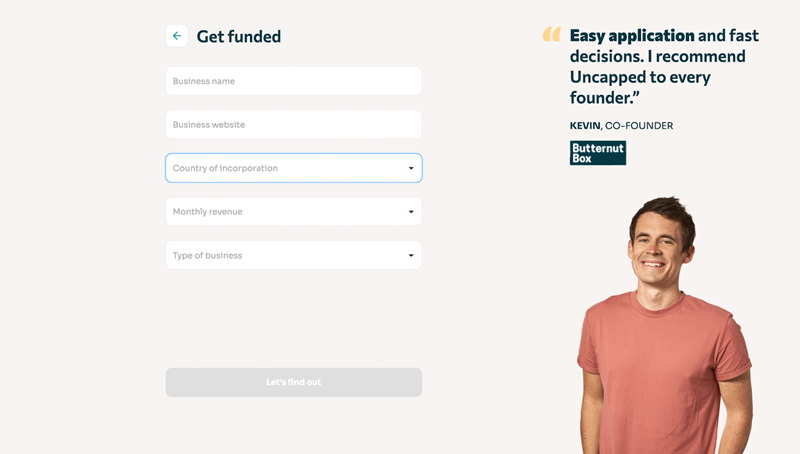

The next step is to provide Uncapped with information about your business. You’ll need to indicate the type of business you operate and your monthly revenue. You’ll also input your business name, website, and country of operation.

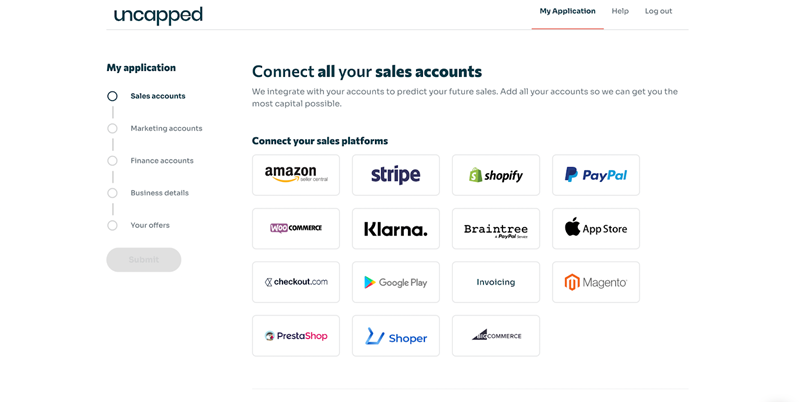

Next, connect all your sales accounts to Uncapped. This gives Uncapped the data the lender needs to evaluate your business and make a funding offer. It’s easy to connect to Amazon, Stripe, PayPal, and more. Once your application is complete, you can expect a decision within 24 hours. If you receive an offer for funding, you’ll sign the agreement and receive the funds as quickly as the next day.

As your business grows, it’ll be possible to get additional capital from Uncapped. You can contact your account manager to find out your options.

Uncapped Customer Support

You can fill out this online form or email support@weareuncapped.com to reach customer support. Unfortunately, Uncapped doesn’t offer phone or live chat support for applicants. And information on the lender’s website is limited. However, once you’re approved for funding, you’ll receive a dedicated account manager you can call with any issues.

Uncapped Perks and Bonuses

Flexibility

The Uncapped revenue-based financing product is very flexible. While Uncapped doesn’t have a hardship program for its fixed-term loans, choosing revenue-based financing can be a way to protect your business during times of slow growth. Since you repay Uncapped out of your sales, payments stop when your revenue halts. This allows you to pause repayment if your business is in trouble. Furthermore, you can access more funding as your business grows.

Transparency

Uncapped charges a transparent finance fee, rather than combining interest with other fees as some lenders do. The lender’s website is informative and provides a calculator that allows you to easily estimate the total cost of borrowing.

Technology

Uncapped customers can enjoy a few perks, including free and fast ACH transfers, automated bills, and unlimited virtual cards for payments. Uncapped also utilizes technology throughout the process to make applying for and repaying your loan easier. For example, you can directly connect your sales accounts to give Uncapped the data it needs to approve your application. And you can even request more funding from your mobile phone as your business grows.

Final Thoughts

Uncapped won’t be the right funding solution for everyone, since the lender only serves established businesses with an online model. But if you’re an ecommerce business and you want to borrow money to invest in advertising, inventory, or hiring without worrying about default, revenue-based financing from Uncapped may be the best fit for your needs. Just be sure to compare the cost of borrowing with traditional loans and understand the tradeoffs.