Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

Best Startup Business Loans to Get in 2024

Startup business loans help new businesses get off the ground without using personal resources or relying on family and friends. Typical uses of startup business loans include operational costs, licenses and permits, inventory, salaries, and other expenses. Explore to find your ideal fit.

Business startup loans help get your new business off the ground without having to use your personal resources or rely on family and friends. Common uses of small business loans for startups include renting or purchasing office space, hiring key staff members, purchasing equipment and inventory, and setting up marketing campaigns to promote your business. Our team of financial experts reviewed and ranked the top online lenders for small businesses to help you get funded.

Top Picks for Best Startup Business Loans

- GoKapital - Best for Low Interest Rates

- Biz2Credit - Best Working Capital Loans for Startups

- Bluevine - Best for Line of Credit

- Torro - Best for Pre-Revenue Business

- National Funding - Best for Customized Loans

When choosing the best startup business loans, there are important factors to consider. In this review, we highlight the terms, rates and fees of each lender and explain what makes them a good option. We also share potential downsides of each lender, and provide a rating methodology you can use to select the best small business loans for your needs.

Best Startup Business Loans for 2024 - Full Overview

National Funding - Best for Customized Loans

- Min. Time in Business: 6 months

- Min. Credit Score 600

- Borrow up to $500,000 in working capital

- Equipment financing up to $150,000

- Factor rate From 1.10

- Fast funding

- Early payment discounts

- Equipment financing repayment 2-5 years

- Working capital repayment 4 months - 2 years

- Customized loans to meet your specific needs

- Simple loan application process

- May receive funding within 24 hours

- Rates vary and can be high

- Daily or weekly repayment terms

National Funding is a direct lender offering customized startup business loans, rather than relying on an algorithm or a computer-generated decision. Loan amounts range from $5,000 to $500,000 and funding specialists work with you to help get your business financing approved. Automatic payments are set up and there are no collateral requirements. National Funding charges no application fee and funding can happen in as little as 24 hours after you apply.

Main Features

There is no risk to apply for a loan from National Funding, as the company does a soft pull on your credit in the application phase (meaning, no risk to your credit score). To qualify for a start business loan from National Funding, you’ll need a minimum credit score of 600, be in business for at least six months, and have over $250,000 in annual revenue. If the revenue goal cannot be met, we recommend looking elsewhere for your startup business loan.

Torro - Best for Pre-Revenue Business

- Borrow up to $575,000

- Loan Repayment 12 - 48 months terms

- Hundreds of financing options

- Use the loan for any purpose

- Fast process

- Min. credit score: 700

- Min. time in business: under 6 months

- Fast approval and funding

- Flexible options

- Funding offered in all 50 states

- Lack transparency regarding rates and fees

- Limited chat support

Torro understands that new venture capital is oftentimes the hardest to acquire when you’re trying to start a business. Because of this, Torro helps startups qualify for loans that other lenders may turn down. It has a three-step application process and works with businesses in various industries to get the best startup business loans. The company has loan products specifically for pre-revenue businesses - including franchises, buying a new business, and starting your own concept.

Main Features

Torro offers business lines of credit specifically designed for startups. Funding amounts are up to $100,000 with APRs ranging from 0-36%. To qualify, you must be in business for at least six months, have a monthly revenue of $5,000, and have a minimum FICO score of 700.

Bluevine - Best for Line of Credit

- Funding up to $250,000

- Min. credit score: 625

- Min. time in business: 6 months

- Interest rates starting at 6.2%

- Loan Repayment 6-12 months terms

- Quick and simple application

- Loan amounts up to $250,000

- Quick funding once approved

- Low minimum credit score requirement

- Short-term repayment plans

- Not available in all 50 states

Bluevine is a financial technology company that offers startup business loans in the form of lines of credit. These give new business owners the flexibility to only borrow what they need. The company has a fast online application process and a dedicated account representative to help you each step of the way. With credit lines up to $250,000 and interest rates starting at just 4.8%, Bluevine is worth looking into to meet your small business financial needs.

Main Features

Bluevine’s lines of credit are their startup business loan product and come with terms ranging from six to 12 months. You pay back each draw with fixed weekly or monthly payments. Instead of getting a lump sum, you have access to a revolving line of credit. To qualify, a startup must have been in business for six months or more and have at least $120,000 in annual revenue. Interest rates start as low as 4.8% and lending decisions are made quickly, usually within 5 minutes.

Biz2Credit - Best Working Capital Loans for Startups

- Borrow up to $2 million

- Loan Repayment 12-36 months terms

- Variable APR depending on the applicant

- Multiple loan types available

- Funding in 72 hours

- Soft credit pull

- Min. time in business: 6 months

- Min. credit score: 575

- No application fees

- Multiple loan options

- Get funded in 72 hours if approved

- High fees and interest rates

- Not all loan types available in all states

Biz2Credit offers three types of startup business loans: working capital loans, term loans, and commercial real estate loans. Working capital loans start at just $25,000 and are paid back from your business receipts. Term loans can be up to $500,000 and allow your business the stability to grow over time. Commercial real estate loans, on the other hand, must be backed by your already-owned commercial real estate, making them less than ideal for startups.

Main Features

Loan terms at Biz2Credit typically range from 12 - 36 months. Once the business starts to have sales, they can also arrange to pay back the loan from their receipts. Loan amounts range from $25,000 to over $2 million, and that increases to $6 million if commercial real estate is involved.

Time in business requirement starts at six months for working capital, and loans are paid back daily, weekly, bi-weekly, or monthly. Annual revenue requirements vary between loan products but are generally $250,000 or more. Interest rates start at 7.99% and interest only-options are available on certain loan products for 36 months.

GoKapital - Best for Low Interest Rates

- Loan Terms 2 to 10 years

- Wide range of loan offers

- Simple application process

- Instant pre-approval

- Min. credit score: 700

- Min. time in business: No Minimum

- Startup business loans APR range between 6% - 18%

- No business history required

- Fast decision and funding times

- Easy online application

- Low interest rates

- Excellent customer service

- Must have solid credit

- No recent negative items on credit report

GoKapital offers startup business loans to companies that have zero business history, and they come with some of the lowest rates we’ve seen across the board. Because of this, GoKapital is ideal for individuals with a solid business idea, a strong personal credit history, and are able to show annual revenue - whether that’s from their business or from a regular job.

Main Features

GoKapital startup loans range from $20,000 to $500,000 with terms of one to five years. GoKapital does not require any sort of business history, so they do expect to see a minimum credit score of 700 and $50,000 in annual revenues. Interest rates are low, starting at just 6%. Once you apply, you’ll get a lending decision within one business day and, if approved, funds can be in your account within one to two weeks.

Main Features of the Best Startup Business Loans

- Min. Credit Score - 700

- Min. Time in Business - No minimum requirement

- Min. Annual Revenue - $50,000

- Loan Amount -$20,000 - $500,000

- Interest Rate - Starts at 6%

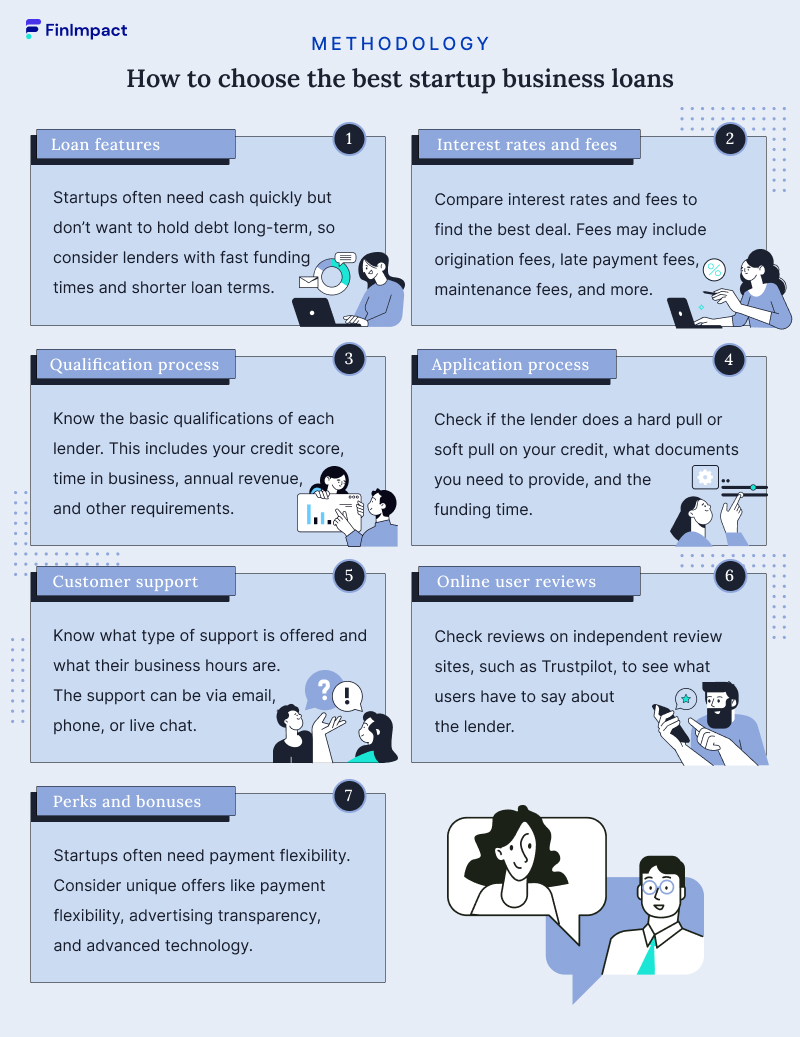

How We Choose the Best Startup Business Loans

- Loan Features: Review your business plan and determine approximately how much you need to borrow and how your business will be able to pay it back. Startups often need cash quickly but don’t want to hold debt long-term, so consider fast funding times and shorter loan terms.

- Application process: Most applications can be done online in as little as 10 minutes. However, it’s important to check if the company does a hard pull on your credit during the application phase, as that may limit your ability to shop around.

- Interest rates and fees: Compare interest rates and fees when shopping for your startup loan. Fees may include loan origination fees, administrative fees, early payoff fees, late payment fees, and more.

- Qualification process: Know each lender’s basic qualifications and see if your business meets them. This will include your credit score, length of time in business, annual revenue, and other business history requirements.

- Customer support: Do you prefer to speak to a live customer support representative or do you prefer online chat options? Know what type of support is offered and what their business hours are.

- Online user reviews: Check reviews on independent review sites, such as Trustpilot, to see what users have to say about the lender. Read both negative and positive reviews to get overarching thoughts about the company.

- Perks and Bonuses: Consider specified service offerings like payment flexibility, advertising transparency, and advanced technology. Startups often need payment flexibility when they are first getting set up.

The True Business Startup Costs

Entrepreneurs started nearly 5.4 million businesses last year, according to Census data. But not all of those businesses will succeed. Per the U.S. Bureau of Labor Statistics, about 10-20% of businesses fail before their first anniversary. Only about half make it to five years in operation.

While some businesses are more costly to get going than others, all new businesses will require some form of capital. It’s best to make a detailed business and financial plan before getting your business off the ground. Make sure to plan for the unexpected, too.

One-time Expenses

- Equipment: Your costs will vary widely depending on the industry and nature of your business. For example, a professional services microbusiness might get started with just a few thousand dollars worth of computer equipment. A restaurant business, however, might require an initial equipment investment of up to $125,000.

- Physical office space if needed: Real estate costs vary by location, but expect to spend at least $300 per employee each month on office space.

- Office supplies and furniture: Plan to spend at least $200 per employee per month on items like desks, chairs, headsets, paper, ink, toner, etc.

- Business licenses and permits: These costs will vary depending on the industry and where your business operates. For example, an initial LLC registration is $50 in Iowa but $500 in Massachusetts.

Ongoing Expenses

- Insurance: Expect to pay a few hundred a month on insurance policies, which may include general and professional liability (around $50 per month each), business owner’s (around $80 per month), and workers’ compensation (between $80 and $90 per month).

- Payroll expenses: Per the Small Business Administration, each employee costs 1.25 to 1.4 times their salary based on factors like payroll tax, state and federal unemployment, and training.

- Legal services: Business lawyers typically charge an hourly rate ($150 - $1,000 per hour) or a flat fee (e.g., $750 to draw up a lease). Your costs will vary depending on your requirements.

- Accounting: These costs may include accounting software, a CPA or tax preparer, and a bookkeeper. Expect to pay around $1,000 a year or more on these expenses.

- Marketing and advertising: Plan to allocate around 7% of your budget to marketing and advertising expenses. This doesn’t include your website, which will cost a few hundred dollars for a Squarespace or WordPress site or a few thousand dollars for a professionally designed site.

- Inventory: Most experts advise keeping 10% of your projected annual inventory sales in stock at any time. So, if you expect to sell $50,000 worth of products, you’ll need to spend $5,000 in startup inventory costs.

- Utilities: If you rent office space, expect to spend $2.14 per square foot on utilities, per Building Owners and Managers Association International.

For these expenses and more, a startup business loan can come in handy. By having the financial part taken care of, you can focus on running your business and bringing in a profit.

Here’s an in-depth guide to calculating startup costs >>

What Is a Startup Business Loan?

A startup business loan is used by brand-new companies to fund initial setup costs. These businesses have little to no prior operational experience and lack financial history, which typically coincides with higher rates and shorter terms than other types of financing.

Given the aforementioned hurdles, new businesses need to be resourceful regarding financing. To find the best startup business loan for your business, you’ll need to evaluate a wide range of products, including credit cards, microloans, and asset-based borrowing.

How Startup Business Loans Work

Startup business loans can help finance initial investments in equipment, inventory, and staff. They can also help you establish a good credit history and lay the groundwork for expansion.

To secure a startup business loan, you’ll need a business plan, expense sheet, and financial projections. Lenders will use these and factors like your personal credit score to determine whether to give you a loan.

Keep in mind that you’ll need to find a lender who specializes in loans for startups or doesn’t have a time-in-business requirement to qualify. Consider banks, credit unions, and online lenders.

Types of Startup Business Loans

Many brand-new business ventures find it difficult to get funding. A Pepperdine University study showed that only 34% of small businesses secure funding through a bank, compared to 75% of their larger competitors. But there are options available, including:

- Lenders that specialize in new businesses: We’ve covered many of these lenders above. While eligibility requirements can be stringent, good rates are available to those that qualify.

- SBA loans: getting funding from the SBA may take weeks or months (as opposed to days), but rates and terms are oftentimes much better.

- Peer-to-peer lending: This type of financing cuts out the middleman and allows you to borrow money directly from another person or company.

- Credit cards: Credit cards are the most common source of small business lending, largely due to the fact they don’t require long business histories.

- Asset-based financing: Asset-based lending is a type of secured business loan that uses your property as collateral for the loan. The risk with this type of financing is the potential loss of the asset if you can’t make payments.

- Personal loans for business: This type of loan is based on your personal credit score, not your business credit score or time in business.

How to Qualify for Startup Business Loans

Requirements vary by lender. In general, expect to provide the following information in order to get a startup business loan:

- A business plan

- Financial projections

- Financial records including bank statements

- Business licenses and registrations

- Personal credit score

You may also have to provide a personal guarantee or collateral, depending on the lender and type of loan.

Legal Requirements for Starting a Small Business

When starting a small business, you need to make sure you’re in compliance with your state’s rules and regulations. Spending some time learning the legal requirements for your small business will benefit you greatly in the future.

In most circumstances, you’ll need a business name, business license, and a tax ID. In addition, you’ll need to decide how you want to set up your business. Common entities include sole proprietorships, partnerships, C-corporations, S-corporations, and LLCs. All have different tax implications and business regulations to qualify.

We have a few state-specific guides on starting a business. They include:

- How to Start a Business in Florida

- How to Start a Business in Virginia

- How to Start a Business in Texas

- How to Start a Business in California

Both funding your business and making sure your business can legally operate are two of the most important features of starting a small business. Once these things are in order, you can focus on the actual business itself.

How to Apply for a Startup Business Loan

A typical startup business loan application process will look like this:

Step 1: Write a business plan In addition to making your case to potential lenders, a good business plan will help you determine your financing needs. Remember to include market research describing your target market and how you can serve it better than your competitors.

Step 2: Choose a lender As a startup, your options will be more limited than an organization with more time in business. Look at online and traditional lenders based on their credit and revenue requirements.

Step 3: Gather the required materials In addition to a business plan, you will likely need personal financial statements and business licenses

Step 4: Follow the lender’s application instructions Most online lenders have a fairly straightforward online application process. Be sure to read the fine print regarding terms, interest rates, and other conditions before accepting a loan offer.

Alternatives to Startup Business Loans

Starting a business requires capital, but you don’t always have to use an unsecured small business loan to get the necessary financing. Other options you may want to consider include:

Crowdfunding

Crowdfunding is raising money for your business through online donations. Popular websites to do this on include GoFundMe, KickStarter, Indiegogo, Patreon, and Crowdfunder. While it’s free to start a crowdfunding campaign, the platforms do charge a payment processing fee and they take a small percentage of the money you raise. You can read more about the different types of crowdfunding here.

Friends and Family

Family and friends can help fund your business via loans, gifts, or equity investments. Regardless of which form their support takes, be sure to write out all terms of the agreement and have the parties sign the documents.

Grants

Depending on your industry and profile, you may be able to secure funding in the form of federal, state, or private grants. The U.S. Chamber of Commerce provides a list of some of these opportunities, including grants for minority-owned businesses, early-career scientists, and biomedical technology firms. You can learn more about grant programs at Grants.gov.

Home Equity Loan

If you own your own home, you can consider using a home equity loan or line of credit to finance your new business. With the increase in housing prices recently, there’s a good chance you’re sitting on substantial equity. Home equity loans come with significantly lower interest rates than other means of borrowing, making them an appealing option. Keep in mind, though, that your house is used as collateral. If you can’t make your payments, you are at risk of losing your house.

Your Own Personal Savings

If you have a savings account, it may be worth considering using some of those funds to finance your new business. We understand it can feel scary to lose your nest egg, but it can be worth it in the long-run to avoid unnecessary fees and high rates.

Here are 10 additional ways to raise capital for your small business

Conclusion

While getting a business up and running is a task, several online lenders have good loan offerings that can provide you with the backing you need to get started. Online lenders often provide better funding options than traditional banks, with more lenient conditions and repayment terms.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!