Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

Best Working Capital Loans to Consider in 2024

Working capital loans help you access the cash you need in order to fund everyday expenses. These business loans can help cover payroll, pay for day-to-day operations, or help keep your cash flow stable. Best of all, you may not need to put up collateral.

A working capital loan is the ideal choice if you need to borrow quickly to increase cash flow and can’t wait on a traditional bank loan. The best working capital loans offer a quick approval timeline, which puts cash in your hand within 24 hours of loan approval. In contrast, some bank loans can takes months from application to approval.

If you’re looking for the business loans that can help you tap into the funding you need, look no further. Our team of financial experts reviewed and ranked the top online lenders to help you get funded.

Top Picks for Best Working Capital Loans

- Lendzi - Best for Businesses With High Revenue

- Backd - Best for Cheapest Interest Rates

- National Funding - Best For Repayment Discounts

- Bluevine - Best for Line of Credit

- Biz2Credit - Best for Fast Approval

- SMB Compass - Best for Fast Funding Times

- Credibly - Best for High Borrowing Limits

Working capital loans can take the form of short-term business loans or a business line of credit, depending on your needs.

In this review, our experts highlight the rates, fees and terms of each lender and explain what makes them a good option. We also share potential downsides of each lender, and provide a rating methodology you can use to select the best option for your needs.

Best Working Capital Loans for 2024 - Full Overview

There are several leading business loans you can use for working capital. Each of the following lenders offers different benefits for business owners, as well as different applicant requirements.

Credibly

- Borrow up to Up to $250,000 in term loans

- Borrow up to $400,000 in working capital

- Term loan rates range between 8-25%

- Working capital factor rate starts at 1.09

- Simple application process

- As soon as same day funding

- Open to high-risk industries

- Simple application

- Flexible credit requirements (500 or higher)

- Multiple loan types

- High borrowing limits (up to $400,000)

- High interest rates

- Origination fees for most loans

- Daily and weekly repayment likely required

Credibly is an established online lender that is more flexible with qualifications than other, newer lenders. Credibly offers business loans for working capital up to $400,000. They have multiple loan types to choose from, including term loans, lines of credit, merchant cash advances, SBA loans, and more.

If you operate in a high-risk industry, such as law or real estate firms, Credibly could be a good pick. They’re one of the few lenders willing to work with these industries. There may be downsides, however, like high interest rates and origination fees.

Main Features

Credibly offers working capital loans that come with a lump-sum charge that’s a total percentage of the loan, rather than an interest rate. This is known as a factor rate, and is determined by the payback amount divided by the funding amount. Max loan sizes can be as high as $400,000, and terms last from 6-18 months.

SMB Compass - Best for Fast Funding Times

- Loans up to $10 million

- Min. credit score: can go as low as 550 for certain loans

- Min. time in business: 1+ years in business, no startups

- Funding times: 5 to 7 days for term loans and 24 - 48 hours for line of credit

- Flexible terms: 2 – 10 years for term loans

- Interest Rates: starting at 8.99% for term loans

- Applying does not impact credit score

- Nine loan products to choose from

- Low, competitive rates

- Large loan amounts

- Loan terms up to 25 years

- Excellent customer service

- Poor credit not accepted

- Not available in all states

- Must be in business at least one year

- High revenue requirements

If you need a working capital loan quickly, SMB Compass can get you your funds within 24 hours of loan approval for qualified borrowers. The lender offers nine different types of business loans that can be used for working capital expenses, such as business lines of credit, business term loans, equipment financing, asset-based loans, SBA loans, and more. Customer service is excellent, so any questions you have will be thoroughly answered. To qualify, you need a minimum credit score of 650, one year of business history, and $20,000 per month in revenue. Applying takes just a few minutes and, if approved, you can have your funds within one business day on certain loans.

Main Features

SMB Compass offers nine different types of small business loans to borrowers, including working capital loans. Their mission is to make loans more accessible to small business borrowers by providing cost-effective and flexible lending solutions. SMB Compass business loans range from $10,000 to $10 million with terms up to 25 years. Rates start at 7.99% for qualified borrowers. The lender has currently provided more than 1,200 U.S. businesses with more than $250 million in financing. To apply, simply fill out their easy online application. It takes just a few minutes and will not impact your credit score. If approved, funding can be dispersed within 24 hours.

Biz2Credit - Best for Fast Approval

- Working capital up to $2 million

- Term loans up to $500,000

- Term loan interest rate starts at 7.99%

- Loan Repayment 12-36 months terms

- Variable APR depending on the applicant

- Funding in 72 hours

- Soft credit pull

- Funds hit your account in three business days

- High maximum loan totals provide flexibility

- Decent interest rates

- Application requirements can be hard to meet

- Loans may come with additional fees

- Higher minimum annual revenue required

Biz2Credit is known for offering a fast turnaround time between application to funding. In most cases, Biz2Credit can get funds deposited within 72 hours after loan approval. This makes the lender an ideal funding source if your small business needs fast access to capital.

Main Features

Biz2Credit’s working capital loans are its most flexible in terms of minimum credit score. You will need $250,000 in annual revenue and six months of operating time to qualify.

Biz2Credit loans also come with significantly higher maximum loan amounts—up to $2 million. Interest rates are competitive, but qualifying for a loan can be harder here than with other lenders.

Bluevine - Best for Line of Credit

- Funding up to $250,000

- Min. credit score: 625

- Min. time in business: 6 months

- Interest rates as low as 4.8%

- Loan Repayment 6-12 months terms

- Quick and simple application

- Quick and easy application

- Funds available in hours or days of loan approval

- Accessible customer service

- Also offers a competitive checking account

- High late fees

- High repayments due to 6-12 month terms

- High interest rates for lower credit scores

Bluevine offers a business line of credit up to $250,000 that can help you get the working capital you need. This option is ideal for business owners who may want to dip into capital repeatedly without having to apply for a loan each time. Bluevine also deposits and withdraws funds directly from a linked checking account, which can provide speed and convenience. Bluevine runs a soft credit pull when you apply to help avoid negative changes to your credit.

Main Features

Bluevine’s line of credit comes with a simple online application process and a decision within five minutes. Loan amounts range from $5,000 to $250,000 with rates starting at just 4.8%. As you pay off your line of credit, your available credit automatically replenishes up to your maximum loan amount for you to use again.

Bluevine also stands out in terms of customer service. The lender offers person-to-person customer support in addition to its online platform, which can go a long way when you have an issue getting paid or with repaying your loan.

National Funding - Best For Repayment Discounts

- Min. Time in Business: 6 months

- Min. Credit Score 600

- Borrow up to $500,000 in working capital

- Equipment financing up to $150,000

- Factor rate From 1.10

- Fast funding

- Early payment discounts

- Equipment financing repayment 2-5 years

- Working capital repayment 4 months - 2 years

- Credit score not impacted with application

- Positive reviews on sites like Trustpilot and Better Business Bureau (BBB)

- No collateral needed

- Daily or weekly repayments

- Personal guarantee required

- No mobile app

National Funding working capital loans come with an early repayment discount. You can lock in a 7% discount on your remaining balance if you pay off your business loan in full within the first 100 days. This can make it more affordable to boost cash flow and fund the cost of everyday expenses like rent, payroll, and utilities or get you through slow seasons.

Main Features

National Funding’s working capital business loans range from $5,000 to $500,000 with repayment terms between four months and two years. The pay rate starts at 1.10. To pursue a working capital loan, you’ll need a minimum credit score of 600, a business track record of at least six months, and $250,000 or more in annual revenue.

Backd - Best for Cheapest Interest Rates

- Borrow up to $2 million in working capital

- Min. Credit Score: 640

- Min. Time in Business: 2 years

- Industry best factor rate for MCA - as low as 1.10

- APR for the Line of credit product starts at 35%

- Flexible repayment terms up to 16 months

- Get funding in as little as 24 hours

- Check your rate with a soft credit pull

- Fast lending decisions and funding times

- No collateral required

- Large loan amounts

- Not available for startups

- Some industries will not qualify

- Rates not disclosed prior to application

Backd was founded in 2018 and offers working capital loans up to $2 million. They tailor to businesses who want to stay in control of their finances, and work to create a unique loan specifically for your business. The online application takes just a few minutes to fill out and a lending decision is given almost instantly. If approved, funds can be in your account within 24-48 hours.

Main Features

Backd working capital loans range from $10,000 to $2 million with terms up to 16 months. Payments are made daily, weekly, or semi-monthly. In addition, Backd offers a business line of credit ranging from $10,000 to $750,000. With this type of financing, you withdraw funds, pay them back, and can withdraw them again. To qualify for either option, you need to be in business for at least two years, have $200,000 or more in annual revenue, and 640+ FICO score.

Lendzi - Best for Businesses With High Revenue

- Borrow up to $4 million in working capital

- Min. credit score: at least 500

- Min. time in business: 6 months

- Equipment financing up to $2 million

- Business line of credit up to $250,000

- See your options without hurting your credit

- Flexible terms: 3 to 15 months

- Excellent customer reviews on independent review sites

- Get funding in as little as 24 hours

- Bad credit accepted

- Flexible terms

- Competitive rates

- Fast funding times

- Excellent customer service

- Multiple phone calls required after application

- Annual income requirement may be high

If your business has high revenue and you have been denied a loan elsewhere, Lendzi may be able to help you get the funding you need. Lendzi was founded in 2020 and caters to small businesses who may have trouble getting a loan. Not only that, but they have more than 2,000 5-star reviews from past and present customers, they offer competitive rates and terms, and they can get you your funding within 24 hours of loan approval.

Main Features

You can get a working capital loan from Lendzi up to $400,000 with terms between three and 15 months. Factor rates start at 1.15 and credit score isn’t an issue with this type of funding, though the lender does recommend a score of at least 500. To apply, simply fill out the online application. Doing this will not impact your credit score. From there, a Lendzi representative will contact you to discuss your financing needs further. You will be guided throughout the process and together will come up with a funding solution. To qualify, Lendzi recommends a business history of at least six months and $180,000 in annual revenue.

Main Features of The Best Working Capital Loans

- Min. Credit Score - 500

- Min. Time in Business - 6 months

- Min. Annual Revenue - $180,000

- Loan Amount - Up to $400,000

- Interest Rate - Factor rates starting at 1.15

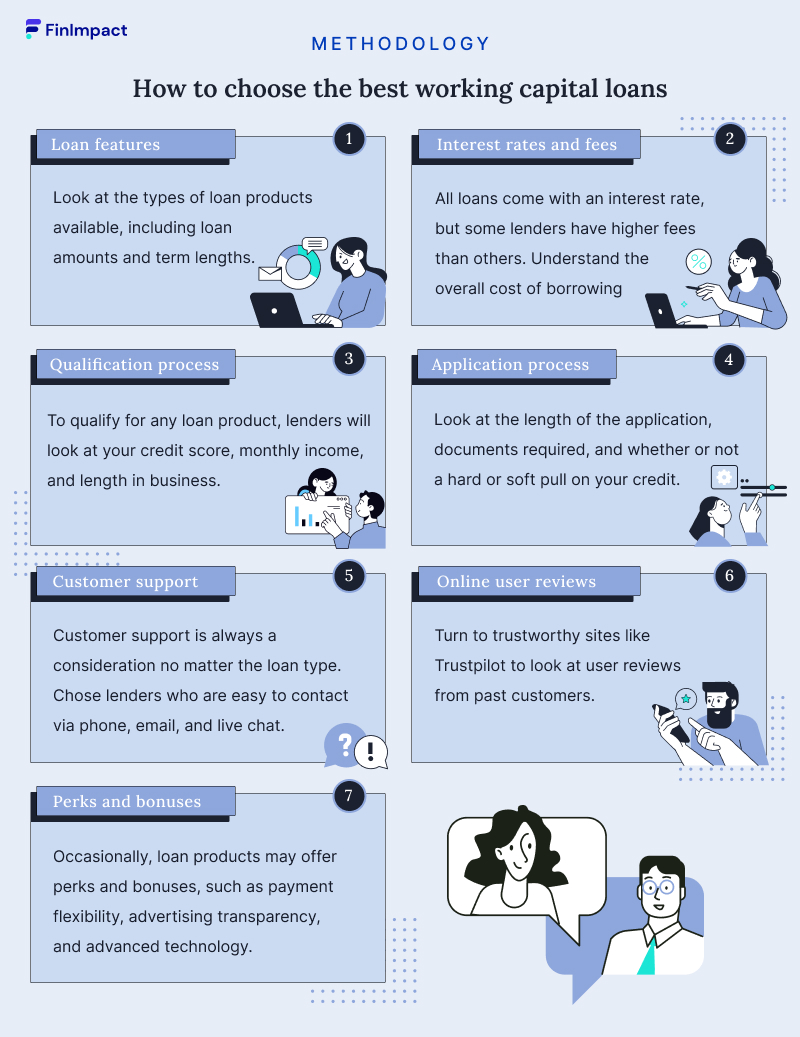

How To Choose the Best Working Capital Loans

- Loan features: This includes working capital loan terms, repayment options, and loan amounts. Most are short-term business loans, meaning they require repayment over 12 months. You may also be able to get a business line of credit, which offers you a sum of money to borrow against during a set period.

- Application process: How much information lenders require in your application. This also includes whether or not the lender needs to run a hard-pull or soft-pull of your credit score, and how long it will take to receive your funds.

- Interest rates and fees: Interest rates vary between lenders, as do fees associated with taking out a loan.

- Qualification process: The credentials lenders require from applicants, including minimum credit score, annual revenue, and business history.

- Customer support: Whether or not a lender offers access to live support representatives, as well as the availability of support across different channels. This also includes the amount and usefulness of supplemental information and tools.

- Online user reviews: What others have to say about their borrowing experience with a lender based on feedback from independent review sites.

- Perks and bonuses: Other benefits associated with borrowing from a certain lender, such as payment flexibility, advertising transparency, and advanced technology.

What Is a Working Capital Loan?

A working capital loan provides you with the funds you need in order to pay for a variety of business expenses. Unlike some loans that require you to use funds for a specific purpose, working capital loans are more flexible and can be used for a broader array of purposes.

Why Should a Business Get a Working Capital Loan?

The Voice of Small Business in America Report shows that businesses that don’t receive the funding they need are forced to make cuts in technology and equipment investments (29%) and owner’s compensation (29%). Further, 48% said that they had trouble expanding into new markets, while 42% said that they had to take on more work themselves instead of hiring employees or contractors.

Working capital loans are a good option when you need to keep your business operations running, purchase equipment, or cover other costs like payroll. Qualifications for working capital loans are usually less stringent than other term loans, which makes them an attractive option for small business owners with less than excellent credit, or for whom a traditional bank loan isn’t likely.

A working capital loan can also be a better fit if time is of the essence and waiting for a term loan from a bank isn’t feasible. Most loan decisions are made within minutes, and funds are dispersed within 72 hours from loan approval.

Types of Working Capital Loans

There are a few types of small business loans that can be used to fund capital:

- Short-term working capital loans provide small businesses with a lump sum of money with a set repayment schedule.

- Business lines of credit offer a set amount of money that you can pull from repeatedly during the life of the loan. Similar to a credit card, you only pay interest on the money you use.

- SBA loans provide up to $5.5 million to be used as working capital or to buy fixed assets like real estate and equipment. These term loans are guaranteed by the Small Business Administration.

- Merchant cash advances allow you to pay back your loan through debit and credit card sales. These loans may be a good option for businesses with relatively low credit scores but solid annual revenue.

How to Qualify for a Working Capital Loan

Each lender has its own requirements for getting a working capital loan. Prerequisites may also vary depending on which loan type you decide to pursue. For example, an SBA loan may offer lower fees and longer repayment terms but will require more paperwork and processing time, while a business line of credit may be a better choice for a smaller, short-term loan.

In general, expect the following requirements from lenders:

- Minimum credit score: 500-640

- Time in business: 6+ months

- Annual revenue: $100,000+

Depending on the loan type and lender, you may also have to provide collateral and/or a personal guarantee.

How to Get a Working Capital Loan

Most online lenders make it easy to apply for a working capital loan through their website. Some offer apps or online dashboards that simplify the process of tracking your application and managing your account if approved.

A typical application process looks like this:

- Gather your documentation including your tax ID number, financial statements, and banking information. Depending on the loan type, you may also need to prepare a business plan and provide a personal guarantee stating that you are responsible for paying off the loan.

- Apply online by following the lender’s instructions. Often, you will be assigned a representative who will guide you through the process.

- Receive your loan offer. Review the fine print, paying close attention to the loan terms, interest and payments due, and any other requirements.

- Sign your offer and receive your payments. Many lenders will link directly to your business bank account, speeding the funding process.

Best SBA lenders for small businesses >>

Working Capital vs. Term Loan

Working capital and term loans are very similar business financing, with working capital loans often taking the form of a term loan. The main difference is working capital loans do not come with rules around how you spend the money and what you spend it on. With other term loans, such as equipment financing, your lender may require you to demonstrate what you’re spending the money on. A working capital loan, however, can be used for a variety of purposes.

Both options don’t normally require collateral, which is an asset that backs the loan. However, if you have collateral you can use, it’s worth mentioning to the lender as that may score you a lower interest rate with a secured loan.

Conclusion

Working capital loans can be a great option for small business owners who need quick access to capital with a fast approval process. There are a variety of lenders who can help you get the cash you need while working with your credit score and business history.

*The required FICO score may be higher based on your relationship with American Express, credit history, and other factors.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!

Related Loan Picks

Merchant Cash Advance

Read MoreE-Commerce Business Loans

Read MoreConstruction Business Loans

Read More