Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

National Funding Reviews: Expert Analysis & User Insights for 2024

National Funding has a "No-Risk" application, which means interested borrowers can check on funding without it impacting their personal credit scores. Its flexible loan terms and amounts make it ideal for businesses small and large.

Expert Reviewer Verdict

National Funding business loans come in two primary forms: small business loans for purposes like working capital for inventory, payroll, marketing, taxes, and other reasons, and equipment financing or leasing loans to help businesses purchase expensive equipment.

National Funding small business loans target many industries, including trucking, agriculture, restaurants, and construction. National Funding also helps minorities, women, and veterans find funding with lenders that have experience working with borrowers in these groups. They offer loans from different lending partners who may have additional borrowing criteria.

National Funding User Reviews

National Funding has almost 1,400 reviews on Trustpilot with an average rating of 4.6 out of 5. It is a testament to the platform’s durability and its time in the market since 1999.

Many reviews focus on how helpful the lender is with approving applicants who've gotten rejected by traditional lenders. Others praise the smooth and intuitive application process and that funding can be fast.

National Funding is active across social media and regularly responds to customer questions and complaints.

| The positive reviews are related to | The negative reviews are related to |

| A quick and easy loan approval process | High cost of the loan |

| Great for those with bad credit | Expensive fees |

| A helpful customer service team | Some loans seem to take a while to approve |

Summarized Ratings

This parameter considers the scores achieved from independent user review sites, such as Trustpilot. Ideally, each platform’s rating reflects scores from three distinct user review sites. However, this isn’t always possible. Ultimately, the various scores were aggregated and averaged to establish an overall user reviews score.

National Funding has a stellar User Reviews rating of 4.6, which is reflective of the independent user reviews posted on Trustpilot.

National Funding Review Video

Our expert, Gordon Scott, provides an in-depth analysis, including pros and cons of National Funding small business loans.

What Is National Funding?

National Funding is a top-rated small business lender that offers flexible loan terms and amounts. You won’t pay compounding interest rates on a National Funding loan. Its products establish a fixed fee structure using factor rates. You’ll be charged a fixed percentage, usually between 17%-36%, of your total loan value, which is then spread over the full loan term.

These interest rates seem higher than other lending platforms, because these loans get made payable within 18 months. This makes the lender a great choice for anyone who’s looking to build their credit scores or those who need fast cash injections and lenient loan requirements.

National Funding Pros and Cons

Pros

Cons

National Funding Loan Features

National Funding does not require collateral, however, you need to provide information on your personal credit to determine the eligibility for a business loan. That suggests you will personally guarantee any loan you take from them. That means you will be personally responsible for repaying the loan, if your business does not.

If you default on your loan, National Funding may attach a lien to your personal property to satisfy the debt. Your loan contract should provide details about personal guarantees for the lender's products. Ask the lender if you are providing a personal guarantee when you sign the loan contract, if you don't see that information clearly stated in the contract.

Small Business Loans

National Funding has offered more than $4.5 billion in loans to over 75,000 small businesses. The application is simple and you can get loan funds in as little as one day. But because the lender is not transparent about the details of its loans during pre-qualification, you have to start a full application to get all loan features.

| Term length | Four months to two years |

| Repayment period | Daily or weekly |

| Min - Max amount | $5,000 - $500,000 |

Equipment Financing and Leasing

Equipment financing and leasing loans let you lease or buy new or pre-owned equipment for your company. The credit requirements for these loans are minimal, so newer companies also can get business growth funding.

These loans take longer to get approved, have no down payment requirement,and you can get a discount by paying loan off ahead of schedule.

| Term length | Two to five years |

| Repayment period | Monthly |

| Min - Max amount | Up to $150,000 |

National Funding Interest Rates and Fees

Borrowers will need a minimum credit score of 600 to get approved for a National Funding loan. Borrowers can expect higher interest rates and fees compared to other small business lenders.

National Funding isn’t transparent with its rates and fees before you go through the entire application process. But, because rates and fees are so high, have a clear budget and know exactly what you can afford each month before you apply. Also, since the lender focuses primarily on short-term loans, there won’t be a significant amount of time for interest to accrue.

Small Business Loans

National Funding doesn’t advertise the rates and fees it charges for its small business loans.

| Fees | Varies |

| Interest rates | Factor rate starts at 1.10 |

Equipment Financing and Leasing

National Funding does not advertise the rates and fees for its equipment financing and leasing loan, either. However, it comes with a lowest lease down payment available guarantee of $1,000.

| Origination fees | 2% plus a one-time fee of between 17% - 36% of the loan total |

| Interest Rates | Not disclosed |

How to Qualify for a National Funding Loan

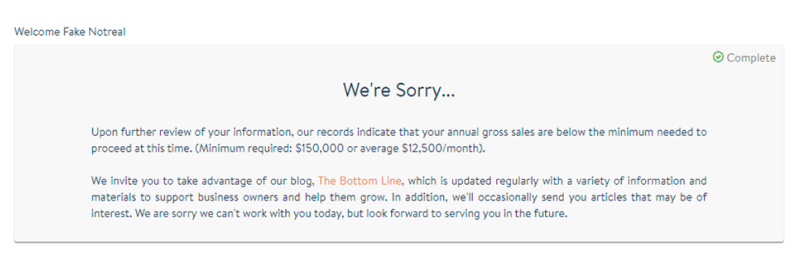

National Funding has a high acceptance rate, and welcomes those with credit scores of 600 to 850 and above. The higher your credit score, the lower your interest rate will be. To qualify, you’ll need an annual income of $100,000 and at least $1,500 in the bank. You’ll also need an annual gross revenue of $250,000 for all loans. But a bankruptcy on your credit record within the last 12 months disqualifies you.

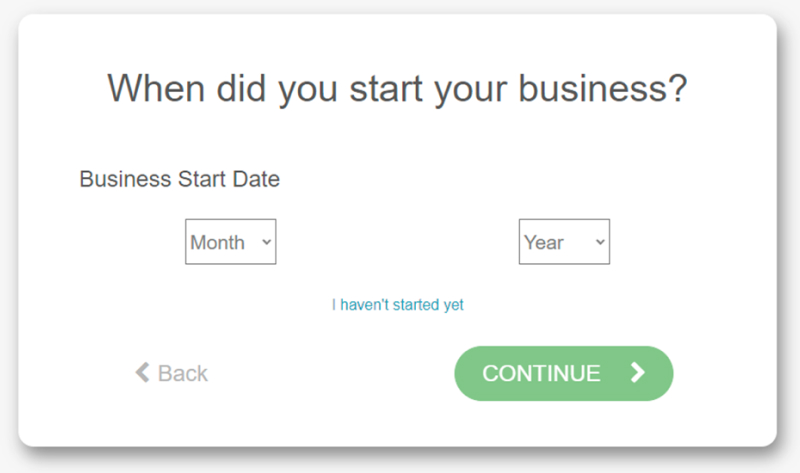

Small business loan borrowers must be in business over six months, and equipment leasing borrowers must be in business for at least two years. Beyond these criteria, the lender is lenient and takes into account multiple factors when determining your eligibility. You’ll also get assigned a dedicated loan specialist when you apply to walk you through their process and provide advice on improving your loan eligibility.

| Small Business Loans | Equipment Financing | |

| Minimum credit score | 600+ | 600+ |

| Minimum annual revenue | $250,000 | $250,000 |

| Minimum time in business | 6+ months | 2+ years |

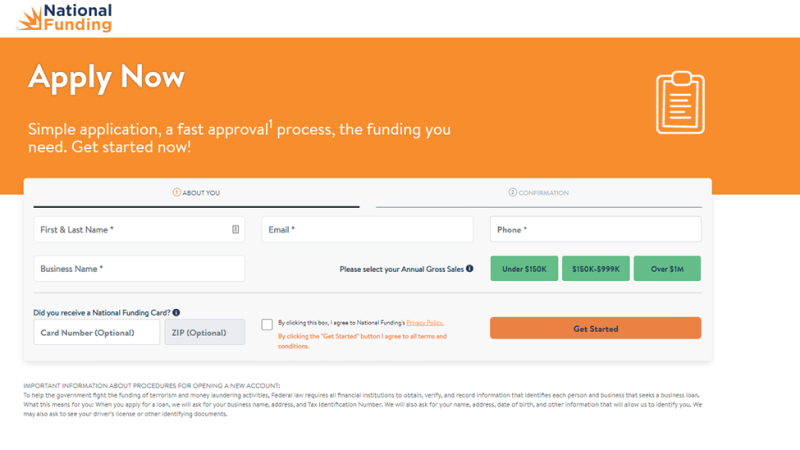

National Funding Loan Application Process

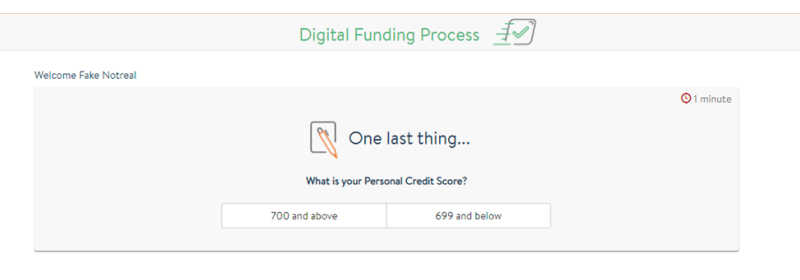

If you’ve decided that a National Funding loan is right for you, you’ll fill out an application. Like any loan application, you’ll fill out a form with some basic financial information, and provide an estimate of your credit score.

First, you’ll have to give them your name and contact info.

Next, you’ll need to provide an estimate of your credit score.

Depending on the answer you select, you’ll get preapproved or see a page explaining why you’ve been declined.

If you’re pre-approved, you may be passed to a partner, like Fundwise, to answer some additional questions.

National Funding claims that you can get a quote for a loan with a soft inquiry, which won’t impact your credit score. If you choose to accept a loan offer, National Funding reviews and makes a lending decision in as little as a day.

National Funding has been recognized as one of the fastest-growing small business lenders in the country by both the San Diego Business Journal and Inc. 5000. The company may still be small when compared to the big names in the business, but this California-based organization punches above its weight on the national scale.

National Funding Customer Support

Contact the lender on its helpline between 7:30 AM to 4:30 PM Pacific Time, Monday through Friday. Or, you can contact them by email or your dedicated loan officer once you’re approved for a loan.

National Funding Perks and Bonuses

This lender offers a few strong benefits of working with them that borrowers will appreciate.

Flexibility

National Funding business loans are highly flexible, but you’ll need to meet their minimum revenue and credit score requirements. You can get financing for an equipment lease with no down payment, and the company is flexible about how you use your loan. You can lease new or used equipment or use the small business loan for anything from marketing expenses to payroll costs. If you build a strong payment history with them, National Funding will let you extend the term of your loan.

Transparency

The company has an A+ rating from the Better Business Bureau and a 4.6 out of 5 from TrustPilot, showing that it’s a legitimate company and trustworthy enough to consider working with.

Technology

National Funding has a fully online application process, which makes it easy to apply for a loan and get approved. However, there’s no online account portal or obvious way to access your account to make payments. The lender also lacks a mobile app, so you’ll deal with the company on a web browser from your computer.

With these perks comes a downside for the lender: lack of transparency. It offers almost no details about the loan costs or other features until you go through the application process and provide enough personal information for them to be able to call or email you.

Conclusion

If you’ve been struggling with cash flow issues and need funding fast, or you’ve been rejected by other lenders for having fair credit, then applying for a National Funding loan could be your solution. The speedy application process, good customer service, and minimal paperwork requirements make it an attractive option for many small businesses.

However, if you’ve got good credit, you might want to try another lender first. This lender’s rates can be high and its fees expensive. This could lead to much more debt than you can afford.

If you’re worried about high payments,talk to one of National Funding’s service agents, who can provide you exactly the fees you can expect, discuss with how to budget appropriately for repayment, and whether these loans are right for you.