Equipment financing rates determine the price you pay to finance the purchase of machinery and other new or used equipment for your company. The higher the interest rate, the more you’ll pay.

There are many factors that influence the interest rates your business will pay if you want to borrow money to finance equipment. We’ll break down what they are and how you can position your company to secure low interest rates.

Key Points:

- Equipment financing rates determine the cost of borrowing to buy equipment

- The lower your rates, the cheaper the loan will be

- Rates depend on factors related to your company, such as income and credit score, and uncontrollable factors such as the global economy

What are the Average Interest Rates for Equipment Financing?

Equipment financing interest rates can vary widely. Companies with excellent credit score and during good economic times might secure rates as low as 5% or less. In other situations, rates can be as high as 30% or more.

In general, larger equipment loans and longer repayment periods can lead to higher interest rates because the lender takes on more risk. If you take a smaller loan or offer a larger down payment, you can often secure lower interest rates.

How Do Interest Rates Affect Your Monthly Equipment Loan Payments?

Interest rates play a significant role in determining both the overall and the monthly cost of equipment loans. The higher the interest rate, the more you’ll pay.

With a traditional loan, every monthly payment has to cover the full amount of interest that accrued over the previous month plus some principal. With higher rates, more interest accrues each month. That means that your monthly payment will have to be larger.

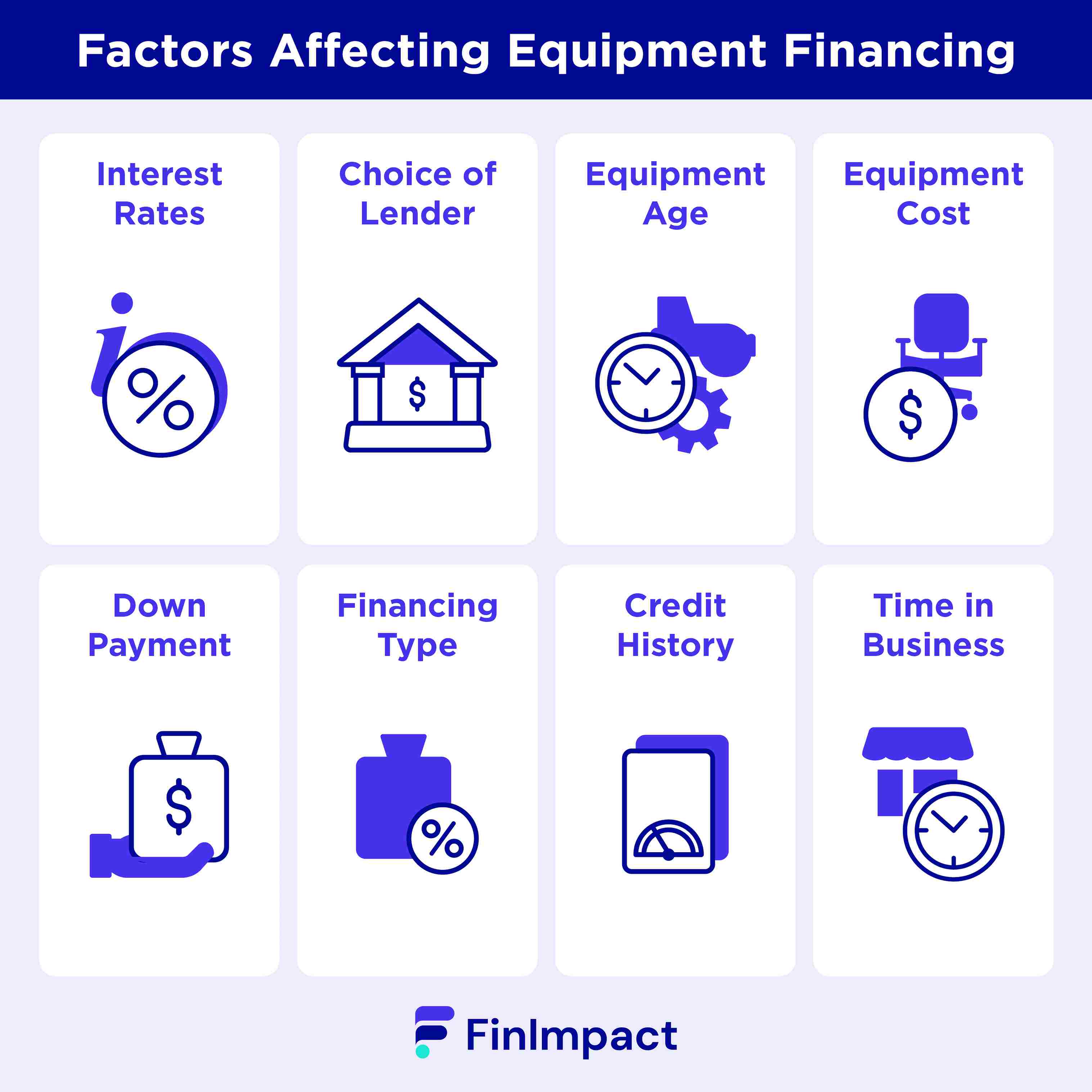

Factors That Affect Equipment Financing Rates

Interest rates are complicated and impacted by many factors. Some of these factors are within your control but others are things that you cannot influence.

National Interest Rates

National interest rates tend to impact the interest rates for every type of loan and even things like savings accounts.

The Federal Funds rate is used as a benchmark rate by many financial institutions. The Federal Reserve adjusts this rate through various means in response to economic conditions. For example, the Fed might lower the rate to spur spending or raise it to fight off inflation.

When the Federal Funds rate is high, interest rates for many types of loans, including equipment financing, tend to rise.

What Lender Is Providing the Financing

Your choice of lender can also influence the price of borrowing. Each lender has its own underwriting conditions and typical rates. Some lenders will specialize in certain types of loans and offer lower rates than others.

In general, online banks can offer low interest rates.

How Old the Equipment Is

The age of the equipment you purchase impacts the risk to the lender and therefore the rate. Newer equipment has a higher value and is more likely to serve as effective collateral for a loan, letting lenders charge lower rates.

If you’re buying used equipment, rates may be higher.

The Cost of the Equipment

The size of your loan, which is directly influenced by the equipment’s cost, plays a big role in how much you pay for the equipment loan.

In general, the more you borrow, the higher your interest rate will be. If you’re buying highly expensive equipment, you can expect to deal with higher equipment loan interest rates.

The Down Payment Amount

The down payment on a loan is the amount of money you put towards the purchase price of equipment. For example, if you buy something worth $50,000, paying $10,000 upfront and financing the remaining $40,000, you’ve made a $10,000 down payment.

The larger your down payment, the lower the lender’s risk. That means that larger down payments lead to lower rates.

The Type of Financing You Choose

There are different types of financing available if you want to buy equipment. Your choice of financing influences the rates.

- Leasing: Equipment leasing doesn’t involve buying equipment at all, so you don’t have to worry about the rates. Usually, equipment leasing has the lowest monthly price.

- Traditional bank loans: These loans might not be secured, so they often have higher rates than dedicated financing loans.

- Online term loans: Online banks usually charge lower interest rates than banks because they have lower overhead costs.

- Dedicated equipment loans: These loans use the equipment you buy as collateral for the loan, allowing the lender to charge a lower interest rate.

- Line of credit: Lines of credit are flexible but usually have higher interest rates than loans. Equipment lines of credit can also have variable rates, which may rise unexpectedly.

Your Personal Credit History

Depending on the age of your business and the type of loan you’re applying for, the lender may take a look at your personal credit report. Your good credit can help your company secure a low rate. If you have bad credit, the lender might charge a higher rate.

Amount of Time in Business

Many businesses, especially new ones, fail. Lenders will look at the age of your company and how your revenue has changed over the previous years to assess the risk of lending.

Newer businesses with a shorter financial track record will pay higher rates than established ones.

Why Are Equipment Financing Rates Important?

Equipment financing rates are incredibly important because they determine how much you need to pay each month. They also influence the overall cost of the loan.

Consider these examples:

Example of a Low Equipment Loan Interest Rate

You choose to finance a construction vehicle for your company, borrowing $100,000 at an interest rate of 6%. The repayment term of the loan is ten years.

Each month, you’ll pay $1,110.21. Over the life of the loan, you’ll pay $133,224.60, of which $33,224.60 goes toward interest charges.

Example of a High Equipment Loan Interest Rate

Now, imagine you get the exact same loan, but at a 10% interest rate instead of 6%. Your monthly payment would rise to $1,321.51 an increase of 19%. Your total loan cost would rise to $158,580.88.

Because equipment loan interest rates have such a huge impact on your company’s borrowing costs, it’s important to do everything you can to secure financing at low rates.

How Equipment Financing Payments Are Calculated

Beyond the interest rate of the loan, your monthly payments depend on three factors: how much you borrowed, the repayment term, and the fees.

Equipment Loan Amounts

The most obvious factor in determining your monthly loan costs is the amount that you borrowed. The more you borrow, the more you have to repay, so larger loan amounts tend to lead to higher monthly payments.

Equipment Loan Terms

The repayment term of a loan also influences how much you have to pay each month. The longer the repayment term, the less you pay each month.

For example, if you got a loan for $60,000 at 0% interest and repaid it over five years, you’d pay $1,000 each month. If you repay it over ten years, you’d pay just $500 a month.

However, long loan terms aren’t a panacea for keeping costs low. The longer the term of a loan, the more time you leave for interest to accrue. Long terms usually have higher overall costs despite their lower monthly payments.

Additional Fees

Some lenders charge additional fees for their loans that can play a role in the cost of your equipment loan. For example, loan origination fees add to the balance of your loan, which increases the required monthly payment.

How to Improve Equipment Financing Rates

While some of the things influencing equipment financing rates are out of your control, there are things you can do to reduce the cost of borrowing.

- Improve your personal and business credit score: Interest rates are directly impacted by the risk of lending, with riskier loans carrying higher rates. You can reduce lenders’ perceived risk by improving your personal and business credit scores by maintaining a solid payment history and paying down your debts.

- Offer a larger down payment: In general, the bigger the down payment you offer for a purchase, the lower the interest rate of your loan.

- Establish a track record of strong business finances: Lenders will be willing to offer lower interest rates to companies with longer histories, especially if they can show a history of stable or growing revenue.

- Shop around: Every lender is different, offering different loan rates and terms. You can shop around and compare offers from multiple lenders to try to find the one with the lowest interest rate.

Understanding Fixed and Variable Rates for Equipment Financing

Understanding fixed and variable equipment financing rates is critical when purchasing new or old equipment. Lenders set fixed rates depending on a variety of factors, including creditworthiness, loan amount, and current economic conditions. Fixed rates are often reasonably stable during the term of the loan. Variable rate loans, on the other hand, can rise and fall in response to changes in market conditions. An adjustable-rate mortgage is the most frequent type of variable rate loan (ARM). Here are five facts about fixed and variable equipment financing rates:

Fixed loans have a fixed interest rate that will not alter over the life of the loan. This makes them perfect for firms that require greater predictability in their spending. Two benefits of this type of loan are that payments are easier to budget for because they remain consistent throughout the loan's term; additionally, if interest rates fall in future years, borrowers will not benefit from those lower rates because they are already locked into their agreement with the lender.

Variable rate loans can be advantageous because they frequently begin with a lower interest rate than fixed rate loans and may go up or down as market circumstances change during the life of the loan. Borrowers should be warned, however, that if interest rates rise dramatically, they may face significant increases in payments; as a result, great consideration should be taken before choosing this sort of loan arrangement.

Another consideration when contemplating financing alternatives is whether to go with a secured or unsecured loan product; both types have distinct terms and conditions, so it's crucial to do your homework before committing funds to either option. A secured loan requires collateral, which could be property or other assets, whereas an unsecured loan does not, but normally has higher interest rates owing to the lack of it.

The fees associated with equipment financing vary depending on the type of product you choose; some fees include origination fees, which cover administrative costs involved in setting up your account, while others may include early repayment penalties, which apply if you pay off your debt before its agreed term length.

Remember that many lenders provide flexible repayment choices, so search around for competitive offers from various financial institutions when deciding on equipment lending programs accessible in today's market. When signing any documents, make sure to ask about any additional charges, such as administration fees, so you know exactly what costs you're consenting to.

When selecting the correct lender to deal with to achieve the greatest rates on fixed or variable rate products, it is critical to research the company's creditworthiness. A company's credit history informs lenders about its present financial situation, which is reflected in the conditions of a loan product as well as the interest rates charged.

It is critical to be aware of any additional charges related with equipment financing, such as maintenance fees, late payment fees, and, if applicable, storage costs. These costs can easily mount up and should be factored into your budget when making a purchase.

Before signing any loan arrangement, read the tiny print to ensure you understand exactly what you are agreeing to, including what happens if you decide to pay off your debt early or make late payments. Understanding these points ahead of time will prevent you from potential problems later on.

Understanding APR & Other Factors That Determine Total Cost

The Annual Percentage Rate (APR) is a significant aspect in determining the total cost of any loan or credit card. The annual percentage rate (APR) is the rate of interest imposed on borrowed funds, and it varies greatly depending on whether you're taking out a loan, using a credit card, or using a line of credit. Although APR is commonly used to evaluate different loans and credit cards, it is not the only element that influences your overall cost. Other elements determining overall cost, in addition to APR, are:

- Loan Term: The amount of time it takes to repay your loan affects the total cost. Longer repayment durations, in general, result in lower monthly payments but higher overall expenditures due to interest charges.

- Interest Rate Type: There are two types of interest rates: fixed and variable, and each has advantages and disadvantages in terms of total cost. Fixed interest rates are normally more expensive in the long run than variable interest rates, but they provide more stability because they do not alter over time.

- Fees and Charges: Depending on the type of loan or credit product you obtain, there may be additional fees added to your amount, such as origination fees or annual fees, which can considerably raise your overall cost if not properly accounted for.

- Prepayment Penalties: Some lenders can penalize borrowers for making early loan payments, which may end up costing more than originally expected if not properly accounted for when calculating expenditures.

- Credit History and Score: Your personal credit history and score can have an impact on your total loan or credit card expenses because lenders use this information to assess how much risk they are taking when giving money out, resulting in higher APRs for people with low credit histories or scores.

Overall, understanding all these factors is key in determining what might be best for you financially when it comes to taking out loans and using other types of borrowing products such as lines of credits or even mortgages.

Maximizing Benefits From Variable Rate Structures

Leveraging the benefits of variable rate structures can be an efficient strategy to assist any firm decrease expenses and boost efficiency. Variable rate systems entail modifying pricing, wages, or product availability for various groups of customers or providers. These changes can assist in establishing competitive advantages in the short and long term. Firms must verify that their pricing strategy is suitable for each situation and current market conditions.

Assess consumer preferences: Understanding your customers' preferences will allow you to provide them with better value while reducing costs connected with unsold products or underutilized services. Offering discounts on things that are frequently purchased together, for example, can encourage customers to buy more items at once and save money in the long run.

Evaluate target markets: Knowing who your target audience is will help you identify what types of discounts will work best for them. For example, if you're targeting students, offering discounted textbook prices could benefit both parties because it encourages students to buy more books while simultaneously lowering your overhead costs associated with selling books in huge numbers at discounted prices.

Use data analytics: Data analytics can provide insight into how consumers react to changes in product or service prices and availability, which can influence judgments about how to best adjust rates on a flexible basis based on customer need or demand.

Keep track of what your competitors are doing: Keeping track of what your competitors are doing with their pricing models is important because it helps you stay competitive while also ensuring that you are not overcharging customers due to a lack of knowledge about other options available on the market.

Review pricing structure on a regular basis: It is critical that businesses review their pricing structure on a regular basis not only to ensure that they remain competitive, but also to identify any opportunities for improvement, such as introducing new products/services or changing existing price points based on market trends or customer feedback.

Should You Refinance an Existing Loan to Get a Lower Rate?

Refinancing an existing loan can help you save money on interest payments while also reducing your overall debt load. Refinancing is the process of obtaining a new loan to pay off an old loan, which usually has different terms than the initial loan. People typically refinance their loans to obtain a lower interest rate or a shorter payback term. When done correctly, refinancing can save you money in the long term; but, before committing to the process, you should evaluate the fees connected with refinancing.

Here are five important considerations to remember before refinancing:

- Loan-to-Value Ratio: When considering whether or not to refinance, the Loan-to-Value (LTV) ratio is critical. It is determined as a percentage by dividing your total mortgage amount by the appraised value of your home. If your LTV is too high (more than 80%), you may not be able to qualify for a lower rate, even if you want one.

- Fees: Just like any other mortgage transaction, refinancing has closing expenses, so it's vital to factor these in when deciding whether or not it makes financial sense for you. These fees are often wrapped into your new loan so that you do not have to pay them upfront, but they will cost you more in the long run owing to interest accrued on them during the life of the loan.

- Timeframe: Prepayment penalties imposed by your current lender may make refinancing more expensive in some situations, depending on how soon after closing your current loan you opt to refinance again. It's critical that you grasp all of these aspects before making a hasty decision so that you don't end up spending more than required to receive a reduced rate on an existing loan.

- Credit Score: Your credit score influences whether or not lenders will give better rates when refinancing an existing loan; this is because lenders assess risk based on creditworthiness, and individuals with higher scores tend to receive better offers than those with lower scores. As a result, if refinancing is something that interests you, it's critical to keep high credit in order to boost your chances of getting decent rates from lenders who are ready to take less risk by issuing loans with favorable terms and conditions.

- Shop Around: Get multiple quotes from different lenders before deciding which offer best suits your financial needs; this could help ensure better rates and terms for yourself as well as provide more clarity when deciding which lender best fits what type of deal/loan structure makes the most financial sense for the situation. This would also necessitate thorough research of various solutions as well as knowing current market trends/rate changes, etc., in order to obtain competitive quotations and make decisions accordingly.

Understanding Credit Evaluations & Their Impact On Rate Offers

Understanding credit evaluations and their impact on rate offers is a critical subject to grasp in personal finance. Credit evaluations are assessments of a person's financial history that result in a credit score, which banks and other lenders use to determine the possibility of a borrower repaying their loan.

If a person's credit score is low, they are unlikely to be approved for many loans from traditional lenders. Yet, if a person has a good credit score, they may be granted lower interest rates when borrowing money, as well as being authorized for more loans in general. Here are five pieces of useful information about how credit evaluations affect rate offers:

A credit score is an evaluation of your financial history that assigns a numerical value based on your payment history and existing debt. This figure assists lenders in determining whether or not to lend you money and what terms to offer you.

Good Credit Is Rewarded: Having good credit often leads to cheaper interest rates or loan amounts than individuals with poor or negative credit. This means that if you have managed your finances well, it may pay off in the form of better interest rates when looking for new loans or financing choices!

Poor Credit Scores May Result in Higher Rates: If you don't have strong credit, lenders may perceive you as a high risk and offer you higher rates than someone with good credit. If this is the case, you should take actions to improve your financial status so that future loan chances will be more favorable to you!

Lenders Consider Other Factors: While having a good or bad overall credit score may influence a lender's decision on whether to approve your application and/or what type of rate offer they make, there are still other factors at play such as income level, collateral offered (if any), employment status, and so on, all of which can influence the decision making process!

It's Important to Browse Around: Just because one lender doesn't offer the best rate doesn't mean another won't- comparing several lenders can save time and money by obtaining more competitive offers from multiple sources!

How to Find Lenders with the Best Equipment Loan Interest Rates

When you’re applying for any type of loan, it’s in your best interest to shop around and compare offers from multiple lenders. That will help you find the lender charging the lowest interest rates or offering the best loan terms.

If you’re working with an equipment dealer, ask if they offer any financing deals and compare them to what you’re seeing on the market. You should also check out dedicated online financing companies because they tend to offer good rates.

We also have a list of some of the best equipment financing companies. We’ve conducted in-depth reviews of these lenders so you can use our info page to learn more.

SBA Loans: Alternative To Equipment Financing with Competitive Interest Rates

The Small Business Administration is a US government agency that is dedicated to helping small businesses across the country. One way the SBA helps businesses is through the SBA loan program.

The SBA loan program offers assurances to lenders who extend loans to small companies. These loans can be for large amounts, as much as $5 million or more, making them a potential option for business owners in need of equipment financing.

SBA loans involve a lot of paperwork and bureaucracy, so they’re not a good choice for people who need cash fast. However, they can have lower interest rates than many other types of equipment loans, so if you don’t mind the paperwork, they can save you money.