| All content presented here and elsewhere is solely intended for informational purposes only. The reader is required to seek professional counsel before beginning any legal or financial endeavor. |

If you run a business and need to purchase important equipment or machinery, equipment financing can be a helpful solution. It allows you to obtain the necessary tools without paying the full price upfront. This is especially beneficial for small businesses that may not qualify for regular bank loans. By learning about equipment financing, you can find out when and why it's worth considering, making informed choices that support your business's growth and success.

What Is Equipment Financing: An Overview

The process of acquiring funds to buy or lease equipment for your company is known as equipment financing. This can be a great method to get pricey equipment that is necessary for running your business without having to pay the entire price up front.

For small firms that might not be eligible for conventional bank loans, many equipment financing companies provide flexible financing options, including loans and leases. This enables small firms to get the tools they need to stay competitive in their sector.

- Knowing what equipment can be financed: Not all types of equipment can be financed, despite the fact that most can. Equipment with a high resale value, a long lifespan, and importance to the operations of the firm is often more likely to be approved for financing by lenders.

- Consider the impact on your cash flow: You can save money by using equipment financing, but you must be aware of the effect it will have on your cash flow. Make sure to account for the recurring payments that will be necessary and confirm that your company can afford them without cutting back on other necessary costs.

- Understanding the tax implications: Tax consequences of equipment financing might be both favorable and unfavorable. The interest you pay on your financing may occasionally be deductible from your business's taxes. Financing, however, can also affect your depreciation schedule so it's important to work with a tax professional to understand how equipment financing will impact your business's tax situation.

- Choosing the right lender: When it comes to equipment finance, picking the correct lender is essential. Find a lender who offers low rates and conditions and has experience financing the kind of equipment you require. You could also work with a lender who focuses on funding for your sector.

Benefits of Equipment Financing for Your Business

Improved Cash Flow: By avoiding big upfront payments, equipment financing can assist maintain cash flow.

Tax advantages: Financing may offer companies tax advantages, such as deductions for depreciating assets.

Increased Purchasing Power: With the help of financing, businesses may be able to buy more equipment than they otherwise could.

Fixed Payments: Fixed payment schedules are frequently included with equipment financing, which can assist firms with budgeting and long-term planning.

Modernized Equipment: Access to financing enables organizations to stay abreast of equipment and technological developments, which can boost productivity and efficiency.

Access to Better Equipment: With the help of equipment financing, firms can rent or buy better equipment they otherwise might not have been able to afford.

Cash Preservation: By financing equipment, businesses can keep their capital intact and put it to use for other crucial costs.

Low Upfront Cost: Since equipment financing often has a low upfront cost, it is an appealing choice for companies with tight cash flow.

Flexible Payment Terms: To accommodate various business needs and cash flow cycles, financing companies frequently provide flexible payment terms.

Protection Against Obsolescence: By allowing companies to upgrade to new technology or equipment at the conclusion of the financing period, financing equipment can help protect against obsolescence.

Quick Approval: Companies that finance equipment frequently provide quick approval and funds, enabling enterprises to quickly acquire equipment.

Improved Productivity: Better equipment can increase productivity, which can help firms increase their income and expand their operations.

What Types of Equipment Can I Get Funding For?

One of the benefits of small business equipment financing is that you can get a loan for almost any type of business equipment. It all depends on what type of company you own and the willingness of a lender to approve your application.

Different businesses need different types of equipment. Some things you can buy with equipment financing include:

- Manufacturing equipment

- Tools

- Gym equipment and other gym opening costs

- Construction equipment

- Vehicles, including semi trucks

- Office furniture

- Phone systems

- Medical equipment

- Dental practice equipment

- Farm tools and equipment

- Commercial fitness equipment

- Computer equipment

- Camera equipment

- Restaurant kitchen equipment

This list is by no means exhaustive. You could even finance used equipment. Every business is different and has different equipment needs, so work with your lender to see what is eligible. Equipment financing is designed to be highly flexible and responsive to the unique needs of your company.

Different Types of Loans For Equipment Financing

There are a few options for business owners who want to finance their company’s equipment purchases.

Equipment loans: Equipment loans are specialized loans designed to help business owners buy equipment. They’re usually secured by the equipment you’re buying and can have long repayment periods, making them good for large purchases.

Term loans: Term loans are simple, unsecured loans that businesses can use for many purposes. You can use these to buy equipment but may have to pay higher interest rates.

SBA loans: The Small Business Administration helps companies borrow money by offering some guarantees to lenders. You can use an SBA 504 loan to purchase equipment.

Lines of credit: Business lines of credit are flexible tools that let you borrow money when you need it and only pay interest when you carry a balance. These can be useful for smaller equipment purchases.

Credit card: For very small equipment purchases, a business credit card might be an option. However, keep in mind that these charge massive interest rates.

It can become a little overwhelming trying to process so much information which is why it is always good to consult a professional or ask a local business advice organization. We have provided a list of such organizations at the end of this article.

Secured vs. Unsecured Equipment Financing: Pros and Cons

Unsecured equipment financing has higher interest rates than secured financing and doesn't require collateral; secured equipment financing does, however, require collateral, such as the piece of equipment being financed. Unsecured loans, however, frequently have higher interest rates and may have stricter credit requirements.

Pros of Secured Equipment Financing:

- Decreased interest rates.

- Easier to obtain for companies with less established financial standing or credit histories.

- Ensures both the lender and the borrower feel secure and stable.

- Possibly come with longer repayment terms than unsecured financing, which could result in lower monthly payments.

Cons of Secured Equipment Financing:

- Requires collateral that may be seized in the event of loan default.

- Due to collateral requirements and other documentation, it may take longer to obtain.

- May restrict the borrower's use of the machinery as security for other loans or financing.

- The equipment may need to be appraised or inspected, which can be expensive and time-consuming.

Pros of Unsecured Equipment Financing:

- Does not require collateral, which is advantageous for companies with few assets.

- Increased flexibility in loan amounts and repayment schedules is possible.

- Quicker approval process because no collateral is required.

- Can be an excellent choice for companies that need to quickly acquire equipment or for short-term projects.

Cons of Unsecured Equipment Financing:

- Higher rates of interest.

- Stricter credit standards than secured financing.

- If borrowers pay off the loan early, they might be hit with prepayment penalties.

- To counteract the risk of lacking collateral, lenders might demand personal guarantees or larger down payments.

Most equipment financing companies want to lend to companies with an established history

Risks of Equipment Financing: What You Need to Consider

Small businesses may find that financing their equipment purchases is an effective strategy, but it's crucial to weigh the risks before signing a financing contract. The demand for an initial down payment, which is normally around 20% of the equipment cost, is one important risk of equipment financing.

Another possible risk is that the financing period may be longer than the equipment's usable life, forcing the business to make payments on assets it no longer needs. Additionally, skipping loan payments could have a negative financial impact on the company.

Recognize the total cost: It's important to look beyond the interest rate and take into account all the costs associated with the financing arrangement. Equipment financing can come with hidden fees and charges.

Check the small print: Before signing on the dotted line, make sure you have read and comprehend all of the financing agreement's terms and conditions. Pay close attention to details like default clauses and early termination fees.

Examine your foreseeable needs: Before signing a financing contract for equipment, take into account how your company's requirements may alter in the future. In a few years, will the equipment still be useful? Will you need to replace or upgrade it earlier than you anticipated?

Think about your cash flow: Before signing an agreement for equipment financing, make sure you have a realistic understanding of the cash flow of your company. Will you be able to timely make the necessary payments without endangering your company?

Have a backup plan: To ensure you can continue to make the required payments on your financing arrangement in the event of unforeseen circumstances, such as equipment failure or a decline in revenue

Stay organized: To avoid missing payments or paying penalties, keep track of all your financing paperwork and payments.

Recognize the total cost of financing: Take into account interest rates and any other fees related to the loan. To get the best deal, make sure to compare offers from various lenders.

Examine the financing term's length: See if it corresponds with the equipment's anticipated lifespan. You don't want to be making loan payments for equipment that is long past its prime.

Think about the possibility of depreciation: Some equipment, such as vehicles, quickly lose value. You might owe more money than the equipment is worth if you default on the loan.

Understand collateral requirements: Many lenders will demand that you use the financed equipment as loan collateral. The tools could be lost if you default.

Consider technological obsolescence: If you're financing technologically advanced equipment, you might sooner than you thought end up with outmoded equipment.

Pay close attention to the details: Verify that you are aware of all the loan's terms and conditions, including any prepayment penalties or other charges.

In case anything is unclear, don't be afraid to ask questions and seek guidance. In fact, to be 100% certain you have everything covered, hire a professional before your sign. It is very easy to miss points that can snowball further down the line.

How to Qualify for Equipment Financing

You typically need to have a good credit score and a strong financial history in order to be eligible for equipment financing. Additionally, lenders will take into account things like how long you've been in business, your earnings and cash flow, and the kind of equipment you want to finance. Some lenders may also demand collateral or a down payment.

- Make sure your credit history and score are in good standing by checking them.

- Create a strong business plan that demonstrates your capacity to manage your finances and generate revenue.

- Assemble financial records for lenders, such as tax returns and bank statements.

- Establish the kind, quantity, and benefits of the equipment you require for your business.

- Find the best lender for your business by researching them and comparing their terms and rates.

- To obtain financing, be prepared to put up collateral such as the equipment itself or a down payment.

- To reduce your upfront costs, think about leasing equipment rather than buying it.

- Tell lenders truthfully about any difficulties or dangers involving your company or the equipment you want to finance.

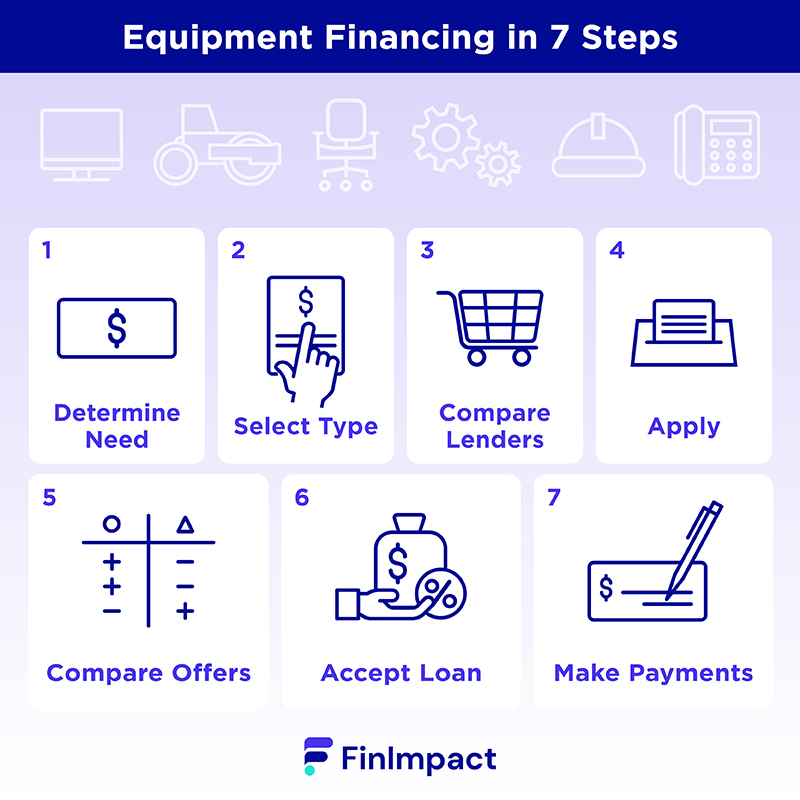

How To Apply for Equipment Financing

Determine How Much to Borrow: This will largely depend on what equipment you’re financing and how much you can afford as a down payment.

Select The Type of Loan: Determine if you’ll use a specialized equipment loan, term loan, SBA loan, or other form of financing.

Compare Lenders: Look at a few different business lenders and compare the options they offer. Consider things like interest rates, fees, and down payment requirements.

Submit Applications: Apply for a loan from one or more lenders. This involves filling out a form with details about your company and its revenue, as well as the loan you want.

Compare Offers: If you applied with multiple lenders, compare the different offers you’ve received to choose the best one for your company.

Accept The Loan: Once you’ve chosen the loan, let the lender know you’d like to move forward.

Start making payments: You’ll start getting a bill every month. Make sure you make your payments on time. If you don’t, it will hurt your credit and the lender could repossess the equipment or other business assets.

How to Calculate Your Equipment Financing Needs

You must consider a number of factors when determining your equipment financing requirements. The first thing you must do is figure out how much the equipment you want to buy or rent will cost. This will cover all related expenses, including taxes, shipping, and installation. Once you have determined the total cost, you need to decide on the down payment amount. A down payment is the amount of money you pay upfront to reduce the loan amount.

To calculate your equipment financing needs, you can use the following formula:

Total Equipment Cost – Down Payment = Equipment Financing Needs

For example, suppose you wish to purchase a piece of equipment that costs $100,000. You have decided to make a down payment of $20,000.

Using the formula above, your equipment financing needs would be:

$100,000 - $20,000 = $80,000

In this example, you would need to secure financing for $80,000 to purchase the equipment you require.

Calculating your equipment financing needs is an essential step in obtaining the money you require to buy or lease the equipment you need for your business. An additional step you can take is to calculate your required financing amount and monthly payment by factoring in the equipment's cost, down payment, interest rate, and repayment term.

This can become a little complicated and we highly recommend you consult with your local SBA office or a business mentoring organization to be sure that your calculations are correct. This way you are not relying on what the lender tells you and you will be greatly empowered to enter into negotiations if you arrive fully prepared and already knowing the information.

Differences Between Equipment Financing and Leasing

Equipment financing and leasing are two ways that companies can acquire expensive equipment without needing to have a huge amount of money upfront.

With financing, you borrow money to purchase a piece of equipment. At the end of the loan, you own whatever you’ve purchased. However, this can be more expensive than leasing, which is like renting equipment for a monthly fee. However, with a lease, you never pay off the machinery and own it. You’re stuck with a monthly payment forever.

Difference Between Business Equipment and Supplies

The difference between equipment and supplies is that equipment usually costs more, the length of time they are in use is longer and equipment has long term value. At some point in the future, equipment can be sold and cash received in return making equipment also an asset. Supplies are short term since they are required for almost immediate use, cost less and have minimal value if they were to be sold anytime in the future.

Where Can I Get Equipment Financing for My Business?

There are many sources of business equipment financing, each with pros and cons.

- Banks: Your business bank may offer loans to its customers. If it does, it can be worth checking whether equipment financing is one of the services it offers. Keeping all of your company’s financial activity in one place can be convenient and the bank already knows your company, which may make approval easier.

- Online lenders: Some specialized business lenders operate purely over the internet. The benefit of online lenders is that they’re usually able to charge lower interest rates and fees that brick-and-mortar lenders due to their lower overhead costs. However, if you like the option to sit down and speak with a lender in person, they’re not a good choice for you. You might like to learn more about what online lenders have to offer from our article about the best equipment financing companies.

- Small Business Administration loans: The SBA works with a variety of lenders to offer loans to small companies that need funding. You can use SBA loans to borrow as much as $5 million to purchase equipment. These loans are popular because businesses that struggle to qualify for other loans might be eligible. They also have low rates. However, approval can be slow and down payments are usually required.

How Are the Costs of Equipment Financing Determined?

Equipment financing costs vary widely based on a few factors, such as:

- The cost of the equipment

- Your company’s creditworthiness

- The size of your down payment

To know how much equipment financing will cost, you’ll primarily want to look at:

- The loan’s interest rate: Lower rates mean lower monthly payments and a lower total cost.

- The loan’s term: Short terms save money overall but mean higher monthly payments. Long terms let you have lower monthly payments at the cost of a higher overall cost.

- Fees: The fewer fees you pay, the better.

For example: imagine you want to buy $10,000 worth of audio equipment for your concert venue. You don’t offer any down payment, so you need to borrow $10,000.

A lender offers a loan with a 5% interest rate and a 3-year term. Your monthly payment will be about $300, and you’ll pay just under $10,800 over the life of the loan. Overall, you’ll pay $800 in interest.

If you shorten the loan’s term to 1 year, you’ll pay $856 per month, but only $10,273 overall, saving you more than $500 over the life of the loan.

Pros and Cons of Small Business Equipment Financing vs. Buying Equipment Outright

Small business equipment financing can be an important tool for business owners who want to expand, but there are pros and cons to consider.

Pros

- Faster expansion: Financing equipment lets you expand more quickly because you don’t have to wait until you can afford the equipment outright.

- Spread the cost of your purchase: Financing lets you spread the cost of your equipment across many months, which can help with cash flow.

- No additional collateral is needed: The equipment you’re financing serves as collateral, making approval faster and easier.

Cons

- Uses are limited: Equipment loans are only for equipment. You can’t use the funds for other purposes, like payroll.

- You’re responsible for the equipment: You have to maintain the equipment and pay for its upkeep. If it fails, you might be stuck with a loan payment and not have any functioning equipment to use.

Why Not Lease Equipment

The primary alternatives to equipment financing are buying the equipment outright and leasing the equipment.

Outright purchases of equipment can be highly expensive. However, they let you avoid loan costs such as interest and fees, saving you money overall.

Leasing is a more common alternative: With a lease, you’re renting the equipment from someone else. Leases are usually cheaper than loans on a monthly basis, but you never wind up owning the equipment. If you plan to upgrade soon, or need the lower monthly cost, leasing could be a viable choice. However, keep in mind that with a loan, you’d eventually own the equipment, which can be valuable. If you're still not sure which funding option is best for your business, read our article about equipment leasing vs. financing.

What to Look for in an Equipment Financing Agreement

Contracts that define the terms of a loan for the purpose of obtaining new equipment are known as equipment financing agreements. When reviewing an equipment financing agreement, it is important to consider the following:

- Interest rate: Verify that it is comparable with other available lending options. It is essential to comprehend how the interest rate is computed and any future adjustments.

- Collateral requirements: Observe the collateral criteria and ensure they are reasonable in relation to the loan's worth. This can prevent the loss of important assets in the event of insolvency.

- Prepayment penalties: It may be worthwhile to negotiate with the lender to waive or decrease these fines.

- Hidden costs: Be mindful of any fees that are not immediately evident, such as administrative or origination fees. These fees might have a substantial impact on the total cost of the loan.

- Financing term length: Make sure that the term length is how you understand it and do not be afraid to negotiate.

- The possibility of renewal or refinancing: This must be in the agreement as if it is not you may want to find another lender. If it is leverage your purchasing power and negotiate for better terms

To guarantee a complete comprehension of the agreement, it is essential to study the tiny print and ask questions about any unclear or confusing phrases.

By following these steps, you can better comprehend the details of a financing arrangement for equipment and make educated judgments regarding whether to accept or reject the offer. It is essential to thoroughly analyze all aspects of the agreement and, if necessary, consult a lawyer or financial advisor.

Tax Implications of Equipment Financing

Depending on the conditions of the financing agreement, equipment financing can be considered differently from a tax viewpoint.

If the financing is structured as a lease, for instance, the lessee may be eligible to deduct the lease payments as an operating expense.

If the financing is structured as a loan, however, the borrower may be able to deduct the interest paid as a business expense.

Notably, the tax consequences of equipment financing can be complex and may rely on a number of variables, including the type of financing, the type of equipment being funded, and the exact conditions of the financing agreement. It is advised that you consult a tax expert to fully comprehend the tax implications of their particular equipment financing arrangement.

- Keep detailed records: Accurately track and report the tax implications of your equipment financing, you must maintain detailed records of all equipment-related expenses, such as lease payments, loan payments, and maintenance costs.

- Consider the Section 179 deduction: Under Section 179 of the tax code, businesses may be able to deduct the full cost of equipment purchases in the year they are made, as opposed to depreciating the cost over several years. This is a valuable opportunity for tax savings for businesses considering equipment financing.

- Determine your tax bracket: As the tax implications of equipment financing can vary depending on the tax bracket of the business. Ensure that you comprehend how your financing arrangement will affect your tax liability based on your tax bracket.

- Consult with a tax professional: Due to the complexity of the tax implications of equipment financing, it is advised that businesses consult with a tax professional to ensure they fully comprehend the tax implications of their financing arrangement and are taking advantage of all available tax savings opportunities.

Organizations Offering Business advice Mentoring

SCORE: SCORE is a nonprofit organization that provides education and mentorship to small businesses through a network of volunteer business mentors. They offer confidential business mentoring services, subject matter expert collaborations, and local workshops and events to help entrepreneurs meet their goals and achieve success. [

Small Business Development Centers (SBDC): SBDC provides no-cost business consulting and low-cost training to small business owners and entrepreneurs to help them start, grow and succeed. They offer one-on-one business consulting, training, and resources to help small business owners develop and grow their businesses.

National Association of Small Business Owners (NASBO): NASBO is a membership organization that provides business resources, education, and networking opportunities to small business owners. They offer business resources, workshops, and a community of like-minded small business owners to help entrepreneurs start and grow their businesses.

Small Business Administration (SBA): The SBA is a government agency that provides resources, financing, and support to small businesses across the United States. They offer resources and information on starting, managing, and growing a business, along with financing options for small businesses.

Women's Business Center (WBC): WBC is a national network of centers that provide resources, training, and support to women entrepreneurs. They offer training, counseling, and resources to help women start and grow successful businesses.

Final Word

Business equipment financing is a way for companies to borrow money to buy expensive equipment to start or expand their operations. These loans can be easier to qualify for than many other types of loans and offer large amounts of funding over long terms, so companies in need of expensive equipment may find them appealing.

Video: Equipment Financing Explained