Equipment financing for startups is a type of loan, however, the advantage of this loan is that the equipment becomes the collateral/guarantee for the loan itself. This means that it is not only easier to be approved for the loan but you do not need any of your own capital in order to purchase the equipment.

What Kind Of Business Equipment Can You Finance?

You can finance most types of new or used equipment, depending on the lender you choose. Essentially, any legal piece of equipment you need to run your business can be financed in some way. Here are a few specific examples, though:

- Heavy equipment like tractors, backhoes, and excavators.

- Company vehicles used for business purposes, like semi-trucks.

- Furniture for offices including desks, chairs, and other accessories.

- Medical devices and dental equipment.

- Exercise machines and other major costs of opening a gym

- Phone and voicemail systems you’d see in an office setting.

- Computers, desktops, and laptops.

- Cameras and photography equipment.

- Restaurant equipment like ovens and mixers.

The list can go on, but this gives you a sampling of what you can finance. On the other hand, the things you can’t finance is a shorter list. Typically, you can’t always finance a property, since that’s a separate loan called a commercial real estate loan. Additionally, rare or specialty business equipment you may not be able to finance since a lender can’t get an average on how much they should realistically be lending you.

How To Qualify For an Equipment Loan

What you’ll need to present for paperwork will largely depend on the lender you choose. Some simply have more rigorous standards than others. For example, online lenders and big-name banks will likely have a longer application process than your local credit union, so consider this when applying.

Generally, you’ll need the following to stand a chance of qualifying for an equipment loan:

- A good credit score: You don’t need a good score, but having one is going to make the process a whole lot easier. Plus, you’ll qualify for the best rates, reducing how much you’ll pay over the life of the loan.

- At least a short history as a business: Most lenders won’t offer financing to brand new businesses, since they can’t be sure the business will do well and they can’t be sure they’ll get paid. You’ll likely need to be in business for at least six months before qualifying for financing.

- Proper financial statements that are organized well: If you have an accountant who organizes your financials, they’ll be your best friend during the equipment financing process. You’ll need quite a bit of documentation including business licenses, profit and loss statements, and more.

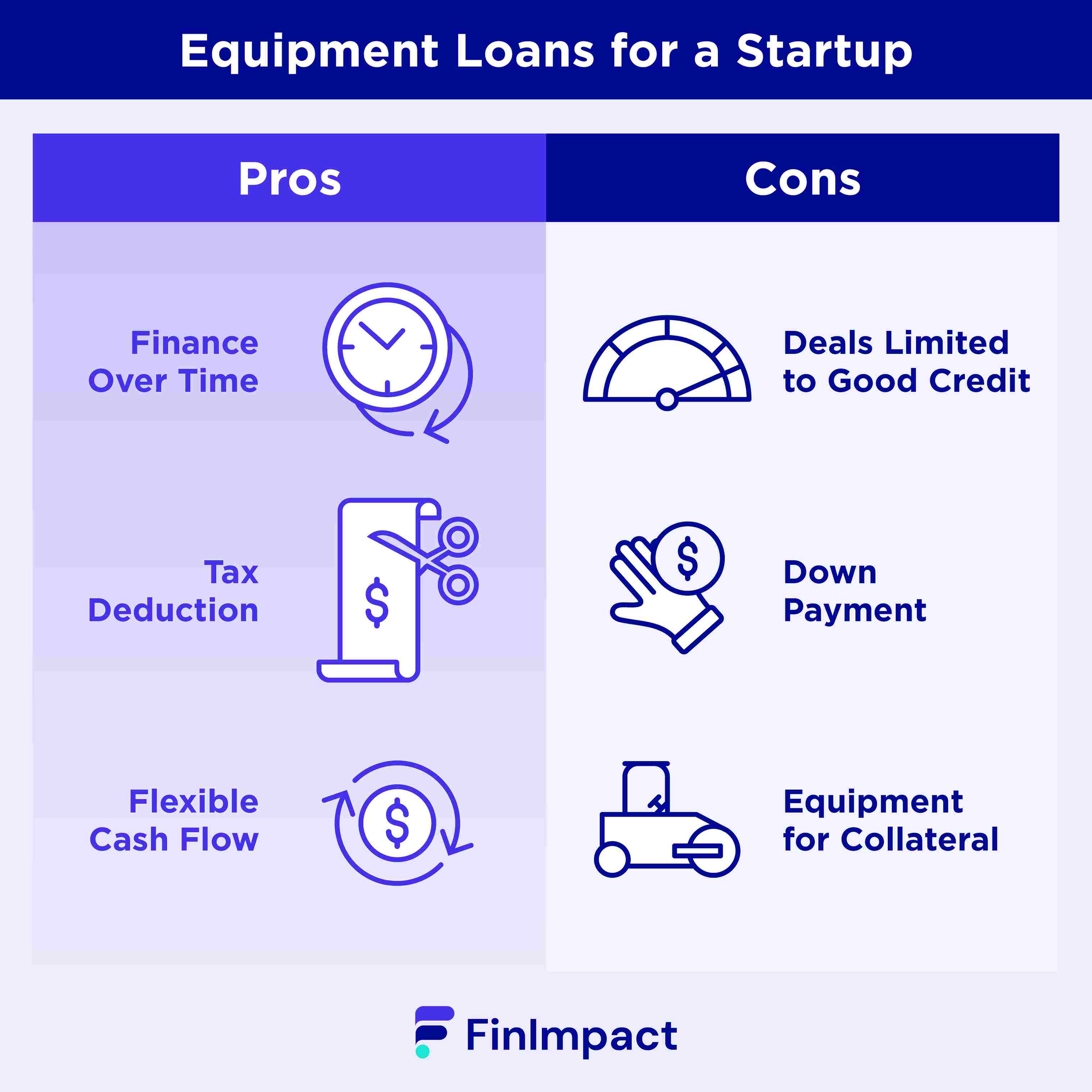

Equipment Loans For a Startup - Pros and Cons

While those with good credit will generally qualify for some decent loan opportunities, anyone considering taking out an equipment loan should consider the pros and cons.

Pros:

- You can finance over time: Equipment can be expensive, so coming up with the cash upfront can be impossible. Getting heavy equipment financing can help you pay down the balance over time, hopefully with a decent interest rate.

- You’ll get a tax deduction: To help businesses, the IRS offers tax deductions for qualifying equipment purchases. In 2022, you can deduct up to $1,080,000.

- You’ll have a more flexible cash flow: When you’re paying smaller amounts month-to-month, your business has money available to save or spend elsewhere. If you need equipment at the same time you’re trying to grow the business as a whole, having the extra cash flow can help you hire additional employees.

Cons:

- Only good credit borrowers will get a good deal: In the loan world, the higher your credit score, the lower your interest rates, and the better your chances of approval. Those with good credit will fare fine, but those with bad credit may have a difficult time finding the terms they want.

- You’ll often need to come up with a down payment: Some equipment lenders will require a down payment. 20% is a common number, so be prepared to pay some towards your new equipment purchase.

- If you default, the equipment will likely be collateral: If you can’t make payments, oftentimes lenders will use the equipment as collateral. They’ll seize the equipment if you continue to miss payments and then you’ll be stuck empty-handed.

Equipment Leasing: Pros and Cons

Equipment leasing is an appealing financing option for both new and existing enterprises. It has various benefits, including the possibility to obtain cutting-edge equipment without making a large initial expenditure, as well as the ability to upgrade equipment as technology improves or business needs change. Maintenance and repair services are frequently included in leasing agreements, which helps reduce operational expenses and downtime. Furthermore, leasing can help organizations conserve cash flow, allowing them to reallocate resources to areas such as marketing or R&D.

However, there are several disadvantages to leasing equipment. Over time, the overall cost of leasing may exceed the cost of acquiring equipment outright, especially if the lease period is extended or a higher-end model is chosen. Furthermore, leasing contracts can be complicated, with varied periods, interest rates, and fees that can be difficult to compare between providers. Certain lease contracts may also include stringent usage or maintenance restrictions, limiting a company's flexibility in how it uses the equipment. Finally, leased equipment is not treated as an asset on a company's balance sheet, which might have an influence on a company's capacity to acquire additional funding or sell the business.

- Investigate various leasing companies to discover the best terms and costs.

- Examine the small print of lease agreements for any early termination fees or penalties.

- Ask about the availability of maintenance and repair services, as well as the costs associated with them.

- Assess the equipment's anticipated lifespan and whether a lease term corresponds to that timeframe.

- Consider the tax advantages of leasing, such as the opportunity to deduct lease payments as a business expense.

- Examine the lease's flexibility, including choices for upgrades or equipment returns.

- Maintain thorough records for rented equipment, including lease agreements, payments, and any maintenance or repairs performed.

Equipment Leasing vs Financing: Pros and Cons

| Leasing | Financing | |

| Pros | ||

| The lessor owns the equipment, so no ownership issues for the startup | The lessor owns the equipment, so no ownership issues for the startup | |

| No depreciation to manage, as the lessor owns the equipment | Potential tax benefits from depreciation of owned equipment | |

| More cost-effective for short-term needs or rapidly changing technology | More cost-effective in the long run when the equipment has a long useful life | |

| Limited customization options, as the equipment is owned by the lessor | Full control over the equipment, allowing for customization if needed | |

| Cons | ||

| Lower initial costs, as leasing typically has lower upfront payments | Requires a larger initial investment for purchasing the equipment | |

| Easier to upgrade equipment when the lease term ends, keeping up with technology advancements | Risk of owning obsolete equipment as technology advances | |

| Maintenance and repair costs may be covered by the lessor, depending on the lease agreement | Responsibility for maintenance and repair costs lies with the owner | |

| More flexibility to switch equipment as business needs change | Less flexibility to change equipment as business needs evolve |

Can You Get Startup Equipment Financing With Bad Credit?

You can get most loans even if you have a bad credit score. Should you? That’s a different story. Those with bad credit will almost always be given higher interest rates. This means you’ll end up paying more over the life of the loan than someone with a better credit score. Additionally, you may not be able to take out a large loan since your lower credit score may indicate poor borrowing habits in the past.

Any business owner with bad credit should ask themselves these questions before opting for financing:

- Can you handle potentially high monthly payments due to a high interest rate? With poorer credit, you may have interest rates in the 20% range, which can add a good chunk to your loan that you’ll need to pay off. Make sure this is something your business can handle.

- Could you get a co-signer with better credit to sign on to the loan with you? Co-signers should be family members or friends who have a good credit score that feels comfortable signing onto the loan with you. Their credit score can help you get a potentially better rate, but be aware that they are on the hook for payments if you fail to pay.

- Would equipment leasing work better? Not all leases require a credit score, so those with poorer credit may want to consider this option before full-blown financing.

Where To Find Equipment Financing for Startups?

There are numerous lenders that offer business equipment financing that will be especially helpful for startups. Whether you’re looking for large equipment loans, no down payment, or flexible credit score requirements, there are options for you. Here are just four best equipment financing companies to consider:

- Lendio offers a huge range of loan amounts between $5,000 - $5 million. You can take these loans out for anywhere between one and five years, and while interest rates through Lendio aren’t rock bottom, you may qualify for a rate as low as 7.5%.

- Credibly has potentially 24-hour turnaround times on their equipment financing, and you can apply online in about 10 minutes. If you don’t have a perfect score, Credibly may be for you, since they claim that about 90% of their applicants are at least pre-approved for financing.

- US Bank offers loan amounts up to $1 million, and they even let you finance multiple pieces of equipment with the same loan. Additionally, there’s no down payment required, and you’ll have terms between 24 – 60+ to choose from.

- National Financing has lower borrowing limits of $150,000 max, but they also offer leasing. You will need a credit score of 575 and you’ll have to have been in business for at least six months. But there’s almost no limitation to the equipment you can lease or finance.

When Is The Right Time To Use Equipment Financing?

Getting equipment financing is a process that business owners shouldn’t take lightly. Before getting pre-qualified for a loan, take a moment to think about if it’s the right move for your business. Equipment financing might be right for you when:

- You need it to run your business: Not all equipment is required right away to keep the business running. For equipment that is needed to make the product or service, this is worth financing since you’ll be out of business for a period without it.

- You have good credit: Good credit score will get you the rate and terms you want when financing. Bad credit borrowers may want to explore other options before jumping to equipment financing, but those with a positive credit history should consider financing.

- You want to direct cash elsewhere: If you need cash to direct towards the growth of your business, financing equipment can help you stretch payments over a longer period of time, leaving you with more cash to put back into your business.

Alternative Startup Funding Options You Could Try

Equipment financing isn’t always the best idea. When you don’t need a piece of equipment for a long period of time or your business can’t handle expensive monthly payments, financing could hurt your business more than it can help. Here are a few alternatives to consider:

- Leasing: Equipment leasing involves temporarily renting equipment from a lender. You likely won’t have to pay a down payment and monthly payments tend to be lower than if you finance equipment. The only downside here is that you won’t ever own the equipment, so you’ll be paying to lease it until you no longer need the equipment.

- Business credit cards: For smaller financing, business credit cards may come in handy. If you can get a card with 0% interest, you’ll have the length of the APR to pay off the purchase. Additionally, you’ll earn rewards on the purchase that you can use for business travel or needs.

- Business lines of credit: Business lines of credit are essentially a combination of a business loan and a business credit card. You’ll apply through a lender who can offer an equipment line of credit that you can draw on at any time. This is more short-term financing, so only less pricey equipment should be financed this way.

- SBA loans: These loans are provided by the Small Business Administration and offer financing of major assets up to $5 million. Your business will need to meet some more rigorous qualifications, but SBA loans come with some more favorable terms.

Maximizing Tax Benefits through Equipment Financing

Equipment financing is an important component of managing a business, and optimizing tax benefits through this procedure can help enhance a company's financial condition. Companies can finance equipment by buying it or leasing it, both of which have different tax effects. Businesses may make informed judgments to optimize their tax savings while acquiring the equipment they need to function efficiently if they understand the tax benefits connected with each strategy.

• Section 179 Deduction: Under this tax provision, firms can deduct the whole cost of eligible equipment purchased or leased during the tax year, up to a certain maximum. The deduction, however, is subject to annual ceilings and phase-out limits, so firms must be aware of the current rules.

• Bonus Depreciation: In addition to standard depreciation, bonus depreciation allows firms to deduct a percentage of the equipment cost in the first year of usage. This expedites tax savings, although it may not apply to all types of equipment or in all tax years.

• Deduction for Lease Payments: When businesses lease equipment, they may be eligible to deduct lease payments as a business expense. The deductibility of lease payments, however, is dependent on the type of lease and the exact terms of the agreement.

• Regular Depreciation: When firms buy equipment, they can deduct the cost of the equipment through regular depreciation during its useful life. This strategy offers long-term tax savings but does not provide immediate benefits such as bonus depreciation or Section 179 deductions.

• Financing Interest Deduction: Interest on equipment loans may be tax deductible as a company expense. The deductibility of interest, on the other hand, is dependent on the precise loan terms and the overall financial situation of the organization.

• Better Cash Flow Management: Financing equipment and capitalizing on tax breaks can help firms conserve cash flow, which is critical for day-to-day operations. To make educated judgments, businesses must carefully analyze the long-term expenses of financing as well as the possible tax benefits.

• Contact a Tax Professional: In order to maximize tax benefits, firms should engage with a tax specialist who can advise on the best financing solutions and tax techniques]. Tax rules can be complicated, and a professional can assist you in navigating the complexities and ensuring compliance with regulations.

Common Pitfalls in the Financing Process

Many individuals and businesses find it difficult to navigate the financing process since it entails making key financial decisions and necessitates a thorough understanding of numerous financial instruments, conditions, and criteria. Frequent financing errors can result in adverse outcomes such as greater costs, missed opportunities, or even financial losses. Being aware of these dangers can assist individuals and organizations in avoiding potential problems and securing the finest financing solutions to fit their needs[10].

• Lack of Planning: Failure to develop a sound financial strategy and a clear grasp of financing requirements can result in unfavorable loan terms[10]. When addressing lenders or investors, it is critical to have a clear vision of your financial goals and requirements.

• Poor Credit History: A poor credit history or insufficient credit can have a substantial impact on the financing process, resulting in higher interest rates or loan denials[10]. When requesting financing, it is critical to maintain a solid credit score and handle any credit difficulties.

• Inadequate Research: Failure to investigate various financing choices and lenders might lead to missed chances and unfavorable loan terms[10]. Take the time to investigate alternative financing options and compare offerings from several lenders to discover the best match.

• Ignoring the Overall Cost of Financing: Concentrating simply on interest rates without taking into account additional charges, such as fees and penalties, might result in greater overall financing expenses[10]. To make an informed decision, consider all associated costs.

• Ignoring Loan Terms and Conditions: Failure to thoroughly review and comprehend loan terms and conditions can lead to unpleasant surprises later on[10]. Before entering into any financial deal, carefully read and comprehend all terms.

• Insufficient Collateral: A lack of collateral might restrict borrowing possibilities and lead to higher interest rates[10]. To get advantageous loan terms, ensure that the collateral given is adequate and appropriately evaluated.

• Failure to Obtain Expert Advice: Failure to seek professional advice might result in costly mistakes and poor financing decisions[10]. Working with financial advisors or consultants can assist you in navigating the financing process and making sound decisions.