A business credit score is established using a variety of information, including the characteristics of your business, your payment and credit utilization history, key financial statement data, and public records. Ultimately, it’s a tool that helps lenders, vendors, and other creditors decide whether it makes sense to loan you money or extend your deferred payment options. This article explains what is a business credit score and how to manage it in a responsible manner.

What Is a Business Credit Score?

A business credit score is a numeric rating that provides an indication of a company’s creditworthiness. It reflects information from your business credit report, which includes payment history, outstanding debt, credit utilization trends, and other key financial data.

Ultimately, the score helps creditors decide whether to offer you credit and on what terms. From their perspective, the stronger the rating, the more likely you are to pay obligations in a timely manner.

Why Is It Important to Have a Good Credit Score?

The importance of building and maintaining a good credit score cannot be overstated. This holds true for a variety of reasons, including those outlined below.

- It gives you a better chance of securing lines of credit and other business loans, and it usually leads to more competitive interest rates. This is invaluable, especially when you encounter unexpected cash flow challenges or opportunities that require an influx of capital.

- A good credit score can help you negotiate more favorable terms with vendors. Most notably, this includes the monetary limit for credit purchases and the length of your credit period.

- A good credit score can also help you reduce insurance costs, as many underwriting models incorporate this data point into the rate-making process.

- A solid credit score can be a marketing tool for your business, serving to impress a variety of potential stakeholders. Beyond creditors and vendors, this includes investors, clients, and employees.

- Lastly, a good business credit score can help protect your personal credit score and possessions. Business and personal credit should be kept separate, but this isn’t always the case. Many businesses lack an adequate credit history, which forces their owners to utilize personal credit for financing. This troubling arrangement often puts their home and other personal assets at risk. Building and maintaining a good business credit score is the surest way to mitigate this exposure.

Having a poor credit impacts your loan terms and rates significantly, but it doesn't mean you can't get a business loan. Explore our list of the best small business loans with bad credit, reviewed and rated by financial experts, to learn more.

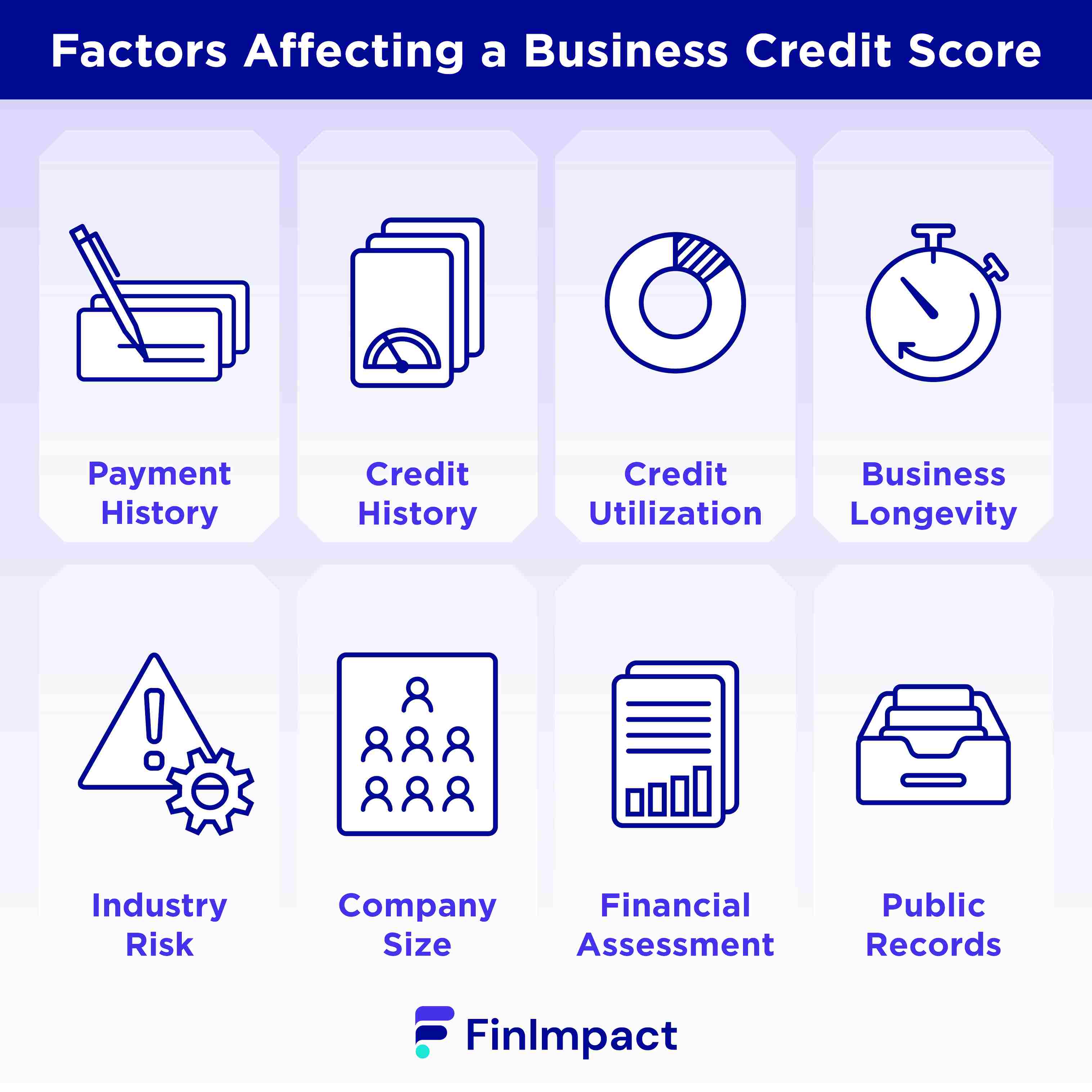

What Factors Affect a Business Credit Score?

Credit-specific Factors:

- Payment History – This is the most important factor for any business credit score; some scores are based completely on it. Fundamentally, it speaks to the timeliness of your business’s payments and whether any defaults have occurred.

- Credit History – This factor considers the length of time and ways your business has been utilizing credit. Mature businesses usually have a long history of transactions, outlining the types and amounts of credit utilized and the duration of the obligations. Conversely, new businesses have little to no history. For creditors, a longer history with ample transactions is much more informative than a limited history.

- Credit Utilization – This metric pertains to revolving lines of credit, such as credit cards. It measures the percentage of total allowable credit a business is using. Generally, a credit utilization below 30 percent is considered good. Ideally, this metric should be measured over time, but some rating organizations only incorporate point-in-time measures into their models.

Business-specific Factors:

- Business Longevity – This factor measures the length of time a business has been in existence. Generally, the longer the period, the better. Mature companies have a reliable track record and a relatively predictable business model. Newer companies have little to no track record and a high degree of uncertainty.

- Industry Risk – This factor considers the high degree of disparity across industries when it comes to risk. Some industries, like bars and restaurants, are historically much riskier than others, such as consulting. Accordingly, lenders view these types of industries very differently.

- Company Size – This factor considers the risks posed by companies of different sizes, whether measured by the number of employees or annual revenue. Generally, bigger companies are viewed as less risky than smaller firms.

- Financial Assessment – A very important, yet complicated, factor is the financial assessment. This considers the financial condition of a business as well as its operating performance. The evaluation of financial condition focuses on the balance sheet (assets, liabilities, and owners’ equity). The evaluation of operating performance focuses on the quality and stability of income and cash flows generated.

- Public Records – This factor incorporates all public records and filings into a business credit score. This includes Uniform Commercial Code filings (UCC) and other reports that disclose liens and judgments.

Business Credit vs Personal Credit: What’s the Difference?

Business credit is similar to personal credit, which is also referred to as consumer credit. Both entail the intentional assumption of a financial obligation, such as a loan from a bank or a liability to pay for goods or services received from a vendor.

For a business, obligations are assumed to support operations. For a consumer, obligations are assumed for a variety of reasons, which can range from meeting basic living needs to supporting lavish lifestyle choices.

Creditors are keenly interested in the creditworthiness of both businesses and consumers, and they often go to great lengths to assess it before putting their money at risk. The most commonly used assessment tool is the credit score.

For consumers, this consists of the FICO Score and the VantageScore. The FICO score ranges from 300 to 850, with most lenders requiring a minimum score of at least 600 for a personal loan. The VantageScore also ranges from 300 to 850, with a similar credit quality interpretation.

For businesses, four well-known organizations establish credit scores. Typically, their rating scheme ranges from 0 to 100, with most small business lenders requiring a minimum score of about 75. We discuss these organizations and their respective methodologies below.

How Does Business Credit Work?

The three major credit rating bureaus are Dun & Bradstreet, Equifax, and Experian. They formulate unique credit scores based on information gathered on your business, including the prominent factors discussed above. FICO also formulates business credit scores, but it is not a credit bureau. It operates as an aggregator, utilizing information obtained from Dun & Bradstreet, Equifax, and Experian to produce its scores.

Regardless of the source, all business scores are designed to provide an indication of creditworthiness, which helps creditors assess the risk of lending you money. That said, each organization has its own method of determining your company’s creditworthiness. They collect information from different sources, and they maintain unique, proprietary scoring algorithms. Not surprisingly, this can lead to scoring differences. Nevertheless, most of the time, the scores reflect a fairly high degree of consistency – at least directionally.

Key information on each of the rating organizations is provided below.