Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

Best Business Line of Credit to Get In 2024

A business line of credit offers small businesses flexibility to manage cash flow. You can borrow any amount you need and pay interest only on the amount you withdraw. These loans are efficient and economical. Below, you’ll find our picks for the best business line of credit on the market.

A Business Line of Credit (LOC) is a flexible, short-term financing option used to cover payroll, purchase inventory, handle emergency expenses, finance growth opportunities, and more. It differs from small business loans in that instead of being given a lump sum of money, you only draw on the specific amount you need.

Our team of financial experts reviewed and ranked the top online lenders to help you get funded. Read on to discover our choices for the six best business line of credit.

Nearly 25% of borrowers turn to online lenders to get the financing they need, according to a report from the Federal Reserve. However, not all lenders offer the same terms for business loan products and lines of credit.

In this review, we highlight the rates, fees and terms of each lender and explain what makes them a good option. We also share potential downsides of each lender, and provide a rating methodology you can use to select the best business line of credit for your needs.

Best Business Line of Credit In 2024 - Full Overview

GoKapital - Best for Early Payments

- Min. credit score 500

- Min. time in business: 2 years

- Borrow up to $55,000

- Loan Terms 2 to 10 years

- Line of credit APR. between 15% and 18%

- Wide range of loan offers

- Simple application process

- Instant pre-approval

- Easy online application

- Early payment discounts

- Low credit accepted

- Lower loan amounts

- Interest rates can be high

GoKapital offers early payment discounts to those that are able to pay their line off sooner than it’s due. If you need a chunk of money (up to $55,000) and know you can pay it off prior to one year, GoKapital is worth looking into.

Main Features

GoKapital business lines of credit range from $5,000 to $55,000 with terms of six, nine, or 12 months. Payments are made weekly, and you only pay for the funds that you use. To qualify, you need to have a minimum credit score of 620 and be in business for at least three years. You also must have $240,000 per year in annual revenue.

Credibly: Best for Bad Credit

- Min. Credit Score: 550+

- Min. Time in Business: 6 months

- Lines of credit up to $250,000

- Borrow up to $400,000 in working capital

- Term loan rates range between 8-25%

- Working capital factor rate starts at 1.09

- Simple application process

- As soon as same day funding

- Open to high-risk industries

- Low minimum credit score requirement (550)

- Lenient qualification standards

- Same-day funding

- Origination fee may apply

- Difficult to increase credit limit

Credibly offers unsecured and secured business lines of credit with low interest rates starting at 4.8%. Well-qualified borrowers may receive flexible credit lines as high as $250,000. In addition to competitive APRs and high maximum borrowing potential, Credibly also has solutions for borrowers with bad credit. The online lender accepts applicants with personal FICO scores as low as 560, but borrowers with lower credit scores or other increased borrowing risk factors shouldn’t expect to receive the lender’s lowest interest rates.

Main Features

Credibly gives would-be borrowers the chance to prequalify online for a business line of credit. Thanks to the online lender’s more forgiving qualification requirements (e.g., 550 FICO score, $50,000 in annual revenue, and six months or more in business), you may have an easier time opening a business line of credit from Credibly than you would elsewhere.

SMB Compass: Best for Large Credit Lines

- Loans up to $10 million

- Min. credit score: can go as low as 550 for certain loans

- Min. time in business: 1+ years in business, no startups

- Funding times: 5 to 7 days for term loans and 24 - 48 hours for line of credit

- Flexible terms: 2 – 10 years for term loans

- Interest Rates: starting at 8.99% for term loans

- Applying does not impact credit score

- Nine loan products to choose from

- Low, competitive rates

- Large loan amounts

- Excellent customer service

- Poor credit not accepted

- Not available in all states

- Must be in business at least one year

- High revenue requirements

Business lines of credit allow you to use the money up to your maximum limit, pay it off, and use it again. SMB Compass offers some of the largest lines of credit (up to $5 million) with low rates and fast funding times. Qualifying for a line of credit from SMB Compass can be a bit stricter than other lenders, as they require two years of business history and $300,000 or more in annual revenue. If you don’t meet these requirements, SMB Compass offers eight other lending products that could be a better fit.

Main Features

SMB Compass offers nine different types of small business loans to borrowers, including business lines of credit up to $5 million. Their mission is to make loans more accessible to small business borrowers by providing cost-effective and flexible lending solutions. SMB Compass business lines of credit range from $10,000 to $5 million with revolving terms. Rates start at 8.99% for qualified borrowers. The lender has currently provided more than 1,200 U.S. businesses with more than $250 million in financing. To apply, simply fill out their easy online application. It takes just a few minutes and will not impact your credit score. If approved, funding can be dispersed within 24 hours.

Bluevine - Best for Startups

- Funding up to $250,000

- Min. credit score: 625

- Min. time in business: 6 months

- Interest rates starting at 6.2%

- Loan Repayment 6-12 months terms

- Quick and simple application

- Competitive interest rates

- Fair credit score may qualify

- Monthly and weekly payment options

- Higher revenue requirements

- Not available nationwide

Bluevine offers a business line of credit with the potential for high credit limits (up to $250,000) and low interest rates (as low as 4.8%) for well-qualified borrowers. Not only can Bluevine’s terms compete with traditional financial institutions, it also offers a streamlined application common to online lenders.

Main Features

Your business will need to be in operation for at least six months to qualify for a line of credit from Bluevine—a time requirement that’s half of what some other lenders require. However, the lender also has a minimum monthly revenue requirement of $10,000, which could be difficult for some to satisfy. You must repay each draw within six or 12 months, and the lender offers both fixed weekly and monthly payment options.

Backd - Best for Large Loan Amounts

- Borrow up to $750,000

- Min. Credit Score: 640

- Min. Time in Business: 2 years

- APR for the line of credit product starts at 35%

- Industry best factor rate for MCA - as low as 1.10

- Flexible repayment terms up to 16 months

- Get funding in as little as 24 hours

- Check your rate with a soft credit pull

- Easy online application

- Instant lending decisions

- Fast funding times

- Large loan amounts: Up to $2 million

- Flexible payment options: Daily, weekly, or semi-monthly

- Not available to startups: Must be in business for one year

- Not all industries qualify

- Rates not disclosed

Backd has a unique business model in that they tailor their loans to each individual business. Backd was founded in 2018 and so far have helped fund more than $1 billion to over 10,000 small businesses. If your small business is in need of a large loan amount, flexible payment options, and a loan tailored to your specific practice, Backd can help provide you with the funding you need.

Main Features

Backd offers two types of business loans: working capital loans and business lines of credit. If you need regular access to funding, a business line of credit may be your best choice. Rather than receive one lump sum, you receive a line of credit that you can draw on as-needed. Once you pay it back, you can use it again. Lines of credit range from $10,000 to $750,000 and terms are unlimited.

To qualify, you need to be in business for two years, have $200,000 or more in annual revenues, and 640+ FICO score.

Lendzi - Best for Businesses With High Revenue

- Business line of credit up to $250,000

- Min. credit score: at least 500

- Min. time in business: 6 months

- Borrow up to $400,000 in working capital

- Equipment financing up to $2 million

- See your options without hurting your credit

- Flexible terms: 3 to 15 months

- Excellent customer reviews on independent review sites

- Get funding in as little as 24 hours

- Multiple lenders to choose from

- Poor credit is accepted

- Thousands of 5-star reviews

- Competitive rates

- Rates can be high for those with poor credit

- Annual income requirements may be high

Lendzi was founded in 2020 and partners with more than 75 lenders, making them an excellent choice for those that are looking to explore their options. They are also a direct lender themselves, offering a line of credit up to $250,000 to qualified borrowers. One thing that makes Lendzi stick out amongst other lenders is their willingness to work with business owners who have previously been denied a loan. If this sounds like you, we recommend inquiring with Lendzi.

Main Features

Lendzi offers business lines of credit directly to borrowers up to $250,000 with terms of six to 12 months. Rates start at 6.20% for 26-week payments. Applying takes just a few minutes and will not impact your credit score. From there, a representative from Lendzi will give you a call to find out more about your business and review your options together. This is an excellent perk, as having someone to guide you along the way can make the process much simpler and more enjoyable. To qualify, Lendzi prefers a credit score of 625 and $180,000 in annual revenue.

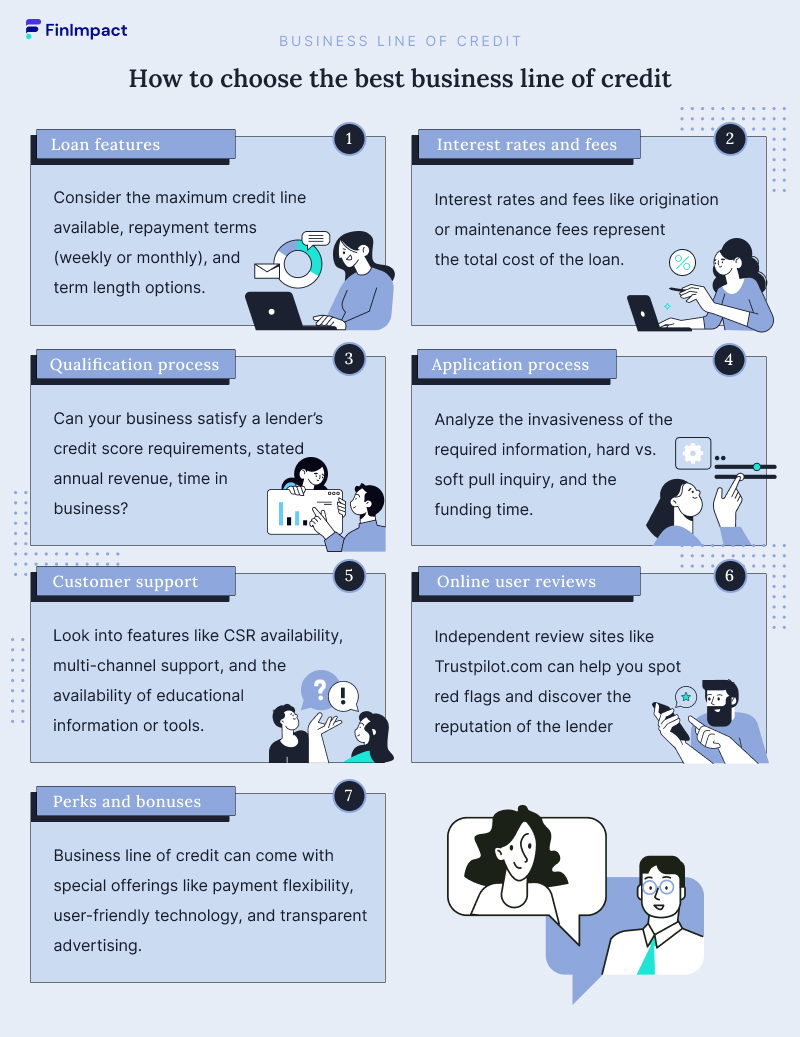

How to Choose the Best Business Line of Credit

When choosing a line of credit for your business, there are numerous details you’ll want to review. Below are some of the key factors our experts considered when ranking the top lenders.

- Qualification Process: Can your business satisfy a lender’s credit score requirements, stated annual revenue, time in business, etc.? If not, that business line of credit is probably a poor fit for you.

- Interest Rates and Fees: Consider both interest rates and fees to get a clear picture of the cost of borrowing. Note that some LOCs might feature usage fees, origination fees, or maintenance fees that could offset the perceived savings of a lower rate.

- Other Loan Features: Details like the maximum credit line available, repayment term (i.e., weekly vs. monthly), and more matter when you’re shopping for a business LOC.

- Application Process: Pay attention to each lender’s process and funding speed. Online lenders often offer faster funding; whereas SBA lenders and traditional financial institutions may take weeks or even months for funding.

- Customer Support: The level of customer support a lender offers is another important detail to consider. Can you talk to a live representative? Are the business hours convenient? Answers to such questions matter when choosing the best business LOC for your company.

- Online User Reviews: No lender has a perfect track record in terms of customer satisfaction, yet independent review sites like Trustpilot can help you spot red flags and discover whether the lender has a better or worse reputation than average.

- Perks and Bonuses: Some business LOCs come with special offerings that could benefit you. Payment flexibility, advanced or user-friendly technology, and transparent advertising are a few examples of perks that you might discover.

What is a Business Line of Credit?

A business line of credit is a flexible form of financing that lets your company borrow multiple times against the same credit line. As you repay all or a portion of the money you borrow (plus interest and fees), you should have access to make future draws from the same lender without submitting a new application for financing.

How Does a Business Line of Credit Work

A business line of credit enables business owners to withdraw funds whenever needed. The borrower can keep withdrawing funds, as long as that borrower keeps current on loan repayments and doesn’t go over the credit limit.

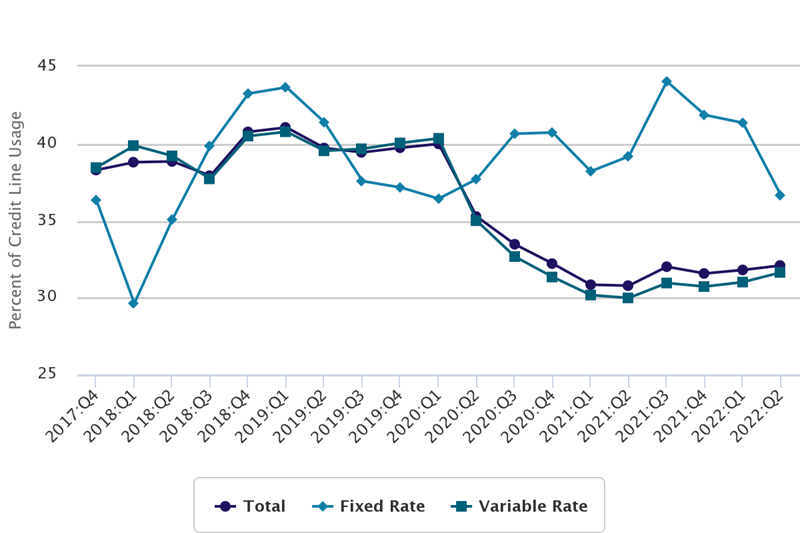

Business credit line use has remained stable over the past year at 32%, even as small business loans decreased after the expiration of the Paycheck Protection Program. However, rates for both credit lines and term loans have continued to increase.

Source: Federal Reserve Bank of Kansas City

To get a business line of credit, you’ll need to prove your business is legitimate. Expect the lender to ask how long the business has been in existence – six months or more is a good rule of thumb for loan approval. You’ll also need to show your minimum annual revenue flow, which proves you have the ability to repay the line of credit.

A good rule of thumb here is annual revenues equal or higher than your line of credit loan request (i.e., if you’re asking for a LOC of $25,000, you’ll need to show that, at minimum, your business revenues exceed $25,000 annually).

Who Can Use A Business Line of Credit?

Business lines of credit are suitable for established businesses with large recurring expenses. Businesses generally use a business line of credit for everyday operations such as payroll, supplies, general cash flow, seasonal inventory, etc. Some firms also use equipment lines of credit to finance their operation.

According to data from the U.S. Bureau of Labor Statistics, about 20% of new businesses fail during the first two years. Historically, cash flow problems are among the top reason for business closures, regardless of the economic environment

Even if cash flow is sufficient, every business has rough periods. Successful maintenance of any company requires regular cash flow. Many companies apply for a line of credit and only use it when they need it.

To be eligible, you will need to be in business at least six months, with annual revenue of $25,000 or more. Additionally, applicants may need a credit score of 600 or above. Lines of credit usually need to be repaid within 3-12 months and are a form of short-term financing.

APR rates can range from 9%-99% depending on credit history and annual business turnover, among other variables. While the rates can be high, this is offset because businesses only need to use what they require and only pay interest on what they borrow.

How to Get a Business Line of Credit

Below are five general steps you can take to open a business line of credit.

- See where you stand. When you apply for a business line of credit, the lender may review details like your credit score (personal and business), time in business, and annual income. It’s critical to know where you stand in each category.

- Determine if you’re eligible. Make a list of lenders offering business lines of credit with eligibility criteria you can likely satisfy. If you know you have fair credit and a lender requires good credit, you shouldn’t include the lender on your list of possible funding sources.

- Gather your documents. Many lenders will require you to submit documentation along with your financing application. Having your business tax returns, business bank statements, and other financial reports ready could speed up the funding process.

- Shop around. Comparing interest rates, fees, and benefits from multiple lenders can help you find a business line of credit that’s best for your situation.

- Apply. Once you settle on your preferred business line of credit, it’s time to apply. Be sure to fill out the complete application and send in any documentation the lender requests promptly.

Business Lines of Credit vs. Business Credit Cards vs. Loans: What's the Best Option

About 33% of small businesses applied for some kind of financing last year, according to the 2021 Small Business Credit Survey (SBCS) from the Federal Reserve. This include credit cards, lines of credit, and/or term loans.

Business Line of Credit vs. Business Credit Cards

Business credit cards and business credit lines own the same financial lineage – they both offer business owners access to much-needed working capital. Typically, business lines of credit offer higher credit limits than business credit cards, so if you’re in need of a large amount of capital, a line of credit may be your best option.

- A small business line of credit: A line of credit is a revolving loan. Once the line of credit is approved, the business owner can access the funds at any time. The borrower repays the funds used from the line of credit either daily, weekly, or monthly, with interest.

- A business credit card: A business credit card also offers business owners access to capital up to a certain credit limit. The main perk of a business credit card is earning card rewards, such as cashback, frequent flier miles, and discounts on common business services. Keep in mind, though, that credit limits are typically lower than with business lines of credit.

Business Line of Credit vs. Small Business Loan

Business lines of credit and small business loans both provide capital to corporate borrowers. But there are a few key differences between these products. Business lines of credit tend to be more flexible but demand higher interest rates. Business loans may offer higher loan amounts but stricter criteria.

- A business line of credit: This product is a good choice if you need funds to cover business expenses and expect to be able to pay the loan back fast. Interest rates are typically higher than loans, but you’ll pay only for the amount of credit you use.

- A small business loan: Term loans offer set terms and a fixed repayment schedule. You’ll receive the lump sum you’re approved for and begin paying back the debt right away.

Secured vs. Unsecured Line of Credit

One element that a line of credit has in common with a term loan is the possibility to be secured or unsecured. Here are some of the key differences between a secured and unsecured business line of credit.

- Unsecured business line of credit: If a lender is comfortable with the risk profile of the borrower, they may approve an unsecured business line of credit, meaning that they don’t demand collateral. This is usually the case with well-established companies that have a good revenue record and are requesting a smaller amount (generally less than $100,000).

- Secured business line of credit: when a lender feels there’s a higher level of risk, they may insist upon a secured line of credit. In this situation, they will demand some form of collateral – an asset belonging to the company that the lender can claim if the borrower defaults on the loan.

Online lenders typically offer unsecured lines of credit, which are popular with small businesses that need help with working capital. In a Fed survey, 79% of borrowers said that meeting operating expenses was their reason for applying for unsecured business financing.

Final Thoughts

A business line of credit can provide a financial cushion when your business experiences a cash flow crunch. If you anticipate slow seasons in your business, you can apply for a business line of credit in advance, long before your business needs to access the funds This preliminary action allows your business to stay afloat during hard times and gives you peace of mind when it comes to the financial security of your business.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!

Related Loan Picks

Best Small Business Loans

Read MoreBest Working Capital Loans

Read MoreBest Startup Business Loans

Read More