| All content presented here and elsewhere is solely intended for informational purposes only. The reader is required to seek professional counsel before beginning any legal or financial endeavor. |

Working capital is a critical aspect of a company's financial health. It refers to the funds available to meet short-term obligations and keep the business operating smoothly. Effective management of working capital is essential for any business, regardless of size or industry. In this article, we will cover various aspects, including how to find working capital, manage it, and why it is important.

How Is Working Capital Calculated

Calculating working capital is an essential step in understanding a company's financial health. It helps business owners identify potential cash flow issues and make informed decisions about financing and investments. In this section, we will explain how to calculate working capital and provide examples to help readers understand the concept better.

Working Capital Formula

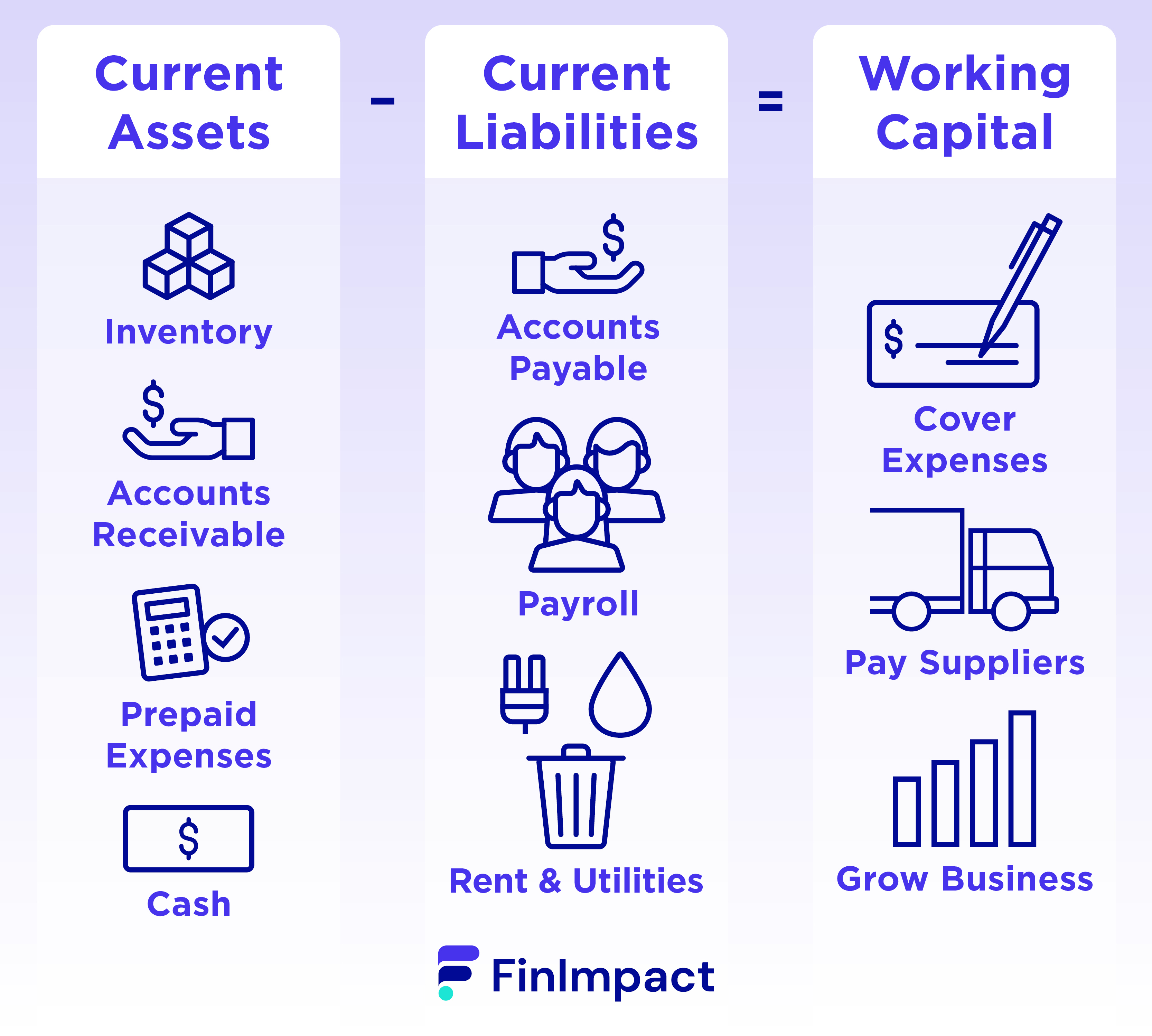

Working Capital = Current Assets - Current Liabilities

Working capital is a measure of a company's short-term financial health, representing its ability to meet its immediate obligations. It is calculated by subtracting current liabilities from current assets, and the resulting figure represents the funds available for day-to-day operations. Effective management of working capital, as well as working capital business loans, is essential for businesses to maintain liquidity, manage expenses, and take advantage of growth opportunities.

Components Of Working Capital

Working capital is a key financial metric that measures a company's ability to meet its short-term financial obligations. It is important to understand how to find working capital, which is calculated by subtracting a company's current liabilities from its current assets. What is included in working capital? Working capital is made up of several components that reflect a company's short-term financial position.

Current Assets

- Current assets are assets that can be easily converted into cash within a year or less. Here are some practical considerations when analyzing current assets:

- Common types of current assets include cash, accounts receivable, inventory, and prepaid expenses.

- Cash is the most liquid current asset, as it can be easily converted into other assets or used to pay current liabilities.

- Accounts receivable represent money owed to a company by its customers, and inventory represents the value of a company's unsold goods.

- The composition of a company's current assets can vary widely depending on its industry and business model.

Current Liabilities

Current liabilities are short-term financial obligations that must be paid within a year or less. Here are some practical considerations when analyzing current liabilities:

- Common types of current liabilities include accounts payable, short-term loans, and accrued expenses.

- Accounts payable represent money owed by a company to its vendors or suppliers, while short-term loans represent borrowed funds that must be repaid within a year.

- Accrued expenses represent expenses that have been incurred but not yet paid, such as salaries, rent, and utilities.

- The composition of a company's current liabilities can vary widely depending on its industry and business model.

In conclusion, understanding what is included in working capital is essential for assessing a company's short-term financial position. By analyzing a company's current assets and liabilities, businesses can make informed decisions about managing their cash flow, meeting their short-term obligations, and investing in growth opportunities.

| Component | Definition | Examples |

| Current Assets | Assets that can be easily converted into cash within a year or less | Cash, accounts receivable, inventory, prepaid expenses |

| Current Liabilities | Short-term financial obligations that must be paid within a year or less | Accounts payable, short-term loans, accrued expenses |

Why Working Capital Is Important

Working capital is a crucial metric for businesses, and its importance cannot be overstated. Essentially, working capital represents the funds a company has available to meet short-term financial obligations and keep the business running smoothly. The formula for working capital is straightforward: subtract current liabilities from current assets. Effective working capital management is vital for a company's success as it helps maintain liquidity, manage expenses, and take advantage of growth opportunities.

Benefits Of Effective Working Capital Management vs Consequences Of Poor Working Capital Management

Here's a table comparing the benefits of effective working capital management versus the consequences of poor working capital management:

| Benefits of Effective Working Capital Management | Consequences of Poor Working Capital Management | |

| Improved liquidity | Enables businesses to meet their financial obligations on time, avoid late payment penalties, and take advantage of growth opportunities | Inability to pay bills and debt, penalties for late payments, and difficulty taking advantage of growth opportunities |

| Reduced risk | Helps businesses avoid financial difficulties and bankruptcy | Increased risk of financial difficulties and bankruptcy |

| Improved cash flow | Helps businesses maintain adequate cash reserves and better predict future cash flow | Inadequate cash reserves and difficulty predicting future cash flow |

| Better inventory management | Enables businesses to optimize inventory levels and reduce inventory holding costs | Excess inventory leading to increased holding costs and potential obsolescence, or insufficient inventory leading to lost sales |

| Improved relationships with suppliers | Ability to negotiate better payment terms and discounts, leading to lower costs | Loss of supplier confidence and potential disruption of supply chain |

| Increased profitability | Effective management can increase profitability by reducing costs and improving cash flow | Poor management can lead to reduced profitability due to increased costs and missed opportunities |

| Improved credit rating | Effective management can improve a company's creditworthiness and ability to obtain financing | Poor management can lead to a poor credit rating and difficulty obtaining financing |

Limitations Of Working Capital

Working capital is an important metric for assessing a company's short-term financial health. However, it does have some limitations that should be taken into consideration when evaluating a company's overall financial position.

Does Not Account For Long-Term Investments

Working capital only reflects a company's short-term financial position and does not account for long-term investments. Here are some practical considerations when analyzing long-term investments:

- Companies with significant long-term investments may have a high working capital ratio, but may not be financially healthy in the long run.

- A high working capital ratio may indicate that a company is not investing enough in long-term growth opportunities, which could impact its long-term profitability.

- Investors should consider a company's long-term investment strategy when evaluating its overall financial position, and not rely solely on its working capital ratio.

Ignores Non-Cash Assets And Liabilities

Working capital only considers cash-based assets and liabilities, and does not account for non-cash items. Here are some practical considerations when analyzing non-cash assets and liabilities:

- Non-cash items, such as goodwill or deferred tax liabilities, can have a significant impact on a company's overall financial position, but are not included in the working capital calculation.

- Companies with significant non-cash items may have a low working capital ratio, but may still be financially healthy.

- Investors should consider a company's non-cash items when evaluating its overall financial position, and not rely solely on its working capital ratio.

How Can A Company Improve Its Working Capital?

Depending on the situation, a company can make the following changes to improve its working capital.

Take On Long-Term Debt

If your company needs an influx of cash, opting for a long-term loan can improve your working capital. After obtaining start-up working capital loans, your current assets will increase due to the newly available cash. But with a long enough loan term, your short-term liabilities will not increase too much.

Refinance Short-Term Debt

If you have short-term debt, consider refinancing into a long-term loan. Through this option, you are spreading out the cost of the loan. With that, the amount you owe the lender for the next 12 months may be lower than it once was. If appropriate for your business, opt for the longest payment terms available.

Sell Illiquid Assets For Cash

If you have illiquid assets, consider selling them for cash. The influx of cash will increase your current assets and improve your working capital. But only sell assets that your company can continue to thrive without.

Reduce Expenses

In addition to increasing your cash reserves, you can reduce expenses to improve your working capital. A few ways to reduce expenses include eliminating debt, cutting pay on unnecessary purchases, and potentially cutting back on labor costs.

Optimize Inventory Management

An optimized inventory management system will help you order just enough of an item. You don’t want to get stuck with unsellable inventory. If possible, look for ways to reduce overstocking and other superfluous expenses.

Automate Accounts Receivable

Automating accounts receivable processes can speed up how quickly you get paid. After all, business owners are often too busy to continuously follow up with a customer about getting paid. Enlist the help of an automated service to tackle this vital chore for you.

Incentivize Fast Payment

If your customers tend to stretch out to the end of their payment term, consider creating an incentive program for fast payment. For example, you could offer a discount to customers willing to pay for your product or service when it’s delivered.

Why A Company Might Need Additional Working Capital

It’s common for companies to seek more working capital in a variety of situations. Here’s when it might make the most sense:

Companies May Require Additional Working Capital For Various Reasons, Including:

- Growth opportunities: A company with adequate working capital is better positioned to seize opportunities in the market and expand its operations.

- Purchasing necessary assets: Some businesses require access to equipment or other assets to carry out their operations effectively. A lack of working capital can hinder their ability to make these purchases. In this case, a working capital loan for new business may be important.

- Smooth operations: Insufficient working capital can lead to disruptions in a company's operations, making it difficult to maintain a steady cash flow and meet financial obligations.

- Seasonal swings: Seasonal businesses may experience fluctuations in demand and cash flow, and may need additional working capital during off-peak periods to cover operating expenses until business picks up again.

Understanding what working capital is used for, as well as the different scenarios that may require additional working capital, can help companies plan and prepare for these situations. By maintaining sufficient working capital, businesses can ensure they have the necessary resources to pursue growth opportunities, purchase necessary assets, maintain smooth operations, and weather seasonal swings.

Here Are Some Additional Situations Where A Company Might Need Additional Working Capital:

Invest in research and development: Companies looking to develop new products or services may require additional working capital to fund research and development efforts.

Expand into new markets: Expanding into new markets can be costly, and businesses may need to increase their working capital to cover the associated expenses, such as marketing and advertising.

Respond to unexpected events: Businesses may face unexpected events, such as natural disasters or supply chain disruptions, that require additional working capital to maintain operations.

Manage seasonality in demand: Some businesses experience fluctuations in demand throughout the year, and additional working capital can help them manage cash flow during periods of low demand.

Cover unexpected expenses: Even well-managed businesses can face unexpected expenses, such as legal fees or equipment repairs, which can strain their working capital.

It's important for businesses to have a solid understanding of their cash flow needs and to plan ahead for any potential challenges. By doing so, they can make informed decisions about when and how to seek additional working capital.

What’s The Difference Between Working Capital And Net Working Capital?

Working capital is sometimes referred to as net working capital. But net working capital can be used to look at a longer time horizon. By taking a long-term look at a company’s finances, net working capital is a valuable metric. You can learn more about this metric and its meaning for small business finance from our article about working capital vs net working capital.

If you're interested in measuring your company's liquidity as an indicator of its short-term financial health, you might like to learn more about net operating working capital.

| Criteria | Working Capital | Net Working Capital |

| Definition | Working capital is the difference between current assets and current liabilities. | Net working capital is the difference between current assets and current liabilities, but current liabilities are subtracted from current assets that are not financed by short-term loans. but current liabilities are subtracted from current assets that are not financed by short-term loans. |

| Component | Includes all current assets and current liabilities of a business. | Includes all current assets and current liabilities of a business, but excludes current liabilities that are financed through short-term loans. |

| Significance | Indicates a company's ability to meet its short-term obligations. | Provides a more accurate representation of a company's liquidity by removing current liabilities financed by short-term loans. |

| Significance | Indicates a company's ability to meet its short-term obligations. | Provides a more accurate representation of a company's liquidity by removing current liabilities financed by short-term loans. |

| Calculation | Working capital = Current assets - Current liabilities. | Net working capital = (Cash + Accounts Receivable + Inventory) - (Accounts Payable + Short-term Debt). |

| Usage | Used to analyze a company's liquidity and operational efficiency. | Used to provide a more accurate representation of a company's liquidity, particularly when short-term loans are a significant source of financing. |

| Relationship to Cash Flow | Working capital changes are included in cash flow from operations. | Net working capital changes are included in cash flow from operations. |

| Limitations | Working capital does not consider the source of financing for current liabilities. | Net working capital only excludes current liabilities that are financed through short-term loans, and does not provide information on long-term liquidity. |

What Is Working Capital Management?

Working capital management is the process of managing a company's short-term assets and liabilities to ensure that it has enough cash flow to meet its day-to-day operating expenses. It involves managing cash, accounts receivable, inventory, accounts payable, and short-term debt. Proper working capital management ensures that a company can pay its bills, continue its operations, and grow without experiencing cash flow problems.

The Importance Of Working Capital Management

What is working capital management used for? Effective working capital management is essential for the success of any business. Here are some reasons why:

- Ensures that a company can pay its bills on time and avoid late payment penalties.

- Helps to improve a company's credit rating and ability to secure financing.

- Allows a company to take advantage of business opportunities as they arise.

- Helps to reduce the cost of capital by minimizing the need for expensive short-term borrowing.

- Provides a buffer against unexpected events that could impact a company's cash flow.

- Helps to improve the efficiency of a company's operations by optimizing the use of its resources.

- Enhances a company's overall financial health and profitability.

Strategies For Effective Working Capital Management

To effectively manage working capital, businesses can employ the following strategies:

- Set clear policies for accounts receivable and accounts payable.

- Implement an inventory management system to optimize inventory levels.

- Negotiate favorable payment terms with suppliers.

- Maintain a cash reserve for emergencies.

- Monitor and analyze cash flow regularly to identify potential issues.

- Evaluate the profitability of each product or service and adjust as necessary.

- Utilize technology and automation to streamline processes and reduce administrative costs.

Benefits Of Effective Working Capital Management vs Consequences Of Poor Working Capital Management

| Benefits of Effective Working Capital Management | Consequences of Poor Working Capital Management | |

| Improved liquidity | Enables businesses to meet their financial obligations on time, avoid late payment penalties, and take advantage of growth opportunities | Inability to pay bills and debt, penalties for late payments, and difficulty taking advantage of growth opportunities |

| Reduced risk | Helps businesses avoid financial difficulties and bankruptcy | Increased risk of financial difficulties and bankruptcy |

| Improved cash flow | Helps businesses maintain adequate cash reserves and better predict future cash flow | Inadequate cash reserves and difficulty predicting future cash flow |

| Better inventory management | Enables businesses to optimize inventory levels and reduce inventory holding costs | Excess inventory leading to increased holding costs and potential obsolescence, or insufficient inventory leading to lost sales |

| Improved relationships with suppliers | Ability to negotiate better payment terms and discounts, leading to lower costs | Loss of supplier confidence and potential disruption of supply chain |

| Increased profitability | Effective management can increase profitability by reducing costs and improving cash flow | Poor management can lead to reduced profitability due to increased costs and missed opportunities |

| Improved credit rating | Effective management can improve a company's creditworthiness and ability to obtain financing | Poor management can lead to a poor credit rating and difficulty obtaining financing |

Current Ratio vs Working Capital

Current ratio and working capital are two important financial metrics that businesses use to assess their short-term liquidity. The current ratio measures a company's ability to meet its current liabilities with its current assets while working capital is the difference between a company's current assets and current liabilities.

While both current ratio and working capital provide insights into a company's ability to meet its short-term obligations, there are some key differences between the two metrics.

Understanding Current Ratio

The current ratio is a financial metric that compares a company's current assets to its current liabilities. It is calculated by dividing a company's current assets by its current liabilities. Here are some practical considerations when analyzing the current ratio:

- A current ratio of 1 indicates that a company's current assets are equal to its current liabilities.

- A current ratio above 1 indicates that a company's current assets are greater than its current liabilities, indicating a potentially healthy financial position.

- A current ratio below 1 indicates that a company's current liabilities are greater than its current assets, indicating potential financial difficulty.

- The ideal current ratio varies by industry, but a general benchmark is a current ratio of at least 1.5

Understanding Working Ratio vs Working Capital

While both current ratio and working capital provide insights into a company's short-term liquidity, they measure different aspects of a company's financial position. Understanding the differences between the two metrics can help businesses make informed decisions about managing their short-term obligations and achieving financial stability.

| Metric | Calculation | Interpretation | Ideal Benchmark |

| Current Ratio | Current Assets / Current Liabilities | Indicates a company's ability to meet its short-term liabilities with its current assets | At least 1.5 |

| Working Capital | Current Assets - Current Liabilities | Represents the amount of cash a company has available to meet its short-term obligations | Positive |

Strategies For Managing Working Capital

To effectively manage working capital, businesses can employ the following strategies:

- Set clear policies for accounts receivable and accounts payable.

- Implement an inventory management system to optimize inventory levels.

- Negotiate favorable payment terms with suppliers.

- Maintain a cash reserve for emergencies.

- Monitor and analyze cash flow regularly to identify potential issues.

- Evaluate the profitability of each product or service and adjust as necessary.

- Utilize technology and automation to streamline processes and reduce administrative costs.

Current Ratio vs Working Capital

Current ratio and working capital are two important financial metrics that businesses use to assess their short-term liquidity. The current ratio measures a company's ability to meet its current liabilities with its current assets while working capital is the difference between a company's current assets and current liabilities.

While both current ratio and working capital provide insights into a company's ability to meet its short-term obligations, there are some key differences between the two metrics.

Understanding Current Ratio

The current ratio is a financial metric that compares a company's current assets to its current liabilities. It is calculated by dividing a company's current assets by its current liabilities. Here are some practical considerations when analyzing the current ratio:

A current ratio of 1 indicates that a company's current assets are equal to its current liabilities.

- A current ratio above 1 indicates that a company's current assets are greater than its current liabilities, indicating a potentially healthy financial position.

- A current ratio below 1 indicates that a company's current liabilities are greater than its current assets, indicating potential financial difficulty.

- The ideal current ratio varies by industry, but a general benchmark is a current ratio of at least 1.5

Understanding Working Capital vs Working Capital

Working capital is the difference between a company's current assets and current liabilities. It represents the amount of cash a company has available to meet its short-term obligations. Here are some practical considerations when analyzing working capital:

- A positive working capital indicates that a company has enough current assets to meet its short-term liabilities.

- A negative working capital indicates that a company's short-term liabilities are greater than its current assets, which could indicate potential financial difficulty.

- Working capital can be improved by increasing current assets, decreasing current liabilities, or a combination of both.

- Maintaining adequate working capital is essential for the day-to-day operations of a business and for investing in growth opportunities.

While both current ratio and working capital provide insights into a company's short-term liquidity, they measure different aspects of a company's financial position. Understanding the differences between the two metrics can help businesses make informed decisions about managing their short-term obligations and achieving financial stability.

| Metric | Calculation | Interpretation | Ideal Benchmark |

| Current Ratio | Current Assets / Current Liabilities | Indicates a company's ability to meet its short-term liabilities with its current assets | At least 1.5 |

| Working Capital | Current Assets - Current Liabilities | Represents the amount of cash a company has available to meet its short-term obligations | Positive |

Confusing Short-Term Working Capital Needs With Long-Term Requirements

It's important for businesses to prioritize their expenses and determine which ones are short-term or long-term requirements. For instance, tightening working capital may help pay off a building, while extending debt terms can provide more short-term working capital. However, it's essential to balance short-term working capital decisions with long-term business costs.

The Significance Of Positive Working Capital

Positive working capital means a company can continue financing its operations for the foreseeable future. While a working capital line of credit can be tempting for significant purchases, specific loans are available for expenses like real estate. Therefore, businesses should consider reserving a working capital line of credit for short-term financing needs and using small business loans for more significant purchases.

Avoiding Unnecessary Fees

When working capital is tight, businesses may end up paying unnecessary fees to pay for expenses later. While this frees up funds in the short term, it can lead to significant costs over the life of the business. Therefore, businesses should determine the exact amount of working capital they need to avoid paying unnecessary fees.

Balancing Debt Obligations

When a company is burdened with too much debt, the monthly payment obligations can strain its working capital. As a result, it's critical for business owners to assess the costs of taking on debt versus a slower growth strategy.

Reevaluating Past Revenue For Financing Future Customers

Business landscapes change over time, and companies must reevaluate financing decisions on a case-by-case basis before financing future customers. Failure to do so can stretch working capital thin while waiting for new customers to pay for the product or service.

Strategies For Managing Working Capital

Working capital management involves implementing strategies to ensure that a business maintains enough liquid assets to meet its short-term obligations while still being able to invest in growth opportunities. Effective working capital management is critical to the success of a business. Here are some strategies that businesses can implement to manage their working capital:

Cash flow forecasting: Creating a forecast of future cash flows can help businesses to anticipate shortfalls in cash and take steps to address them before they become problems.

Efficient inventory management: Managing inventory levels carefully to ensure that the business has enough stock to meet demand without carrying too much inventory that ties up working capital.

Optimizing accounts receivable: Businesses can shorten the time it takes to receive payment by offering early payment discounts, offering payment plans, or payment reminders to encourage customers to pay their invoices promptly.

Lengthening accounts payable: Stretching out payment terms with suppliers can help businesses to maintain their cash balances while still meeting their obligations.

Negotiating with suppliers: Businesses can work with their suppliers to negotiate better payment terms, discounts, and prices to reduce costs and improve cash flow.

Avoiding overtrading: Overtrading occurs when a business expands too quickly without having enough working capital to support growth. This can lead to cash flow problems and even bankruptcy.

Regularly reviewing working capital: Regular reviews of working capital can help businesses to identify areas of inefficiency and take corrective action.

By implementing these strategies, businesses can effectively manage their working capital, improve their cash flow, and ensure they have the resources they need to grow and succeed.

Pros And Cons Of Working Capital Business Loans

Working capital business loans have advantages and disadvantages that businesses need to consider before taking on debt. This section will cover the pros and cons of working capital business loans and provide guidance on how to evaluate whether a loan is a right choice for a business.

| Pros | Cons |

| Provides quick access to funds | Typically has higher interest rates compared to other loan types |

| Can be used for various business purposes | May require collateral or a personal guarantee |

| Helps businesses maintain cash flow and cover day-to-day expenses | Short repayment terms may put pressure on cash flow |

| Offers flexibility in loan amounts and repayment terms | May not be suitable for long-term investments |

| Helps improve credit scores if payments are made on time | May lead to a cycle of debt if not managed properly |

| Allows businesses to take advantage of growth opportunities | Approval may be difficult for businesses with poor credit or financial history |

| Can help businesses stay competitive in the market | May involve additional fees such as origination fees |

Overall, working capital loans can be a useful tool for businesses to manage their cash flow and cover day-to-day expenses. However, businesses should carefully consider the pros and cons of working capital loans before applying and should have a clear plan for how they will manage the loan and repay it on time to avoid falling into a cycle of debt.

How To Secure A Working Capital Business Loan

Securing a working capital business loan can be a daunting task, especially for small businesses. This section will provide guidance on how to prepare a loan application, find the right lender, and improve the chances of approval.