| All content presented here and elsewhere is solely intended for informational purposes only. The reader is required to seek professional counsel before beginning any legal or financial endeavor. |

Working capital management is a critical aspect of any business, yet it is often overlooked or undervalued by many business owners. It refers to the management of a company's short-term assets and liabilities, which are essential for daily operations.

The management of working capital is crucial to ensure that a company has enough funds to pay for its expenses, debts, and other obligations, while still maintaining adequate cash flow.

Video: What Is Working Capital:

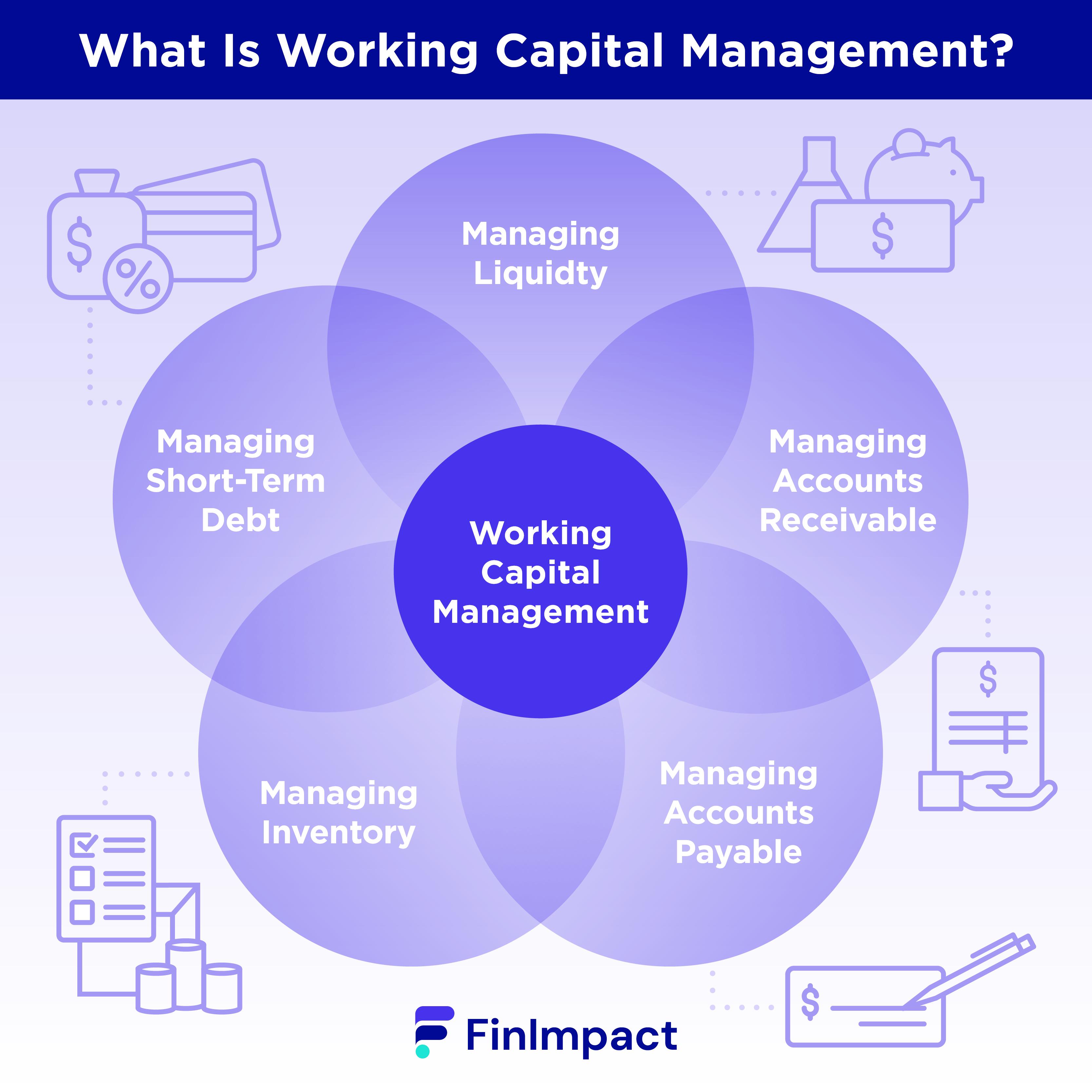

What Is Working Capital Management?

Working capital management refers to the process of managing a company's short-term assets and liabilities, such as inventory, accounts payable, accounts receivable, and cash. It involves optimizing the balance between these assets and liabilities to ensure that a business has sufficient cash flow to meet its short-term obligations while maintaining its daily operations.

Understanding working capital management, as well as effective practices, is crucial for businesses to remain solvent and profitable, as it ensures that a company can cover its expenses and debts while still having enough cash on hand to fund its growth and expansion.

Without proper management, a business may struggle to pay its bills, which could lead to cash flow issues, missed opportunities, and ultimately, failure. Therefore, working capital management is an essential function of financial management for businesses of all sizes and industries.

Key Components Of Working Capital Management

The key components of working capital management are as follows:

- Inventory Management: Inventory management refers to the process of managing the inventory levels of a business to ensure that it has sufficient stock on hand to meet customer demand while avoiding overstocking. This is important as excess inventory ties up valuable cash, while inadequate inventory can lead to lost sales.

- Accounts Receivable Management: Accounts receivable management involves managing the credit given to customers and ensuring that they pay their bills on time. This is crucial for maintaining cash flow and avoiding bad debts.

- Accounts Payable Management: Accounts payable management involves managing the payments made to suppliers and other creditors to ensure that bills are paid on time, but not too early, to preserve cash flow.

- Cash Management: Cash management involves managing the inflow and outflow of cash to ensure that a business has sufficient cash on hand to meet its short-term obligations while maintaining adequate liquidity.

- Working Capital Financing: Working capital financing involves securing financing to fund the day-to-day operations of a business, such as short-term loans or lines of credit.

- Forecasting and Planning: Forecasting and planning involves predicting future cash flow needs and developing strategies to meet those needs, such as increasing sales, reducing expenses, or securing additional financing. This is important for ensuring that a business can continue to operate and grow in the long term.

Effective management of these components is critical to the success of a business, as it ensures that the business has sufficient cash flow to meet its short-term obligations and support its growth and expansion.

Objectives Of Working Capital Management

The primary objectives of working capital management are to ensure that a company has sufficient liquidity to operate its day-to-day activities, manage short-term debts, and fund growth opportunities. Here are the key objectives of working capital management:

- Maintaining Adequate Cash Flow: One of the primary objectives of working capital management is to maintain sufficient cash flow to meet a company's daily operating expenses, such as rent, payroll, and utilities.

- Optimizing the Balance Between Assets and Liabilities: Working capital management aims to ensure that a company has a balanced mix of short-term assets and liabilities, which maximizes cash flow and minimizes the cost of capital.

- Minimizing the Cost of Capital: Effective working capital management can reduce the cost of capital by optimizing the use of existing assets and liabilities, reducing the need for expensive short-term financing, and improving creditworthiness.

- Managing Short-Term Debt: Working capital management also aims to manage short-term debt effectively, such as credit lines and accounts payable, to ensure that a company can meet its financial obligations without incurring excessive costs.

- Enhancing Profitability: By optimizing cash flow and minimizing the cost of capital, effective working capital management can contribute to enhanced profitability by increasing revenue and reducing expenses.

- Supporting Growth Opportunities: Finally, working capital management aims to ensure that a company has sufficient resources to pursue growth opportunities, such as expanding product lines, entering new markets, or acquiring other businesses.

The objectives of working capital management are closely tied to a company's financial stability, profitability, and growth prospects. By managing its short-term assets and liabilities effectively, a company can maintain its financial health and position itself for long-term success.

Factors That Affect Working Capital Needs

Effective management of working capital is critical to the success of any business, as it ensures that the company has sufficient cash flow to meet its short-term obligations and support its growth and expansion.

There are several internal and external factors that can affect a company's working capital needs, and understanding these factors is essential for effective working capital management.

Here is a table comparing internal and external factors that affect working capital needs:

| Factors | Internal | External |

| Sales Volume | Higher sales volume increases working capital needs. | Economic conditions, competition, and market demand affect sales volume. |

| Operating Cycle | Longer operating cycle increases working capital needs. | Industry practices and supplier terms affect operating cycle. |

| Business Model | Different business models require varying working capital levels. | Industry trends and market dynamics affect business model. |

| Efficiency | Efficient operations reduce working capital needs. | Economic conditions, market demand, and competition affect efficiency. |

| Management Style | Effective management reduces working capital needs. | Market volatility and changes in business environment affect management style. |

| Seasonality | Businesses with seasonal sales require higher working capital during peak seasons. | Seasonal trends and market dynamics affect seasonality. |

| Industry | Different industries require varying levels of working capital. | Industry trends, market competition, and government regulations affect industry dynamics. |

In summary, internal factors such as sales volume, operating cycle, business model, efficiency, and management style can all affect a company's working capital needs.

Meanwhile, external factors such as economic conditions, market demand, competition, supplier terms, seasonality, and industry trends can also significantly impact a company's working capital requirements.

Understanding and managing both internal and external factors is crucial for effective working capital management.

Factors That Affect Working Capital Needs

Working capital is the money that a company uses to fund its day-to-day operations. It represents the difference between a company's current assets and its current liabilities. A company's working capital needs can be affected by several factors, including:

- Industry: Different industries have different working capital needs. For example, companies in the retail industry typically require a larger amount of working capital to maintain inventory levels and cover operational expenses, while companies in the service industry may require less working capital.

- Sales Volume: Companies with higher sales volume generally require more working capital to cover expenses such as payroll, inventory, and accounts receivable. Conversely, companies with lower sales volume may require less working capital.

- Seasonality: Companies that experience seasonal fluctuations in demand may require more working capital during peak seasons to cover expenses such as increased inventory levels and labor costs.

- Growth: Companies that are experiencing growth may require more working capital to fund expansion plans, such as opening new locations or launching new products.

- Payment Terms: Companies that offer longer payment terms to customers may require more working capital to cover expenses until payment is received. Similarly, companies that negotiate longer payment terms with suppliers may require less working capital in the short term.

- Operating Efficiency: Companies that have streamlined their operations and are able to collect payments from customers quickly and efficiently may require less working capital than companies that have inefficient processes.

- Economic Conditions: Economic conditions can affect a company's working capital needs. For example, during a recession, companies may require more working capital to cover expenses while waiting for payments from customers, as customers may be slower to pay during tough economic times.

Benefits Of Effective Working Capital Management

Effective working capital management can bring several benefits to a company, including:

- Improved Cash Flow: Effective working capital management helps a company to generate more cash flow by reducing the time it takes to convert inventory and accounts receivable into cash. This improves the company's ability to meet its financial obligations and invest in growth opportunities.

- Better Financial Stability: Efficient management of working capital can help a company to maintain financial stability by ensuring that it has sufficient cash reserves to cover its short-term obligations. This can also help the company to weather economic downturns or unexpected events.

- Lower Financing Costs: By reducing the need for external financing, effective working capital management can lower a company's financing costs. This can free up resources that can be used for other purposes such as research and development or marketing.

- Improved Vendor Relationships: Effective working capital management can help a company to negotiate better payment terms with suppliers. This can result in lower costs for inventory and supplies, which can help to improve the company's profitability.

- Better Creditworthiness: Efficient management of working capital can improve a company's creditworthiness and make it more attractive to lenders and investors. This can make it easier for the company to secure financing at favorable terms, which can help to fuel growth and expansion.

- Improved Profitability: By reducing the cost of financing and improving cash flow, effective working capital management can help to improve a company's profitability. This can also help to increase shareholder value and enhance the company's reputation in the market.

Tips For Working Capital Optimization

It’s clear that working capital optimization is a useful priority. Here are some effective working capital management strategies you can implement.

1. Manage Procurement and Inventory

Inventory and procurement systems are some of the most important factors in your working capital. With that, taking steps to optimize these systems is key.

Start with tracking: It can be difficult to make adjustments to these systems without careful tracking in place. If possible, set up a tracking system that collects information about your inventory.

Make reasonable decisions about demand: Instead of ordering inventory with an optimistic mindset, make your inventory orders based on hard data.

2. Pay Vendors on Time

It’s difficult to thrive as a business if you are consistently late with paying your vendors. Late payments lead to bad feelings: When you don’t make payments on time, it can be challenging to get access to the materials you need in the future. Plus, suppliers are more likely to negotiate better terms for products with customers that pay on time.

3. Improve the Receivables Process

Everyone wants to get paid on time. As a business, it’s important to build out the accounts receivables process to streamline getting your money for goods and services.

Send out invoices ASAP: Although sending invoices can be a chore, it’s a critical part of getting paid. Don’t skip this task.

Enlist the help of technology: Use an invoicing reminder system that contacts customers with their due date is approaching.

Incentivize on-time payments: If you want to speed up payments, make an incentive program. Consider offering a discount to customers that pay in full when they receive the goods.

4. Manage Debtors Effectively

Providing debt to customers is sometimes unavoidable as you grow your business. If you provide financing, negotiate repayment terms that work well for your business.

Create a short repayment term: Look for ways to get the funds as soon as possible.

Run credit checks: Avoid approving a loan to a borrower with a bad track record.

Working Capital Management Solutions

Working capital management involves managing a company's short-term assets and liabilities to ensure that it has sufficient cash flow to meet its operational needs. Effective working capital management techniques are important to a company’s success.

Here are some solutions that companies can implement to improve their working capital management:

- Cash Flow Forecasting: Companies can implement cash flow forecasting to better understand their cash inflows and outflows. This can help to identify potential shortfalls in cash flow and allow the company to take corrective action.

- Inventory Management: Companies can implement inventory management solutions to optimize their inventory levels and reduce excess inventory. This can help to free up cash and reduce carrying costs.

- Accounts Receivable Management: Companies can implement accounts receivable management solutions to improve their collection processes and reduce the time it takes to receive payments from customers. This can improve cash flow and reduce the need for external financing.

- Accounts Payable Management: Companies can implement accounts payable management solutions to optimize their payment processes and negotiate better payment terms with suppliers. This can improve cash flow and reduce financing costs.

- Short-term Financing: Companies can use short-term financing options such as lines of credit or factoring to bridge cash flow gaps and meet short-term obligations. However, it is important to use these financing options judiciously as they can be expensive.

- Supplier Relationship Management: Companies can implement supplier relationship management solutions to establish strong relationships with suppliers and negotiate favorable payment terms. This can help to reduce costs and improve cash flow.

- Working Capital Metrics: Companies can use working capital metrics such as the current ratio, quick ratio, and cash conversion cycle to monitor their working capital performance and identify areas for improvement. This can help to ensure that the company's working capital management practices remain effective over time.

Key Performance Indicators (KPIs) For Measuring Working Capital Efficiency

Key Performance Indicators (KPIs) are important metrics used to measure the efficiency and effectiveness of working capital management practices in a company. By monitoring these KPIs, a company can gain insights into its financial health and identify areas for improvement. Here are some of the key KPIs used for measuring working capital efficiency:

- Current Ratio: This measures a company's ability to pay off its short-term obligations using its current assets. A higher current ratio indicates a stronger liquidity position.

- Quick Ratio: This measures a company's ability to pay off its short-term obligations using its most liquid assets. A higher quick ratio indicates a stronger liquidity position.

- Cash Conversion Cycle (CCC): This measures the time it takes for a company to convert its investments in inventory and accounts receivable into cash. A lower CCC indicates better efficiency in managing working capital.

- Days Sales Outstanding (DSO): This measures the average number of days it takes for a company to collect payments from customers. A lower DSO indicates better efficiency in managing accounts receivable.

- Days Payable Outstanding (DPO): This measures the average number of days it takes for a company to pay its suppliers. A higher DPO indicates better efficiency in managing accounts payable.

- Working Capital Turnover: This measures the amount of revenue generated per unit of working capital invested. A higher working capital turnover indicates better efficiency in managing working capital.

| KPI | Formula | Significance |

| Current Ratio | Current Assets / Current Liabilities | Measures the liquidity position of the company. |

| Quick Ratio | (Current Assets - Inventory) / Current Liabilities | Measures the company's ability to pay off short-term obligations using its most liquid assets. |

| Cash Conversion Cycle | Days Inventory Outstanding + Days Sales Outstanding - Days Payables Outstanding | Measures the time it takes for a company to convert investments in inventory and accounts receivable into cash |

| Days Sales Outstanding | (Accounts Receivable / Total Sales) x Number of Days | Measures the average number of days it takes for a company to collect payments from customers |

| Days Payable Outstanding | (Accounts Payable / Cost of Goods Sold) x Number of Days | Measures the average number of days it takes for a company to pay its suppliers |

| Working Capital Turnover | Revenue / Working Capital | Measures the amount of revenue generated per unit of working capital invested |

By monitoring these KPIs, a company can gain a deeper understanding of its working capital management practices and identify areas for improvement. For example, if a company has a high DSO, it may need to improve its collection processes to reduce the time it takes to receive payments from customers.

Similarly, if a company has a low current ratio, it may need to increase its current assets or reduce its current liabilities to improve its liquidity position.

Trends And Developments In Working Capital Management

Working capital management is a critical component of any organization's financial strategy. With the ever-changing business landscape, companies need to keep up with the latest trends and developments in working capital management to stay competitive. Here are some of the emerging trends and developments in this field:

- Automation and Technology: The use of technology and automation is becoming increasingly important in working capital management. Companies are adopting advanced software solutions to streamline their financial processes and improve efficiency.

- Artificial Intelligence (AI) and Machine Learning (ML): The use of AI and ML is gaining popularity in working capital management as it helps companies identify patterns and trends in their financial data. This, in turn, enables them to make more informed decisions and improve their financial performance.

- Data Analytics: With the increasing availability of data, companies are leveraging data analytics to gain insights into their working capital management practices. By analyzing financial data, companies can identify inefficiencies and opportunities for improvement.

- Supply Chain Finance: This is a new trend that involves collaboration between buyers, suppliers, and financial institutions to optimize the flow of working capital across the supply chain. This trend is gaining popularity, particularly among large corporations.

- Sustainable Finance: There is a growing awareness of the importance of sustainable finance, which involves integrating environmental, social, and governance (ESG) factors into financial decision-making. This trend is gaining traction, particularly among socially responsible investors.

Working capital management is a constantly evolving field, and companies need to keep up with the latest trends and developments to stay ahead of the competition.

The adoption of technology, AI, and data analytics can help companies improve their efficiency, while supply chain finance and sustainable finance are emerging trends that can help companies optimize their working capital and contribute to a more sustainable future.

Final Word:

In summary, effective working capital management is essential for businesses to maintain financial stability and growth. By monitoring key performance indicators, companies can improve their cash flow, reduce risk, and optimize their working capital. Here are some FAQs on the topic: