| All content presented here and elsewhere is solely intended for informational purposes only. The reader is required to seek professional counsel before beginning any legal or financial endeavor. |

Working capital turnover ratio is a financial metric that measures a company's ability to efficiently utilise its working capital to generate revenue. This ratio is a key indicator of a company's financial health as it helps to determine how efficiently the company is managing its short-term assets and liabilities.

Working capital turnover ratio is widely used by investors, creditors, and analysts to evaluate a company's operational efficiency and profitability.

What Is Working Capital Turnover Ratio?

The working capital turnover ratio is a financial metric that measures a company's ability to generate revenue relative to its working capital, which is the funds that a company has available to cover its short-term operating expenses and debts.

Formula Of Working Capital Turnover

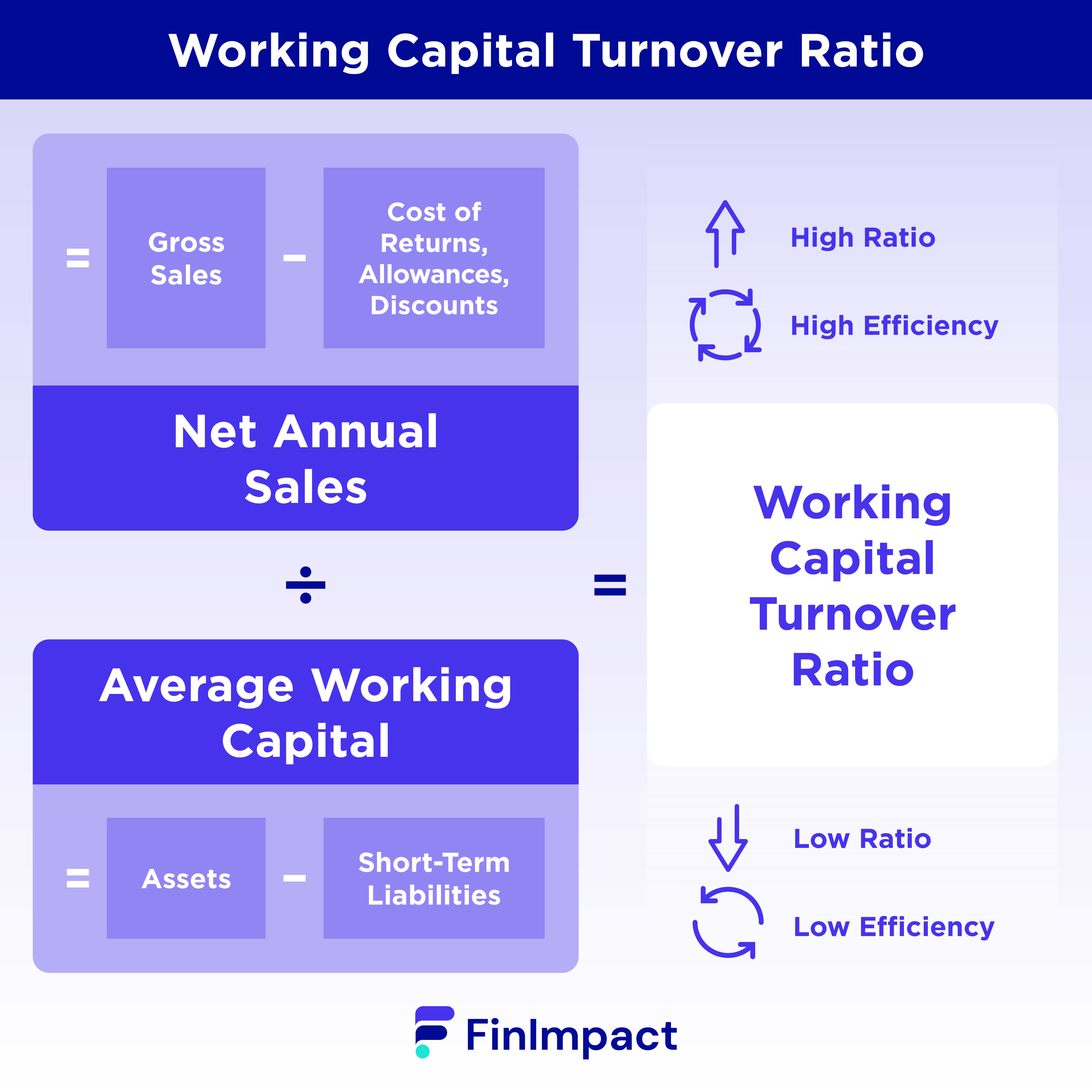

The working capital turnover ratio formula is:

Working Capital Turnover Ratio = Net Sales / Average Working Capital

where net sales refer to a company's revenue, which is calculated by subtracting the cost of goods sold from the total sales, and average working capital is calculated by adding together a company's current assets and subtracting its current liabilities, and then dividing the result by two.

How To Calculate The Working Capital Turnover Ratio

Here’s how to put that Working Capital ratio formula into action.

- Calculate average working capital: You can determine working capital by subtracting short-term liabilities from the company’s assets. Assets include notes receivable, prepaid expenses, and cash.

- Liabilities include accounts payable, wages payable, taxes, expected debt payments, dividend payables, and unearned revenue. You can find this number at multiple points during the year to find an average.

- Calculate net annual sales: Find the net annual sales for your company by looking in your books. Or you can calculate the number by subtracting the cost of returns, allowances, and discounts from your company’s gross sales.

- Divide net annual sales by average working capital: At this point, you’ll find the working capital turnover ratio.

An Example Calculation Of The Working Capital Ratio.

Here’s an explanation of how to calculate the working capital turnover ratio in 3 steps:

Step 1: Calculate the net sales

Net sales refer to a company's revenue, which is calculated by subtracting the cost of goods sold from the total sales. For example, if a company had total sales of $1,200,000 and cost of goods sold of $200,000, the net sales would be $1,000,000 ($1,200,000 - $200,000).

Step 2: Calculate the average working capital

Average working capital is calculated by adding together a company's current assets and subtracting its current liabilities, and then dividing the result by two. For example, if a company had current assets of $300,000 and current liabilities of $50,000, the working capital would be $250,000 (($300,000 - $50,000)/2).

Step 3: Calculate the working capital turnover ratio

The working capital turnover ratio is calculated by dividing the net sales by the average working capital. For example, if the net sales are $1,000,000 and the average working capital is $250,000, the working capital turnover ratio would be 4 ($1,000,000 / $250,000).

Overall, the working capital turnover ratio is a measure of how efficiently a company is using its working capital to generate revenue. A higher ratio indicates that a company is generating more revenue for each dollar of working capital, which is generally seen as a positive sign for investors and stakeholders.

What Does The Working Capital Turnover Ratio Tell You?

The working capital turnover ratio is a financial ratio that measures the efficiency of a company in generating revenue from its working capital. Working capital is the difference between current assets and current liabilities and represents the funds available to a company to finance its day-to-day operations.

The working capital turnover ratio is calculated by dividing a company's net sales by its working capital. The ratio provides insight into how well a company is using its working capital to generate sales. A higher ratio indicates that a company is generating more sales with its available working capital, while a lower ratio suggests that a company may not be using its working capital effectively.

By analysing the working capital turnover ratio, investors and analysts can gain a better understanding of a company's liquidity and operational efficiency. A high ratio indicates that a company is efficiently using its working capital to generate sales, while a low ratio may indicate that a company is struggling to convert its working capital into sales.

It is important to note that the working capital turnover ratio should be used in conjunction with other financial ratios and metrics to get a complete picture of a company's financial health.

Pros And Cons Of High Working Capital Turnover

Here’s a table that summarises the pros and cons of having a high working capital turnover ratio:

| Pros | Explanation | Cons | Explanation |

| Efficient use of working capital | A high working capital turnover ratio indicates that a company is using its working capital efficiently to generate sales, which can lead to higher profitability | Limited flexibility | A company with a high working capital turnover ratio may have limited flexibility to respond to changes in demand or unexpected events, as it has a smaller buffer of working capital. |

| Improved liquidity | A company with a high working capital turnover ratio can quickly convert its current assets into cash, which improves its liquidity and ability to meet short-term obligations. | Reduced growth potential | A high working capital turnover ratio can limit a company's ability to invest in growth opportunities, as it may not have enough working capital to support expansion. |

| Better inventory management | A high ratio can indicate that a company is managing its inventory well, reducing the risk of overstocking and obsolescence. | Higher risk of stockouts | A company with a high working capital turnover ratio may be at a higher risk of stockouts if it cannot quickly replace inventory as it sells out. |

| Increased competitiveness | A company with a high working capital turnover ratio may be better positioned to compete with its peers, as it can generate more sales with the same level of working capital. | Limited ability to offer credit | A high ratio may indicate that a company does not have enough working capital to offer credit to its customers, which can limit its ability to compete with peers who offer credit terms. |

| Reduced financial risk | A high working capital turnover ratio can reduce a company's financial risk, as it is less reliant on external financing to support its operations. | Higher reliance on suppliers | A company with a high working capital turnover ratio may need to rely more heavily on |

Advantages And Disadvantages Of Using The Working Capital Turnover Ratio

The working capital turnover ratio is one of many metrics you can use to assess the health of your business. In most cases, it’s not the only metric you should look at. Let’s explore the advantages and disadvantages of using this accounting principle.

Advantages Of Using The Working Capital Turnover Ratio

- Guarantees liquidity: Regularly monitoring your working capital can help you avoid running out of money. It’s easy to spot liquidity problems if you constantly check into this ratio.

- Enhances financial health: Typically, tracking this ratio encourages you to make changes that improve the overall financial health of the company.

- Boost the company’s value: A high working capital turnover indicates efficiency, which can increase the value of the company.

- Prevents disruptions: If your company is very efficient, it’s likely to avoid operational interruptions. That’s especially true if you are keeping an eye on the working capital.

- Increases profitability: As you increase your working capital turnover ratio, that can lead to more profits with the tweaks you make along the way.

Disadvantages Of Using The Working Capital Turnover Ratio

Of course, there are also some disadvantages to using the working capital turnover ratio:

- Doesn’t look beyond monetary factors: Monetary factors have a big impact on your company’s bottom line. But other non-monetary factors can influence the overall financial health of the company. For example, unhappy employees or a recession on the horizon aren’t accounted for.

- Open to misinterpretation: It’s easy to misinterpret a working capital turnover ratio. Although a high ratio is usually good, it can sometimes indicate unsustainable sales growth.

Here are some of the best ways to use the working capital turnover ratio:

- Assessing efficiency: The working capital turnover ratio is a useful tool for assessing a company's efficiency in managing its working capital. A higher ratio indicates that the company is using its working capital more efficiently to generate revenue, while a lower ratio indicates that the company may be using its working capital inefficiently.

- Comparing performance: The working capital turnover ratio can be used to compare a company's performance with its competitors or with the industry average. This can help identify areas where the company may be lagging behind its peers or where it may be performing better.

- Identifying trends: By tracking the working capital turnover ratio over time, a company can identify trends in its performance. If the ratio is increasing over time, it may indicate that the company is becoming more efficient in using its working capital. Conversely, if the ratio is decreasing over time, it may indicate that the company is becoming less efficient.

- Making investment decisions: The working capital turnover ratio can be used to help make investment decisions. A high ratio may indicate that the company is a good investment, as it is using its working capital efficiently to generate revenue.

Conversely, a low ratio may indicate that the company may not be a good investment, as it may be using its working capital inefficiently.

- Improving operations: By analyzing the working capital turnover ratio, a company can identify areas where it may be able to improve its operations. For example, if the ratio is low, the company may be able to improve its inventory management or collect its accounts receivable more quickly, which can improve its working capital turnover ratio.

Overall, the working capital turnover ratio is a useful tool for assessing a company's efficiency in using its working capital to generate revenue. By using this ratio, companies can identify areas where they may be able to improve their operations and make better investment decisions.

How The Working Capital Turnover Ratio Can Help Identify Cash Flow Problems

The working capital turnover ratio is a financial metric that measures a company's efficiency in using its working capital to generate revenue. This ratio can be used to identify potential cash flow problems and take corrective action to improve cash flow management.

Identifying Cash Flow Problems

One way the working capital turnover ratio can help identify cash flow problems is by revealing how well a company is managing its inventory and accounts receivable.

A low ratio may suggest that a company is carrying too much inventory or struggling to collect payments from its customers, which can tie up cash and lead to cash flow problems. Analysing the working capital turnover ratio can help a company identify potential cash flow issues early on and take corrective action to address them.

Improving Inventory Management

A low working capital turnover ratio may indicate that a company is carrying too much inventory, which can be a drain on cash flow.

By analysing the ratio, a company can identify areas where it may be able to improve its inventory management, such as reducing inventory levels or implementing more efficient inventory tracking systems. These actions can help free up cash and improve the company's cash flow position.

Enhancing Accounts Receivable Processes

Another potential cause of cash flow problems is delays in collecting payments from customers. Analysing the working capital turnover ratio can help a company identify areas where it may be able to improve its accounts receivable processes, such as offering incentives for early payment or implementing more effective collection procedures.

These actions can help improve cash flow by reducing the time it takes to collect payments and increasing the amount of cash available for day-to-day operations.

Increasing Operating Cash Flow

A low working capital turnover ratio may also indicate that a company is not generating enough cash from its operations to sustain its growth. In this case, the company may need to consider ways to increase its operating cash flow, such as reducing expenses or improving its sales processes.

By addressing these issues, a company can improve its working capital turnover ratio and ensure that it has the cash flow it needs to meet its financial obligations.

The Importance Of Working Capital Turnover Ratio In Managing Business Operations

The working capital turnover ratio is a vital metric for managing business operations as it helps to ensure that a company is using its working capital efficiently to generate revenue.

This ratio measures the number of times a company's working capital is used to generate revenue over a given period. A high working capital turnover ratio is indicative of efficient use of working capital, while a low ratio may indicate a less efficient use of working capital.

Here are some key points on the importance of the working capital turnover ratio in managing business operations:

- Efficient use of working capital: The ratio helps to ensure that a company is using its working capital efficiently to generate revenue. By improving the efficiency of working capital, a company can free up cash for other activities, such as investing in new projects or paying off debt.

- Planning and budgeting: By analysing the working capital turnover ratio, a company can develop more accurate financial forecasts and budget projections. This can help a company plan for future expenses and revenue growth, ensuring that it has the necessary resources to support its operations.

- Identifying operational inefficiencies: A low working capital turnover ratio may indicate inefficiencies in the company's operations. By identifying these inefficiencies, a company can take corrective action to improve processes, reduce costs, and increase profitability.

- Cash flow management: The ratio can be used to monitor cash flow and identify potential cash flow problems. By managing cash flow more effectively, a company can ensure that it has the resources it needs to meet its financial obligations and take advantage of growth opportunities.

- Evaluating performance: The working capital turnover ratio can be used to compare a company's performance to industry benchmarks and competitors. This can help a company identify areas where it is underperforming and take steps to improve its competitiveness.

Overall, the working capital turnover ratio is an important tool for managing business operations. By analysing this ratio, a company can improve its efficiency, plan for the future, identify inefficiencies, manage cash flow, and evaluate performance. By using this ratio to its advantage, a company can improve its financial position and achieve its growth objectives.

The Working Capital Turnover Ratio And Its Relationship With Profitability

The working capital turnover ratio is a financial metric that measures a company's efficiency in using its working capital to generate revenue. This ratio is an important indicator of a company's financial health and its ability to generate profits. A higher working capital turnover ratio indicates that a company is using its working capital more efficiently to generate revenue, which can lead to increased profitability.

The Working Capital Turnover Ratio And Its Relationship With Profitability

Here are some key points on the relationship between the working capital turnover ratio and profitability:

Efficiency In Using Working Capital

The working capital turnover ratio measures the efficiency of a company in using its working capital to generate revenue. A higher ratio indicates that a company is generating more revenue per unit of working capital invested, which can lead to increased profitability.

Impact On Profit Margins

Efficient use of working capital can also have a positive impact on a company's profit margins. When a company uses its working capital efficiently, it can generate more revenue with the same amount of investment, leading to higher profit margins.

Importance Of Cash Flow

The working capital turnover ratio is also closely related to cash flow management. By improving the efficiency of working capital, a company can free up cash for other activities, such as investing in new projects or paying off debt. This can lead to improved cash flow management, which can have a positive impact on profitability.

Identifying Areas For Improvement

Analysing the working capital turnover ratio can help a company identify areas where it can improve its operations and increase profitability. For example, a low ratio may indicate that a company is carrying too much inventory or struggling to collect payments from customers, which can be addressed to improve profitability.

Comparing To Industry Benchmarks

Comparing a company's working capital turnover ratio to industry benchmarks can also provide insight into its profitability. If a company's ratio is lower than industry averages, it may indicate that it is not using its working capital as efficiently as its competitors, and action may need to be taken to improve profitability.

The working capital turnover ratio is a valuable metric for evaluating a company's financial health and its ability to generate profits. By analysing this ratio and taking steps to improve the efficiency of working capital, a company can increase its profitability, improve cash flow management, and achieve its growth objectives.

Final Words

In conclusion, the working capital turnover ratio is a vital financial metric that can help companies assess their efficiency in using their working capital to generate revenue. By analysing this ratio, companies can identify areas for improvement, plan for future expenses and revenue growth, manage cash flow, and evaluate their performance.

Ultimately, the working capital turnover ratio is an essential tool for managing business operations and achieving financial objectives.