| All content presented here and elsewhere is solely intended for informational purposes only. The reader is required to seek professional counsel before beginning any legal or financial endeavor. |

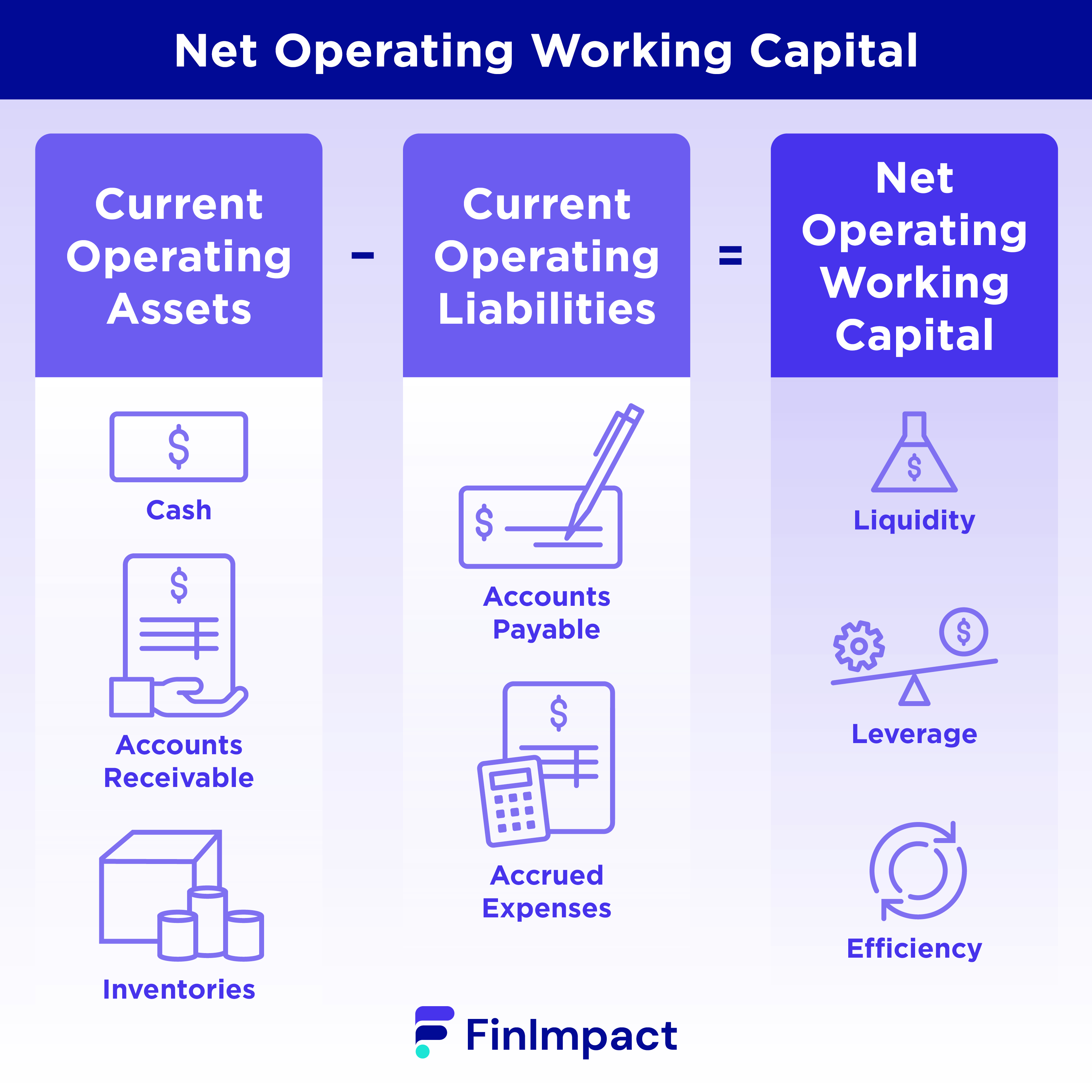

Net Operating Working Capital (NOWC) is a financial metric that measures a company's short-term liquidity and efficiency in managing its current assets and liabilities. Essentially, it represents the difference between a firm's current assets, such as inventory and accounts receivable, and its current liabilities, such as accounts payable and accrued expenses.

NOWC is an important indicator of a company's ability to fund its daily operations, as it measures the cash that is tied up in current assets and liabilities. In this article, we will discuss how NOWC works, how it differs from other measures of working capital, and why it is a useful metric for investors and analysts.

Key Points:

- Current assets refers to anything you can quickly turn into cash within a year, while liabilities refers to any outstanding debt, such as business loans.

- Understanding your working capital means you know how much money your company has for its daily operations.

- Remember, it usually takes money to make money, which is why NOWC is a crucial number.

Understanding Net Working Operating Capital

What is Net Operating Work Capital?

This is a common question that crosses the mind of many people. Net Operating Working Capital (NOWC) is a metric that provides insight into a company's short-term financial health. It measures the difference between a firm's current assets and current liabilities, excluding cash and cash equivalents. It's important to note that NOWC represents the cash that is tied up in a company's day-to-day operations, rather than the cash that is available for investment or other uses.

To calculate NOWC, you first need to identify a company's current assets and current liabilities. Current assets are assets that are expected to be converted into cash within one year, such as inventory, accounts receivable, and prepaid expenses. Current liabilities are debts that are expected to be paid within one year, such as accounts payable, accrued expenses, and short-term loans.

Once you have identified a company's current assets and current liabilities, you can calculate NOWC by subtracting current liabilities from current assets. The resulting number represents the amount of cash that is tied up in a company's day-to-day operations.

It's important to note that NOWC differs from other measures of working capital, such as gross working capital and net working capital. Gross working capital represents a company's total current assets, while net working capital represents the difference between a company's current assets and current liabilities, including cash and cash equivalents.

NOWC is an important metric for investors and analysts because it provides insight into a company's short-term liquidity and efficiency in managing its current assets and liabilities. A high NOWC may indicate that a company is inefficient in managing its working capital, while a low NOWC may indicate that a company is too reliant on short-term financing to fund its day-to-day operations.

What’s Included in Net Operating Working Capital?

Net Operating Working Capital (NOWC) is a financial metric that includes a company's current assets and current liabilities, excluding cash and cash equivalents.

Here are some examples of what is typically included in NOWC:

Current Assets:

- Accounts Receivable: Money that a company is owed by its customers for goods or services that have been sold but not yet paid for.

- Inventory: The value of goods that a company has in stock and available for sale.

- Prepaid Expenses: Money that a company has paid in advance for goods or services that it will receive in the future, such as rent or insurance.

Current Liabilities:

- Accounts Payable: Money that a company owes to its suppliers for goods or services that it has received but not yet paid for.

- Accrued Expenses: Money that a company owes for expenses that have been incurred but not yet paid, such as wages or utilities.

- Short-term loans: Debt that a company has taken on that must be repaid within one year.

It's important to note that NOWC only includes current assets and current liabilities that are directly related to a company's day-to-day operations. It excludes cash and cash equivalents, such as bank deposits and short-term investments, because these assets are not tied up in a company's operations and can be easily converted into cash if needed.

By including these specific items, NOWC provides a more accurate picture of a company's ability to fund its daily operations and meet its short-term obligations. By monitoring any change in Net Operating Working Capital over time, investors and analysts can gain insight into a company's efficiency in managing its working capital and its ability to generate cash from its operations.

Where To Find Net Operating Working Capital

Net Operating Working Capital (NOWC) can be found in a company's financial statements or annual reports, which are typically publicly available. The financial statements will include a balance sheet, which lists a company's assets, liabilities, and equity at a specific point in time.

To calculate NOWC, you would need to subtract a company's current liabilities from its current assets, excluding cash and cash equivalents.

Some financial data providers and investment research platforms also provide NOWC data for companies. These platforms may calculate NOWC using their own methodology or source the data directly from a company's financial statements.

When analyzing NOWC, it's important to compare the metric to industry benchmarks and to a company's historical performance. A high NOWC may indicate that a company is inefficient in managing its working capital, while a low NOWC may indicate that a company is too reliant on short-term financing to fund its day-to-day operations.

By monitoring changes in NOWC over time and comparing it to industry peers, investors and analysts can gain insight into a company's financial health and make more informed investment decisions.

How to Calculate Net Operating Working Capital

Net Operating Working Capital (NOWC) formula involves subtracting a company's current liabilities from its current assets, excluding cash and cash equivalents. Here are the steps to calculate NOWC:

- Determine a company's current assets: Current assets are assets that are expected to be converted into cash within one year. Examples of current assets include accounts receivable, inventory, and prepaid expenses. You can find a company's current assets listed on its balance sheet.

- Determine a company's current liabilities: Current liabilities are debts that are expected to be paid within one year. Examples of current liabilities include accounts payable, accrued expenses, and short-term loans. You can find a company's current liabilities listed on its balance sheet.

- Exclude cash and cash equivalents: Cash and cash equivalents are excluded from NOWC because they are not tied up in a company's day-to-day operations. Cash and cash equivalents include bank deposits and short-term investments.

- Calculate NOWC: If you are looking to know how to find Net Operating Working Capital, subtract a company's current liabilities (excluding any short-term debt that has been used to finance current assets) from its current assets (excluding cash and cash equivalents).

If you wish to know how to calculate net operating working capital, use this formula:

NOWC = Current Assets - Current Liabilities (excluding short-term debt used to finance current assets) - Cash and Cash Equivalents

Once you have calculated NOWC, you can use it to analyze a company's financial health and compare it to industry benchmarks or a company's historical performance. A high NOWC may indicate that a company is inefficient in managing its working capital, while a low NOWC may indicate that a company is too reliant on short-term financing to fund its day-to-day operations.

Net Operating Working Capital - Example

Let's say you know how to calculate Net Operating Working Capital (NOWC) and you wish to do so for a fictional company called ABC Manufacturing.

From ABC Manufacturing's balance sheet, you determine the following values:

Current Assets:

- Accounts Receivable: $100,000

- Inventory: $200,000

Prepaid Expenses: $50,000

- Total Current Assets = $350,000

Current Liabilities:

- Accounts Payable: $80,000

- Accrued Expenses: $70,000

Short-term loans: $50,000

- Total Current Liabilities (excluding short-term loans used to finance current assets) = $150,000

Cash and Cash Equivalents = $20,000

To calculate NOWC for ABC Manufacturing, we use the formula:

NOWC = Current Assets - Current Liabilities (excluding short-term debt used to finance current assets) - Cash and Cash Equivalents

NOWC = $350,000 - $150,000 - $20,000

NOWC = $180,000

This means that ABC Manufacturing has $180,000 in net operating working capital. By monitoring changes in NOWC over time, ABC Manufacturing and its stakeholders can gain insight into the company's ability to fund its daily operations and meet its short-term obligations.

Why Is Net Operating Working Capital Important?

Net Operating Working Capital (NOWC) is an important financial metric because it measures a company's ability to fund its day-to-day operations. It is an indicator of the amount of capital a company has tied up in its operating activities, which is important because it directly affects a company's ability to pay its bills, invest in growth opportunities, and generate profits.

Here are some key reasons why NOWC is important:

- Liquidity: NOWC is a measure of a company's liquidity, or its ability to meet its short-term obligations as they come due. Companies that have a high NOWC are generally better able to pay their bills and meet their financial obligations than those with a low NOWC.

- Efficiency: NOWC can help measure a company's efficiency in managing its working capital. A company that has a high NOWC may have too much capital tied up in its operations, which can lead to lower profitability and higher financing costs. On the other hand, a company that has a low NOWC may be too reliant on short-term financing to fund its operations, which can be risky and costly in the long run.

- Growth: NOWC can also be an indicator of a company's ability to fund growth opportunities. Companies that have a high NOWC may have more cash available to invest in growth initiatives, such as expanding into new markets or launching new products.

- Investor Confidence: NOWC is an important metric for investors because it provides insight into a company's financial health and its ability to generate profits. Companies that have a strong NOWC may be viewed as more financially stable and therefore more attractive to investors.

Net Operating Working Capital vs. Net Working Capital

Net Operating Working Capital (NOWC) and Net Working Capital (NWC) are two related financial metrics that are commonly used to evaluate a company's financial health.

Net Working Capital (NWC) is a broader measure that includes all of a company's current assets and liabilities, including cash and cash equivalents. It is calculated by subtracting a company's current liabilities from its current assets.

On the other hand, Net Operating Working Capital (NOWC) is a narrower measure that excludes cash and cash equivalents from current assets and short-term debt that has been used to finance current assets from current liabilities.

It is calculated by subtracting a company's current liabilities (excluding any short-term debt used to finance current assets) from its current assets (excluding cash and cash equivalents).

While both metrics are useful for evaluating a company's liquidity and financial health, NOWC is a more precise measure of a company's ability to fund its day-to-day operations. NOWC focuses specifically on the capital a company has tied up in its operating activities, which is more relevant for short-term financial management.

Here's a table summarizing the key differences between NOWC and NWC:

| Metric | Calculation | Scope |

| Net Working Capital | Current Assets - Current Liabilities | Includes all current assets and liabilities, including cash |

| Net Operating Working Capital | Current Assets - Current Liabilities (excluding short-term debt used to finance current assets) | Excludes cash and cash equivalents from current assets and short-term debt used to finance current assets from liabilities |

Overall, both NOWC and NWC are important metrics for understanding a company's financial health and its ability to meet its short-term obligations. However, NOWC provides a more focused view of a company's working capital that is particularly relevant for managing day-to-day operations.

Net Operating Capital vs. Total Operating Capital. use table

Net Operating Capital (NOC) and Total Operating Capital (TOC) are two financial metrics that are used to evaluate a company's operating capital.

Net Operating Capital (NOC) is a measure of the capital a company has invested in its operating activities, after accounting for its operating liabilities. It is calculated by subtracting a company's operating liabilities from its operating assets.

Operating assets are those assets that are necessary to generate revenue and profits, such as accounts receivable, inventory, and property, plant, and equipment. Operating liabilities are those liabilities that are directly related to a company's operating activities, such as accounts payable and accrued expenses.

Total Operating Capital (TOC), on the other hand, includes all of a company's capital invested in its operating activities, regardless of the source of the capital.

It is calculated by adding a company's operating assets and its operating liabilities. This includes all sources of financing for operating activities, such as equity and debt financing.

Here's a table summarizing the key differences between NOC and TOC:

| Metric | Calculation | Scope |

| Net Operating Capital | Operating Assets - Operating Liabilities | Captures the capital invested in operating activities, net of liabilities |

| Total Operating Capital | Operating Assets + Operating Liabilities | Captures all of the capital invested in operating activities, regardless of source of capital |

How to Interpret Net Operating Working Capital

So you have a Net Operating Working Capital formula and calculation in front of you and can see the results in black and white. Now what? The information can be useful to draw some conclusions about the direction of the overall business.

Negative Operating Net Working Capital

If the Net Operating Working Capital formula and calculation shows a negative number, it means there are more liabilities than assets and without additional funding, the company will not be able to pay employees or meet other financial obligations.

However, do keep in mind there are some industries where a negative working capital number may be the norm, such as an industry with high levels of inventory, like a grocery store.

Positive Operating Net Working Capital

When the calculation shows you have a positive NOWC, it means you should have the ability to meet your financial obligations and your existing liabilities within the short-term.

How to Improve Net Operating Working Capital of Your Business?

Improving Net Operating Working Capital (NOWC) can help a business improve its liquidity and financial health, which in turn can lead to improved profitability and growth. Here are some strategies businesses can use to improve their NOWC:

- Reduce inventory levels: Excess inventory ties up capital that could be used elsewhere in the business. By optimizing inventory levels and reducing excess inventory, businesses can improve their NOWC.

- Improve collections: Late payments from customers can cause cash flow problems and increase the amount of working capital tied up in accounts receivable. Businesses can improve their NOWC by implementing better collections practices, such as offering discounts for early payments or using automated invoicing and payment systems.

- Negotiate better payment terms: Businesses can also improve their NOWC by negotiating better payment terms with their suppliers. Longer payment terms can help free up cash for other uses, while shorter payment terms can help reduce accounts payable and improve the NOWC.

- Manage payables effectively: Managing accounts payable effectively can also help improve NOWC. Businesses can negotiate better payment terms with suppliers, consolidate purchases to reduce the number of suppliers, and use electronic payment methods to improve efficiency.

- Improve operational efficiency: Improving operational efficiency can help reduce costs and improve cash flow. This can include streamlining processes, reducing waste, and investing in automation and technology.

- Consider financing options: In some cases, businesses may need to use financing to improve their NOWC. This can include options such as factoring, where a business sells its accounts receivable to a third-party for cash, or working capital loans, which can provide short-term financing to cover operating expenses.

Limitations of Net Operating Working Capital

While Net Operating Working Capital (NOWC) is a useful metric for assessing a company's liquidity and financial health, there are some limitations to consider:

- Limited scope: NOWC only considers a company's operating assets and liabilities, which may not provide a complete picture of its overall financial health. For example, it does not include non-operating assets such as investments or non-operating liabilities such as debt.

- Ignores timing of cash flows: NOWC does not take into account the timing of cash flows, which can be important for assessing a company's ability to meet short-term obligations. For example, a company may have a positive NOWC but still struggle to pay its bills if it has a large upcoming payment due.

- Industry-specific: NOWC may not be an appropriate metric for all industries. For example, a manufacturing company may have a large amount of inventory that is necessary for its operations, which would result in a higher NOWC. However, a service-based company may have little to no inventory and a lower NOWC.

- Limited benchmarking: There are no industry-standard benchmarks for NOWC, making it difficult to compare a company's NOWC to that of its peers or competitors.

- Does not consider financing structure: NOWC does not consider a company's financing structure, which can have a significant impact on its financial health. For example, a company with a high level of debt may have a negative NOWC even if it is generating strong operating cash flows.

Reporting Net Operating Working Capital

Net Operating Working Capital (NOWC) is an important financial metric that can be reported in a company's financial statements or other reports. Here are some ways that NOWC can be reported:

- Balance sheet: NOWC can be reported on a company's balance sheet as a line item that shows the difference between current operating assets and current operating liabilities.

- Income statement: NOWC can also be reported on a company's income statement as a component of operating cash flows.

- Management reports: Companies may also report NOWC in internal management reports or other financial reports, such as investor presentations or quarterly earnings releases.

- Benchmarking: NOWC can be used as a benchmarking tool to compare a company's financial health to that of its peers or competitors. This information can be included in industry reports or other financial analysis publications.

When reporting NOWC, it is important to provide context and explain any changes or trends over time. Companies should also consider including additional financial metrics, such as cash flow from operations or days sales outstanding, to provide a more comprehensive view of their financial health.

Overall, by reporting NOWC and other financial metrics, companies can provide stakeholders with valuable information to assess their liquidity and financial health.

How to Analyze Changes in Net Operating Working Capital Over Time

Analyzing changes in net operating working capital (NOWC) over time is an important part of financial analysis for businesses. By tracking changes in NOWC, businesses can gain insights into their liquidity, efficiency, and overall financial health. Here are some ways to analyze changes in NOWC over time:

- Calculate NOWC for Multiple Periods: To analyze changes in NOWC over time, it's important to use the net operating working capital formula to first calculate NOWC for multiple periods. This allows you to see how NOWC has changed over time and identify any trends or patterns.

- Compare NOWC to Industry Benchmarks: Another way to analyze changes in NOWC over time is to compare your NOWC to industry benchmarks. This can help you understand how your business is performing compared to similar companies in your industry.

- Identify Changes in Current Operating Assets: Changes in current operating assets can have a significant impact on NOWC. By identifying changes in accounts receivable, inventory, and other current assets, you can better understand how NOWC has changed over time.

- Identify Changes in Current Operating Liabilities: Changes in current operating liabilities, such as accounts payable and accrued expenses, can also impact NOWC. By analyzing changes in these liabilities, you can identify any trends or patterns that may be impacting NOWC.

- Look for Seasonal Patterns: Some businesses may experience seasonal changes in NOWC, such as higher inventory levels during peak sales periods. By identifying these patterns, you can better understand how NOWC changes over time and adjust your financial management strategies accordingly.

Analyzing changes in NOWC over time is an important part of financial analysis for businesses. By tracking NOWC and identifying trends or patterns, businesses can make informed financial management decisions and ensure long-term financial health.

The Role of Accounts Receivable and Payable in Net Operating Working Capital

Accounts Receivable

- Represent the amount of money owed by customers for goods or services provided but not yet paid for

- High levels of accounts receivable can reduce cash available for immediate operating needs, negatively impacting NOWC

- Effective management of accounts receivable is critical for maintaining a healthy NOWC

- Strategies for managing accounts receivable include ensuring timely payment from customers, offering discounts for early payment, and implementing stricter payment policies

Accounts Payable

- Represent the amount of money owed to suppliers for goods or services received but not yet paid for

- High levels of accounts payable can increase cash available for immediate operating needs, positively impacting NOWC

- Effective management of accounts payable is critical for maintaining a healthy NOWC

- Strategies for managing accounts payable include paying suppliers on time, maintaining good relationships with suppliers, and potentially negotiating better terms

Strategies for Managing Accounts Receivable and Payable to Improve NOWC

- Offer discounts for early payment to incentivize customers to pay on time

- Implement stricter payment policies to ensure timely payment from customers

- Maintain good relationships with suppliers to negotiate better terms and potentially reduce accounts payable.

- Pay suppliers on time to maintain good relationships and potentially negotiate better terms.

The Relationship Between NOWC and a Company's Cash Conversion Cycle

- The cash conversion cycle (CCC) represents the time it takes for a company to convert its investments in inventory and other resources into cash flow from sales

- A shorter CCC can help improve NOWC by reducing the amount of time and resources tied up in the conversion process.

- Strategies for reducing CCC include improving inventory management, reducing production times, and improving payment and collection processes.