| All content presented here and elsewhere is solely intended for informational purposes only. The reader is required to seek professional counsel before beginning any legal or financial endeavor. |

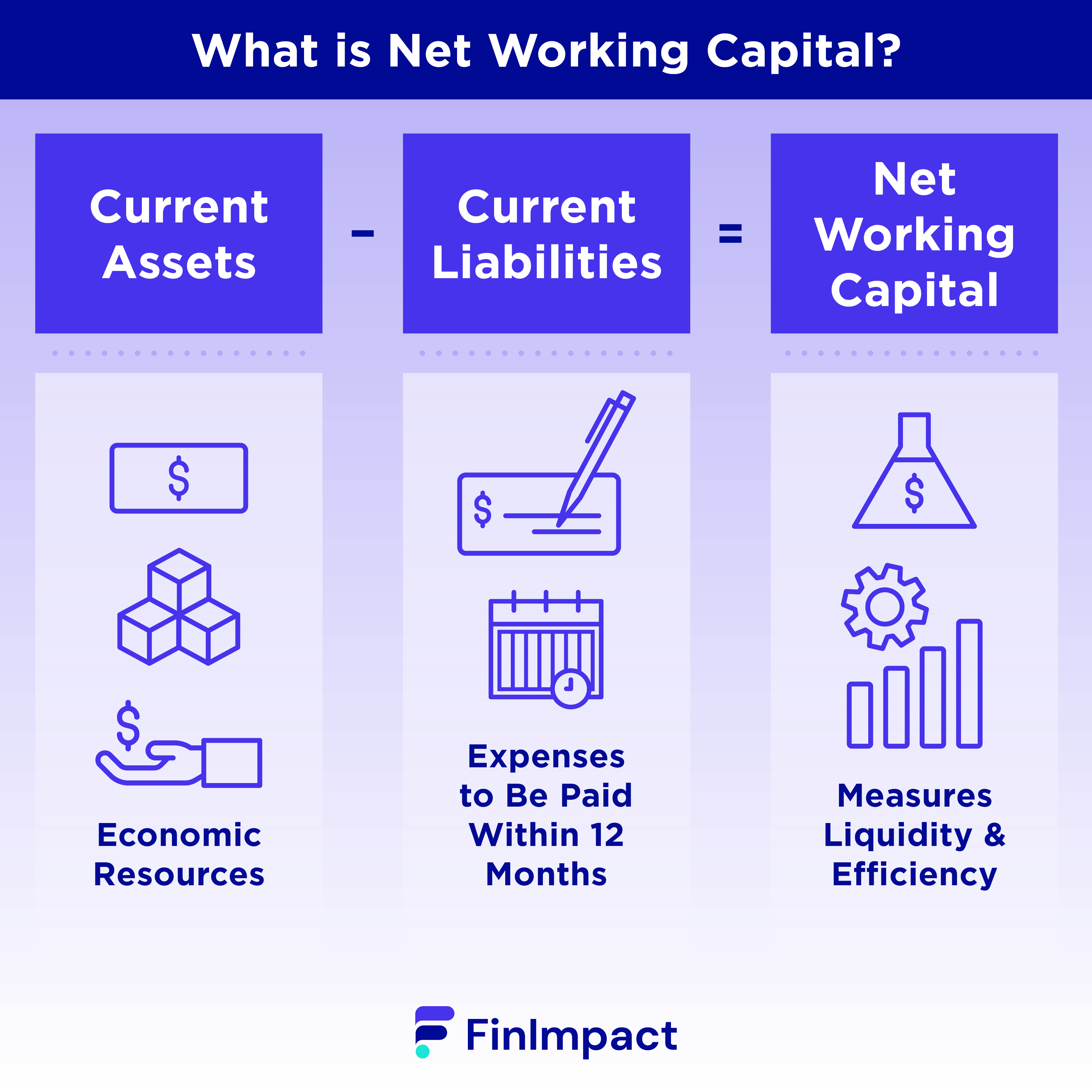

Net Working Capital (NWC) is a crucial concept in finance that measures a company's short-term financial health and its ability to pay its current liabilities. In simple terms, it refers to the difference between a company's current assets and its current liabilities. Essentially, NWC represents the amount of cash a company can use to fund its day-to-day operations.

What’s Included In Net Working Capital?

Current assets are those that can be converted into cash within a year, while current liabilities are those that must be paid within a year.

To figure out how to find Net Working Capital, the following items, which are typically included, must be introduced:

- Cash and cash equivalents: These are the most liquid assets a company has and include cash in hand, bank deposits, and short-term investments.

- Accounts receivable: This is the money that a company is owed by its customers for goods or services provided on credit.

- Inventory: This is the raw materials, work in progress, and finished goods that a company has on hand and expects to sell within a year.

- Prepaid expenses: These are payments made in advance for goods or services that will be received in the future.

- Other current assets: This includes any other assets that a company expects to convert into cash within a year, such as short-term loans to employees or deposits held by suppliers.

- Accounts payable: This is the money that a company owes to its suppliers for goods or services purchased on credit.

- Accrued expenses: These are expenses that a company has incurred but has not yet paid, such as wages or taxes.

- Short-term debt: This is any debt that must be repaid within a year, such as bank loans or lines of credit.

What Is Net Working Capital Formula?

The net working capital formula is quite simple and can be expressed as follows:

Net Working Capital = Current Assets - Current Liabilities

In other words, subtracting the total value of a company's current liabilities from the total value of its current assets will give you its net working capital.

Current assets include cash and cash equivalents, accounts receivable, inventory, prepaid expenses, and other short-term assets.

Current liabilities include accounts payable, accrued expenses, short-term debt, and other short-term obligations that the company owes.

The resulting net working capital figure gives an idea of how much cash a company has available to fund its day-to-day operations and short-term obligations. A positive net working capital indicates that a company has enough cash on hand to cover its short-term obligations, while a negative net working capital indicates that a company may have difficulty meeting its short-term obligations.

Uses Of Net Working Capital

Net working capital is an important financial metric for businesses, as it reflects the amount of cash a company has available to fund its day-to-day operations and short-term obligations. The following are some of the uses of net working capital:

- Assessing a company's liquidity: Net working capital helps investors and creditors assess a company's liquidity and ability to meet its short-term obligations. A positive net working capital indicates that a company has enough cash on hand to cover its short-term obligations, while a negative net working capital indicates that a company may have difficulty meeting its short-term obligations.

- Identifying cash flow issues: If a company has a negative net working capital, it may indicate that the company has cash flow issues, which could lead to difficulties in paying its bills and meeting its short-term obligations.

- Evaluating a company's financial health: Net working capital is an important metric that investors and creditors use to evaluate a company's overall financial health. A company with a positive net working capital is generally considered financially healthy, while a negative net working capital can indicate potential financial distress.

- Managing inventory levels: Net working capital can be used to help manage inventory levels. A high level of inventory can tie up cash, while a low level of inventory can result in lost sales. By managing inventory levels, a company can optimize its net working capital and improve its overall financial performance.

- Financing business operations: Net working capital can be used to finance a company's day-to-day operations, such as paying bills, purchasing inventory, and meeting payroll obligations. By maintaining a positive net working capital, a company can ensure that it has enough cash on hand to meet its short-term obligations and keep the business running smoothly.

Why Is Net Working Capital Important?

Net working capital is an important financial metric for businesses because it reflects the amount of cash a company has available to fund its day-to-day operations and short-term obligations.

The following are some of the reasons why net working capital is important:

- Indicates liquidity: Net working capital indicates a company's liquidity, or its ability to pay its short-term obligations. A positive net working capital means a company has more current assets than current liabilities, indicating that it can meet its short-term obligations without difficulty.

- Provides insight into financial health: Net working capital can provide insight into a company's overall financial health. A positive net working capital indicates that a company is financially healthy, while a negative net working capital can indicate potential financial distress.

- Helps with managing inventory: Net working capital can help businesses manage their inventory levels. A high level of inventory can tie up cash, while a low level of inventory can result in lost sales. By managing inventory levels, businesses can optimize their net working capital and improve their overall financial performance.

- Assists with cash flow management: Net working capital is an important metric for cash flow management. By monitoring their net working capital, businesses can ensure that they have enough cash on hand to meet their short-term obligations and keep their operations running smoothly.

- Used by lenders and investors: Lenders and investors often use net working capital to evaluate a company's financial health and its ability to meet its short-term obligations. A positive net working capital can be seen as a positive sign for investors and lenders, indicating that a company is financially stable and able to meet its obligations.

How Net Working Capital Is Calculated

Net working capital is a useful metric for business owners. For this reason, it is imperative to understand how it works. Let’s explore how to calculate Net Working Capital:

Calculating Current Assets

Start by adding up all of the current assets of your business.

Assets to Include:

- Cash

- Accounts Receivable

- Inventory

Net working capital measures the difference between and business's current assets and current liabilities..

Calculating Current Liabilities

Add up your current liabilities facing your business.

Liabilities to Include:

- Accounts Payable

- Debt Payments

- Other Expenses on the Horizon

Subtract Current Liabilities From Current Assets

At this point, you can subtract your current liabilities from your current assets. The number represents the net working capital of your business.

Example Of Net Working Capital Calculation

- Current Assets: In total, the business has $150,000 in current assets.

- Current Liabilities: In total, the business has $100,000 in current liabilities.

- Working capital: With these numbers, the business would have $50,000 of net working capital.

How To Interpret Net Working Capital

Net working capital (NWC) is a financial metric that measures the difference between a company's current assets (such as cash, inventory, and accounts receivable) and its current liabilities (such as accounts payable and short-term debt).

While it is easy to understand how to calculate Net Working Capital, interpreting it involves analyzing the company's ability to meet its short-term financial obligations, manage its cash flow, and invest in growth opportunities.

A positive NWC indicates that a company has enough current assets to cover its current liabilities, which is generally seen as a positive sign. This indicates that the company has sufficient liquidity to cover its short-term financial obligations, such as paying suppliers, meeting payroll, and servicing short-term debt. A high positive NWC may also indicate that the company has room to invest in growth opportunities or pay dividends to shareholders.

Conversely, a negative NWC indicates that a company's current liabilities exceed its current assets. This may indicate that the company is facing financial difficulties and may struggle to meet its short-term financial obligations.

However, a negative NWC may also be a sign of a company that is in a growth phase, investing heavily in its future growth, and thus temporarily consuming more cash than it generates.

In addition to analyzing the absolute value of NWC, it is also important to consider the change in Net Working Capital over time. A steady or increasing NWC may indicate a stable or growing business, while a declining NWC may indicate declining business performance or difficulty managing cash flow.

Problems With Net Working Capital

Here are some specific problems that may arise with NWC:

- Inadequate working capital: If a company's current assets are not sufficient to cover its current liabilities, it may struggle to pay its bills and meet its obligations. This can lead to cash flow problems and a decline in business operations.

- Poor management of inventory: A company that holds too much inventory can tie up cash that could be used for other purposes, while a company that holds too little inventory may not be able to meet customer demand. Both scenarios can lead to problems with NWC.

- Slow collections on accounts receivable: If a company is slow to collect payments from customers, it may struggle to pay its own bills and meet its obligations. This can lead to cash flow problems and a decline in business operations.

- Too much short-term debt: If a company has too much short-term debt, it may struggle to pay it back in a timely manner, leading to cash flow problems and potentially even bankruptcy.

- Inaccurate forecasting: If a company's forecasts of future cash flows are inaccurate, it may not be able to plan effectively for its short-term financial needs. This can lead to problems with NWC if the company finds itself short of cash to meet its obligations.

How To Improve Net Working Capital

Improving Net Working Capital (NWC) involves managing a company's current assets and liabilities in a way that maximizes cash flow and short-term financial stability. Here are some strategies that can help improve NWC:

- Increase sales revenue: Increasing sales revenue can provide a boost to current assets, which can improve NWC. This can be achieved by implementing effective marketing strategies, expanding product lines, and improving customer service.

- Improve inventory management: Effective inventory management can help optimize cash flow by ensuring that inventory levels are neither too high nor too low. This can be achieved by implementing inventory control systems, improving supply chain management, and forecasting demand accurately.

- Reduce accounts receivable collection time: Companies can improve NWC by collecting payments from customers more quickly. This can be achieved by improving billing procedures, offering incentives for early payment, and implementing collection procedures.

- Negotiate better payment terms: Negotiating longer payment terms with suppliers can help improve NWC by providing more time to pay bills. This can be achieved by improving vendor relationships, negotiating better pricing, and exploring alternative financing options.

- Reduce short-term debt: Companies can improve NWC by reducing their reliance on short-term debt. This can be achieved by implementing cost-cutting measures, exploring alternative financing options, and improving cash management practices.

- Improve cash management: Effective cash management practices, such as optimizing cash inflows and outflows, can help improve NWC. This can be achieved by implementing cash management systems, improving forecasting accuracy, and managing cash balances effectively.

- Regularly monitor NWC: Regularly monitoring NWC can help companies identify potential problems and take corrective action before they become serious. This can be achieved by using financial metrics to track NWC, conducting regular audits, and reviewing financial statements regularly.

Reporting Net Working Capital

To report NWC, a company typically prepares a balance sheet that includes current assets and current liabilities. The difference between current assets and current liabilities is the company's NWC.

The balance sheet should clearly distinguish between current and noncurrent assets and liabilities, and provide a breakdown of the different components of NWC, such as inventory, accounts receivable, and accounts payable.

When reporting NWC, it is also important to provide context and explain any significant changes or trends over time. For example, if NWC has decreased, the company should explain why this has happened and what steps it is taking to address the issue.

NWC can also be analyzed in relation to other financial metrics, such as the company's cash conversion cycle, which measures the time it takes for a company to convert its investments in inventory and accounts receivable into cash. This can provide additional insights into a company's short-term liquidity and operational efficiency.

In summary, reporting NWC is an essential part of a company's financial reporting process, and should be presented clearly and with context to help stakeholders understand the company's financial health and short-term liquidity.

Net Working Capital Vs. Operating Cash Flow

Below is a table that compares net working capital and operating cash flow

| Aspect | Net Working Capital | Operating Cash Flow |

| Definition | The difference between current assets and liabilities | The amount of cash generated or used by a business operations. |

| Time Period | Snapshot of a company's short-term liquidity | Measures cash flows over a period of time (usually a quarter or year) |

| Components | Current assets and current liabilities | Cash flows from operating activities |

| Purpose | Measures a company's ability to meet short-term obligations | Measures the amount of cash generated or used by core operations |

| Calculation | NWC = Current Assets - Current Liabilities | Operating Cash Flow = Net Income + Non-cash Expenses - Changes in Working Capital |

| Interpretation | Positive NWC is generally preferred, but varies by industry and company size | Positive OCF indicates that a company can generate enough cash to support its operations |

| Limitations | Does not take into account cash flows from operating activities | Does not account for capital expenditures or debt payments |

| Usefulness | Useful in determining a company's short-term liquidity | Useful in evaluating a company's ability to generate cash from its operations |

| Relationship | NWC can impact OCF, and vice versa | Positive NWC may indicate positive OCF, but they are not directly related |

| Industry | Examples Retail, manufacturing, and service industries | High-tech, research and development, and biotech industries |

What Does A Positive And Negative Net Working Capital Mean?

Net Working Capital (NWC) is a measure of a company's short-term liquidity, which is its ability to meet short-term obligations. A positive NWC indicates that a company has sufficient current assets to cover its current liabilities, while a negative NWC indicates that a company may have difficulty meeting its short-term obligations.

Here are 7 bullet points explaining what a positive and negative NWC means:

- Positive NWC: A positive NWC indicates that a company has sufficient current assets to cover its current liabilities. This means that a company can meet its short-term obligations and is better equipped to handle unexpected expenses or changes in the business environment.

- Negative NWC: A negative NWC indicates that a company may have difficulty meeting its short-term obligations. This means that a company may struggle to pay its bills and may have to rely on external financing to stay afloat.

- Preferred NWC: While a positive NWC is generally preferred, the optimal amount of NWC varies by industry and company size. For example, a manufacturing company may require a higher level of NWC due to the need for inventory and raw materials, while a service-based company may require less NWC.

- Causes of Negative NWC: Negative NWC can be caused by a variety of factors, including poor inventory management, slow collections on accounts receivable, and too much short-term debt.

- Consequences of Negative NWC: Negative NWC can lead to cash flow problems, difficulties in paying bills and meeting obligations, and potentially even bankruptcy.

- Improving Negative NWC: To improve a negative NWC, companies can take steps such as improving inventory management, collecting payments from customers more quickly, and reducing short-term debt.

- Watch for Red Flags: Investors and analysts should pay close attention to NWC trends, as a declining or negative trend may indicate underlying problems in a company's operations or financial health.

A positive NWC indicates a company's short-term liquidity is healthy, while a negative NWC suggests that a company may have difficulty meeting its short-term obligations.

Final Word

In summary, Net Working Capital (NWC) is a measure of a company's short-term liquidity, which is its ability to meet short-term obligations. It is calculated by subtracting current liabilities from current assets.

A positive NWC indicates that a company has sufficient current assets to cover its current liabilities, while a negative NWC indicates that a company may have difficulty meeting its short-term obligations.