Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

Best Merchant Cash Advance Companies to Consider in 2024

Merchant cash advances give you near-instant access to cash and provide funding for emergency situations. Credit scores don’t matter as much, and there are no fixed monthly payments with merchant cash advances.

A merchant cash advance is a form of lending where you pay back the loan with future debit and credit card sales. Rather than making monthly or weekly payments as you would with a traditional small business loan, the lender gets a small portion of each debit and credit card sale until the loan is paid back. Our team of financial experts reviewed and ranked the top online lenders to help you get funded. Read on to discover our choices for the seven best merchant cash advance companies.

Top 7 Merchant Cash Advance Companies

Merchant cash advances may be a good option if you need access to capital immediately, as funds are typically in your account within one to two business days of loan approval. In this review, we highlight the rates, fees and terms of each lender and explain what makes them a good option. We also share potential downsides of each lender, and provide a rating methodology you can use to select the best option for your needs.

Best Merchant Cash Advance Companies for 2024 - Full Overview

Torro - Best for New Businesses

- Borrow up to $575,000

- Loan Repayment 12 - 48 months terms

- Hundreds of financing options

- Use the loan for any purpose

- Fast process

- Easy qualification, even with average or bad credit

- Connects you to a variety of lenders to compare offers

- Fast funding puts money in your account quickly

- Torro has a syndicated network of investors

- High fees

- Limited support

Torro offers startup loans, working capital loans in a form of merchant cash advances. With startup loans you make fixed monthly payments over a specified period of time. Merchant cash advances, however, are based on your future income. Rather than worrying about monthly payments, Torro takes a percentage of your credit card sales each day. Torro doesn’t provide as much information about the loans—such as the terms and fees you might encounter—until providing you with an offer. That said, there are some broad-strokes details that they do offer publicly.

Main Features

Torro’s loan terms vary from lender to lender, which means you may get different offers with different features. Credit score requirements tend to be low, so long as you can prove your monthly revenue of $10,000 and that you’ve been in business for six months or more.

Uncapped - Best for Ecommerce Business Loans

- Borrow up to $10 million

- Flat fee instead of interest rate for term loans: 2% - 12%

- Revenue-based financing: 5% -25% revenue share rate

- No minimum credit score

- No personal guarantees required

- Best for online businesses

- Fees as low as 2%

- No hidden costs

- No prepayment penalties

- Fixed-term and revenue-based options

- Quick turnaround time

- Borrow up to $10 million

- Must have an online business model to qualify

- Some state limitations

- Must be established for 6 months

- Minimum of $10,000 in monthly revenue

While some merchant cash advance providers charge pricey factor rates and hidden fees, Uncapped uses a revenue-based financing model with a transparent flat fee that is a percentage of the loan amount. And you can still benefit from the downside protection of repaying the loan from your sales.

Main Features

With Uncapped, you can borrow between $10,000 and $10 million at a flat fee ranging from 2% to 12% of the loan amount. You can repay the loan in fixed installments over a term of three to 24 months, or you can pay Uncapped 5% to 25% of your sales until the principal and fee are repaid. Either way, there are no prepayment penalties or hidden costs. There are also no minimum credit score requirements, but you’ll need to be an online business with at least six months of business history and at least $10,000 in monthly revenue to qualify.

GoKapital - Best for Same Day Funding

- Borrow up to $5 million

- Loan Terms 2 to 10 years

- Merchant cash advance factor rates from 1.20 to 1.49

- Wide range of loan offers

- Simple application process

- Instant pre-approval

- add Min. credit score: 550

- add Min time in business: 1 year

- Fast funding times

- Large loan amounts

- Daily or weekly payment options

- All industries qualify

- Rates can be high

- High annual revenue requirement

If you need funds quickly, GoKapital offers same day funding and high borrowing amounts. All industries are eligible and GoKapital offers funding in all 50 states. Whether you need a small amount to cover daily expenses or you’re in need of up to $5 million, GoKapital can get you approved and funded within 24 hours.

Main Features

GoKapital merchant cash advances range from $20,000 to $5 million with terms ranging from three to 18 months. To qualify, you need to have a minimum credit score of 550 and a business history of at least one year. You also must have $360,000 or more in annual revenue. Factor rates range from 1.20 to 1.49 depending on qualifications.

Fora Financial - Best for Poor Credit

- Min. time in business: 6 months

- Min. credit score: 550+

- Borrow up to $1.4 million

- Factor rate from 1.15 to 1.40

- Ideal for plenty of industries

- Approval not solely credit based

- Early payoff discounts

- Fast funding once approved

- High borrowing limit

- Low credit score requirement

- No collateral

- Not ideal for cash-heavy companies with few card transactions

- High interest rates compared to other financing options

- Steep borrowing fee

Fora Financial is a direct lender that offers small- and medium-sized businesses with merchant cash advances and short-term business loans. Their merchant cash advances range from $5,000 to $750,000, depending on your eligibility. Fora Financial usually takes only 24 hours to approve loan applications, making it quick and easy to tap into the financing you need without waiting to receive funds.

Main Features

Fora Financial’s merchant cash advances are ideal for businesses who need a large amount of capital in a short amount of time. Like all merchant cash advance lenders, fees can be steep, so this is something you need to consider. Fora Financial is among the more lenient lenders in terms of credit, however, which may make additional fees a trade-off for getting financing.

Backd - Best for Cheapest Interest Rates

- Borrow up to $2 million

- Min. Credit Score: 640

- Min. Time in Business: 2 years

- Industry best factor rate for MCA - as low as 1.10

- APR for the Line of credit product starts at 35%

- Flexible repayment terms up to 16 months

- Get funding in as little as 24 hours

- Check your rate with a soft credit pull

- Easy application

- Fast lending decision and funding times

- Large loan amounts

- Flexible payment options

- Cannot be a startup

- Not available for all industries

- Must apply in order to see rates and fees

Backd offers working capital loans of up to $2 million in a form of merchant cash advances. These loans are customized to your unique business and financial needs. The company was founded in 2018 and has since funded more than $1 billion to 10,000+ small businesses. Backd offers both working capital loans and business lines of credit. To apply, fill out their easy online application and receive a lending decision almost instantly. From there, you can review the terms and conditions prior to moving forward. If you do decide to accept the loan, funds can be in your account within 24-48 hours.

Main Features

Merchant cash advance loans range from $10,000 to $2 million with terms up to 16 months. Payments are made daily, weekly, or semi-monthly. Business lines of credit range from $10,000 to $750,000 with unlimited terms. A line of credit is a good option for a small business that needs funding for more than one use, such as paying for operating expenses. To qualify, you need to have $200,000 or more in annual revenue, and be in business for at least two yeas, and have 640+ FICO score. You also must be based in the U.S. and have a business bank account.

Credibly - Best for Fast Funding

- Min. Credit Score: 500+

- Min. Time in Business: 6 months

- Merchant cash advance up to $400,000

- Borrow up to $400,000 in working capital

- Merchant cash advance factor rate starts at 1.09

- Simple application process

- As soon as same day funding

- Open to high-risk industries

- Fast decision and funding time

- Flexible credit score requirements

- Offers prepayment incentives

- Blanket lien required

- Daily, fluctuating repayments can be hard to budget for

- Includes a $50 monthly administrative fee

Credibly has been providing small businesses with financing since 2010, and has built a reputation for reliability and customer service in the years since. It takes just 10 minutes to fill out an application, and you’ll get a decision within 24 hours. If approved, you can receive your cash advance from Credibly in as little as 48 hours.

Main Features

Credibly offers merchant cash advances up to $400,000. Factor rates begin at 1.09, but may be higher depending on your application. To qualify, you’ll need a minimum credit score of 500, have been in business for at least six months, and have monthly bank deposits of $15,000 or more.

Lendzi - Best for Excellent Customer Reviews

- Merchant cash advances up to $4 million

- Min. credit score: at least 500

- Min. time in business: 6 months

- Equipment financing up to $2 million

- Business line of credit up to $250,000

- See your options without hurting your credit

- Flexible terms: 3 to 15 months

- Excellent customer reviews on independent review sites

- Get funding in as little as 24 hours

- Multiple products and lenders to choose from

- Excellent customer reviews

- Competitive rates

- Flexible terms

- Funding in as little as 24 hours

- Poor credit accepted

- High rates for those with poor credit

- No credit-building benefit

- More expensive than other forms of financing

Founded in 2020, Lendzi has since accumulated more than 2,000 5-star reviews on sites like TrustPilot, Google, and Better Business Bureau. They operate as a direct lender and are partnered with more than 75 other lenders, giving you a plethora of options when choosing a small business loan or merchant cash advance. Their application takes just a few minutes to fill out, and if approved, funds can be in your account in as little as 24 hours.

Main Features

A merchant cash advance from Lendzi ranges from $5,000 to $400,000 with terms of three to 15 months. Factor rates start at 1.10. To qualify, you’ll need to be in business for at least six months and have $180,000 or more in annual revenue. Credit score doesn’t matter as much with this type of financing, but Lendzi does like to see at least a FICO score of 525.

Main Features for the Best Merchant Cash Advance Companies

- Min. Credit Score - N/A

- Min. Time in Business - 12 months

- Min. Revenue - $100,000

- Loan Amount - $10,000 to $2 million

- Interest Rate - Not disclosed

How We Choose the Best Merchant Cash Advance

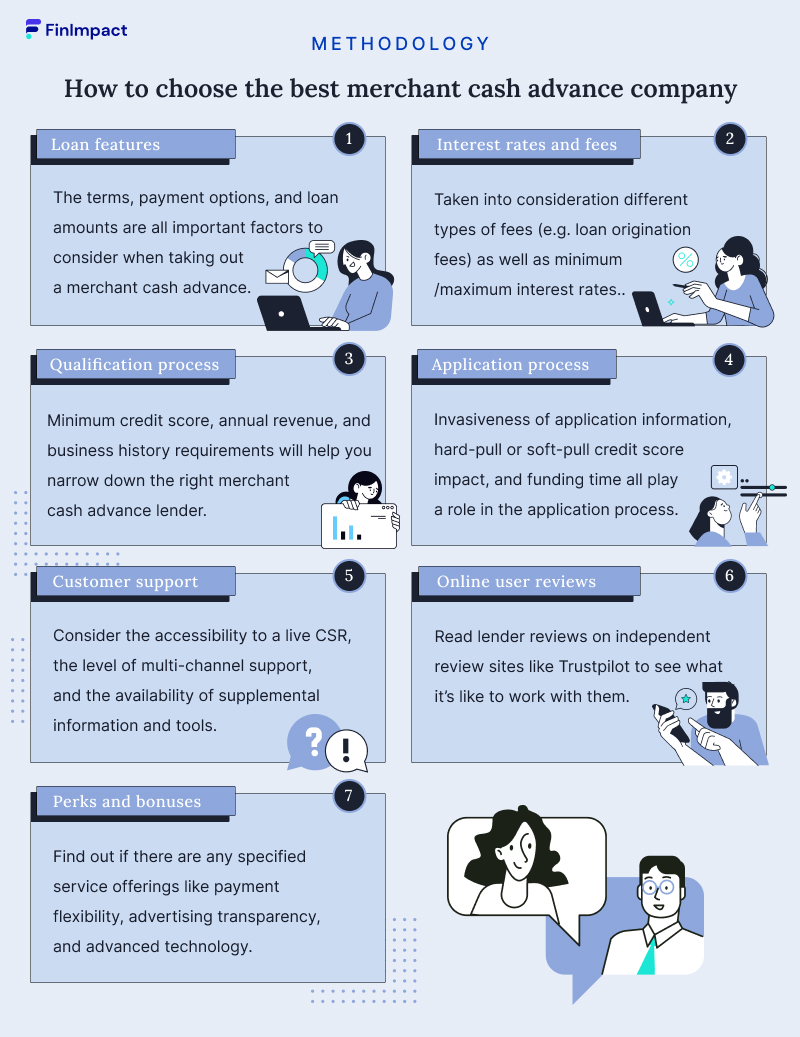

There are several aspects to a merchant cash advance you should consider, especially when it comes to picking the best lender. These factors can help you make the right decision and are the basis for our recommendations.

- Loan features: The terms, payment options, and minimum and maximum amounts available are all important factors to consider when taking out a merchant cash advance.

- Application process: Invasiveness of application information requirements, hard-pull or soft-pull credit score impact, and funding time all play a role in the application process.

- Interest rates and fees: Different types of fees (e.g. loan origination fees) as well as minimum/maximum interest rates were taken into consideration.

- Qualification process: Minimum credit score, annual revenue, and business history requirements will help you narrow down the right lender for your merchant cash advance.

- Customer support: Accessibility to a live CSR rep, the degree of multi-channel support offered, and the availability of supplemental information and tools are something to consider.

- Online user reviews: We looked at online reviews on independent review sites like Trustpilot.

- Perks and bonuses: Specified service offerings like payment flexibility, advertising transparency, and advanced technology are a factor, too.

What Is Merchant Cash Advance?

A merchant cash advance loan is a cash advance based on your future credit and debit card sales. A lender will take a look at your daily receipts and determine how much it thinks you’ll be able to pay back plus interest, usually known as a factor rate.

To work out your total payment, you’ll need to multiply your borrowing amount by the factor rate. For example, if you borrow $50,000 and your factor rate is 1.4, you’ll pay a total of $70,000 (50,000 x 1.4). As you can see, rates can be high, but merchant cash advances are incredibly convenient.

How Does a Merchant Cash Advance Work?

Merchant cash advance companies work in a slightly different way compared to conventional business lenders. In simple terms, a merchant cash advance requires your business to sell your future credit and debit card sales at a discounted figure. You then get access to a lump sum of capital, and payments are made based on future sales.

The holdback – the percentage of your daily card sales – will be sent directly to the lender via your card terminal provider, which means that you have no risk of missing payments.

Merchant Cash Advance Requirements

Since the lender knows roughly how much you can afford based on your credit card transactions, credit scores aren’t as important. Usually, those with scores of 500 or above will qualify. Monthly minimum revenue requirements vary considerably between lenders, but usually range between $2,500 and $15,000. Most lenders also want you to be in business for at least six months.

Applying for a merchant cash advance will not impact your credit score, allowing you to shop around before settling on a lender.

How to Apply for a Merchant Cash Advance

Generally, the application process for a merchant cash advance is much more streamlined than other types of lending. Here are the steps to applying for a merchant cash advance:

- Step one - Submit basic personal details to your chosen lender, including the preferred borrowing amount.

- Step two - The lender will ask for verification of your credit and debit card receipts, usually for the previous 12 months. You can provide this via your business bank statements or via records from your approved payment processor.

- Step three - Lenders may ask for additional information, like your company structure and general financial health.

- Step four - The lender will make a decision within a few hours of submitting your application. If approved, funding is usually dispersed within 24-48 hours.

Merchant Cash Advance Legal Issues

Some people have called the legitimacy of a business cash advance into question, claiming this type of alternative funding is illegal. In the U.S., the Federal Trade Commission (FTC) has launched a thorough investigation into cash advance loans due to potentially unfair contract terms imposed by online lenders.

However, the reality of the matter is that merchant cash advances are not meant to be viewed as loans, and are therefore almost wholly unregulated. They aren’t subject to usury laws or banking laws such as the Truth in Lending Act.

Because of this, lenders don’t need to take credit scores into account and borrowing amounts are almost entirely based on sales figures. This lack of regulation means interest rates and fees can be incredibly high and many companies can often end up trapped in cycles of unpayable debt. Always check your agreement carefully and make sure you’re confident of meeting the repayments.

Merchant Cash Advance Pros and Cons

Pros

- Fast funding - Most lenders will be able to make an instant decision once you’ve submitted your documentation. This means small businesses can have access to a lump sum of cash within 24 hours of applying.

- Unsecured lending - Almost all merchant cash advances are unsecured, meaning your assets aren’t at risk if you default.

- Payments scale with sales - Most agreements will allow payments to fluctuate with sales, meaning that when your sales dip, so do your payments. This makes it easier to manage cash flows.

- Generous borrowing amounts - Borrowing amounts range from $2,000 up to $10 million depending on the lender. Typically, the more monthly revenue you have, the more you’ll be able to borrow.

- Easy application process - As long as you have the right documents on hand, you can finish an application in around 10 minutes.

Cons

- High APR - The factor rates applied here often mean interest rates can run into triple digits. There’s no denying this is a convenient type of borrowing, but it’s very expensive. If you’re not careful, you could get trapped into a cycle of debt.

- Cash flow issues - In some cases, small businesses may struggle to make daily deductions. Some might end up being unable to pay unexpected expenses or daily operating costs if a significant portion of sales go to repaying loans.

Alternatives to Merchant Cash Advances

The fees associated with merchant cash advances are high, making them one of the most expensive forms of borrowing. If you have decent credit, you may want to look into other forms of financing, as well.

Here are some alternatives to merchant cash advances worth considering.

Low (or Zero) Interest Credit Cards

- Promotional interest rates may end up costing you less than factor rates.

- Ideal for candidates with good credit

- Can provide quick funding, especially if you get your card number right away

- Requires you to repay your debt quickly to avoid interest charges

Learn more about Business Credit Card Funding >>

Invoice Factoring

- Ideal for businesses with outstanding invoices that need capital

- Lenders own your invoices and pay you a percentage of their worth up-front

- Factor charges are a fraction of what merchant cash advances cost

- Generous borrowing amounts available

Here are the best invoice factoring companies of 2023 >>

Equipment Financing

- Ideal for last-minute equipment purchases

- Less flexibility with how you use the funds

- Easy qualification, even with fair credit

- No collateral required (purchased equipment serves that role)

- Interest rates typically lower than merchant cash advance factor rates

Check out these top equipment financing lenders >>

Final Thoughts

The good news for borrowers is that there are a variety of options out there. For those with poor credit, or for whom time is of the essence, a merchant cash advance is one way to get money quickly. This option can be expensive, however, and may compound cash flow problems if you can’t keep up a steady amount of credit card transactions.