Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Torro Business Funding Reviews: Expert Analysis & User Insights

Torro provides business start-up capital and working capital solutions to accommodate the needs of virtually any type of business. In this Torro funding review, you’ll learn exactly how to get started.

Expert Reviewer Verdict

Torro is an excellent source of funding for both new and existing businesses looking to close quickly. With just two loan options, limited paperwork, and in-house underwriting, you can get the funding you need without any hassle. The only major downside is that you may be subject to loan fees and higher interest depending on your credit.

In this review, our team of expert reviewers has thoroughly analyzed and evaluated Torro small business loans. We will share our findings and provide our expert recommendations on whether Torro small business loans are worth considering.

Torro Review Video

Our small business loan expert, Gordon Scott, provides an in-depth analysis, including pros and cons of Torro business funding.

Torro Business Funding Customer Reviews

Torro has a 4.7 rating out of 5 on Trustpilot and generally positive feedback from customers. Customers say Torro was very helpful in getting them funding fast and that the experience was very professional.

Many customers have turned to Torro after other lenders denied working with them for a business loan. They mention how the process with Torro was easy and closing was quick so they could cover important business expenses on-time.

Torro also had a few negative reviews from customers and prospects. Some people claimed that their interest rate was too high while others were upset that they didn’t qualify for the loan while speaking with a service rep on the phone.

As with any business loan, it’s important to make sure you pre-qualify before submitting an application so it’s nice to know that Torro customer service reps will ask applicants those important questions. Also, while it’s unfortunate, interest rates can be high if your credit score is low or you lack other important requirements to obtain a loan.

On the Better Business Bureau (BBB) website, Torro receives 4.7 out of 5 stars across 107 reviews and an A+ rating. Notably, Torro closed 8 complaints in the last 3 years and 2 in the last 12 months.

| The positive reviews are related to | The negative reviews are related to |

| Quick and easy loan approval process | High cost of the loan |

| Exceptional customer service | Not meeting qualifications |

| Few loan requirements (especially for newer business owners) | Origination fee that comes with loan |

Summarized Ratings

Torro has a peer leading User Reviews rating of 4.9, which is reflective of the independent user reviews posted on Trustpilot.

What Is Torro Business Funding?

Torro acts as a middleman, or loan broker, between applicants and lenders. Torro helps provide business start-up capital and working capital solutions to accommodate the needs of virtually any type of business. In this Torro review, you’ll learn exactly how to get started.

Torro Business Funding Pros and Cons

Pros

Cons

Torro Loan Features

Torro’s two main small business loan options are business funding for existing businesses and startup capital for new businesses. Not many lenders offer financing for new businesses, but with Torro funding you can get the capital you need to get your business off the ground.This can come in handy if you’re looking to fund startup costs or purchase equipment and other supplies to get the business up and running.

Start-up Capital

If you’re looking to start a new business or purchase an existing one, Torro offers up to $125,000 in funding. Torro accepts applicants who have been in business for less than six months and earn a maximum revenue of $5,000 per month. The company prefers a FICO score of at least 600.

| Term length | 12 - 48 months |

| Repayment period | Varies |

| APR range | Up to 36% |

| Min - Max amount | $25,000K - $125,000 |

Working Capital

Torro’s working capital loan is geared toward existing businesses that have been in operation for more than six months. You’ll need to have a monthly revenue of $10,000, and credit requirements will vary. It’s best to make sure you have the best credit score possible, though, in order to secure a lower interest rate.

| Term length | 3 - 24 months |

| Repayment period | Varies |

| APR range | Up to 36% |

| Min - Max amount | Up to $575,000 |

Torro also offers open-ended funding to existing businesses. This is a revolving type of loan that acts similar to a credit card, where you draw only on the amount you need. Maximum loan amounts are $125,000, and terms are typically more flexible than with traditional Torro business funding.

Torro Interest Rates and Fees

The fees are not always clear, because Torro matches you to other lenders. They do state APRs will not exceed 36%. Once you apply, you’ll have a better idea of the rates and fees your lender charges. Always make sure you factor this into your budget and read your loan agreement thoroughly before you sign.

| Startup Capital | Working Capital | |

| Origination fees | 5% | 5% |

| Prepayment fees | None | None |

| Late payment fees | Not disclosed | Not disclosed |

| Maintenance fees | Not disclosed | $25 - $50 monthly ACH fee |

| Interest rates | Max 36% APR | Max 36% APR |

Torro Loan Requirements

Torro partners with lenders who all have varying loan requirements, so it’s tough to say what the “minimum” qualifications are. In general, the better your credit score, the better your rate will be. Torro has funded loans with credit scores as low as 400, though, so it’s best to apply before ruling yourself out.

When applying for a Torro business loan, lenders will take into account your business as a whole. Your credit score is not the only factor. Torro also looks at your monthly revenue, your length in business, your business projections, your monthly debt obligations, and prior loan experience.

| Minimum Credit Score | 400 for working capital, 700 for startup loans |

| Minimum Annual Revenue | $120,000 (working capital) |

| Minimum Time in Business | Under 6 months (start up capital) More than 6 months (working capital) |

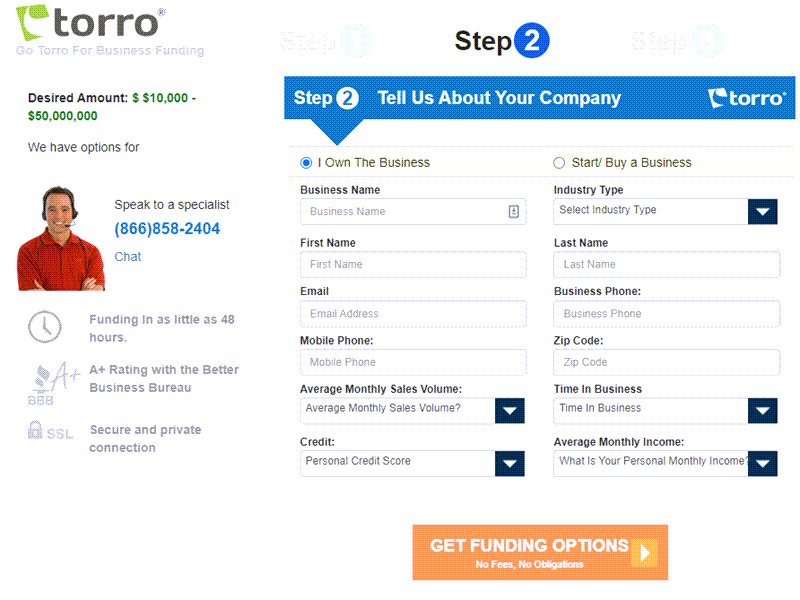

Torro Loan Application Process

You can fill out an application online or contact Torro by phone. The initial online application takes just a few minutes to complete and contains information such as your business name, industry type, monthly income, and credit score.

Torro does a soft pull on your credit when you apply, which does not affect your credit score. Once you decide to move forward with your loan, the lender will do a hard credit inquiry.

After you apply, you may be asked for additional paperwork. Documents may include:

- Tax ID number

- Social Security number

- Personal and business tax returns

- Three months of bank statements

- Business leases, if applicable

Once your application is submitted, Torro uses their syndicated network to help you get the business funds you need. Their goal is to help you find the best loan option for your needs. Thanks to limited asset verification, no business appraisal, and hardly any paperwork to fill out, you can get the money you need in your account sooner than later.

Torro Customer Support

You can contact Torro online via the website’s chat feature or give them a call Monday through Friday. Torro customers report they are mostly happy with the support they’ve received.

Here are what customers are saying online about Torro’s level of service:

“Charlie is always a pleasure to work with. Very patient and offers great customer service.”

“Kelsey got me funded fast and easy when I didn't have other funding options, Thank you torro.”

“We were in a last minute bind on a job and with a quick message to Tyler S. he was able to help!

Torro Perks and Bonuses

Flexibility

Torro offers a variety of business loans with fast approvals and the potential for same business loans. However, the company does not offer a payment deferral program for hardships, nor do they offer a rewards program.

If you’re looking for flexible funding, Torro does offer open-ending funding via their revolving loan. You receive a maximum loan amount and are able to make draws up to that amount.

Transparency

The Torro website is informative and helpful, and the company seems to go out of their way to offer as much information on their loans as possible. Customers who have questions can call Torro to inquire or chat with an agent on the Torro website.

Torro also boasts an A+ rating with the Better Business Bureau (BBB), where the company is accredited. On the BBB website, Torro has received 7 complaints in the last three years, all of which have been resolved and closed.

Technology

While Torro does not offer its own mobile app, the Torro website is functional on mobile. The company also boasts its own online dashboard for customers, allowing users to check the status of their funding, communicate with a funding specialist, and send or receive documents regarding their loan.

Payments on your Torro business loan can be deducted automatically from your business bank account.

Final Thoughts

Torro offers two types of funding: working capital for your existing business and start-up capital for new businesses. Torro's start-up capital loan can help fund a new business idea and provide resources to purchase equipment and materials. Torro business loans can help leverage existing sales and invoices to fund everyday expenses including expansion efforts.