Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

Best Equipment Financing Companies and Loans in 2024

Buying equipment can be a significant expense for entrepreneurs. Small businesses may need to purchase IT equipment or machinery to get up and running or replace outdated equipment to improve efficiency. Equipment financing can help if your business doesn’t have the extra capital on hand.

Equipment financing is a type of small business loan that’s used to help businesses purchase the equipment they need. According to the Equipment Leasing and Finance Association (ELFA), 79% of U.S. companies use some kind of business funding to acquire equipment. If you need new equipment to keep your business running, read on below. Our experts have compiled a list of the best equipment financing companies in 2023.

Top 7 Equipment Financing Companies

- Lendzi - Best for Low Interest Equipment Loans

- National Funding - Best for No Down Payment Equipment Loans

- SMB Compass - Best for Flexible Loan Terms

- Credibly - Best for Borrowers with Bad Credit

- Backd - Best for Good Credit Score

- Biz2Credit - Best for Equipment Financing for Startups

- Bluevine - Best for Lines of Credit

- Fora Financial - Best for No Collateral Requirement

ELFA reports that 19% of companies who financed equipment purchases used secured loans. But there are dozens of equipment financing companies out there that also offer unsecured loans, making it hard to know which lender is right for you.

In this review, we highlight the terms, rates and fees of the best equipment financing companies and explain what makes them a good choice. We also share potential downsides of each company, and provide a rating methodology you can use to select the best equipment financing option for your needs.

Best Equipment Financing Companies - Full Overview

Bluevine - Best for Lines of Credit

- Funding up to $250,000

- Min. credit score: 625

- Min. time in business: 6 months

- Interest rates starting at 6.2%

- Loan Repayment 6-12 months terms

- Quick and simple application

- Easy application process

- Quick funding

- Flexible repayment

- Not available in all states

- Not available for all industries

Bluevine offers business lines of credit that can be used to buy equipment. A line of credit acts more like a credit card, where you draw against the line when needed. Interest is only paid on the amount you use.

Main Features

Since Bluevine does not offer equipment financing loans, there is no collateral requirement. However, in order to borrow from the company, you will have to agree to a personal guarantee, meaning you'll be on the hook for paying off the loan even if your business defaults.

providerName

- Ideal for plenty of industries

- Approval not solely credit based

- Early payoff discounts

- Can be used for all business expenses

- No collateral requirement

- Opportunity to receive additional funding

- Short-term financing

- Lack of transparency

It's important to note that Fora Financial does not offer a true equipment financing loan. Instead, their small business loans can be used to finance new equipment purchases and cover additional expenses.

Main Features

To qualify for a small business loan with Fora Financial, potential borrowers need to have six months in business and an annual revenue of at least $144,000. In addition, the company also states that it will not work with any businesses that have had a recent bankruptcy.

SMB Compass - Best for Flexible Loan Terms

- Loans up to $10 million

- Min. credit score: can go as low as 550 for certain loans

- Min. time in business: 1+ years in business, no startups

- Funding times: 5 to 7 days for term loans and 24 - 48 hours for line of credit

- Flexible terms: 2 – 10 years for term loans

- Interest Rates: starting at 8.99% for term loans

- Applying does not impact credit score

- Nine loan products to choose from

- Low, competitive rates

- Large loan amounts

- Loan terms up to 10 years

- Excellent customer service

- Poor credit not accepted

- Not available in all states

- Must be in business at least one year

- High revenue requirements

SMB Compass equipment financing loans have long, flexible terms up to 10 years. Loan amounts are large at up to $5 million and rates are competitive, starting at just 7.99%. Equipment financing is used to amortize the cost of equipment, and the lender recommends making sure the loan term is the same or shorter than the life expectancy of the equipment. This way, your loan is paid off by the time you need new equipment. To qualify for equipment financing with SMB Compass, you’ll need a credit score of 600 or higher and at least one year of business history.

Main Features

SMB Compass offers nine different types of small business loans to borrowers, including equipment financing. Their mission is to make loans more accessible to small business borrowers by providing cost-effective and flexible lending solutions. SMB Compass equipment financing loans range from $25,000 to $5 million with terms up to 10 years. Rates start at 7.99% for qualified borrowers. The lender has currently provided more than 1,200 U.S. businesses with more than $250 million in financing. To apply, simply fill out their easy online application. It takes just a few minutes and will not impact your credit score. If approved, funding can be dispersed within 24 hours.

Biz2Credit - Best for Equipment Financing for Startup Businesses

- Working capital up to $2 million

- Term loans up to $500,000

- Term loan interest rate starts at 7.99%

- Loan Repayment 12-36 months terms

- Variable APR depending on the applicant

- Funding in 72 hours

- Soft credit pull

- Quick application process

- More lenient qualifying requirements

- Longer loan terms

- Collateral requirement

- High interest rates

- Not available in all 50 states

Biz2Credit offers funding that is closely tied to the equipment itself, so there's no worry of borrowing more money than you can handle. Plus, their eligibility requirements should be attainable for less-established businesses looking for financing options.

Main Features

Business owners can use Biz2Credit loans to finance up to 100% of the equipment value and loan terms will often match the estimated life of the equipment.

Biz2Credit also offers unique access to funding through Accounting firms. Accounting firms that are part of Biz2Credit's CPA Business Funding Portal can refer their clients to Biz2Credit for funding.

Backd - Best for Equipment Loans with Good Credit Score

- Borrow up to $2 million

- Min. Credit Score: 640

- Min. Time in Business: 2 years

- Industry best factor rate for MCA - as low as 1.10

- APR for the Line of credit product starts at 35%

- Flexible repayment terms up to 16 months

- Get funding in as little as 24 hours

- Check your rate with a soft credit pull

- Easy online application

- Fast funding times

- Large loan amounts up to $2 million

- Flexible payment options

- Not available to startups

- Rates are not disclosed prior to applying

- Not all industries will qualify

Backd was founded in 2018 in order to get more businesses the funding they need to grow, thrive, and expand. While they don’t specifically offer equipment financing loans, they do offer working capital loans and business lines of credit, both which can be used to purchase much-needed equipment.

Main Features

Backd working capital loans range from $10,000 to $2 million and do not require collateral. Terms are up to 16 months and payments are made daily, weekly, or semi-monthly. Backd also offers small business lines of credit up to $750,000 with unlimited terms. With a line of credit, you can draw on the funds at any time, pay them back, and draw on them again. If you are constantly needing to replace or update equipment, a line of credit may be your best option.

To qualify, you need to be in business for at least two years, have annual revenues of $200,000 or more, and a FICO score of 640 or higher. The better you score, the better rates you'll recieve.

Credibly - Best for Borrowers with Bad Credit

- Borrow up to Up to $250,000 in term loans

- Borrow up to $400,000 in working capital

- Term loan rates range between 8-25%

- Working capital factor rate starts at 1.09

- Simple application process

- As soon as same day funding

- Open to high-risk industries

- Borrow up to $10 million in equipment financing

- Flexible qualifying requirements

- High loan amounts

- Fast funding

- Lack of transparency

- Collateral requirement

Credibly offers equipment financing for almost any type of equipment your business may need. From medical devices to tools and farm equipment to office furniture, they've got you covered. Credibly has flexible financing options and same-day funding. They accept credit scores as low as 500, making them the best for borrowers with less-than-ideal credit.

Main Features

Since the equipment itself generally acts as collateral for the loan, Credibly is able to offer incredibly flexible qualifying criteria. Despite requiring a minimum credit score of just 500 and a minimum time in business of six months, the company boasts that over 90% of its equipment financing applicants get approved.

National Funding - Best for No Down Payment Equipment Loans

- Min. Time in Business: 2 years

- Min. Credit Score 600

- Borrow up to $500,000 in working capital

- Equipment financing up to $150,000

- Factor rate From 1.10

- Fast funding

- Early payment discounts

- Equipment financing repayment 2-5 years

- Working capital repayment 4 months - 2 years

- Easy application

- Fast funding

- Fair credit accepted

- Daily or weekly repayments

- High annual revenue requirements

- No mobile app

National Funding offers loans you can use to cover the cost of new or used equipment. Depending on your finances and the cost of your equipment, you may get approved for up to $150,000 in funding and repay what you borrow every month. Best of all, there is no down payment required.

Main Features

National Funding’s equipment loans cap out at $150,000 with repayment terms between two and five years. National Funding uses a factor rate rather than an interest rate, and rates begin at 1.10. To qualify for a National Funding loan, you’ll need a credit score of at least 600, be in business for two years or more, and show $250,000 or more in annual revenue.

Lendzi - Best for Low Interest Rates Equipment Loans

- Equipment financing up to $2 million

- Min. credit score: at least 500

- Min. time in business: 6 months

- Borrow up to $4 million in working capital

- Business line of credit up to $250,000

- See your options without hurting your credit

- Flexible terms: 3 to 15 months

- Excellent customer reviews on independent review sites

- Get funding in as little as 24 hours

- Multiple lenders to choose from

- Competitive interest rates

- Poor credit accepted

- Excellent customer reviews

- No collateral required

- Startups may not qualify

- Annual revenue requirements may be high

- Rates high for those with poor credit

Lendzi offers some of the lowest interest rates on equipment financing loans. This is because they are both a direct lender and a partner with more than 75 additional lenders, allowing them to find the lowest rate possible for your small business. Lendzi’s online application is quick and seamless, and applying will not affect your credit score. Whether you need a small, $10,000 equipment financing loan or are looking for a loan up to $2 million, Lendzi can help.

Main Features

Most equipment loans that Lendzi can get you are up to $2 million and have terms ranging from 12 to 84 months. The minimum credit score required is 550, and rates start at just 3.49%. Rates are typically lower with equipment financing loans as opposed to traditional small business loans because the equipment acts as collateral. If you default on the loan, the lender can confiscate your equipment.

In addition to a credit score of 550, lenders ideally want to see you’ve been in business for at least six months (ideally two years) and have a minimum cash flow of $100,000 to $130,000.

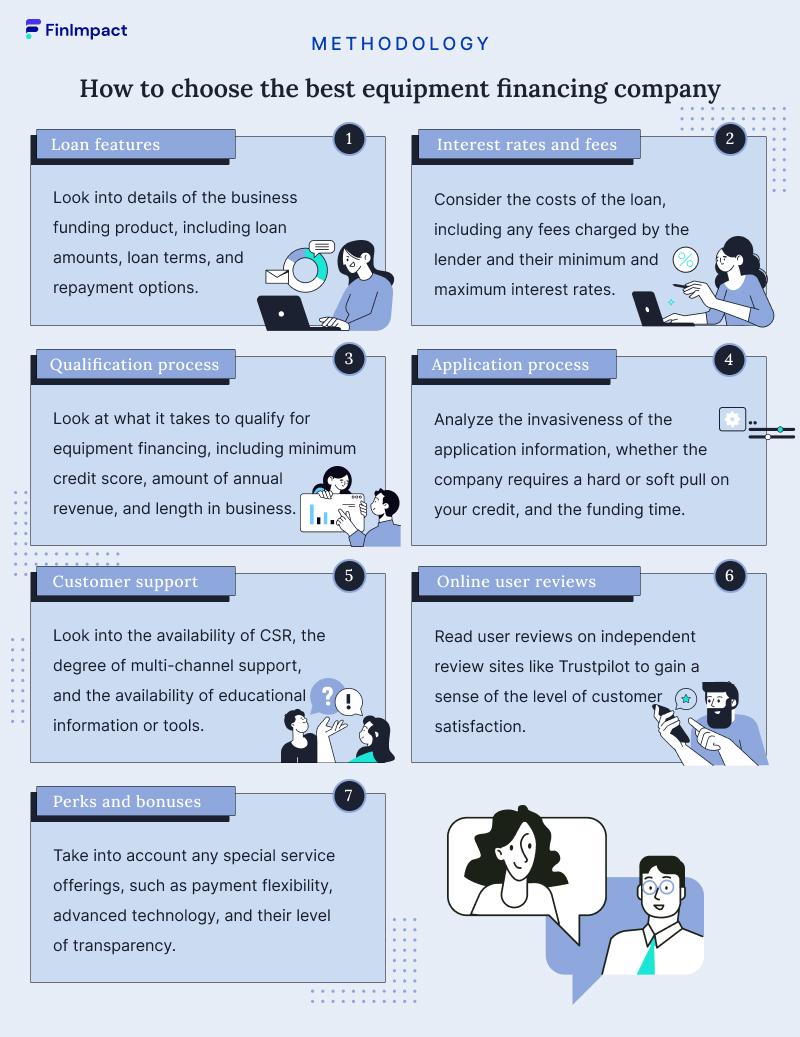

How to Choose the Best Equipment Financing Companies

- Loan features: We looked into details of the business funding product, including loan amounts, loan terms, and repayment options.

- Application process: We analyzed the details of the application process, such as the invasiveness of the application information, whether the equipment fincnaing company requires a hard or soft pull on your credit, and what the funding time looks like.

- Interest rates and fees: We considered the costs of the loan, including any fees charged by the lender and their minimum and maximum interest rates.

- Qualification process: We looked at what it took to qualify for equipment financing, including minimum credit score, amount of annual revenue, and length in business.

- Customer support: We looked into various customer support features, such as the ability to talk to a customer service representative, the degree of multi-channel support, and the availability of educational information or tools.

- Online user reviews: We read company reviews on independent review sites like Trustpilot to gain a sense of the level of customer satisfaction.

- Perks and bonuses: Finally, we took into account any special service offerings, such as payment flexibility or advanced technology, as well as their overall level of transparency.

Main Features of the Best Equipment Financing Companies

Now that you’ve had a chance to learn about the top equipment financing companies in depth, this side-by-side comparison will help you decide which one is the best fit for you.

Min. Credit Score - 550

Min. Time in Business - 6 months

Min. Revenue - $100,000

Loan Amount - Up to $2 million

Interest Rate - Begins at 3.49%

What is Equipment Financing?

Equipment financing is a loan used specifically for purchasing equipment. It usually doesn’t include working capital loans that are meant to provide funding for day-to-day operations. ‘Equipment’ is tangible assets such as computers, freezers, vans, trucks, tools, and other functional machinery necessary for running the business. Equipment financing can also cover software.

Businesses spend approximately $2 trillion dollars investing in equipment each year. About 57% of that investment is financed through loans, lines of credit, or other financial products.

With an equipment financing loan, the total loan amount cannot exceed the total economic value of the equipment itself. You pay interest on the loan, but it is not as steep as other methods (such as credit cards or working capital loans) because the equipment acts as collateral for the loan. If you fail to pay, the lender will seize the equipment.

Remember that equipment financing is a loan, not a lease. You own the equipment and have to make payments; whereas with a lease, you are renting the equipment and do not own it. With equipment financing, you can claim depreciation on your asset to reduce your tax liability.

How Equipment Financing Works

Business equipment financing is usually viewed as a more cost-effective and lower-risk way compared to other forms of financing. It allows businesses to maintain their cash reserves because they do not purchase the equipment outright.

Each lender that offers equipment financing and small business loans will have different terms, but you can usually find a lender that will finance around 80% of the asset’s total purchase price.

Generally speaking, you will need to pay the initial 20% of the cost and then repay your lender over the term of the agreement. There are some equipment financing lenders, though, that do not require a down payment.

More than 50% of the equipment acquired by U.S. businesses is financed, according to the Equipment Leasing and Finance Association.

Types of Equipment Financing

There are several types of business funding that you can use to finance an equipment investment including:

- Secured business loans: This type of small business loan uses the equipment as collateral, potentially reducing interest rates for the term of the loan.

- Business line of credit: As a type of short-term business loan, a business line of credit may be a good choice if you plan to pay off the debt quickly.

- Term loan: These business loans may be either short- or long-term and used to finance equipment purchasing or leasing. However, you may be required to put up additional collateral to secure these loans.

- SBA CDC/504 loan: These government-backed loans can be used to finance machinery and equipment as well as facilities and land. These loans are available only through Certified Development Companies (CDCs).

According to the Equipment Leasing and Finance Association, Equipment financing lenders include traditional banks (53%), manufacturers/vendors (17%), and fintechs (14%).

Businesses That May Use Equipment Financing

Equipment financing loans are best suited for startup companies that find it difficult to obtain traditional loans. However, any business that needs equipment can use this method, not just startups.

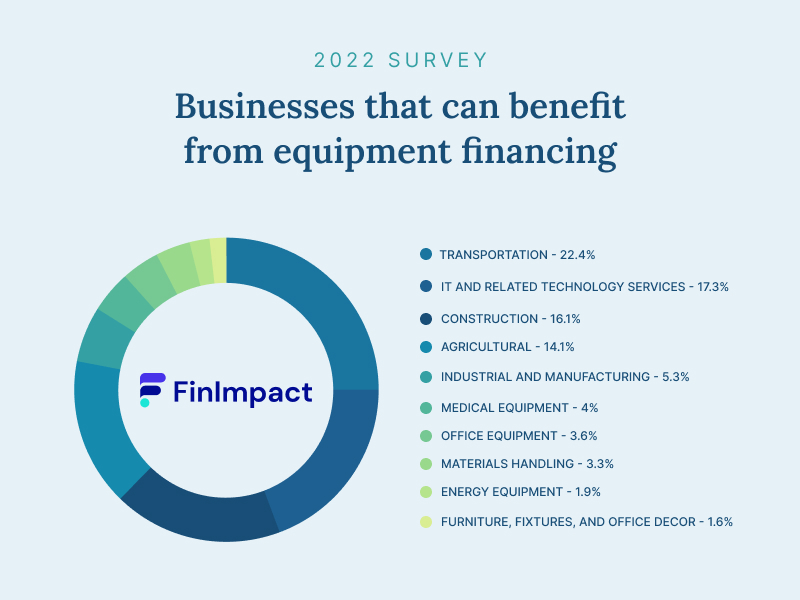

Here are some examples of businesses that could benefit from equipment financing and the types of equipment they finance:

- Transportation: transportation equipment represents 22.4% of the total equipment financing volume in the U.S. This includes box trucks, dry van trailers, flatbed trailers, stepdeck trailers, removable gooseneck trailers

- IT and related technology services: IT equipment represents 17.3% of the total equipment financing volume. This includes modems, routers, network switches, UPS, and servers

- Construction: construction equipment represents 16.1% of the total equipment financing volume. This includes excavators, bulldozers, trenchers, cranes, and other heavy equipment financing.

- Agricultural and farm businesses: agricultural equipment represents 14.1% of the total equipment financing volume. This includes cutters and shredders, harvesting, planting, and seeding equipment

- Industrial and manufacturing industry: industrial equipment represent 5.3% of the total equipment financing volume. This includes centrifuges, generators, storage tanks

- Medical practices : medical equipment represents 4% of the total equipment financing volume. This includes medical imaging machines, insulin pumps, nebulizers, and more

- Other industries: office equipment represents (3.6%), materials handling equipment represent 3.3%, energy equipment represent 1.9%, furniture, fixtures, and other office decor represent 1.6% of the total volume of equipment financing in the U.S.

Source: Equipment Leasing and Finance Association (ELFA)

Equipment Financing Eligibility Requirements

While every lender sets their own criteria for equipment financing loans, most work off of the same basic eligibility requirements. To approve borrowers for this type of business funding, lenders will take a close look at the following items:

- Time in business: Most lenders want you to have at least 3-6 months of business history.

- Annual revenue: Typically, lenders want to see you’re making at least $100,000 in revenue annually.

- Credit score: You’ll need a personal credit score of at least 500. In some cases, a lender may ask for a business credit score as well.

- Industry: Not all lenders service every industry. Some limit who can apply for an equipment financing loan.

Equipment Financing Rates

While equipment financing rates are very competitive (due to the collateral supplied), they tend to have high minimum loan amounts. Some lenders require business owners to finance a minimum of $20,000. If this is too high, a term loan or business line of credit may be more suitable.

There is little standardization for equipment financing rates because there are many different types of equipment. It’s important to distinguish equipment financing from inventory financing and equipment leasing, as the average rates will differ. Equipment financing rates and terms will depend on your specific situation, i.e., your credit score and what you require. A good equipment financing rate might be as low as 5% or even less

Equipment Financing Pros and cons

Pros

- Fast approvals - Since the asset is being used as collateral, it’s usually much faster to arrange this type of lending. Most of the lenders on our list offer equipment financing to small business owners within 24 hours of approval.

- Spread the cost - Financing is the perfect way to spread the costs over a long period of time so your cash flow doesn’t take a hit.

- No additional collateral needed - Your other small business and personal assets aren’t at risk if you default on a loan. Only the asset you’ve applied to secure a loan will be seized if you default.

- Tax benefits - You can write off all of your loan repayments as tax-deductible expenses, helping you to minimize your total bill at the end of the year.

- Fuel growth - For small businesses that might not have the capital to purchase large pieces of equipment, loans are a real lifeline. The injection of cash can prove an incredible boost to growth.

- Boost credit score - Like any loan, your credit will be affected. If you make your payments on time, you’ll see a gradual improvement in your score.

Cons

- Tougher eligibility criteria - Most lenders seek applicants with good credit scores and strong business history.

- Restricted applications - Your loan purpose is strictly limited to the specific asset you want to purchase. Other types of working capital loans will offer more flexibility for your small business.

Conclusion

At the end of the day, finding the best equipment financing companies is no different than finding a lender for a different type of loan. You'll want to shop around for multiple quotes before applying and read any terms and conditions carefully before signing on the dotted line.

However, none of that can happen until you’ve chosen the lender that’s the best fit for you. If. you're ready to take the next step toward getting the equipment funding you need, use the list above to help you get started.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!

Related Loan Picks

Gym Equipment Financing

Read MoreBest Franchise Loans

Read MoreBusiness Loans with Bad Credit

Read More