| All content presented here and elsewhere is solely intended for informational purposes only. The reader is required to seek professional counsel before beginning any legal or financial endeavor. |

Business owners have a lot to think about when they need to buy a new piece of equipment. It goes beyond the purchase price, their good or bad credit score, and financing options available. They also need to think of the tax implications of each purchase. Equipment depreciation, primarily used for tax filing, allows business owners to deduct the cost of the expensive, but used equipment over its entire life.

How To Depreciate Equipment

When you buy an expensive piece of new or used equipment for your business, you can take a deduction on your taxes. However, when this equipment is meant for long-term use, you’ll need to spread the cost of the deduction over the life of the equipment. The method of finding this cost is depreciation.

Depreciation can be simple, with the deduction being the same each year. Or you can use what’s called an accelerated depreciation method to get a higher deduction for the first few years. There are a variety of equations accountants use to calculate depreciation. Which they use will largely depend on how quickly the equipment’s value decreases and the specific industry they work within.

How To Calculate Depreciation Of Equipment

Calculating depreciation can be fairly simple, but as you’ll see is a theme here: it depends on your specific industry and equipment. In general, though, you’ll need the following pieces of information:

- Cost Value: This is the price you originally purchased the piece of equipment for. And is often determined by the equipment financing rates.

- Salvage Value: This is the resale value at the end of the equipment’s life.

- Book Value: The book value is the cost value minus the salvage value.

- Equipment Lifetime: This is simply how long your equipment will last. You can predict the life of your specific equipment by working with an appraiser or asking the company who you bought it from to give you an estimate.

Once you know this information, you can choose a method of calculating depreciation.

Straight-line depreciation

Straight-line depreciation is fairly simple. The exact formula is as follows:

Cost value - salvage value / useful life of the equipment = Depreciation

To give you an example of a straight line depreciation method - say a farmer buys a tractor for $60,000. The tractor is expected to last eight years and can be scrapped for parts for $10,000 at the end of its life. When he goes to calculate his straight-line depreciation, his equation looks like this:

$60,000 - $10,000 / 8 = $6,250 annual depreciation

Double declining balance

Double declining depreciation allows you to get a higher deduction the first year you own the equipment. You’ll depreciate your asset or assets at double the rate of the straight-line method. This results in a declining deduction as the years go on.

To get the exact calculation, you’ll do exactly as you would in the straight-line method, except you double the annual depreciation for the first year. In the example above with the farmer who bought the tractor, his annual depreciation for the first year would be $12,500.

This method is best used for assets that depreciate quickly in the first few years. Vehicles are the best example here since they depreciate quickly as soon as they’re driven off the lot.

Units of production

The unit of production method doesn’t rely so heavily on how long you’ll use a piece of equipment, but rather on how much it can produce. The exact formula is:

Unit Production Rate x Units Produced = Depreciation Expense

How the heck do you find those numbers?

Well, the unit production rate is simply the original value of the equipment and you subtract the salvage value. Divide this number by how many units you expect to produce, and bam, you have your unit production rate. The exact equation looks like this

Original Value – Salvage Value / Estimated Unit Production = Unit Production Rate

Sum-of-years’ digits (SYD)

Like the double declining method, the SYD method accelerates depreciation so you get the highest deduction in the first few years you own the asset. SYD uses the number of years the asset is expected to last and adds together the digits. For example, if the new oven you just bought for the restaurant you’re opening has a life expectancy of seven years, you’d add 7 + 6 + 5 + 4 + 3 + 2 + 1. This equals 28. You’ll then divide each year by this number to get the depreciation percentage for each year.

So, this is the depreciation percentage (rounded up) for each year you’d own the oven:

● 7 / 28 = 25%

● 6 / 28 = 21%

● 5 / 28 = 18%

● 4 / 28 = 14%

● 3 / 28 = 11%

● 2 / 28 = 7%

● 1 / 28 = 4%

The SYD method is best used for quickly depreciating assets since you’ll get the highest deduction in the first year.

What Is the Equipment Depreciation Rate?

There is no hard and fast rate since it depends on the industry you’re in and the equipment in question. In construction, for example, depreciation can happen in just a few years since the equipment is used daily and is used for tough jobs. Most technology, on the other hand, can last up to 10 years.

What Types of Equipment Depreciate?

The IRS calls any property that can depreciate capital assets. In general, anything you use for more than two years that helps you produce income will qualify as a capital asset. These are usually big-ticket items like:

● Vehicles.

● Computers, cameras and other long-lasting technology.

● Factory equipment.

On the other hand, things you can’t depreciate are smaller items that can contribute to business success, but don’t necessarily help you produce your product or service. Office supplies, for example, won’t qualify. Additionally, some intangible (aka, not physical) assets won’t qualify. This means computer programs, trademarks, and patents won’t often depreciate.

Factors that Affect Equipment Depreciation:

There are several factors that can affect equipment depreciation, including:

- Asset Cost: A significant aspect in determining the rate of depreciation is the equipment's initial purchase price. The depreciation amount will be higher the more expensive the equipment is.

- Useful Life: The time frame over which an asset is anticipated to be economically useful is known as the asset's useful life. The depreciation amount will be higher the shorter the equipment's useful life is

- Salvage Value: The projected price at which an item can be sold when its useful life is over is known as salvage value. The equipment's high salvage value will result in a lower rate of depreciation.

- Tax Laws: A nation's tax regulations may have a variety of effects on how quickly equipment depreciates. For instance, tax rules may offer particular tax breaks for the acquisition of specific pieces of equipment, which may have an effect on the depreciation percentage.

- Utilization: The equipment's use might have an impact on depreciation. The equipment will age more quickly if it is used frequently and intensively than if it is used less frequently.

How to Choose the Right Calculation Method for Your Business

When it comes to how to calculate depreciation of equipment, there are a number of methods that work best for certain industries. Here’s a sampling of who these methods may be best for:

- Straight-line depreciation is right for those looking for the simplest method of depreciation. You’ll get an even rate of depreciation over the life of the asset, so it’s also better for equipment that doesn’t lose value quickly. Additionally, if you predict that you could end up in a higher tax bracket down the road, the straight-line method is a better option. That way you can secure a higher deduction later on, rather than taking a higher one in the first few years when your income is lower.

- Double declining balance depreciation is right for businesses that frequently buy pieces of equipment that depreciate quickly. This can be vehicles or heavy-duty equipment that takes a lot of wear and tear.

- Units of production depreciation is right for businesses that use their equipment for regular production purposes. If your equipment doesn’t necessarily last long, but it can produce a lot, you could potentially secure a better deduction using this method.

- SYD depreciation is right for businesses that hold assets that depreciate quickly, similar to the double declining depreciation.

What Are The Benefits of Depreciation?

Understanding your business’s equipment depreciation can help you understand a number of things about your business. Here are two specific benefits you’ll see by calculating the depreciation of your assets.

- Taxation write-offs: Predominantly, your accountant will calculate depreciation on any assets you have in order to get you a deduction on your taxes.

- Helps to make decisions on repairing the assets: Understanding depreciation helps you understand the true value of your assets. If you find that a piece of equipment is on its last legs, understanding how much it has depreciated can help you understand if it’s worth repairing or if you should just buy new.

Should Equipment Depreciation be a Factor in Deciding to Buy or Lease New Equipment ?

The depreciation value of the equipment is one thing to consider when considering whether to buy or lease it.

According to the IRS, in order to be depreciated, equipment must be:

- Owned by the company

- Used in a commercial or income-producing activity

- A determinable useful life that is likely to last more than one year

Both buying and leasing should include tax deductions and future resale value when assessing equipment costs. Leasing can provide tax benefits, with leasing expenditures being 100% tax-deductible for small enterprises up to $500,000. Furthermore, leasing can provide minimal upfront expenses and pass maintenance costs to the leasing business. Owning the equipment outright, on the other hand, may provide a higher future resale value as well as more control over the equipment.

When determining whether to buy or lease equipment, consider tax deductions, resale value, up-front expenditures, and maintenance duties, as well as the equipment's depreciation value.

The Role of Equipment Depreciation in Qualifying for A Small Business Loan

When looking for financial support for your business, it's important to take into account how equipment depreciation affects your ability to qualify for a small business loan.

Since depreciation is the process of lowering an asset's value over time, it plays a significant role in determining your company's financial stability.

The following important considerations should be made when thinking about how equipment depreciation affects your ability to obtain a small business loan:

- The equipment's worth is taken into account when assessing the financial stability of your company.

- The estimated useful life of the equipment and the depreciation method are used to calculate depreciation (e.g. straight-line, accelerated, etc.).

- Depreciation costs are deductible for tax purposes, which can lower your company's taxable income.

- Depreciation of equipment has an impact on the loan's collateral value, making it a crucial consideration for small business loans.

The amount of the loan, as well as its terms, including the interest rate and repayment period, are based on the value of the collateral.

It becomes more challenging for a business to be approved for a loan when the value of the collateral is lower because this results in a smaller loan amount and higher interest rate.

Tips for Optimizing Equipment Depreciation for a Small Business Loan

- Maintain equipment in good condition to increase its value

- Replace outdated equipment to prevent errors and failures.

- Use the straight-line depreciation formula: Calculating the depreciation of an asset over the course of its useful life is simple when using the straight-line depreciation formula. The equation is: Annual depreciation = (Asset cost - salvage value) useful life.

- Verify your company owns the property and utilizes it for commercial or income-generating purposes: Businesses may depreciate property that they own and use in a business or income-producing activity, according to the IRS.

- Think about using Section 179 to maximize your deduction: The tax code's Section 179 allows small businesses to write off the entire cost of qualifying hardware and/or software they bought or financed during the tax year. It may be possible to do this to increase your depreciation deduction.

- The choice to utilize Section 179 must be made in the tax year in which the asset is put to use for business purposes, and the deduction cannot exceed your earned income for the tax year.

- Deduct the expense in the year the asset is used for business purposes: Take the deduction in the year that you begin using the asset to maximize equipment depreciation.

- Keep accurate records of all business-related equipment, including the date of purchase, the equipment's price, and any other pertinent data. It's important to keep accurate records of all business-related equipment. When figuring out how much your equipment has depreciated, this information will be helpful.

How to Use Equipment Depreciation to Your Advantage When Making Equipment Investment Decisions

- Start by having a thorough understanding of equipment depreciation. Depreciation of equipment is the term used to describe how an asset loses value over time as a result of use and aging.

- Think about the equipment's function and intended use: Be sure you comprehend the equipment's intended usage and how it will be put to use to bring in money for your company.

- Find out the equipment's usable life: The equipment's useful life is a crucial consideration when choosing an investment. The equipment will maintain its value for a longer amount of time if it has a longer usable life.

- The decreasing balance approach, the sum-of-the-years' digits method, and the straight-line method are a few of the numerous ways to calculate equipment depreciation.

- Contrast the price of purchasing vs. leasing the equipment. Although leasing may offer tax advantages, minimal upfront costs, and no maintenance charges, it could not give you as much control as buying the equipment altogether.

- Think about the equipment's prospective resale value: It's crucial to think about the equipment's resale value because it can affect your company's overall return on investment.

- Take into account the equipment's total cost, which includes all maintenance, repairs, and replacement parts. Make sure you are aware of the entire cost of ownership for the equipment, including the expenses related to maintaining it.

- Consider the effect that equipment depreciation will have on your company: It can significantly damage the financial statements of your company and your entire financial situation.

- Take into account the most recent market trends and best practices: Keep abreast of the most recent market developments and best practices because they may affect your choice of investments.

- Using the information you gathered to make wise decisions: Before making an investment decision, make sure to acquire all pertinent information, taking into account the equipment's function, intended use, usable life, and overall ownership expenses.

- Consult specialists for guidance. To assist you in making knowledgeable judgments about your equipment investments, think considering asking professionals for advice, such as accountants or equipment investment advisors.

- Your equipment investments are generating the anticipated return on investment, you should regularly assess their performance.

- Think about the effects of inflation: Over time, inflation can have a big impact on the value of your equipment, so keep that in mind when making investment decisions.

- Make sure to plan for the eventual replacement of your equipment, as this can have a huge impact on the financial health of your company.

- Regularly review your investment choices: Review your investment choices frequently to make sure they are still producing the expected outcomes and to make any required alterations.

How To Report Depreciation on Your Tax Return

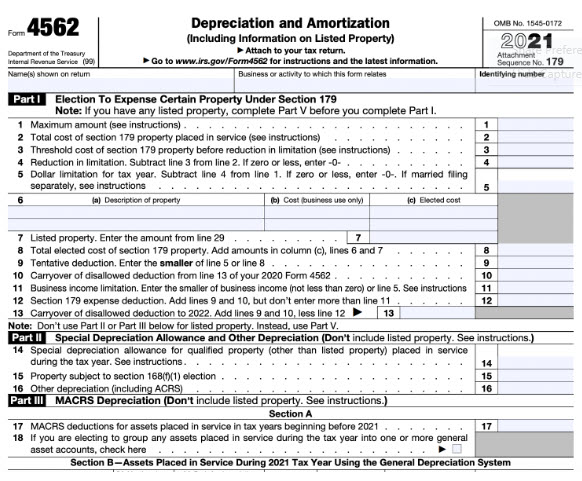

When filing your taxes, you’ll calculate and record any depreciation deductions on IRS Form 4562, as shown below.

The IRS offers step-by-step instructions on how to fill out this form, but I’ll explain what each part consists of:

- Part I: This first part is all about the Section 179 deduction. In simplest terms, this deduction allows business owners who purchase qualifying equipment or machinery and get the full deduction the first year they own or finance it.

- Part II: The next part focuses on the special depreciation allowance. If you have qualifying property (listed on page 5 of the IRS instructions), you can get an additional deduction the first year your equipment is bought and used.

- Part III: If you plan to use an accelerated depreciation method, you’ll need to fill out this section. The MACRs (Modified Accelerated Cost Recovery System) depreciation method is a common accelerated method used by the IRS. It’ll allow you to take a larger deduction your first year and have it slowly decrease throughout the life of the equipment.

- Part IV: Even though the “Summary” section of the form is placed in the middle, this is simply where you add up your totals from Parts I, II, III, and V.

- Part V: If you have any equipment that’s both for personal and professional use, you’d list that here. You’ll split up the items based on if they’re used more for personal or professional reasons.

- Part VI: This final section is in regards to amortization. That’s essentially depreciation of intangible (or not physical) assets like copyrights and patents.

Final Word

Depreciation can get you a much-needed deduction on expensive equipment, especially if you need to take out heavy equipment financing. If you have a business accountant, they can likely take care of securing the proper deduction for you, so check in with them.

Additionally, in the event that you’re in need of financing so you can buy vital equipment, consider National Funding, a small lender providing equipment financing for startup businesses. They offer same-day funding for many borrowers, including those with lower credit, and prequalification is super easy. You can learn more about National Funding in our review here.