Contrary to what you might think, there is equipment financing for bad credit and having bad credit doesn’t immediately disqualify you from financing options, it just limits your choices a little and the loan terms become a little more expensive.

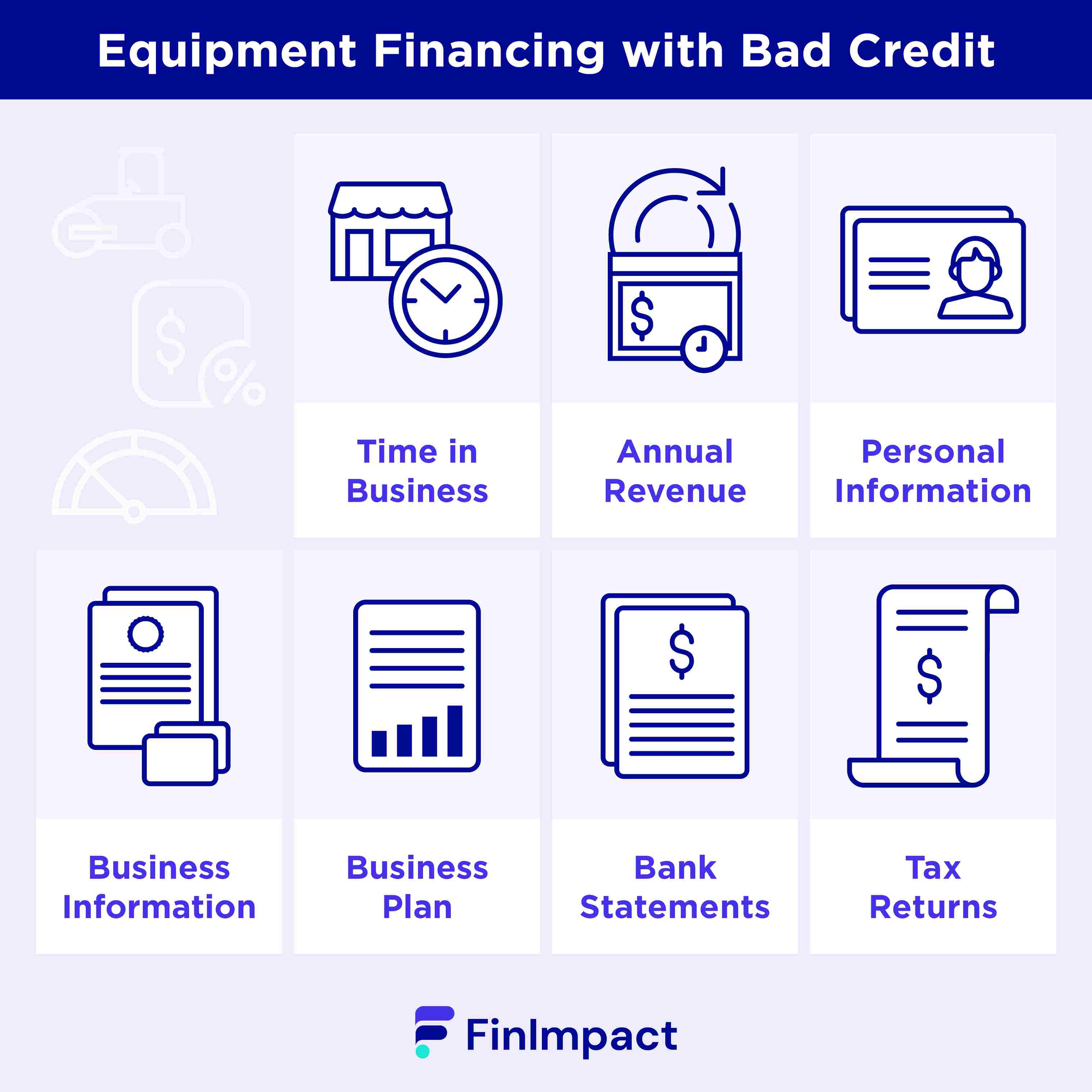

Practical Advice: You’ll need to present lots of documentation like your business plan, tax returns, bank statements, and more, so make sure you have your paperwork in order before applying.

How To Acquire Equipment Financing With Bad Credit

When you apply for a loan, in addition to allowing the lender to pull your credit, you’ll need to provide proof that your business is performing well. The most common application requirements include proof of:

● Your time in business: You’ll need to be in business for at least six months most of the time in order to qualify for any sort of financing.

● Your annual revenue: Just like with most loans, you’ll need to provide proof of income so the lender knows that you can pay the loan back. Be honest, as you’ll be asked for other documents that need to show this income.

● Personal information: You’ll be asked the basics such as your name, phone number, email address, and Social Security Number. This will usually come at the very beginning of the application.

● Business information: You’ll have to explain a lot about your business so the lender can understand why you need the loan. You’ll need to provide the business name, the type of business and industry, your business address, and your business’s Tax ID.

● A business plan: When starting a business, coming up with a business plan is what you should already be doing. That way you have a clear goal written down with a way to reach it outlined. Lenders will want to see this so they know that you’re a serious business owner who can pay down their debts.

● Recent bank statements: You’ll have to provide at least a few months of bank statements for most equipment financing. Your bank statements will be used to verify your income.

● Business and personal tax returns: Typically, you’ll be asked to provide two years of tax returns. Again, this is for verification purposes so the lender can see that your income is reported correctly, as well as any other assets you have.

Where To Look for an Equipment Loan With a Bad Credit Score

For the most part, many lenders require a score of 600 minimum to qualify for equipment financing. Still, there are lenders that are built around offering bad credit borrowers financing. Here are three options to consider when looking for the best equipment financing with bad credit.

Credit unions: Credit unions are community banks, so you’ll often have a more personal relationship with your bank than if you use an online lender. This means you stand a better chance of pleading your case for funding, so those with a more limited credit history may qualify when they wouldn’t elsewhere.

National Business Capital: National Business Capital offers equipment financing with no credit check needed. There is a catch, of course. You only don’t need a credit check if you have an annual income of $120,000 and have been in business for at least six months. Some applicants can even get 24-hour funding.

Crestmont Capital: Crestmont states on its website that your credit score is a lesser factor in their decision process since you do put up the equipment as collateral. Their application process is simple and you can also get same-day funding in some instances.

Tips To Acquire Equipment Financing With a Bad Credit Score

There are ways to get the financing you need, even if you have poor credit. You just have to know what your best options are. Here are a few tips for getting financing when you have a low credit score.

● Make a larger initial down payment: Oftentimes, if you’re able to make a higher down payment the lender will offer better terms. Since you’ll be lessening their risk, they’re more apt to reward you.

● Leverage existing bank relationships: If you have a local bank that you’ve been working with for years, consider starting there. They understand your financial history and can often help you out when you need it most.

● Apply with the help of a cosigner: If you have a family member or friend who does have good credit, consider asking them to cosign a loan for you. Their score could help you qualify for better terms. Just make sure that you can afford the payments you’ll get, as the cosigner will be responsible for the payments if you can’t make them.

● Offer additional collateral: When you get equipment financing, the equipment itself will likely be the collateral on the loan. For example, when financing heavy equipment, chances are you can offer up another piece of equipment or a company vehicle as collateral, thus lessening the risk for the lender, so you may be rewarded with a better rate.

● Update your business plan and financials: Before you apply for a loan, make sure your business plan and financials are up to date. This will paint the most accurate picture for the lender and can help ensure you’re getting the rate you deserve.

● Apply with online lenders instead of traditional funding sources: Online lenders sometimes have more lenient qualifications than big-name banks. Additionally, they often have faster turnaround times once you complete your application.

How to Prepare Before Applying for Equipment Financing with Bad Credit

Having bad credit can make it difficult to finance a piece of company equipment. Applying for equipment financing with negative credit might be challenging, but there are actions you can take to increase your chances of approval. When applying for equipment financing, it is critical to understand what lenders require and to plan ahead of time.

This will help to guarantee that you have all of the appropriate papers when it comes time to apply. Here are seven practical measures you may take to prepare before applying for bad credit equipment financing:

Check Your Credit Report: Understanding your credit report is vital because lenders will use it to assess whether or not to approve or reject your loan application. Make certain that the information on your report is correct so that it does not reflect badly on you throughout the loan application process.

Calculate Your Debt-to-Income Ratio: Lenders will want to ensure that you can manage any new debt payments in addition to existing responsibilities, so determine what percentage of your monthly income goes toward debt payments and be prepared to supply this information when requested.

Prioritize Your Debts: If possible, try to pay off some debts before asking for an equipment loan to reduce your overall debt load before applying.

Research Financing Options: Depending on the amount of money needed and other characteristics such as credit score or industry affiliation, there are numerous sorts of equipment financing alternatives available, so make sure you do your homework ahead of time to choose the best option for your scenario.

Create a Business Plan: A business plan should include financial statements from previous years as well as a complete budget plan for future years to demonstrate to possible lenders that you have planned a strong strategy for success once funding is provided.

Locate Collateral or a Co-Signer: If possible, offer collateral (a valuable asset) or find a cosigner to boost your chances of acceptance and/or to earn better payback conditions if authorized.

Obtain Required Documentation: When filing an application, gather any essential papers such as tax returns, bank statements, business licenses, and so on that may be required by lenders.

Tips for Negotiating Better Terms on Equipment Financing with Bad Credit

There are various aspects to consider when choosing an equipment loan lender for bad credit. To begin, ensure that the lender is respectable and trustworthy. Look out their internet reviews and ratings to get a feel of the quality of their service, as well as any consumer comments.

Second, ask about the loan terms, such as interest rates and repayment alternatives. It is recommended that you examine several lenders to locate the greatest price that meets your financial circumstances.

In addition, look into any hidden fees linked with the loan, such as origination or closing costs. Finally, before entering into a contract with a lender, make sure you understand the overall cost of borrowing so you can budget accordingly for long-term success.

- Reputation: Read online reviews and ratings from previous customers to have an understanding of the lender's service quality.

- Loan Terms: Ask about loan conditions such as interest rates and repayment schedules to see which one best meets your financial requirements.

- Hidden Fees: Inquire about any additional expenses related with borrowing from this specific lender, such as origination fees or closing costs, so you know exactly what you'll be spending on top of your monthly payments over time.

- Overall Cost: Determine the entire cost of borrowing so that you may budget for success in both short and long term goals connected to equipment financing needs with this specific lender while remaining financially within your means.

- Collateral Requirements: Before committing yourself financially, make sure that you understand all collateral requirements associated with obtaining a loan from this specific lending institution so that if things don't go as planned, you know exactly what is at stake or potentially lost due to defaulting on payments owed back over time due to circumstances beyond your control or otherwise stated otherwise by contract agreement between both parties (i.e., borrower & lending institution).

- Credit Score & History: Know what kind of credit score & history is required for qualifying for certain loans, which could save time during the application process if already known beforehand through prior research, thus eliminating potential surprises down the road ahead when it comes time for actually applying and/or receiving funding needed via approved loan agreement between both parties involved (i.e., borrower & lending institution).

- Flexible Options Available: Determine whether there are flexible options available should circumstances change unexpectedly, such as the ability to modify the initial payment plan agreed upon between both parties involved (i.e., borrower and lending institution) without incurring excessive late payment penalties/fees, etc., if needed due to unexpected life events, etc.

Common Mistakes to Avoid when Financing Equipment with Bad Credit

It is critical to be aware of the frequent mistakes individuals make when financing equipment with negative credit in order to acquire the best terms and prices for your loan. The most important thing to remember is that simply because you have low credit, you should never accept a loan with higher interest rates or unfavorable terms. Although it may appear to be a fast fix, it may end up costing you more in the long term. Other typical pitfalls to avoid when financing equipment with weak credit include:

- Not Shopping Around: In order to find the finest loan conditions, it is critical to shop around and evaluate multiple lenders. Do not accept the first deal you receive without first shopping around and comparing various options.

- Failure to Keep Good Credit Habits: Maintaining solid credit habits throughout the loan application process will increase your chances of getting approved at an attractive rate. To maintain your credit score high while applying for a loan, make sure all payments are completed on schedule and debts are paid off fast.

- Not Paying Attention To Loan Details: Before signing any agreement or contract, read through all documents properly, since there may be hidden fees or additional expenditures that were not initially mentioned.

- Applying For Too Many Loans At Once: Applying for many loans at once might harm your credit score and make lenders less likely to approve your application due to the higher risk factors connected with having multiple applications on file at the same time.

- Failure to Give Full Documentation: When asking for a loan, make sure to supply all relevant evidence upfront so that lenders may accurately analyze your eligibility swiftly and simply, without any worries about missing documents later on.

- Ignoring Personal Financial Situation: Before applying for any loans, take some time to carefully evaluate your personal financial situation so that you know what type of loan would be best suited for you based on what you can afford in the long run, rather than simply going with whatever offer looks most appealing initially without considering whether it fits into your budget in the long run or not.

- Not Having a Backup Plan: It's always a good idea to have a backup plan in place in case something goes wrong throughout the process or if an application is denied due to poor credit—have another choice available just in case!

Tips and Strategies for Improving Your Chances of Approval in Costly Situations

Making expensive selections may be a stressful process. Whether you're buying a car, taking out a loan, or investing in a costly item, it's critical to make the best option for yourself and your budget. Here are some pointers and ideas to help you be approved in these situations:

Extensive study: Take the time to properly examine all prospective possibilities so that you can make an informed selection and obtain the best bargain possible. Before making any decisions, compare pricing and analyze your options.

Be prepared: Before making any major purchases, ensure that you have all of the relevant documentation (e.g., credit report, financial statements). This will help to expedite the procedure and boost your chances of acceptance.

Make a spending plan: Before beginning discussions with sellers or lenders, determine how much money you're willing to pay on the item or service in question. This will assist you avoid overspending.

Negotiate: Don't be scared to bargain with sellers or lenders; it's typically the greatest method to get a better deal on an expensive item. You might be shocked at how much money you can save just by asking!

Learn about the various types of financing available: Investigate the many types of financing available for the purchase or loan you're considering (e.g., low-interest loans). If it fits within your budget, this might possibly save you a lot of money over time.

Build good credit: If possible, work on improving your credit score so that lenders view you favorably when granting loans or other forms of financing; this will also give them more confidence in granting approval because they know they are dealing with someone who is less likely to default on payments in the future.

Maintain track of paperwork/documentation: Always retain copies/records/documentation connected to any expensive decisions taken; this will help if there are any queries about contracts, warranties, and so on later on down the line, which could otherwise lead to conflicts if not addressed swiftly.

Alternative Funding Opportunities for Bad Credit

Equipment financing is a popular method for businesses to purchase the equipment they require to function. Yet, if a company has poor credit, equipment financing may be out of the question. Fortunately, there are other options for firms with negative credit that can assist them in acquiring the necessary equipment. Some possibilities include leasing, renting, and using supplier finance.

- Leasing: Leasing can be a wonderful option for businesses with negative credit because it has lower upfront expenses than buying outright and does not require a lender or any type of credit check. This can be accomplished through an equipment leasing business or directly from the supplier of the rented equipment. The disadvantage of this choice is that the lessee will not own the property at the end of the lease term.

- Renting: Renting gives firms access to critical equipment on a short-term basis without requiring a long-term commitment or the hefty upfront expenditures involved with acquiring it altogether. This makes it excellent for people on a restricted budget or who simply need limited access to select pieces of equipment in specific regions. The disadvantage is that if rented over a lengthy period of time, rental expenses can quickly pile up and may become more expensive than buying in some situations, depending on usage frequency and duration.

- Supplier Financing: Certain suppliers may provide their own financing solutions, which may be advantageous for those with a low credit history who would otherwise find traditional lending difficult or impossible due to background checks or other considerations involved in granting such loans. These programs often involve directly negotiating payment plans between the supplier and the client, which can be advantageous in terms of interest rates if the terms are acceptable to both parties involved in such agreements.

- Trade-In Programs: Many suppliers now offer trade-in programs in which consumers may trade in older models for newer versions at reduced prices rather than purchasing them outright from more expensive sources such as retail stores or internet merchants.

- Crowdfunding: Crowdfunding platforms enable interested individuals/groups (referred to as backers) to invest money in projects/ventures they support without necessarily having direct control over how that money is used by whoever developed said project/venture (the campaign creator). Businesses interested in acquiring new machinery may find crowdfunding platforms useful in obtaining funds without having lenders perform extensive background checks based solely on one's credit score, as backers typically consider other factors when investing their money, such as potential returns on investment, innovative products being created, and so on...

- Government Grants: Government grants are another excellent option for acquiring new machinery, even if your company has a terrible credit history, because these funds do not need repayment unless otherwise stipulated by the grant's provider (s). They are typically provided by national governments (especially during times of economic hardship) or by private foundations/organizations interested in supporting specific causes within specific industries where conditions are deemed favorable enough to grant financial support at specific times throughout the year (s).

- Personal Loans: If all else fails, taking out personal loans may be a viable option depending on how much money is needed and what type of interest rate is approved for based on an individual's personal financial situation rather than solely relying on one's business' credit score, which may not always accurately reflect overall financial health due to mismanagement and other factors.

Is Equipment Leasing a Good Alternative for Bad Credit Borrowers?

For businesses that need equipment only temporarily, equipment leasing may be a much more affordable option. Often, you won’t need to put down a down payment and your credit may not be run, making this a potentially better option for those who don’t have great credit but still need vital pieces of equipment.

While you won’t ever own the equipment completely by leasing, this may be a better option for quickly evolving industries like the tech industry. This industry changes rapidly, with new equipment coming out every year. Leasing allows you to trade in outdated equipment for the latest technology.

You’ll still pay potential fees and interest on the lease. The lender has to make money somehow, after all. That said, equipment leases are often less costly than equipment financing, meaning you have lower monthly payments. This helps keep your business’s cash flow open so you can use it for other business needs.

How Does Bad Credit Affect Equipment Financing?

Equipment financing for bad credit comes with a number of risks and drawbacks that should be considered before making a decision. Similar to an auto loan, equipment financing allows an individual to purchase equipment with the intention of repaying it over time. If you have poor credit, however, there are various characteristics of this form of loan that make it potentially unsafe or harmful.

High Interest Rates: Because of your poor credit score, the lender may charge you higher interest rates than usual, and you may end up paying more in interest than the equipment is worth. Because lenders take on extra risk when lending money to someone with bad credit, lenders may demand higher interest rates on equipment financing loans.

Restricted Options: If you have bad credit, you may not have as many options when looking for an equipment finance loan, restricting your ability to shop around for the best rate or conditions available. Because lenders are unwilling to grant money due to their higher risk exposure, having negative credit limits your alternatives when looking for lenders who offer equipment finance loans.

Reduced Approval Odds: Those with bad credit have a considerably tougher and less likely time being approved for an equipment finance loan than those with good-excellent credit. Individuals with weak or low credit ratings are unlikely to qualify for traditional loans from banks and other organizations, making it harder, but not impossible, to locate lenders prepared to work within their financial limits.

Longer Repayment Periods/Terms: Lenders will often require longer repayment periods/terms to assist offset some of the risk taken on by granting someone with weak credit access to an Equipment Financing Loan (upwards of 5 years). Lenders offering Equipment Financing Loans may require longer payback periods/terms (5+ years) because they are taking on larger risks by providing such access to those with poor credit.

Increased Down Payments: Moreover, lenders may ask greater down payments from applicants seeking Equipment Financing Loans despite having poor credit. Lenders may require applicants seeking Equipment Financing Loans with lower credit ratings to make greater down payments in order to cover some of the additional risks.

Additional Fees & Charges: Applicants seeking an Equipment Financing Loan despite having a low credit score should expect additional fees and charges to be added to their total costs, potentially increasing overall prices even more than just high interest rates. Because lenders assume higher risk when making these loans, they generally tack on additional fees and levies as a cushion against potential losses connected with such high-risk investments.

Limited Flexibility: Finally, those looking for an Equipment Financing Loan with less-than-ideal credit may find themselves with little room to negotiate better terms or find alternate ways to restructure payments, etc... With fewer alternatives comes less flexibility, which means applicants will have fewer possibilities to negotiate better terms or restructure payment schedules, among other things.

Understanding The Risks Involved In Getting A High Risk Equipment loan

Working with a high-risk equipment loan, it is critical to understand the hazards involved. A high-risk loan is one with a higher interest rate or a shorter repayment time than other loans, and the lender may want greater security from the borrower to secure the loan. Obtaining a high risk equipment loan may involve numerous risks, including:

- Default Risk: If you do not make your payments on time or as stipulated in your contract, you run the danger of defaulting on the loan, which can have major financial ramifications.

- Repossession Risk: If you are unable to make payments on time or in accordance with the terms of your contract, the lender may opt to repossess any assets used as security for the loan. This can be expensive and result in additional costs and fines.

- Interest Rate Risk: High risk loans frequently have higher interest rates than regular loans, which can raise your overall borrowing costs and lower your capacity to repay what you owe.

- Effect on Credit Score: Taking out a high-risk loan may have a negative impact on your credit score if you fail to make payments on time or as stated in your contract. This could limit future borrowing prospects and make obtaining financing for other projects or purchases more difficult.

- Payment Penalties: Depending on the conditions of their arrangement, borrowers may be penalized for late or missed payments, which might raise their total cost of borrowing even more.

- Prepayment Penalties: Many lenders levy prepayment penalties if customers pay off their loans before they are due, which can add additional charges to an already expensive type of financing.

- Fraudulent Activity Risk: There is always the possibility of fraudulent activity when taking out any type of financing, so it's critical for borrowers to do their homework before signing any contracts so that they know exactly what they're getting into and can take the necessary precautions to protect themselves from scammers or lenders who are not legitimate business entities.

Managing Debt Responsibly To Avoid Defaulting On An Equipment loan

Avoiding a default on an equipment loan requires responsible debt management. Defaulting on a loan can have major implications, including the loss of collateral, legal action, and a worse credit score. To stay in good standing with your lender and avoid defaulting on the loan, you must keep organized and attentive of the payment schedule.

The following pointers can assist you in managing your equipment loan responsibly and avoiding default:

Make On-Time Payments: Making on-time payments is one of the most crucial measures for keeping out of default. Skipping even one payment could result in major consequences, so be sure you always make your payments on time.

Make a Budget: Making a budget will allow you to keep track of all of your costs and plan out how much money you have available for payments each month. This will help to ensure that you always have enough money to make your monthly payments without worrying about missing them or going over budget.

Watch Interest Rates: Because interest rates fluctuate over time, it's critical to keep an eye on them to ensure that they remain manageable for you. Keep an eye out for changes in interest rates because they can affect how much money needs to be paid back each month as well as how long it will take to pay off the loan altogether.

Combine Other Debts: Consolidating other debts into a single payment may assist lower the amount of money that must be paid back each month and lessen the stress associated with managing various loans at the same time. This could potentially reduce the danger of missing payments or falling behind on payments, which could lead to default on the equipment loan if not carefully managed.

Maintain Contact With Your Lender: Maintaining communication with your lender is critical when it comes to managing debt responsibly and avoiding default on an equipment loan. Communicate with them on a frequent basis about any changes in your financial condition or any unanticipated challenges that may develop so that they can work with you accordingly during the payback time.

Automated Payments: Set up automated payments through online banking platforms to provide borrowers peace of mind that their debts are being paid without having to personally transmit payments every month. This strategy also eliminates the possibility of forgetting or skipping a payment due date, which could result in default if left unchecked.

Be Persistent: Remaining persistent throughout the repayment process motivates borrowers to make their monthly payments consistently until they eventually pay off their whole sum within the agreed-upon deadline. Failing to persevere may result in missed opportunities to reduce overall costs by taking advantage of lender discounts, which can mount up over the course term if used properly.

Utilizing Co-Signers To Acquire a Loan For Individuals With Bad Credit

A co-signer is someone who agrees to be financially accountable for a loan if the primary borrower fails to make payments. Those with negative credit can obtain a loan by using a co-signer, who allows them to leverage the good credit of another person in order to qualify for a loan or other financial instrument. Because of their poorer credit score, co-signed loans frequently have lower interest rates and higher sums than what an individual would be able to obtain on their own.

In order for a person with bad credit to employ a co-signer, both parties must agree on the loan terms and sign all required documents. The principal borrower should also be aware that failing to make regular payments might have a severe impact on both their own finances and the finances of their co-signer. Here are seven useful bits of information regarding using co-signers:

- A co-signer must have good or excellent credit: In order for lenders to consider a co-signer, they must have good or exceptional credit: Before making a decision, a lender will normally consider both the borrower and cosigner credit scores. As a result, it's critical that your selected cosigner has outstanding or great credit in order for you both to succeed.

- Both parties need sufficient income: enders analyze each party's income when deciding whether or not to approve the loan application; therefore, it is critical that your selected cosigner, as well as yourself, have enough income coming in every month.

- Your debt load should not be more than 40%: In general, the total amount of debt you owe should not exceed 40% of your total income; this includes any other outstanding loans and/or debts you may have taken out in addition to the new one being applied for with your cosigner.

- Both parties are equally liable: When taking out a loan with a cosigner, both parties are equally liable during the duration of the agreement; this means that if either party fails at any point during repayment, it has a negative impact on both people's finances.

- Consider purchasing a life insurance policy: To protect against unforeseen events such as death or disability, consider purchasing an insurance policy that will cover any outstanding balances owed on the loan should either party pass away before repayment is completed - this can help protect your family from any unexpected financial burden associated with unpaid loans/debts after death/disability occurs.

- Make sure all documents are correctly signed: Before signing off on any documents related to obtaining financing with a co-signer, make sure all paperwork is completed correctly and accurately - this way, you can avoid potential issues down the road due to incorrect information being entered into agreements by mistake (which could lead to legal issues).

- Consider refinancing alternatives later on: After establishing some positive payment history by paying off some portion of your debt on a regular basis over time (and hopefully building up more favorable terms), refinancing may become available as an option where you could potentially get better interest rates/terms than what was initially offered when using someone else's good name via signing up as cosigners - so keep that in mind when looking into longer term financing solutions!