Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Fundbox Reviews: Expert Analysis & User Insights for 2024

If you run a small business and are looking to obtain a loan fast, consider using Fundbox - a convenient online lending platform with competitive rates and flexible repayment terms.

Expert Reviewer Verdict

Offering both term loans and a lines of credit, Fundbox is the ideal lender if you are looking for a quick and easy loan application process. With Fundbox, you can get a decision in just three minutes of completing the application.

The more you work with Fundbox, the better your terms become. Get a loan, prove you can make the payments on time, and you’ll be offered more money at a lower interest rate the next time you apply. In this review, our team of expert reviewers has thoroughly analyzed and evaluated Fundbox loans. We will share our findings and provide our expert recommendations on whether Fundbox loans are worth considering.

Fundbox User Reviews - What People Are Saying

If you’re wondering, “Is Fundbox legit?” it’s important to know that yes, Fundbox is a legit online small business lender. The company has funded over $3 billion in capital since its origination in 2013. Fundbox is a leading provider of small business loans and has connected to over 500,000 businesses and counting.

Trustpilot rates Fundbox 4.8 out of 5 stars across more than 3,500 customer reviews. Across multiple reviews, users comment on the friendly customer service, ability to easily reach someone when needed, and the overall simplicity of the company’s application process and account management through the online dashboard.

What’s interesting to note is that most of the complaints found on Trustpilot center on applications that were not approved or were delayed during the height of the pandemic. Several of them relate to Paycheck Protection Program (PPP) loans, which the company no longer offers. Otherwise, there are few current customer complaints. The lower reviews that are posted generally see a response from Fundbox in less than 24 hours.

On the Better Business Bureau (BBB) website, Fundbox receives 4.74 out of 5 stars across 350 reviews and an A+ rating. Notably, Fundbox closed 12 complaints in the last 3 years and 5 in the last 12 months. This highlights some of the challenges noted in the Trustpilot reviews related to the PPP loans and delays during the pandemic.

Summarized Ratings

Fundbox has a stellar User Reviews rating of 4.6. It reflects the average rating from 3 independent user review sites, including a Trustpilot score of 4.7.

Fundbox Review Video

Gordon Scott, our CMT expert applied for a $2,000 loan and shared his experience. Find the full Fundbox review video and all the details down below.

What is Fundbox?

Fundbox is an online lender offering financial products to small businesses. Since its launch in 2013, Fundbox has worked with over 500,000 small businesses and funded over $3 billion in capital. The company also ranked in the Forbes top 500 best startup employers for 2022 and was in The Financial Technology Report’s top 100 FinTech companies in 2021.

Fundbox creates a simple, automated process through its platform with minimal documentation. While its streamlined lending process is a key point of differentiation from its competition, they actively communicate with customers and make it their goal to help improve their customers’ financial lives.

Fundbox Pros and Cons

Pros

Cons

Fundbox Loan Features

Fundbox provides two main products: business lines of credit and term loans. Each product has its own features.

Line Of Credit

Lines of credit act as short-term funding sources for small businesses, similar to a credit card but typically with higher borrowing limits. Lines of credit provide on-demand access to funding that scales up or down with your needs. You can borrow as much or as little as you need, paying interest only on the open balance. As you repay your loan, your available credit replenishes.

| Term Length | 12-24 Weeks |

| Repayment Period | Weekly |

| Interest Rate | Start at 4.66% for 12 week terms |

| Min-Max Amount | $1,000 to $150,000 |

Term Loan

Term loans are one-time loans that you can pay back over longer periods of time than lines of credit. You receive one lump sum that you repay weekly. Small businesses choose term loans for one-time upgrades or investments such as new equipment purchase.

| Term Length | 24 or 52 Weeks |

| Repayment Period | Weekly |

| Interest Rate | Start at 8.33% for 24 week terms |

| Min-Max Amount | $1,000 to $150,000 |

Fundbox Interest Rates and Fees

Although Fundbox makes its loan process fairly easy, its rates do tend to run higher than competitors and traditional banks.

| Business Line of Credit | Term Loans | |

| Origination Fees | None | None |

| Prepayment Fees | None | None |

| Late Payment Fees | Yes | Late payment fees are added to the end of the payment plan |

| Maintenance Fees | None | None |

| Interest Rates | 4.66% for 12 week terms and 8.99% for 24 week terms | 8.33% for 24 week terms and 18% for 52 week terms |

How to Qualify for a Fundbox Loan

Fundbox lines of credit and term loans may require you to sign a personal guarantee upon approval of your application or at a later date. Personal guarantees state that if the business is unable to repay the loan, you will be responsible to resolve any outstanding balance.

Additionally, Fundbox may require a lien on your business as a condition for the loan. These arrangements don’t ask for a specific item to be used as collateral. However, if your business defaults on payments, Fundbox can pursue your business’s assets as compensation for the remaining sum.

Currently, Fundbox requires a business checking account with three months of transactions to qualify for a line of credit.

You must also meet the minimum requirements below:

| Minimum Credit Score | 600 |

| Minimum Annual Revenue | $100,000 |

| Minimum Time in Business | 6 Months |

The Fundbox Loan Application Process

When applying with Fundbox, the platform does a soft credit pull. A soft credit pull does not affect your credit score. Once you’ve been approved for the loan, the lender will then do a hard credit check.

The loan application process is fast and simple. You will be able to fill out the application within 5 minutes and receive the response as quickly as 6 minutes later. Let's walk through the process step-by-step as described by Gordon Scott.

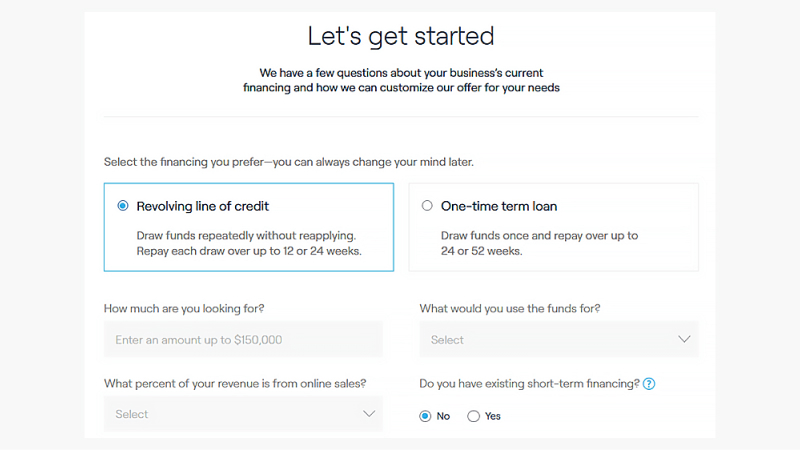

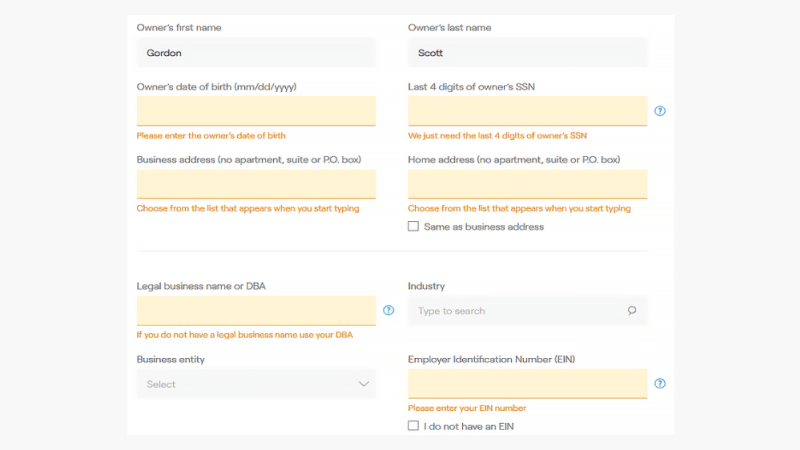

1. Filling out your application form

When filling out your application form, you need to specify whether you need a revolving line of credit or a one-time term loan. You can also choose whether you want to repay each type of funding over 12 to 24 weeks or 24 to 52 weeks.

In addition, you will need to provide some basic information about yourself, such as your identification, business name, business address, and more.

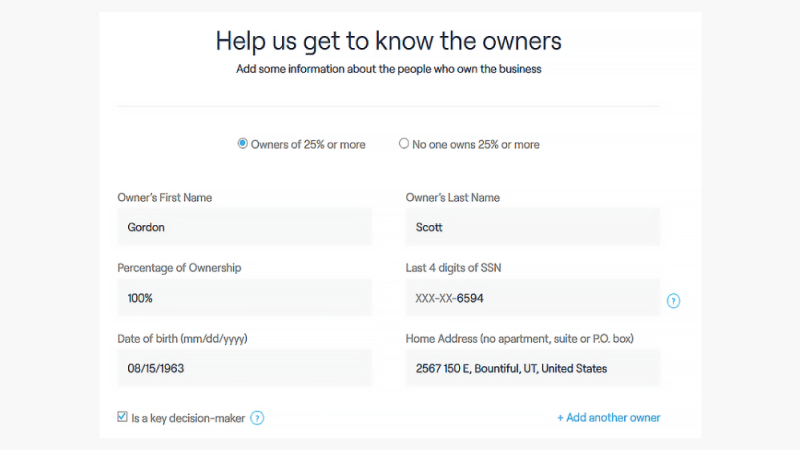

Finally, you are required to share some information about the business owners, including the percentage of ownership you have in the small business, as well as whether or not you are the key decision-maker. The good news is that, unlike other lenders, Fundbox doesn’t ask you to provide a complete business plan, which makes the application process so much easier.

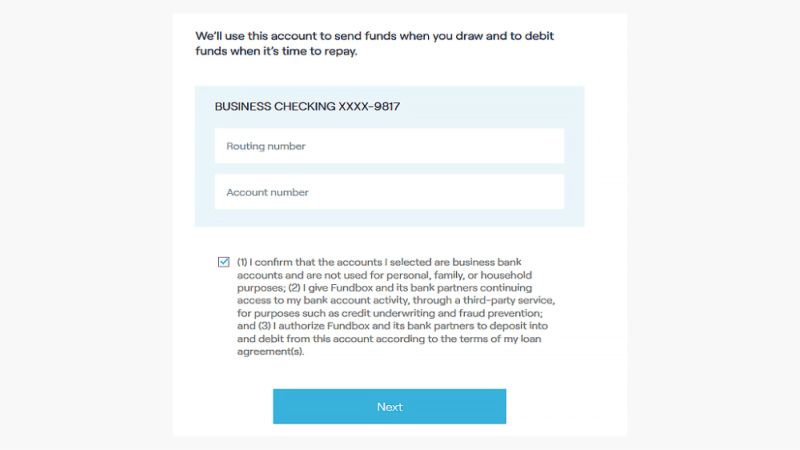

Business Checking

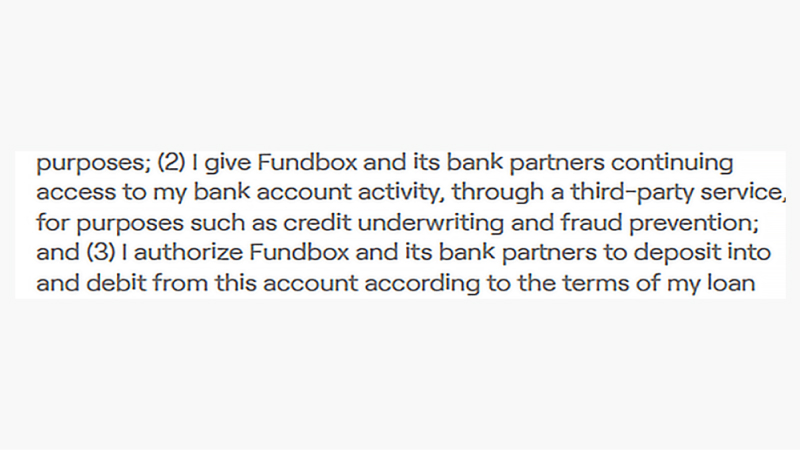

When applying for a small business loan with Fundbox, don’t be surprised if the application asks you to provide the banking information of your business. When issuing the loan, Fundbox will electronically transfer the money directly to your bank account, but it is a two-way street.

Make sure to read the fine print carefully and focus on what the platform is asking. In a nutshell, when you complete the application process, you are giving Fundbox and its bank partners continuing access to your bank account activity. In addition, you are authorizing Fundbox and its partners to deposit in your account and, more importantly, debit from the same account.

This means that Fundbox is going to deposit the money electronically into your account and withdraw pre-determined payments according to their regular schedule. In fact, this is what Fundbox is built on. If they are able to take out the payments to repay the loan in accordance with their schedule, they can provide you with a quick loan, even if your credit score is far from perfect. In fact, Fundbox can issue the loan automatically in a matter of minutes, just remember that it comes with a price - they will have the access and ability to monitor and withdraw funds from your bank account.

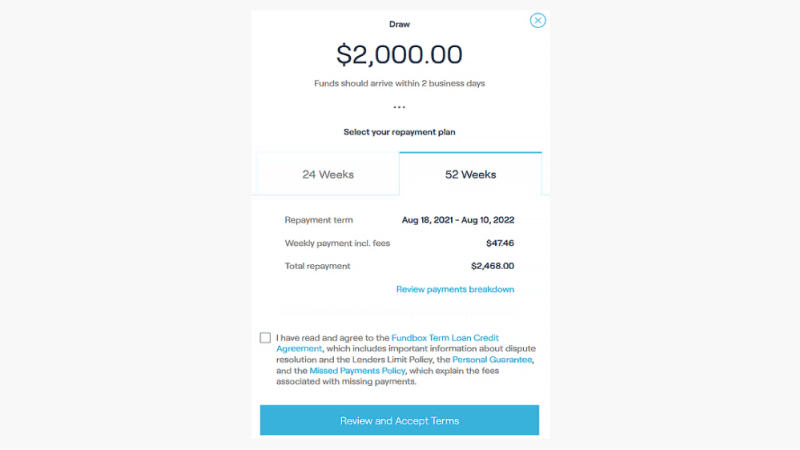

2. Analyzing Repayment Options

With Fundbox, you can choose between two different options for payback - each with its own interest rate. As such, you can repay the loan either on a 52-week schedule or a 24-week schedule for a term loan. For a line of credit, you repay the loan on a 12- or 24-week schedule.

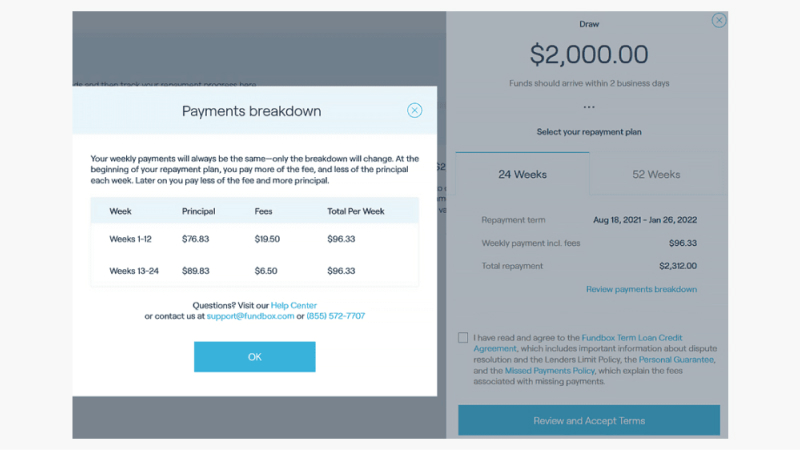

24-Week Repayment Schedule

Let’s take a closer look at the terms associated with a 24-week repayment schedule. During weeks 1 through 12, Fundbox will charge a certain amount of principal along with a certain amount of interest, which comes up to a fixed weekly repayment amount. During weeks 13 through 24, the principal and interest portions change, yet the total weekly repayment remains fixed.

In the case of a $2,000 business equipment loan, the total payment per week equals $96.33. This means that you would need to pay approximately $312 in interest over the 24-week lifetime of the loan, which translates to around 31%.

While this may seem like a quite high interest rate, keep in mind that this rate is annual. The actual amount of interest you are going to pay is only 15-16% of the total loan amount.

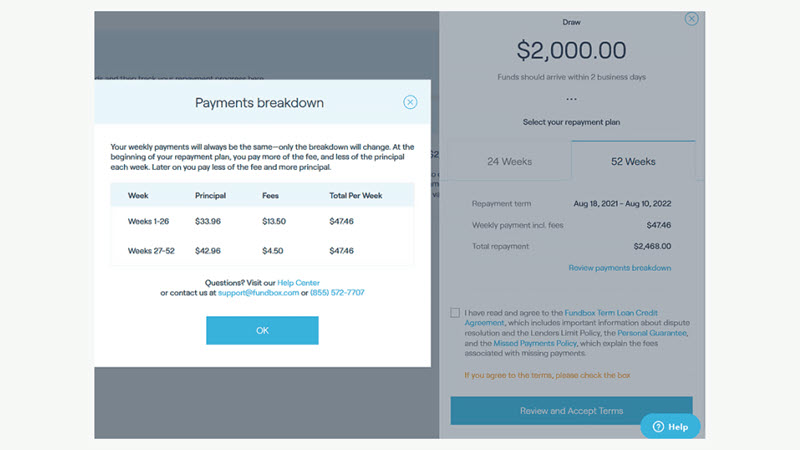

52-Week Repayment Schedule

With the 52-week repayment schedule, the principal fees and the total per week are different. For a $2,000 loan, you can expect to pay the weekly interest fee of $13.50 for the first 26 weeks.

Keep in mind that since the interest rate is charged weekly, you could reduce the total interest fee by paying off the loan early. For example, with the 52-week repayment option, you end up paying less interest per week, as compared to the 24-week option. So, if you choose the 52-week repayment schedule and repay the loan early, you would end up paying less money in interest fees than if you chose the 24-week schedule right away.

3. Funding the Loan

Fundbox makes receiving the funds simple. Once your application is approved, the money will be deposited directly into your bank account. However, there are a few things to keep in mind during the process.

Once you complete the loan application and approval process, you won’t automatically receive the loan. Before the loan funding process can begin, you need to agree to Fundbox’s Terms and Conditions. If you are taking some time to think about moving forward with the loan, you can expect to receive a personal email from a Fundbox customer service representative to see whether they can be of any help. The representative will provide you with a phone number to reach out to in case you need further clarification on what you can expect during the process.

For example, one thing some people might not realize is that the first payment will be taken out of their bank account five days after the loan is funded. After that, Fundbox will automatically take their payments every week. So, as long as you have the money in your bank account, you don’t need to worry about repaying the loan on a weekly basis - Fundbox will take care of it.

4. Paying Back the Loan

When paying back the loan from Fundbox, you can simply let the automatic schedule take over. However, you might want to select a 52-week option and pay it off early to minimize the number of interest charges. This way, you will end up paying a minimal amount of interest and receive a greater return on investment.

Fundbox Customer Support

Fundbox prides itself on delivering excellent customer support. Although they operate as an online lender, customers can reach live representatives fairly easily.

Telephone support is available Monday through Friday from 8AM - 8PM EST. You can also contact them through email or through its online dashboard.

They also support social media communication, including Twitter direct messaging.

To supplement its personal support, Fundbox provides a robust help center to answer common questions. Here, you will find information categorized by topic - such as choosing between a term loan or credit line. This area also includes helpful information about connecting your accounting software to Fundbox.

Additionally, their resource center includes a wide array of blog posts and guides. Here you’ll find curated content on everything from the people behind Fundbox to accounting and tax tips.

Fundbox Perks and Bonuses

Flexibility

One incentive that many borrowers look for is the potential for discount on their loans or other services. Fundbox offers customers discounts for prepayments, but doesn’t provide other additional perks and benefits outside of the FlexPay feature for Fundbox Line of Credit borrowers. The FlexPay feature gives borrowers three additional days to pay on a line of credit at no additional charge.

For customers experiencing financial challenges, Fundbox doesn’t offer a mechanism to defer upcoming payments. For borrowers who miss a payment, they will automatically lose access to any approved funds. Also, original terms cannot be modified, so make sure you are able to make your payments on time prior to taking the loan.

Transparency

Fundbox has an easy to use and accessible website incorporating both video, audio and written resources helping future and current borrowers understand how to get approved for Fundbox lending and what to expect.

Though the website offers a fairly robust variety of tools, additional content detailing the fee structures for the loans and line of credit could be added and featured more prominently on the website.

One important part of the Fundbox lending process is the requirement of a lien against business assets and potential of needing to make a personal guarantee that the funds will be repaid. This information is not found easily on the Fundbox website and some borrowers may be uncomfortable with this requirement.

For specific questions about your loan’s rates and terms, we always recommend speaking to a Fundbox representative before accepting your loan.

Technology

Users are able to access their account information via an online portal or their mobile app. Borrowers can make payments using a credit card of stored banking information. The Fundbox Resource Center also provides podcast and video content for users who may need a different way to understand the products and services that Fundbox provides.

And as a final note, Fundbox offers discounts on weekly fees. For some holidays and other occasions, Fundbox sends out coupons that are automatically applied to your next draw fees. Plus, if you pay your outstanding draw in full before the payment term ends, Fundbox will waive all remaining fees for the unused weeks.

Fundbox Alternatives

Bluevine

Bluevine offers lines of credit from $2,000 to $250,000 with rates starting at 4.8%. Terms are six or 12 months with payments being made weekly or monthly. You can draw on your line, pay interest on only what you use, and then use the funds again once you pay off your loan.

To qualify, Bluevine requires a minimum credit score of 625. Revenue requirements are $10,000 per month, and you need to be in business for at least six months. You also cannot have any bankruptcies within the past year.

Learn more about how these lenders compare in our Bluevine vs. Fundbox review

Additional Alternatives

| Lender | Loan Amount | Interest Rates | Min. time in business | Min. Revenue |

| Biz2Credit | $25K - $6 million | Starting at 7.99% | 6 months | $250K |

| Credibly | Up to $400K | Starting at 6.99% | 2 years | $100K |

| OnDeck | $6k - $250K | Varies | 1 year | $100,000 |

Conclusion

Fundbox is an online small business lender offering both short-term loans and lines of credit. Their application process is simple and straightforward, taking just a few minutes to apply. Once approved, you can receive your funds as soon as the next business day. With loan amounts up to $150,000, Fundbox is ideal for small businesses looking to purchase more inventory, pay for operating expenses, or expand their business. Applying is safe and secure, and your credit score will not be impacted. Reach out today to see what you’d be eligible for!