Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Pros

Cons

Biz2Credit Loan Features

Biz2Credit interest rates are very reasonable and start from just 7.99%. However, we’ve found that credit score and other eligibility requirements can be tough to meet, especially for newer businesses. You should be aware that startups won’t be able to apply.

Terms are quite flexible across each of the financing options and you can usually borrow for up to 36 months. Plus, if you don’t like the products they offer, the platform has partnered with a number of additional lenders you can turn to. Each product is outlined in detail below.

Term Loans

This is by far Biz2Credit’s most popular funding option. Its term loan offers fixed weekly, semi-monthly, or monthly repayments and the cash can be in your account within 72 hours. With borrowing limits set at $500,000, it’s an ideal choice for those that want to fund a medium to large-sized project.

| Term Length | 12 - 36 months |

| Repayment Period | Weekly, semi-monthly, or monthly |

| Min-Max Amount | $25,000 - $500,000 |

Working Capital Loans

Most often used to fund your company’s day-to-day operations, working capital loans will be used to cover short-term expenses. Biz2Credit offers an incredibly fast 24-hour turnaround time from application to funding - as long as you’re able to provide the relevant documentation upfront.

| Term Length | Variable - To be discussed on application |

| Repayment Period | Daily, weekly, or semi-monthly |

| Min-Max Amount | $25,000 - $2 million |

Commercial Real Estate Loan

These loans are typically taken out when a business needs new premises or is undergoing an expansion. Biz2Credit’s real estate loans allow you to borrow up to $6 million and are backed by your already-owned commercial real estate.

| Term Length | 12 - 36 months |

| Repayment Period | Monthly |

| Min-Max Amount | $250,000 - $6 million |

Biz2Credit Interest Rates and Fees

Rates and fees will vary depending on your own personal financial situation. Those with higher credit scores and plenty of evidence of healthy business experience will generally be seen as low risk and be offered more desirable rates and fees.

Regardless of which Biz2Credit funding type you choose, you’ll almost certainly have to pay an origination fee, as well as maintenance and other admin charges. These can vary considerably for each applicant and it’s difficult to get an idea of exactly what you’ll be paying until you apply.

Generally, you won’t be charged for paying off your loan early, but if you sign up with one of the platform’s partner lenders, you may be subject to different terms. We always recommend reading your loan agreement very carefully before signing to make sure the repayments are affordable.

That being said, we’ve covered some general rates and fees information for each loan type below.

| Term Loan | Working Capital | Commercial Real Estate | |

| Origination Fees | 1% - 6% | 1% - 6% | 1% - 6% |

| Underwriting Fees | Typically $250-$400 | Typically $250-$400 | Typically $250-$400 |

| Late Fees | Not applicable | Not applicable | Not applicable |

| Interest Rate | Starting from 7.99% | Disclosed on application | Starting from 10% |

Biz2Credit Loan Eligibility Requirements

Biz2Credit’s eligibility criteria is a little more strict than those you’d find at competitor platforms, and only businesses with at least ‘good’ credit will be accepted. Plus, you’ll need a minimum of six months in business, if not more in most cases, to be eligible. You should bear in mind that even if you meet the minimum criteria, you aren’t guaranteed to be accepted.

This is perhaps one of the few downsides of the service, and business newbies and those with bad credit will need to search elsewhere. However, these stringent policies do mean that Biz2Credit has a talent for only selecting businesses that are capable of repaying loans, which is why its reputation has endured and remains a top choice for organizations with good to excellent credit.

We’ve summarized the basic requirements for each loan type below.

| Criteria | Term Loan | Working Capital Loan | Commercial Real Estate Loan |

| Minimum Credit Score | 660 | 575 | 660 |

| Minimum Annual Revenue | $250,000 | $250,000 | $250,000 |

| Minimum Time in Business | 18 months | Six months | 18 months; plus already own commercial property |

Biz2Credit Loan Application Process

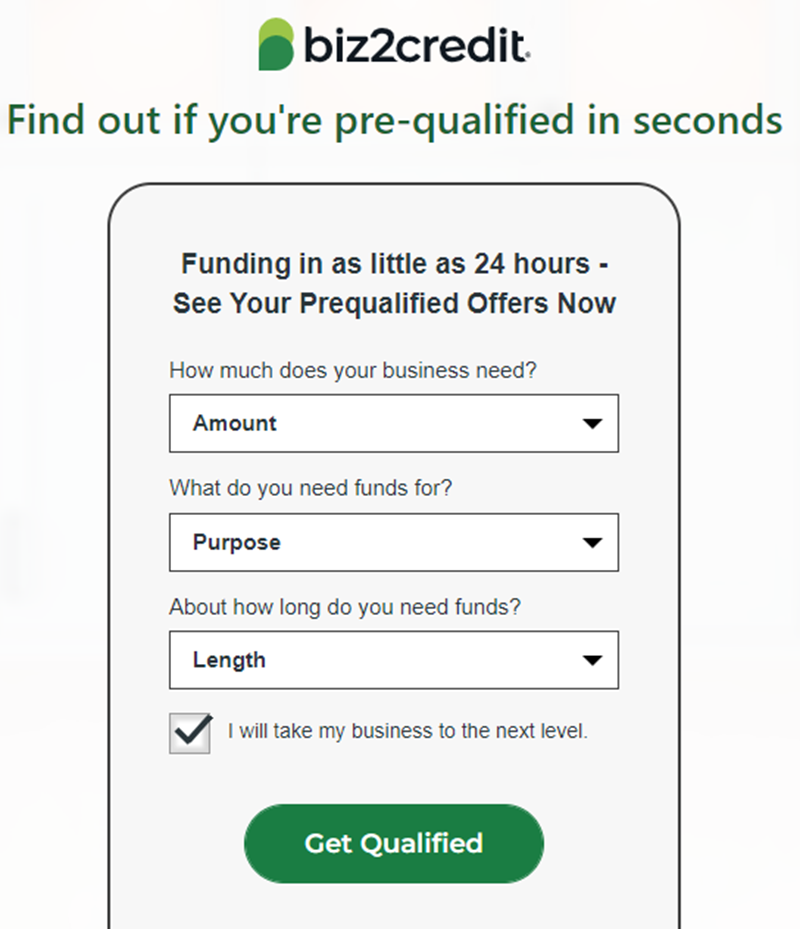

Biz2Credit encourages future borrowers to go through the prequalification process in order to see if they might be approved for the financial product they’re requesting. Information requested during this process includes the following:

- The amount the business would like to borrow

- The purpose of the loan

- The repayment term the borrower would prefer

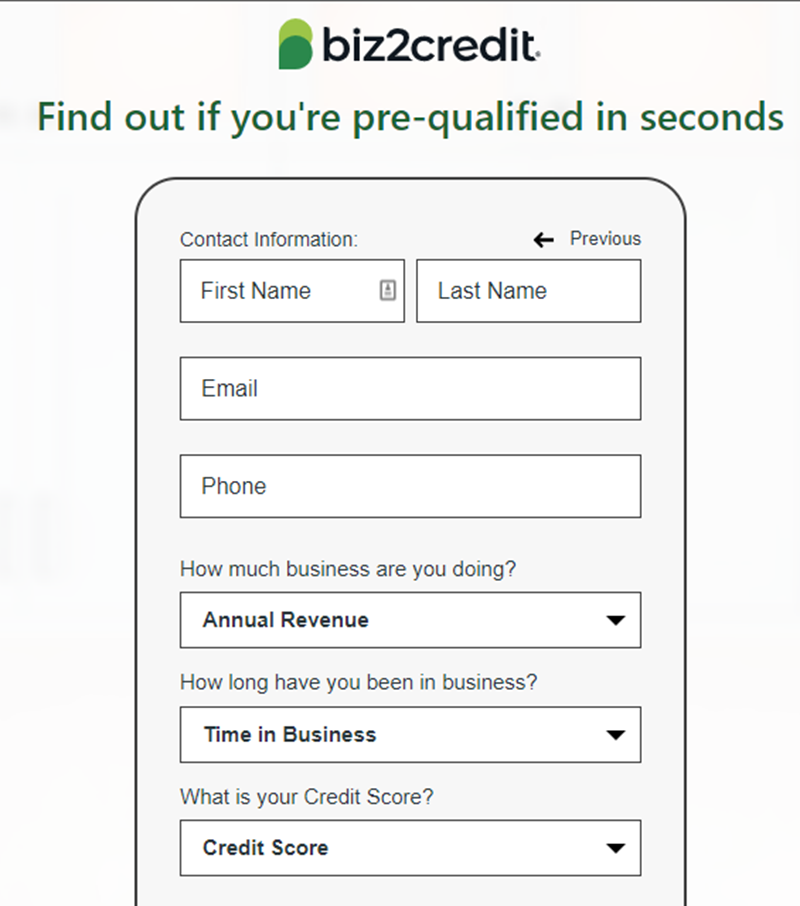

You’ll also need to provide:

- Contact information: first name, last name, email address, and phone number

- Information about your business: annual revenue, how long have you been in business, and a current credit score*

Biz2Credit’s website states that a minimum credit score of 575 is eligible for a loan. However, it’s a good idea to work on nurturing your credit score and growing it in order to gain access to better lender terms. The higher a credit score, the better the lending terms will be especially related to the APR associated with a loan. The lower the APR, the less the loan will cost over the duration of time for the loan.

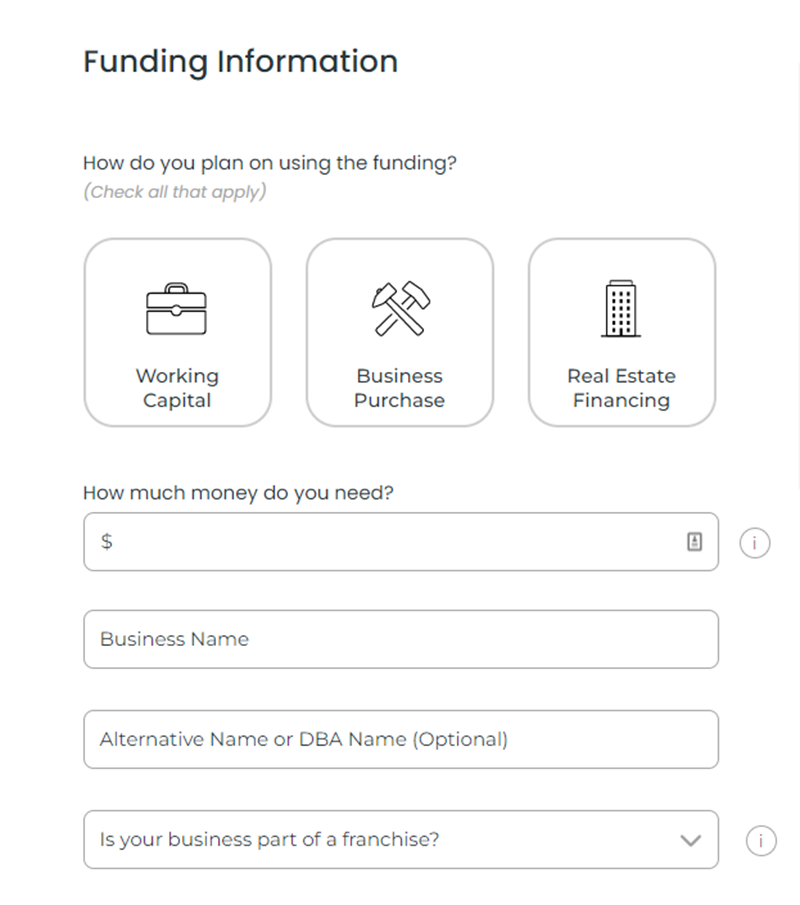

Once you’ve been prequalified, it’s time to make the official funding request, borrowers will need to provide additional information including:

- The type of loan you need

- How much money do you need?

- Is your business a part of a franchise?

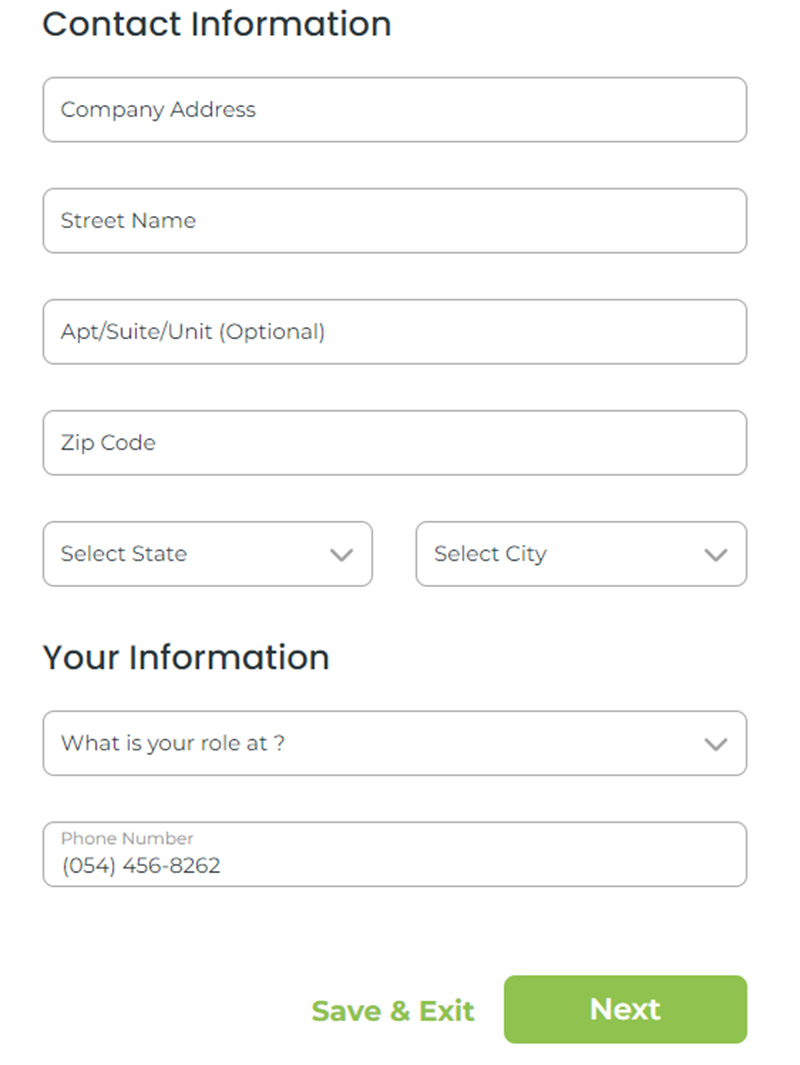

You’ll also need to provide your company address, your role at the company, and your phone number

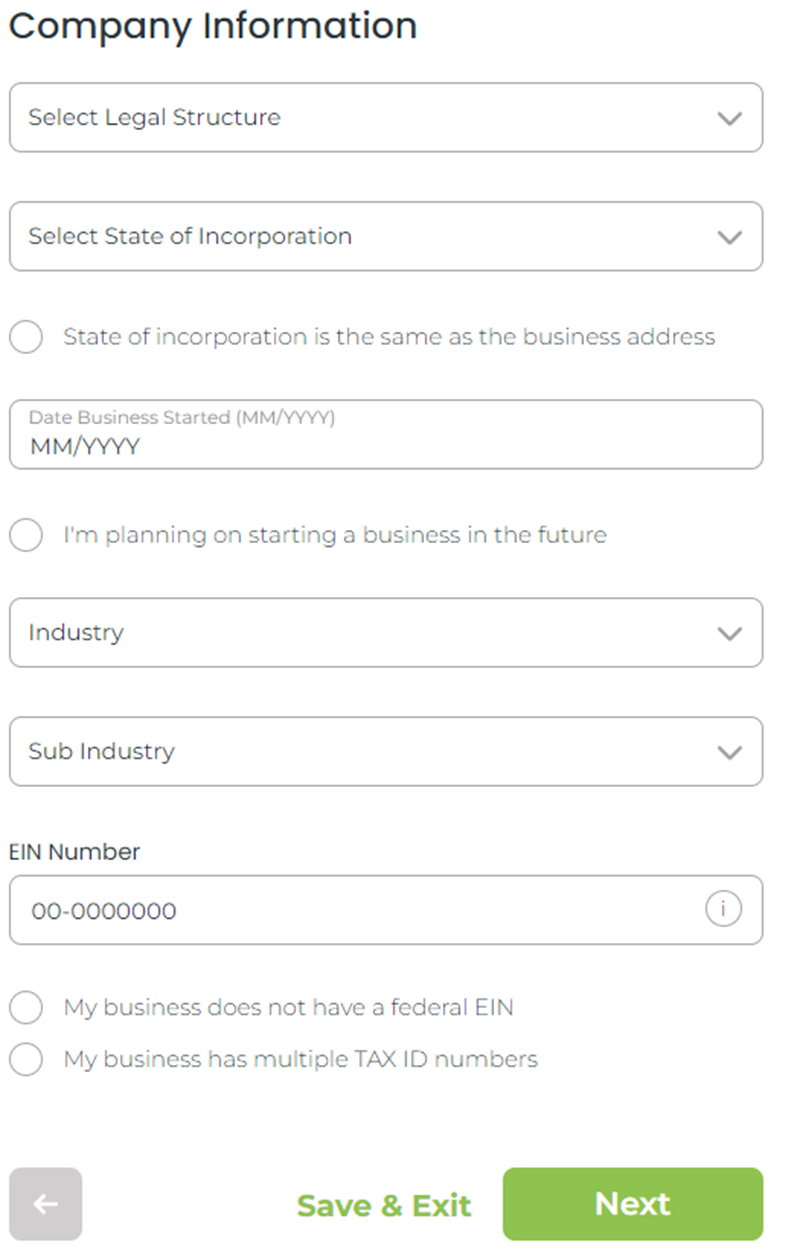

The next step is to provide basic information about your small business:

- The legal structure of your business

- State of incorporation

- The date the business was established, or if you’re planning on starting a new business

- The industry you’re in

- You EIN number

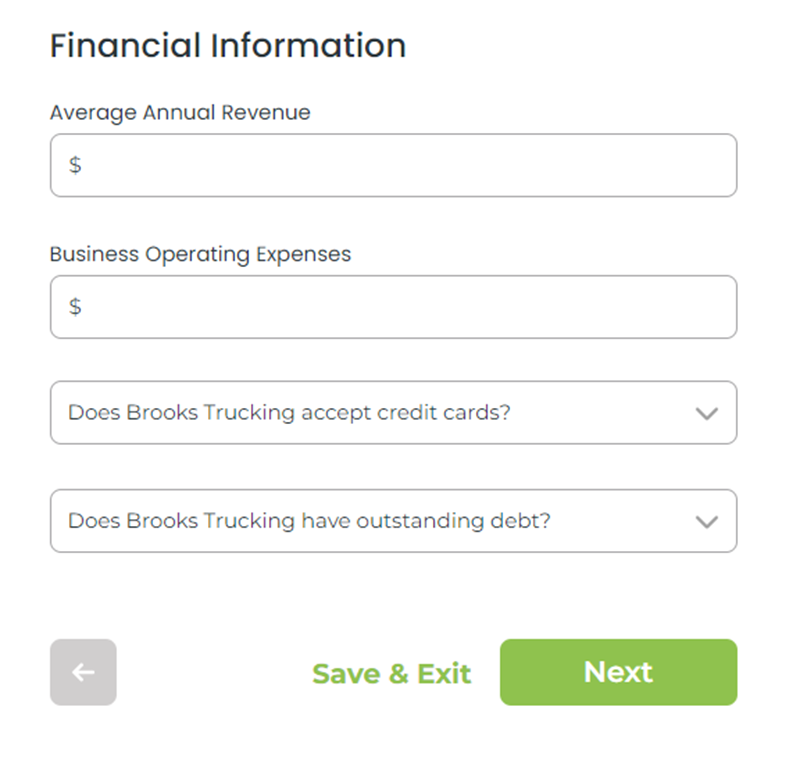

The next step is to provide some financial information of your small business:

- Average Annual Revenue

- Business Operating Expenses

- Does your business accept credit cards?

- Do you have outstanding debt?

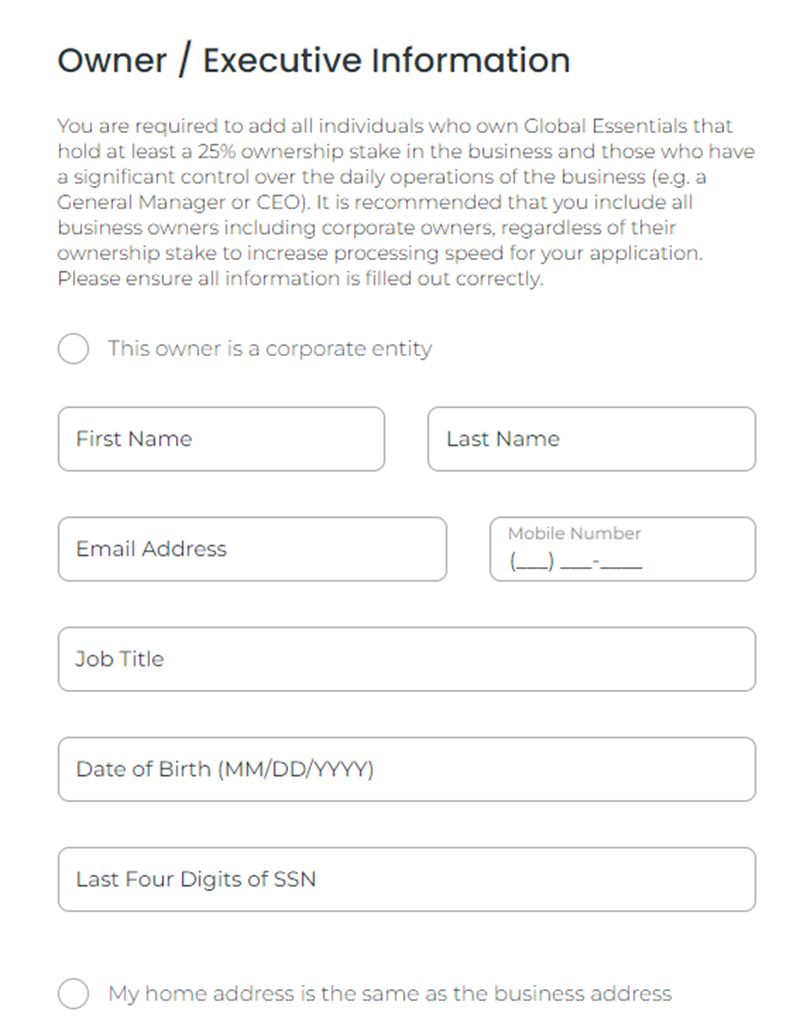

Now you need to add all individuals who own at least a 25% ownership stake in your business and those who have a significant control over the daily operations of your business (e.g. a General Manager or CEO).

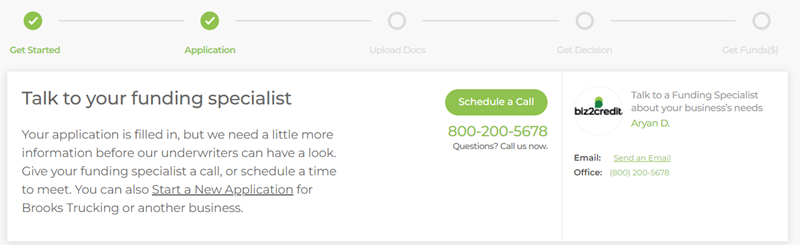

After submitting your online application request, you’ll have to talk to one of Biz2Credit’s funding specialists. You can schedule a call or take the initiative and call them yourself to speed up the process.

At this point, the following documentation should be collected and submitted:

- Several years of tax returns (both individual and corporate)

- A business plan detailing aspects related to service provided, goals and business projections

- Several months of bank statements

- Business balance sheet and/or profit loss statement

- Any legal documents - such as articles of incorporation or bylaws and lease agreements - that provide deeper context and details about your business’s legal structure

Once approved, you may be funded in as little as 72 hours.

How Does Biz2Credit Determine Loan Amount

Biz2Credit determines your loan amount primarily by your credit score, but your annual income and time in business will have an effect, as well . Generally, the higher all of these figures are, the more likely you are to have an extended borrowing limit.

Biz2Credit doesn’t disclose exactly how it calculates the amount for each customer, but you’ll be assigned a loan advisor who can walk you through any questions and explain the final offers before you sign up.

Biz2Credit Customer Support

Biz2Credit customer service has earned an excellent reputation. All borrowers are assigned a loan advisor from start to finish of the application process.

If you have any other general queries, you can get in touch over the phone or by email. Phone lines are open between 8 AM and 7 PM ET, and you never usually have to wait long for a response whichever contact method you opt for.

What’s more, you’ll find an incredibly handy knowledge center that contains blogs, research reports, how-to guides, and even e-books that are completely free to download. You can also get your hands on a series of loan guides and a lending index that will let you know your chances of being accepted for funding across a range of different lending types.

Biz2Credit Perks and Bonuses

Flexibility

It’s unclear if borrowers can modify their initial loan terms based on financial hardship. Prior to saying yes to a Biz2Credit loan, potential borrowers should ask questions specific to the repayment process and any potential for loan modifications.

Transparency

The Biz2Credit website is intuitive for users, though it does feel a bit outdated. The standout on the platform is the knowledge center that provides a number of useful resources that borrowers can review before submitting their applications.

Technology

Borrowers can access an online portal detailing information related to products being serviced by Biz2Credit. Data is stored in the cloud and there is an app available for customers who would like to have expanded mobile access.

At this point in time there is no chat feature currently on the main website.

Biz2Credit Alternatives

National Funding

National Funding has two loan products: Short-term business loans ranging from $5,000 to $500,000 and equipment financing and leasing up to $150,000. They’ve helped more than 75,000 businesses and have funded more than $4.5 billion. National Funding’s process is extremely streamlined - you can both get approved and funded within 24 hours of applying if you meet their requirements.

Qualifications aren’t as stringent, but we recommend having a credit score of 600 or more, being in business for at least six months, and having $50,000 or more in annual revenue. Their fees are not disclosed, so make sure to speak with a representative to fully understand the rate and fees you’ll be charged prior to signing for the loan.

Learn more if National Funding is right for you in our National Funding review

Final Thoughts

It’s difficult to go wrong when you apply for a Biz2Credit small business loan. Applications are fast and simple and there’s enough lending variety to cover a huge range of entrepreneurial needs. What’s more, borrowing limits are quite generous, interest rates are reasonable, and the excellent customer service ensures that someone is on hand to help you resolve any issues.

However, keep in mind that you’ll need a good credit rating to apply here, as well as significant annual revenues. If you have poor credit or are operating a startup, you’ll need to try another platform.