Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

Best Commercial Real Estate Loans to Consider in 2024

Commercial real estate loans (CRE) provide the necessary financing for businesses to purchase, refinance, expand, or renovate their place of business, whether it's an office building, retail space, warehouse, or any other commercial property. Below, you’ll find our top picks for the best CRE loans.

A commercial mortgage is a loan that uses your commercial property as collateral, similar to a mortgage on a residential property. Because the property is collateral, interest rates are much lower than with other types of small business financing. Our team of financial experts reviewed and ranked the top business lenders to help you get funded.

Top Picks for Best Commercial Real Estate Loans

- Lendzi - Best for Excellent Customer Service

- Biz2Credit - Best for Fast Funding

- SmartBiz - Best for SBA Loans

- GoKapital - Best for High Loan Amounts

- Lendio - Best for Business Renovations

- Rapid Finance - Best for Smaller Loans

In this review we highlight the terms, rates and fees of each commercial real estate lender, and explain what makes them a good option. We also share potential downsides of each lender, and provide a rating methodology you can use to select the best option for your needs.

Best Commercial Real Estate Loans - Full Overview

Rapid Finance - Best for Smaller Loans

- Efficient application process

- Great customer service

- Generous lending limits

- Min. credit score: 550

- Min. time in business: 2 years

- Small Loan Minimums: $75,000+

- Fast Application Process: Quick decision

- Loan types: Multiple loans to choose from

- Lack of Info: Rate and funding time not shown

- Time open: Two years so no new businesses

- Website: Lacking loan specifics

Rapid Finance is dedicated to the success of your small business, making them an excellent choice for commercial real estate loans. The company prides itself on offering streamlined applications, quick approvals, and fast funding times.

Main Features

Loan amounts range from $75,000 to $2 million, with terms from five to 20 years. With Rapid Finance, payments are made monthly and are automatically debited from your account. To apply, Rapid Finance requires only three documents: A valid ID, two years of tax returns, and a schedule of debts. Once you apply, your information will be reviewed and a team member will reach out if any additional information is needed. If approved, you’ll have access to an online portal and business advisors to answer any questions during the loan term.

Lendio - Best for Business Renovations

- Easy to apply

- Product & lender choice

- Competitive offers

- Min. credit score: 560

- Min. time in business: 6 months

- Multiple Lenders: Compare and then choose

- Low Rates: Starting at 4.25%

- Long Terms: Up to 25 years

- High Loan Minimums: Start at $250,000

- Variables: Rates and terms vary

Lendio is a loan marketplace, not a direct lender. The platform helps match you with a commercial real estate loan that will best serve your business needs based on a preliminary application that uses a soft credit pull.

Lendio offers SBA loans, term loans, and commercial mortgages. Loans are typically used to buy, build, remodel, or refinance.

Main Features

Lendio loan amounts range from $250,000 to $5 million, with rates as low as 4.25-6.00%. Loan terms are 20-25 years and funding takes place in as little as 45 days. Because Lendio matches you to other lenders, minimum credit score and annual income requirements will vary. While your credit score typically determines your rate, lenders will look at other aspects of your business, too.

SmartBiz - Best for SBA Loans

- SBA 7(a) loans up to $350,000

- SBA commercial real estate loans up to $5 million.

- Min. Credit Score: 660

- Min. time in business: 2 years

- Loan Repayment 10 - 25 years

- SBA 7(a) loan rates: 10.75% - 11.75%

- SBA Commercial real estate loan rates: 5.50-6.75%

- Receive multiple loan offers

- Low rates: Starting at 7.00% for CRE loans

- SBA Guarantee: Keeps rates and fees low

- Long terms: Up to 25 years

- Prepayment penalty: On some loans

- Application Process: Can be tedious

- Lender Requirements: They can set their own

SmartBiz offers 7(a) commercial real estate loans from the Small Business Administration (SBA). These loans have competitive interest rates and loan terms up to 25 years. You can prequalify in five minutes on their site with just a soft credit pull.

Main Features

SmartBiz offers commercial real estate loans from the SBA with loan amounts ranging from $500,000 to $5 million. Interest rates typically start at 7.00% and the lender sets the minimum credit score requirements. Annual revenue requirements vary and required time in business is usually two years.

Additionally, SmartBiz offers other loans on its AI-powered lending platform which can help your business refinance debt or pay for working capital. They offer loans from banks and private online lenders and can match you with the best suited ones.

GoKapital - Best for High Loan Amounts

- Borrow up to $5 million

- Loan Terms 2 to 10 years

- Interest rates start at 25%

- Wide range of loan offers

- Simple application process

- Instant pre-approval

- Min. credit score 500

- Min. time in business: 2 years

- No minimum credit score

- High Loan Maximum: Up to $50 million

- No industry restrictions: Cannabis allowed

- Varying Criteria: Lender requirements differ

- Minimum Property Value: $100,000+

- Funding Times: Not disclosed

Both a direct lender and a loan marketplace, GoKapital makes it easy to compare loan products for commercial real estate borrowers. You’ll receive a pre-approval within 24 hours of applying, along with professional mortgage loan consultants to help you every step of the way.

Main Features

Loan amounts range from $150,000 up to $50 million, making them an excellent choice for borrowers in need of higher loan amounts. There are no minimum credit score requirements (though 560+ is ideal) and interest rates start as low as 6%. Some loans offer the choice of fixed or adjustable rates, and terms range from one to 30 years.

In addition to commercial real estate loans, GoKapital offers fix and flip loans (hard money loans) and rental investment property loans.

Biz2Credit - Best for Fast Funding

- Working capital up to $2 million

- Term loans up to $500,000

- Term loan interest rate starts at 7.99%

- Loan Repayment 12-36 months terms

- Variable APR depending on the applicant

- Funding in 72 hours

- Soft credit pull

- Fast: Application process and funding

- High Loan Amounts: Up to $6 million

- Time in Business: Only 18 months is required

- Credit Score: Need a 660+ to qualify

- No Small Loans: Minimum loan amount $250,000

- High Minimum Revenue: $250,000+ per year

Biz2Credit commercial real estate loans are typically used for acquisitions, extensive renovations, refinancing an existing project, or growing the business by acquiring space to expand. Dedicated funding specialists are available to guide you through the process of obtaining a commercial real estate loan.

Main Features

Biz2Credit offers commercial real estate loans up to $6 million with rates starting at 10%. Applications take as little as four minutes to complete, loan decisions are usually made within 48 hours, and loans can be funded as quickly as 72 hours.

Annual revenue requirements are $250,000+ and you need to be in business for at least 18 months. Credit score requirements are typically 660+ and rates vary. Loans range from $250,000 to $6 million and terms range from 12 to 36 months. Interest-only loans are available for qualifying applicants.

Lendzi - Best for Excellent Customer Service

- Borrow up to $4 million in working capital

- Min. credit score: at least 500

- Min. time in business: 6 months

- Equipment financing up to $2 million

- Business line of credit up to $250,000

- See your options without hurting your credit

- Flexible terms: 3 to 15 months

- Excellent customer reviews on independent review sites

- Get funding in as little as 24 hours

- Multiple lenders in their network

- Representatives help you throughout the process

- Rates are competitive

- Excellent customer service

- May take a few months to receive funding

- Poor credit borrowers will receive higher rates

Lendzi offers a multitude of loan products, including commercial real estate loans. They are both a direct lender and a partner with more than 75 additional lenders, which increases your odds of being approved for a commercial real estate loan. To apply for a commercial real estate loan through Lendzi, you’ll first fill out their simple online application. From there, a representative will contact you via phone. They will work with you to find the best lender in order to get you the funding you need. These types of loans typically take longer to fund than traditional small business loans, so be prepared to receive your funding up to three months from inquiring.

Main Features

Because Lendzi works with other lenders to find the best fit for you, rates and loan amounts will vary extensively. One lender in their network, for example, offers commercial mortgages up to $500,000,000. Typically, term lengths max out at 10 years, but this may vary based on which lender you choose. Overall, Lendzi prefers you have an annual income of at least $180,000 and have been in business for six months or more. Most lenders will want to see a credit score of at least 600, but for larger loans, we recommend a score of no less than 700.

Main Features of the Best Commercial Real Estate Loans

- Min. Credit Score - 600

- Min. Time in Business - 6 months

- Min. Annual Revenue - $180,000

- Loan Amount - Varies

- Interest Rate - Varies

How to Choose the Best Commercial Real Estate Loans

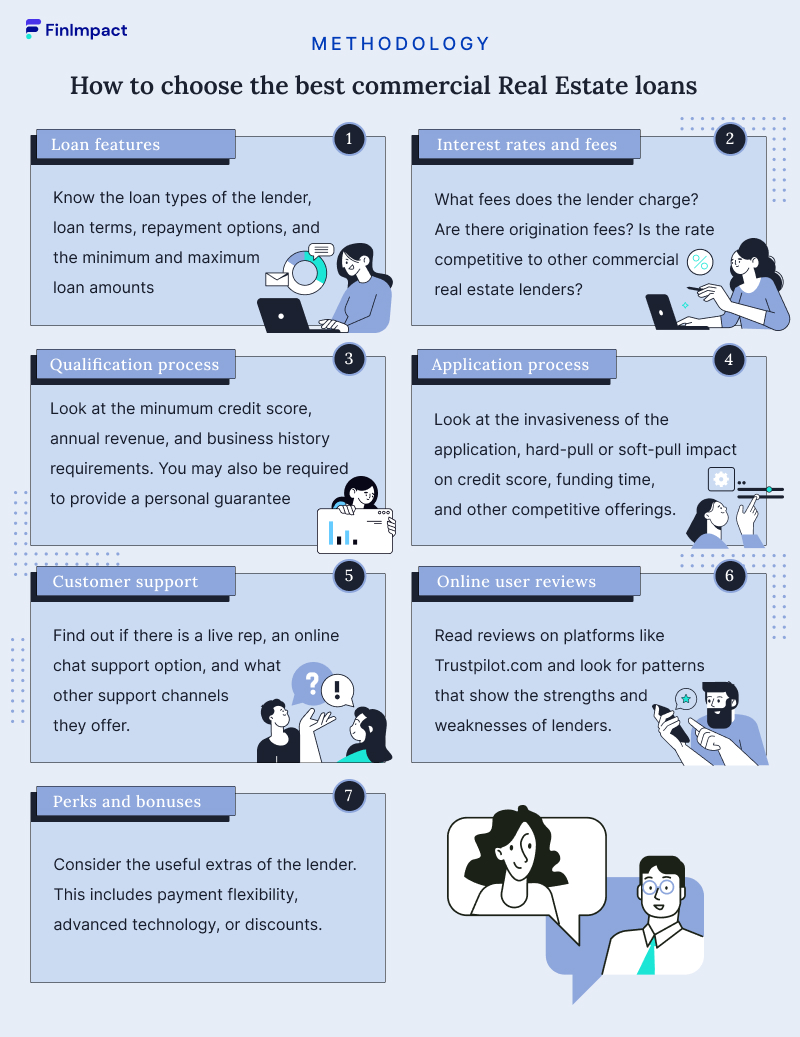

Our experts use the following factors to rank commercial real estate lenders:

- Loan Features: Know the loan terms, repayment options, if there’s a prepayment penalty, and the minimum and maximum loan amounts.

- Application process - Look at the invasiveness of application information requirements, if there is a hard-pull or soft-pull credit score impact, funding time, and any distinctively competitive offerings.

- Interest rates and fees - What fees does the lender charge? Are there origination fees or points? Is the rate competitive to other commercial real estate lenders?

- Qualification process - Know what you and your business need in order to qualify for a loan. The lender will look at your credit score, amount of time in business, and annual revenue, among other things.

- Customer support - You need customer support who works when you do. Find out if there is a live rep, an online chat support option, and what other support channels they offer. Check out any additional offerings such as webinars, frequently asked questions, and supplemental tools.

- Online user reviews - Check out reviews on independent review sites like Trustpilot to see what customers really think of the company’s commercial loan products. Read positive and negative reviews and look for patterns for what the lender does right and what they could improve on.

- Perks and Bonuses - Consider what extras the lender offers that will be useful for your business. They may include payment flexibility, advanced technology, discounts at select vendors, or a networking platform.

What Are Commercial Real Estate Loans?

A commercial real estate loan, also known as a commercial mortgage, is used by businesses to purchase a specific property, land, or to cover building renovations. Buildings that can be purchased with commercial real estate loans include office spaces, apartment complexes, warehouses, and retail spaces.

The loan-to-value ratio is usually around 65% - 80%, meaning organizations are expected to cover 20% - 35% of the property purchase while the lender will cover the rest. This type of lending usually has quite high barriers to entry and borrowers will be expected to have a good credit score, evidence of good income, and to have been in operation for a number of years.

If you’re looking to invest in a personal property, such as a single-family rental home or an Airbnb, you’ll need to use a traditional consumer loan. Here are the top lenders for Airbnb loans, which can also be used for other long-term investment properties.

How Do Commercial Real Estate Loans Work?

While similar in nature, there are several key differences between traditional consumer mortgages and commercial real estate loans.

- Rates - Interest rates usually tend to be a little higher when taking out a commercial real estate loan. This is because the lender is shouldering a little more risk and values are usually, but not always, higher than you’d find with consumer options.

- Collateral - This is the asset that will be used to secure your loan. In most consumer mortgages this will be the house or property itself. However, in commercial real estate loans, borrowers may use any asset of value to secure the funding.

- Terms - Consumer mortgages tend to have 30-year repayment terms, while commercial real estate options are generally shorter, ranging from 10 to 25 years.

- Down payments - Expect to pay significantly more of a downpayment on a commercial real estate loan. It’s rare to find a lender that doesn’t require a 20% deposit at the very least

8 Steps you need to take to purchase commercial real estate

Types of Commercial Real Estate Loan

There are many different types of commercial real estate loans, including:

- Bridge loans - This is a type of short-term loan where you borrow against part of the value of an existing property. Typically, they are used when you need to purchase a property but are waiting on the funds from the sale of another one.

- Hard money loans - Hard money loans provide cash quickly but for a short amount of time. These types of loans may be used when flipping a house, but they do typically come with very high interest rates.

- SBA 504 loans - Backed by the Small Business Administration (SBA), these loans are guaranteed by the federal government and are a low-risk type of commercial real estate lending. 504 loans offer fixed rates and loan amounts up to $5 million.

- Long-term fixed interest loan - This is the most common type of real estate loan and the one most similar to traditional consumer mortgages. These can take several months to arrange, but have the best interest rates and longest repayment terms.

Commercial Real Estate Loan Requirements

While requirements for commercial real estate loans will vary by lender, we recommend taking a look at the following recommendations:

- Good credit: First and foremost, real estate loan providers ideally want to see a good credit score – the higher the better. Your score will have a direct impact on your rate, so try to improve your score prior to applying.

- Solid down payment: Your chances of being approved for a commercial real estate loan accelerate with a decent down payment on a commercial property. A down payment of 20% or more of the total loan can boost your chances of loan approval. Like with credit scores, the more cash you include in a down payment, the higher your chances of loan approval.

- Know what the lender expects from your business: When filling out a commercial real estate loan application, expect to include pertinent information on your business, such as:

- How long your business has been in existence (two years or more may be expected by a lender.)

- The value of any collateral you may put up to secure a loan (such as business equipment, vehicles, or personal collateral)

- Your company’s debt-to-income ratio (the lower your debt amount and the higher your annual income, the better.)

- Total annual revenues. Commercial real estate lenders expect to see a history of solid annual revenues before green-lighting your property loan.

Cover the above areas and you’re well on your way to receiving a good commercial real estate loan.

Commercial Mortgage Loan Rates

Interest rates for commercial real estate loans tend to be a little lower than other types of small business lending. This is because the lender will often use the property itself as collateral, meaning there’s a much lower borrowing risk to the lender.

That being said, there can still be a huge variation between different platforms, and factors like your credit score, business history, and overall financial health will all play a role in determining what rate you’ll pay.

Typically, rates vary between 6% and 18% depending on your personal circumstances and the size of your loan. Borrowing amounts often max out at around $5 million, and repayment terms will be between 10 and 25 years.

How to Get Commercial Real Estate Loans

- Plan how you’ll use the loan - Most lenders will want to see a business plan and how you intend to make money from your property purchase. Whether this is to be used as a source of rental income or it’s for a business expansion, you’ll need to prove profitability to be approved

- Choose your loan type - Are you in this for the long haul or do you need an emergency injection of cash? Remember, long-term loans take a while to arrange while risker types of commercial borrowing, like bridging loans, can be funded very quickly

- Choose lender - Have a look at the lenders on our list and see if you meet the eligibility criteria. Most of our approved lenders welcome applications from all businesses, but some might have stricter criteria, such as length in business or hefty income requirements.

- Prepare your documentation - You’ll need more documents here than you would with other loan types. Common documents include: business plan, financial statements, current lease information, legal documentationBusiness and personal tax returns, a government-issued ID.

Commercial Real Estate Pros and Cons

Pros

- Good rates - Most commercial property loans have great rates and it's rare to see interest reach double digits. Plus, taking out a long-term fixed option will give you financial certainty and help you budget your business expenses.

- Good business opportunity - Purchasing real estate is usually a sure-fire investment as property values are more likely to go up than down. Rental income can be a secure and stable form of income and purchasing new premises for your business can accelerate growth and revenue.

- Long repayment terms - Unlike other forms of small business loans that usually max out at five years, you’ll find commercial property options that allow terms of 10 years and beyond.

- More room for negotiation - Since you’ll usually be borrowing quite a significant amount, there’s a little more wiggle room for negotiating rates and terms with the lender than with other types of borrowing. Plus, providers will be more willing to take other factors into account rather than relying on just a credit score.

Cons

- Expensive down payments - You’ll need to put down a significant portion of the property cost to secure the loan, usually 20% or more. This tends to exclude smaller businesses.

- Not open to new investors - Startups generally won’t be able to apply. This can put many brand new businesses in a situation where they need property to get going but can’t find the funding to do it.

Final Thoughts

For any business that's looking to get an investment property or needs new premises for expansion purposes, we’d highly recommend a commercial real estate loan. We’d advise trying to secure long-term funding, as those come with the best rates and repayment terms.

As long as you’re confident you’ll be able to keep up with the repayments, it’s a relatively low-risk type of lending. However, be aware that you’ll need to put down some significant capital upfront to get started.

Related Loan Picks

Best Equipment Financing

Read MoreHow to Invest in Commercial Real Estate

Read MoreHow to Find Investment Properties

Read More