Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

Best Secured Business Loans to Consider in 2024

Secured business loans leverage collateral to reduce lender risk, allowing them to provide lower interest rates, longer repayment terms, and a higher chance of approval for business owners with less-than-perfect credit. Below, you’ll find our picks for the best secured business loans.

Torro - Best for Startups

- Borrow up to $575,000

- Loan Repayment 12 - 48 months terms

- Hundreds of financing options

- Use the loan for any purpose

- Fast process

- Fast funding process

- More lenient lending requirements

- Offers options for startups

- Lack of transparency

- Short loan terms

- Potentially high fees

Torro offers secured business loans in the form of startup funding and working capital loans for existing businesses. With Torro, collateral isn’t “required,” but it is one of the determining factors as to whether or not you will qualify for a loan. Torro also takes into consideration your credit history, debt obligations, annual business revenue, and your prior loan experience with Torro Funding, if applicable.

Main Features

In general, Torro has more lenient qualifying requirements than some of its competitors. Companies only have to show a business history of six months and an annual revenue of $120,000 to secure a working capital loan worth up to $575,000. Those opting for its lower-limit startup funding will face even fewer requirements.

National Funding - Best For No Down Payments

- Min. Time in Business: 6 months

- Min. Credit Score 600

- Borrow up to $500,000 in working capital

- Equipment financing up to $150,000

- Factor rate From 1.10

- Fast funding

- Early payment discounts

- Equipment financing repayment 2-5 years

- Working capital repayment 4 months - 2 years

- Fair credit accepted: Even if you don’t have the best credit, National Funding may approve you as it accepts borrowers with credit scores of 600 or higher.

- No down payment required: National Funding may approve you even if you don’t have any money saved for a down payment.

- Fast funding: Depending on when you apply, you may receive your funds via direct within 24 hours.

- High annual revenue requirement: National Funding only offers equipment loans to businesses who earn at least $250,000 per year.

- Industry restrictions: If you’re in an industry like cannabis, adult entertainment, or guns, National Funding won’t be able to lend to you due to regulations.

- Can be expensive: Compared to loans from other lenders, National Funding products come with higher rates, which can increase the overall cost of borrowing.

National Funding specializes in equipment loans you can use to fund the cost of new or used equipment. Depending on your unique situation, you might be eligible for up to $150,000 and won’t have to pay a down payment. Plus you can prequalify and check your loan offers without any impact to your credit score.

Main Features

National Funding’s equipment loans cap out at $150,000 with repayment terms between two and five years. The pay rate starts at 1.10 and you’ll repay your loan on a monthly basis. To be considered for an equipment loan, you’ll need a credit score of at least 600, at least two years of business history, and $250,000 or more in annual revenue.

GoKapital - Best for Early Payment Discounts

- Borrow up to $250,000

- Loan Terms 2 to 10 years

- Small business term loans APR. 25% - 75%

- Wide range of loan offers

- Simple application process

- Instant pre-approval

- Min, credit score: 500

- Min. time in business 2 years

- Easy online application

- Fast decision and funding times

- Early payment discounts

- Competitive rates

- Poor credit accepted

- Available in all 50 states

- High annual income requirements

- Rates are high for borrowers with low credit

Founded in 2013, GoKapital makes it easy for entrepreneurs in any industry to secure the funding they need. Whether you are looking for a business line of credit, a working capital loan, an SBA loan, or a merchant cash advance, GoKapital has a product that will fit your needs. In addition to the many types of products available, they also offer early payment discounts on certain types of loans. If you are able to pay back your loan early, you could potentially save thousands over the course of your loan.

Main Features

Secured business loans from GoKapital range from $5,000 to $5 million depending on which product you choose. Their line of credit is the smallest product and it caps out at $55,000. Equipment financing and merchant cash advances, however, go all the way up to $5 million in funding. To qualify, you need a minimum credit score of 500, one year of business history, and an annual revenue of $240,000 or more. If your income is less than that, GoKapital offers startup and personal loans with less stringent requirements.

Funding Circle - Best for for Established Businesses

- Few restrictions to your loan purpose

- Quick and straightforward application

- Min. Credit Score 650

- Min. TIme in business 2 years

- Quick application and approval process

- Long loan terms

- Dedicated account managers

- No minimum revenue requirement

- Not an option for startups

- Need decent credit

- Higher fees

- Not available in Nevada

Funding Circle offers secured business loans in the form of term loans, SBA 7(a) loans, lines of credit, invoice factoring, and working capital loans. Loans will need to be secured by your business assets, such as equipment, vehicles, accounts receivable, or inventory. The application takes just six minutes to complete, and most funding takes place within five days.

Main Features

Funding Circle requires two years of business history and decent credit in order to apply for one of its secured business loans. Yet, there is no annual revenue requirement, making it more flexible than some of the other options on this list. In addition, Funding Circle allows you to borrow up to $500,000, which should be enough funding to satisfy most borrowers’ needs.

SMB Compass - Best for Variety of Loans

- Loans up to $10 million

- Min. credit score: can go as low as 550 for certain loans

- Min. time in business: 1+ years in business, no startups

- Funding times: 5 to 7 days for term loans and 24 - 48 hours for line of credit

- Flexible terms: 2 – 10 years for term loans

- Interest Rates: starting at 8.99% for term loans

- Applying does not impact credit score

- Nine loan products to choose from

- Low, competitive rates

- Large loan amounts

- Loan terms up to 25 years

- Excellent customer service

- Poor credit not accepted

- Not available in all states

- Must be in business at least one year

- High revenue requirements

A secured business loan from SMB Compass is one that is backed by collateral, typically in the form of equipment financing. Equipment financing loans range from $25,000 to $5 million with rates starting at 7.99%. Terms are up to 10 years, making them a great choice if your equipment has a high life expectancy. Ideally, you’ll choose a term that is equal to or less than the life expectancy of your equipment. Once your equipment needs to be replaced, your loan should be paid in full if you timed it right. To qualify for equipment financing with SMB Compass, you’ll need a credit score of 600, one year of business history, and $20,000 per month in revenue.

Main Features

SMB Compass offers nine different types of small business loans to borrowers, including secured business loans. Their mission is to make loans more accessible to small business borrowers by providing cost-effective and flexible lending solutions. SMB Compass business loans range from $10,000 to $10 million with terms up to 25 years. Rates start at 7.99% for qualified borrowers. The lender has currently provided more than 1,200 U.S. businesses with more than $250 million in financing. To apply, simply fill out their easy online application. It takes just a few minutes and will not impact your credit score. If approved, funding can be dispersed within 24 hours.

Lendzi - Best for Businesses With High Revenue

- Borrow up to $4 million in working capital

- Min. credit score: at least 500

- Min. time in business: 6 months

- Equipment financing up to $2 million

- Business line of credit up to $250,000

- See your options without hurting your credit

- Flexible terms: 3 to 15 months

- Excellent customer reviews on independent review sites

- Get funding in as little as 24 hours

- Simple online application

- Applying does not impact credit score

- Bad credit is accepted

- Fast funding times

- Excellent customer reviews

- Annual income requirement may be high

- Phone calls required after applying

- Startups may not qualify

Lendzi was founded in 2020 and offers low rates to businesses with high revenue on equipment financing loans. The reason for this is the equipment acts as collateral, which gives you a better rate on your loan. Lendzi also is known for their excellent customer satisfaction rates. They currently have more than 2,000 5-star reviews across multiple review sites, such as Google, TrustPilot, and Better Business Bureau.

Main Features

Equipment financing loans from Lendzi are up to $2 million with terms of 12 to 84 months. Rates start at just 3.49%, which are some of the lowest we’ve seen. Lendzi is both a direct lender and a lending marketplace, which gives you access to more than 75 lenders when looking for a secured business loan.

To increase your chances of approval, Lendzi recommends a business history of six months and $180,000 or more in annual revenue. The minimum credit score required is 550. Once you submit your application, a representative will be in touch to discuss your business in more detail and review your secured funding options.

Main Features of The Best Secured Business Loans

- Min. Credit Score - 550

- Min. Time in Business - 6 months

- Min. Annual Revenue - $180,000

- Loan Amount - Up to $2 million

- Interest Rate - From 3.49%

In this review, we highlight the terms, rates and fees of each secured business loan, and explain what makes them a good choice. We also share potential downsides of each company, and provide a rating methodology you can use to select the best secured business loan option for your needs.

Beyond their collateral requirement, secured business loans are no different than other small business loan options on the market. They can be used for a variety of expenses, such as working capital, purchasing real estate, or buying equipment. Whether you're searching for the best small business loans or specifically tailored secured loans, our experts reviewed and ranked the best secured business loan options available to help you get funded.

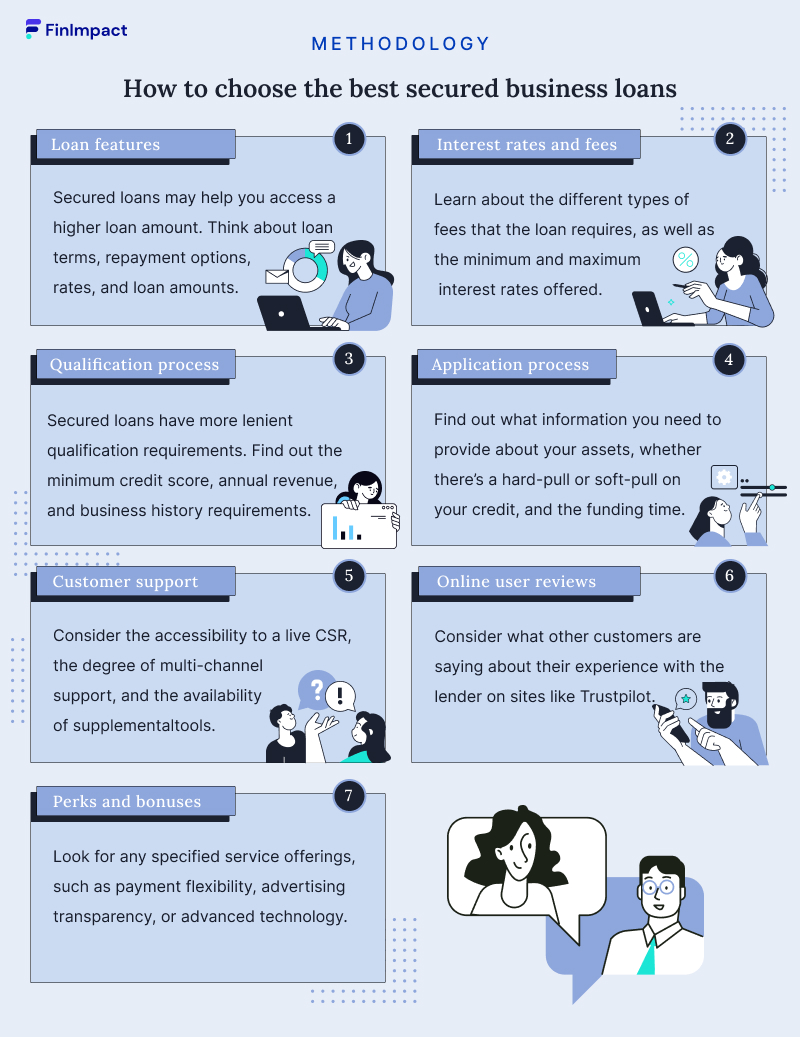

How to Choose the Best Secured Business Loan

There are many different factors that you need to consider when you search for the best secured business loan. Here’s what our experts looked at:

- Loan Features: You’ll need to think about loan terms, repayment options, interest rates, and loan amounts. Generally, choosing a secured business loan may help you access a higher loan amount then if you chose a similar unsecured business loan option.

- Application process: You’ll need to look at the invasiveness of the application information requirements, whether there’s a hard-pull or soft-pull on your credit, and the funding time. For secured loans, you'll usually need to provide some specific information about your assets.

- Interest rates and fees: Learn about the different types of fees that the loan requires, as well as the minimum and maximum interest rates offered.

- Qualification process: Educate yourself on the qualification process, including any requirements for minimum credit score, annual revenue, or business history. Typically, choosing a secured business loan allows for more lenient qualification requirements.

- Customer support - Consider the accessibility to a live customer support representative, the degree of multi-channel support, and the availability of supplemental information and tools.

- Online user reviews: Be sure to read reviews on independent review sites like Trustpilot.

- Perks and Bonuses: Look for any specified service offerings, such as payment flexibility, advertising transparency, or advanced technology.

What Is a Secured Business Loan?

A secured business loan is a type of borrowing in which one or more of your business assets is used as collateral. If you fail to keep up with payments, the lender may seize this collateral to cover the cost.

Typically, lenders will accept the following assets as collateral: commercial property, inventory and stock, large pieces of equipment and machinery, vehicles, and unpaid invoices. Interest rates on secured loans tend to be lower than other borrowing arrangements, but they present a greater risk to the borrower.

Traditional lenders, like brick-and-mortar banks, prefer this type of borrowing. There’s also a host of alternative, online platforms that provide secured debt arrangements.

Secured Vs. Unsecured Business Loan: What’s the Difference?

The main difference between a secured business loan and an unsecured one is collateral. Secured loans require it; unsecured business loans don’t. If you’re able to put down collateral, we recommend doing so. It eliminates risk for the lender and therefore gives you better interest rates and terms.

For unsecured business loans, take a look at these best loans for working capital.

Below is a breakdown of the differences between secured and unsecured business loans:

- Risk - Secured loans will require you to put down one or more of your business assets as collateral. Should you fail to keep up with the payments, the lender may seize those assets to cover the cost. Because of that, the lender will be able to offer you a lower rate.

- Interest rates - Rates generally tend to be much lower for secured loans than unsecured business loans. This is attributable to the collateral associated with the former. It greatly reduces the risk of lending, thereby enabling creditors to offer lower rates.

- Borrowing limits - Because you’re borrowing against the value of a specific asset, the lender can offer greater financing flexibility. In some circumstances, the loan amount can be quite high. For example, if you post a fleet of vehicles, an expensive piece of machinery, or an expansive stock inventory, your borrowing limit could easily reach hundreds of thousands of dollars.

- Term limits - This is another area where secured loans come out on top. You might find terms as long as 10 or 25 years, while unsecured business loan options tend to hover at around five-year limits.

Types of Secured Business Loans

- Mortgage - A mortgage loan is the most recognizable type of secured loan. Like a residential home loan, it entails the pledging of real estate property. For businesses, the property pledged is a commercial real estate asset.

- Equipment financing - With this type of arrangement, the borrower purchases a specific piece of equipment and simultaneously pledges it as collateral. Lenders will usually provide between 80% and 100% of the total value of the asset being purchased. Here are the top equipment financing lenders.

- Term loan - A term loan is a traditional type of fixed-rate borrowing that entails a fair amount of flexibility regarding collateral. Most term loans do not require collateral, but if you have it, it’s worth mentioning to the lender to see if you can get a lower rate.

- SBA 7(a) loans - Small Business Administration (SBA) loans are guaranteed by the federal government, usually on an unsecured basis. However, those borrowing more than $350,000 must provide some form of collateral. Here are our top recommendations for SBA lenders.

- Business line of credit: A business line of credit can be secured or unsecured, but a secured business line of credit requires collateral. The collateral can be business assets such as equipment, inventory, or accounts receivable.

Types of Collateral to Secure a Business Loan

Collateral is any asset that backs the loan, including cash reserves. This makes the loan significantly less risky for the lender because if you are unable to make the payments, the lender is able to confiscate the collateral. Types of collateral for secured business loans include:

- Inventory - This is a popular choice for predominantly product-based businesses, such as e-commerce stores and retail outlets that carry large amounts of stock. Bear in mind, you’ll need inventory with long shelf lives to qualify for funding.

- Property - This is a very common source of collateral, but quite risky in the event of default. Failure to keep up with payments could have a significant impact on your business.

- Equipment - Another popular choice for businesses is the pledging of equipment. This route is most often taken when purchasing equipment, vehicles, and/or specialized machinery. It is probably one of the easier types of funding to secure, given the transparent and easily verifiable nature of the purchased asset.

- Invoices - Many businesses have long turnaround times on invoices and might not receive payment for work until months after completion. Lenders can accelerate the cash flow by providing funding, as long as you are willing to pledge the invoices as collateral.

- Blanket lien - This is a common arrangement for borrowers with poor credit. A blanket lien gives the lender full discretion to use any of your business assets to cover your debt in the event of default.

How to Get a Secured Business Loan?

Step one - Do your research

Make sure your chosen lender will accept the type of collateral you’re offering. Some will ask for specific items of equipment or inventory, while others will provide a blanket lien. You should understand what’s at risk before you apply. It might also be worthwhile to perform a valuation of your assets beforehand.

Step two - Start submitting applications

Most alternative lenders will let you submit an application without facing a hard pull to your credit rating. This is a great way to assess your financing potential. We recommend trying a few loan marketplaces to help increase your chances of finding an optimal solution.

Step-by-step business loan application process explained

Step three - review eligibility criteria

Each lender has distinct criteria you’ll need to meet before you can apply. A few fairly common criteria include your credit rating, the length of time you’ve been in business, and your monthly income. All criteria should be made clear before you apply.

Step four - Gather your documentation

Once you’ve chosen a lender and the type of secured business loan you’d like, it’s time to prepare your documentation. Most secured loans will require, at a minimum, the following items:

- Proof of identity

- Evidence of your monthly income

- Evidence of ownership of any asset being used as collateral

- Personal and business tax returns

- Three months of bank statements

In addition, many lenders will ask for business licenses and leases, along with other pertinent information related to your business.

Secured Business Loans Pros and Cons

Secured Business Loan Pros

- Low-interest rates. Since lenders are almost guaranteed to recover the money being loaned, either through the receipt of regular payments or seizure of collateralized assets, credit risk is low. As a result, lending rates tend to be relatively low.

- High funding limits. When taking out a secured loan, the limit can be quite high relative to an unsecured arrangement. This is especially true if you have a particularly valuable asset to use as collateral.

- Easier to obtain. If you’re already in possession of a high-value asset, oftentimes, it can be used as proof of previous business acumen. Moreover, if pledged as collateral, it can facilitate a loan approval.

- Long repayment terms. Since lenders have a good idea of the lifetime of any assets pledged, this can often result in generous repayment terms, often up to 25 years.

Secured Business Loan Cons

- Higher risk to borrower. Borrowers should always be aware that any asset they pledge as collateral could potentially be seized in the event of default. Make sure the collateral you pledge isn’t critical to your business.

- Must have an established business. It’s very rare for startups to be able to access secured funding, simply because they haven’t been around long enough to accumulate a pool of marketable assets. This usually translates to relatively high-interest rates for newbies.

Final Thoughts

While secured business loans do require that an asset be used as collateral to secure the funding, they also have their advantages. Often, choosing a secured business loan can help you access a better interest rate and more lenient qualifying requirements. If you’re interested in accessing this type of loan for your business, use this list of lenders to help you get started finding the right match for you.