Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses or reviews expressed in this article are those of the author alone and have not been approved or endorsed by any partner.

Funding Circle Reviews: Expert Analysis & User Insights for 2024

Funding Circle connects business owners to a variety of financing products - including term loans, SBA loans, and business lines of credit. Compared to other lenders, it offers low rates, an easy online application process, and personalized customer service to meet your small business needs.

Expert Reviewer Verdict

Funding Circle is a peer-to-peer marketplace lender founded in 2010. It uses technology to match small business borrowers to investors who are offering financing. It’s best for business owners who have been around for at least two years, have good to excellent credit, and are looking for a fast alternative to bank loans.

While Funding Circle lends to businesses in a variety of industries, its loans are not available to nonprofits, speculative real estate firms, weapons manufacturers, gambling businesses, marijuana dispensaries and those in pornography. Loans are available in all states except Nevada.

Funding Circle Loan Reviews

Funding Circle loans have a very respectable score of 4.5 out of 5 stars on both TrustPilot and MerchantMaverick. Customers are particularly impressed with the constructive and helpful support provided by the customer service team, along with how easy the application process is.

Some customers have been shocked by the possible high origination fees, and others feel the withdrawal fees on lines of credit are a little steep. Funding Circle does make every effort to respond to each piece of criticism individually and welcomes any direct feedback via its website and customer service team.

| Positive Reviews | Negative Reviews |

| Excellent customer service | High origination fees |

| Fast application process | Expensive withdrawal fees |

| Clear guidance on loan types | Poor responses to emails |

| Fast turnaround times on funding | Slow service on complex applications |

Summarized Ratings

Funding Circle gets a 3.4 for Loan Features. This slightly above average score reflects a fairly broad offering of loan terms, somewhat flexible loan limits, and highly accommodative repayment options.

What Is Funding Circle?

Funding Circle is P2P lender that connects you directly to investors that you’ll be repaying the loan to. However, Funding Circle will underwrite the loans and approve any applications. Rates are competitive, ranging between 4.99%-27.99% (estimated) and you can borrow up to $500,000.

The applications are flexible, but Funding Circle does require a minimum credit score of 660. However, you will be assessed on more than just your credit score, making the process a little easier.

Funding Circle Pros and Cons

Pros

Cons

Funding Circle Loan Features

All investors are welcome to join the platform and lend money to various businesses at different levels of risk. You’ll find banks, large financial institutions, and angel investors alongside regular retail investors looking for a good return on their savings. For borrowers, the loan features will largely be dependent on your credit score, your length in business, and your annual revenue. Funding Circle offers five types of small business loans, outlined below.

SBA Loan

SBA loans are guaranteed by the government, and you won’t be borrowing the money directly from Funding Circle. These types of loans generally have more lenient eligibility requirements than traditional bank loans and they offer lower interest rates.

| Term Length | Up to 10 years |

| Repayment Period | Usually monthly |

| APR Range | Prime rate plus 2.75% (the time of writing the prime rate is 6%, so a total of 8.75%) |

| Min-Max Amount | $75,000 to $500,000 |

Small Business Loan

A fairly standard offering and one of the most popular loan choices on offer, small business loans can be approved within 24 hours and funded within three days of loan approval.

| Term Length | 6 months to 7 years |

| Repayment Period | Monthly |

| APR Range | 4.99% - 27.99% |

| Min-Max Amount | $25,000 to $500,000 |

Line of Credit

Business lines of credit are a flexible loan type that allows you to borrow from a designated borrowing limit and only pay interest on the money you withdraw. Think of it as a credit card with much higher borrowing limits. Plus, these types of loans can usually be approved much more quickly than other types of lending.

| Term Length | No limits disclosed |

| Repayment Period | Daily, weekly or monthly |

| APR Range | Starting from 4.8% Plus a withdraw fee |

| Min-Max Amount | $6,000 to $250,000 |

Merchant Cash Advance

A merchant cash advance involves borrowing against your expected credit and debit card sales. For the length of your loan, you’ll repay directly via your credit card sales, including any interest.

| Term Length | 3 - 18 months |

| Repayment Period | Monthly or weekly |

| APR Range | Factor rates from 1.15 |

| Min-Max Amount | $5,000 to $400,000 |

Invoice Factoring

Invoice factoring involves borrowing against any unpaid invoices. It’s a type of short-term borrowing to cover cash flow issues, and your loan is usually paid off once your clients have paid you the following month. With invoice factoring, you can borrow 85-90% of the invoice amount upfront.

| Term Length | Usually one month |

| Repayment Period | Daily or weekly |

| APR Range | Starting from 0.25% per week |

| Min-Max Amount | $6,000-$100,000 |

Funding Circle Interest Rates and Fees

Fees and rates can vary considerably across each type of loan, and not everything will be disclosed until you apply. However, we’ve outlined what you can expect below.

| SBA Loan | Small business Loan | Line of Credit | Merchant Cash Advance | Invoice Factoring | |

| Origination Fees | 3.49% - 6.99% | 3.49% - 6.99% | 3.49% - 6.99% | 3.49% - 6.99% | 3.49% - 6.99% |

| Withdrawal Fees | None | 1.6% - 2.5% | 1.6% - 2.5% | None | None |

| Late Payment Fees | 5% | 5% | 5% | 5% | 5% |

| Maintenance Fees | 1% annually | 1% annually | $20 annual fee | Not disclosed | Not disclosed |

| Interest Rates | Prime rate plus 2.75% | From 4.8% | From 4.8% | Factor rates from 1.15 | Starting from 0.25% per week |

Late payment fees are charged for payments more than seven days overdue.

How to Qualify for a Funding Circle Loan?

To be eligible for a business loan, Funding Circle requires that you’ve been in business for at least two years and have no personal bankruptcies within the past seven years. In addition, one business owner must have a minimum personal FICO score of 660.

While there is no minimum annual revenue requirement, Funding Circle’s other criteria seems to be stricter than that of other lenders. According to Funding Circle, the average borrower has good to excellent personal credit, has been around for 11 years, earns $1.4 million in annual sales, and has a team of 12 employees.

The Funding Circle Application Process

While Funding Circle offers a number of small business loans, the application process is the same for every prospective borrower. Here’s what it entails.

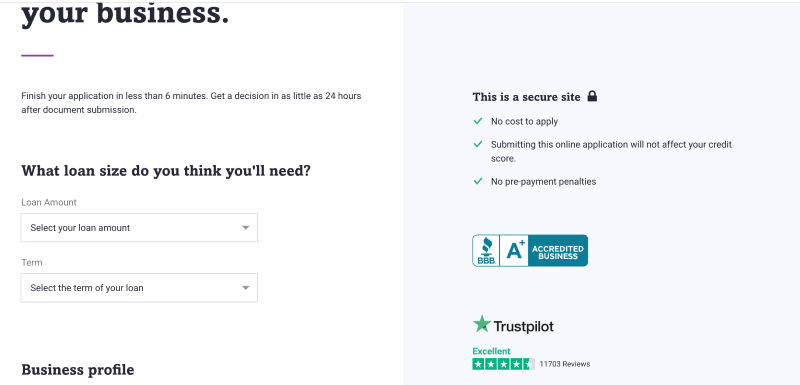

1. Submit an online application

Visit the Funding Circle website and click “Apply Now” on the upper right hand corner. The application will take less than six minutes to complete and will ask you for the following:

- Loan amount

- Loan term

- Business name

- Owner’s name

- How long you’ve been in business

- Your financial history

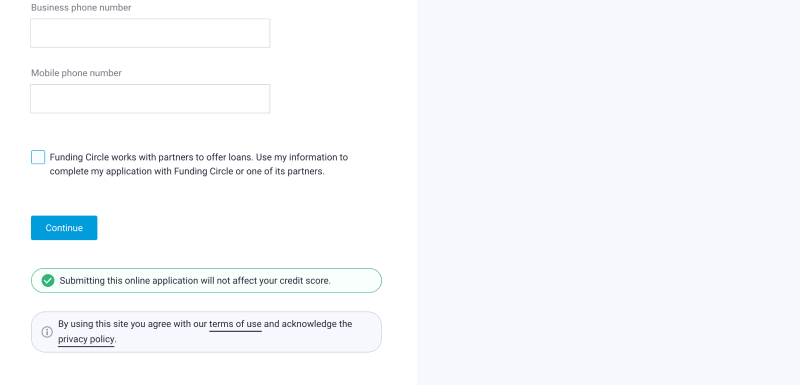

You’ll need to check a box that states Funding Circle can distribute your information to its lending partners. Note that your credit score won’t be affected if you submit an application.

2. Connect to a personal account manager

Once you complete your application, a personal account manager will contactyou. They’ll discuss your needs and may request additional information and documents, such as bank statements, personal tax returns, business tax returns, and more.

3. Wait for a decision

You won’t have to wait long to find out whether you’ve been approved for a Funding Circle loan. Depending on your situation, you might receive an answer in as little as 24 hours. If Funding Circle would like more information, they’ll get in touch before they make a decision.

4. Accept the loan and collect funds

Upon approval, you’ll receive a loan agreement. If you decide to pursue the loan, the money will be distributed to your business bank account in as little as one business day.

5. Start making payments

During the application process, you’ll enroll in automatic payments from your business bank account. However, if you prefer, you can repay your loan via check.

How Funding Circle Determines the Loan Amount

Everything here is based on how much risk the investors are willing to take on. If you’ve got a high-risk venture to propose, your application will likely come with a higher interest rate and shorter repayment terms in order to guarantee your investors make some kind of return. Outside of this, your previous business performance, general financial health, and business plan will all help in determining your final offer.

Funding Circle is at the forefront of innovation in the lending industry and recently won an award from the Center for Financial Professionals for its contributions to FinTech. In addition, the platform can stake claim to creating more than 135,000 sustainable jobs throughout 2020, quite an impressive feat during a global pandemic. Funding Circle takes great care to review every application that comes through its doors, meaning those that do get accepted have a much higher chance of maintaining a successful business.

Funding Circle Customer Support

- Funding Circle offers customer service via phone and email. You may call 855-385-5356 to connect to a representative Monday through Friday from 7am to 4pm PST or email customer support at loanquestions@fundingcircle.com.

- The lender’s detailed FAQ page answers questions you might have on applying for loans, repaying loans, the costs of borrowing, and more.

- If you decide to move forward with Funding Circle, you’ll be assigned a personal account manager who can help you find the best loan for your small business and guide you through the process. You can count on them to ensure your application has been completed correctly and inform you of a decision in as little as 24 hours.

The majority of Funding Circle reviews are positive. Most customers are pleased with the helpful customer support.

“Great service. Great customer care. We got approved for a loan quickly and the follow up due diligence was carried out without a hitch,” said one customer. “These guys provide an unbelievable loan application service. They are simply the best. From the start of the loan application to the receipt of the fund was easy and very straightforward.,” explained another satisfied Funding Circle borrower.

Funding Circle Perks and Bonuses

Flexibility

If you’re late on repaying your loan or believe you will be, Funding Circle encourages you to get in touch with them right away. Depending on your circumstances, they can explore several options.

Transparency

The Funding Circle website is professional and informative. It features detailed information about each loan product, plus provides a handy resource center, loan calculator, list of frequently asked questions, and customer success stories. In addition, the website is transparent about rates and fees. Overall, Funding Circle has a track record of ethical sales. This is no surprise, as the lender “believes small businesses should be protected from unfair, deceptive financial practices.”

Technology

Funding Circle can set up automatic payments from your business bank account so you’re never late and always keep your credit score in tip-top shape. Unfortunately, the mobile app is only available to investors at this time, so you’ll have to manage your loan on a computer or laptop rather than a mobile device.

Final Thoughts

The flexible loan options, generous terms, high funding limits, and low interest rates all make Funding Circle a great choice for a small business loan. Combine this with a smooth application process and excellent customer support, and you can rest easy knowing your borrowing needs will be well taken care of.

However, if you have bad credit, are a new startup, or simply don’t have enough business experience, you'll likely need to try another lender.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!