Many or all of the products featured here are from our partners who compensate us. This may affect which companies we write about and where the company appears on a page. However, any analyses, or reviews expressed in this article are those of the author’s alone, and have not been approved or endorsed by any partner.

Best SBA Lenders: Top 7 Options to Consider in 2024

SBA loans are backed by the Small Business Administration (SBA) and can be used to start or expand your business, purchase equipment or inventory, pay off existing business debt, or even buy commercial property. Below, you’ll find our picks for the best SBA lenders on the market.

Fundera - Best for Comparing Loan Offers

- Connections to multiple lenders

- Competitive rates

- Soft credit check

- Min. credit score 550+

- Multiple offers with one application

- Competitive rates

- Soft credit check

- Application process may take several weeks

- Currently only offers two SBA lenders

While Fundera does offer some loans directly, it also has a loan marketplace that connects borrowers with the best financing options, including SBA loans. Once you input a few details about your business, you will be shown offers from SBA and other lenders, including the rates and terms you qualify for. If you choose one of these options, Fundera gets a referral fee and you get the SBA loan you are looking for.

Main Features

SBA loans offered by Fundera partners, like all SBA loans, can be used for a variety of purposes, from buying equipment to investing in marketing. With the SBA 7(a) loan, you can borrow up to $5 million. With CDC/504 loans, you can borrow up to $5.5 million, and with SBA microloans, up to $50,000.

GoKapital - Best for Low Interest Rates

- Borrow up to $5 million

- SBA loan terms 5 - 25 years

- SBA loan APR range 5% - 9%

- Wide range of loan offers

- Simple application process

- Instant pre-approval

- Min. credit score 680

- Min. time in business 2 years

- Large loan amounts

- Terms up to 25 years

- Competitive interest rates

- Must be in business at least two years

- Not all industries will qualify

- High annual revenue requirements

GoKapital offers six different types of loans to small businesses, including SBA loans. If you have strong credit and a solid business history, an SBA loan from GoKapital can offer some of the best rates around. While funding times can be a bit longer with SBA loans, the rates and terms are usually significantly better than with traditional small business loans. If you can wait 30-60 days for funding, an SBA loan from GoKapital could save you thousands in interest.

Main Features

An SBA loan from GoKapital ranges from $250,000 to $5 million with terms of 5 to 25 years. Rates are some of the lowest you’ll see in the industry, starting at just 5%. Once you fill out an application, you should receive a response within three to five business days. From there, it does take a little while for funding - up to three months, but the savings in interest can be well worth your wait.

Funding Circle - Best for a Flawless Application

- Few restrictions to your loan purpose

- Quick and straightforward application

- Min. Credit Score 650

- Min. TIme in business 2 years

- Loan specialists aid with application

- Competitive rates

- Fast funding

- High annual revenue requirements

- Closing cost, loan guarantee, and broker fee

Funding Circle provides you with one of their loan specialists to help you with the entire SBA loan process. Start by answering a few questions about your business, and then you’ll receive a call from a Funding Circle Loan Specialist. The loan specialist will then help you fill out the rest of the application, increasing your chances of being approved for an SBA loan. Funding Circle has a network of lenders that can provide in-house approvals in a matter of weeks.

Main Features

Funding Circle lending partners offer SBA 7(a) loans of $50,000 to $500,000 with loan terms up to 10 years. These loans have a flat rate of 6%, which is the current Prime Rate plus 2.75%. Applying for a loan will not impact your credit score.

Credibly - Best for Fast Funding

- Min. Credit Score: 550+

- Min. Time in Business: 6 months

- Borrow up to Up to $250,000 in term loans

- Borrow up to $400,000 in working capital

- Term loan rates range between 8-25%

- Working capital factor rate starts at 1.09

- Simple application process

- As soon as same day funding

- Open to high-risk industries

- SBA loans up to $20 million

- Fast application process

- Same-day funding once approved

- Transparent criteria to qualify

- Collateral may be required

- You may need to make a down payment

Credibly offers two types of SBA loans: SBA 7(a) loans and SBA 504 loans. SBA 7(a) loans are used for everyday business expenses, whereas SBA 504 loans are used for commercial real estate financing. Credibly prides itself on getting you your money fast. Once you’re approved for a loan, you can see the funds hit your account the same business day. You can also get approved quickly; where other SBA lenders can take two to three months to process your application, an SBA Preferred Lender like Credibly can process your application much faster.

Main Features

Credibly SBA loans can be used for a variety of purposes, from working capital to debt consolidation and equipment purchases. You can borrow less than $150,000 up to $20 million, depending on the SBA loan type. Fixed interest rates start at 6.99%.

SMB Compass - Best for Large Loans

- Loans up to $10 million

- Min. credit score: can go as low as 550 for certain loans

- Min. time in business: 1+ years in business, no startups

- Funding times: 5 to 7 days for term loans and 24 - 48 hours for line of credit

- Flexible terms: 2 – 10 years for term loans

- Interest Rates: starting at 8.99% for term loans

- Applying does not impact credit score

- Nine loan products to choose from

- Low, competitive rates

- Large loan amounts

- Loan terms up to 25 years

- Excellent customer service

- Poor credit not accepted

- Not available in all states

- Must be in business at least one year

- High revenue requirements

SBA loans from SMB Compass come with large loan amounts, competitive rates, and flexible loan terms up to 25 years. Funding does typically take a bit longer than with traditional small business loans, but SMB Compass usually can fund SBA loans within 30-60 days. To qualify for an SBA loan, the lender prefers a minimum credit score of 620, three years of business history, and $500,000 in annual revenue. If you don’t quite meet these requirements, SMB Compass offers eight other loan products that may be a better fit.

Main Features

SMB Compass offers nine different types of small business loans to borrowers, including SBA loans up to $10 million. Their mission is to make loans more accessible to small business borrowers by providing cost-effective and flexible lending solutions. SMB Compass SBA loans range from $100,000 to $10 million with terms up to 25 years. Rates start at 8.5% for qualified borrowers. The lender has currently provided more than 1,200 U.S. businesses with more than $250 million in financing. To apply, simply fill out their easy online application. It takes just a few minutes and will not impact your credit score. If approved, funding can be dispersed within 24 hours.

SmartBiz - Best for Upfront Pricing

- SBA 7(a) loans up to $350,000

- SBA commercial real estate loans up to $5 million.

- Min. Credit Score: 660

- Min. time in business: 2 years

- Loan Repayment 10 - 25 years

- SBA 7(a) loan rates: 10.75% - 11.75%

- SBA Commercial real estate loan rates: 5.50-6.75%

- Receive multiple loan offers

- Clearly communicated interest rates

- Streamlined SBA loan application process

- Financial professionals to help

- Higher requirements to qualify

- May be additional applications with lender

It’s not always easy to understand how much you’ll pay in interest for an SBA loan, but SmartBiz puts its pricing up front so you can easily calculate what it might cost to borrow money from the lender. In addition to transparent pricing, SmartBiz has financial professionals who can guide you through the streamlined application process, helping you get your loan funds faster. And because SmartBiz is a lending platform, you’ll get multiple offers from different lenders to choose from.

Main Features

SmartBiz lenders offer 7(a) loans of $30,000 to $350,000, as well as commercial real estate loans of $500,000 to $5 million. The interest rate for the 7(a) loans is the Prime Rate plus 2.75% to 3.75%, which currently makes that range 6.25-7.25%. The rate for the commercial real estate loans is Prime plus 1.5% to 2.75%, so currently 5-6.25%.

Lendzi - Best for Excellent Customer Service

- Borrow up to $4 million in working capital

- Min. credit score: at least 500

- Min. time in business: 6 months

- Equipment financing up to $2 million

- Business line of credit up to $250,000

- See your options without hurting your credit

- Flexible terms: 3 to 15 months

- Excellent customer reviews on independent review sites

- Get funding in as little as 24 hours

- SBA loans up to $5 million

- Shop multiple SBA lenders all in one place

- Competitive interest rates

- Excellent customer service

- No impact on credit when applying

- Funding times are longer than with traditional loans

- Must have decent credit

- Relatively high annual income required

Lendzi was founded in 2020 and is a direct lender and a lending marketplace. The company offers a multitude of small business loan products, including loans backed by the Small Business Administration. One of our favorite features of Lendzi is their excellence in customer service. And, with more than 2,000 5-star reviews on sites like Google and TrustPilot, past and present customers agree. It takes just a few minutes to fill out an application on Lendzi’s website, and from there an expert representative will give you a call to discuss your business and loan options further. This makes the entire process quicker and more efficient.

Main Features

Lendzi does the work for you by connecting you with many SBA lenders to choose from. SBA loans can be used for any business expense, and rates are typically lower than with other types of financing. Types of SBA loans offered by Lendzi include SBA 7(a) loans, SBA 504 loans, SBA microloans, SBA disaster loans, and more. The SBA 7(a) loan is the most popular type, and most borrowers can request anywhere from $5,000 to $5 million.

Main Features of The Best SBA Lenders

- Min. Credit Score - 680

- Min. Time in Business - 2 years

- Min. Annual Revenue - $150,000

- Loan Amount - Up to $5 million

- Interest Rate - 6.5% on average

There are many factors to consider when choosing the right SBA lender for your business. In this review we highlight the rates, fees and terms of each SBA lender and explain what makes them a good option. We also share potential downsides of each lender, and provide a rating methodology you can use to select the best option for your needs.

SBA loans come with lower interest rates and longer repayment periods than other types of funding. If your business is in need of working capital, whether that’s to expand your business or pay for daily expenses, an SBA loan can help meet those needs.

While SBA loans are backed by the federal government, they are not funded by them. Instead they are funded by banks and online lending institutions. Our team of financial experts reviewed and ranked the top online business lenders to help you get funded.

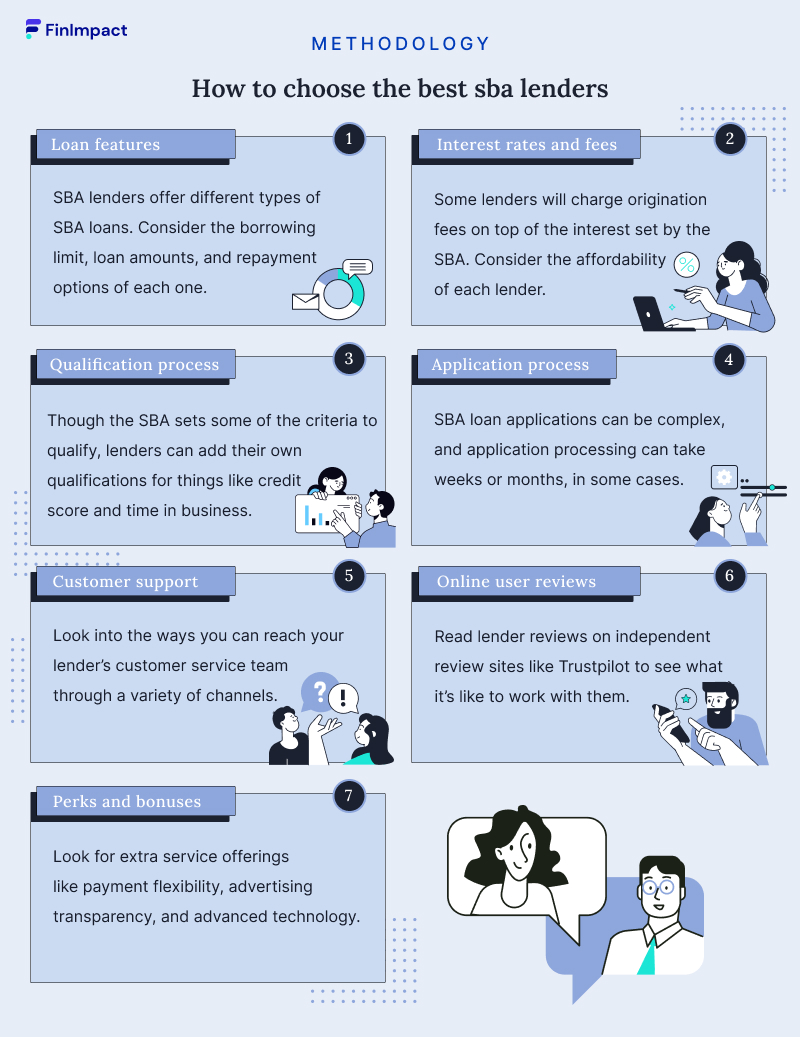

How To Choose the Best SBA Lenders?

- Loan Features: SBA lenders offer different types of SBA loans, each with its own borrowing limit and requirements.

- Application process:SBA loan applications can be complex, and application processing can take weeks or months, in some cases.

- Interest rates and fees: Some lenders will charge origination fees on top of the interest set by the SBA. Affordability was a strong factor we took into consideration.

- Qualification process:Though the SBA sets some of the criteria to qualify, lenders can add their own qualifications for things like credit score and time in business.

- Customer support:Being able to reach your lender’s customer service team any time, and through a variety of channels, is important.

- Online user reviews: We read lender reviews on independent review sites like Trustpilot to see what it’s like to work with them.

- Perks and Bonuses: Look for extra service offerings like payment flexibility, advertising transparency, and advanced technology when considering SBA lenders.

What is SBA Lending?

Small Business Administration (SBA) loans are a type of small business funding that will be funded by a bank, alternate lender, or a group of lenders. Each loan is partially backed (up to 85%) by the federal government, but the SBA doesn’t actually fund the loans themselves .

Since the loans are backed by the SBA, though, the lender takes on less risk and is therefore able to offer lower rates. There are many different types of SBA loans available at any one time, each one fulfilling a specific business need.

What Are the Different SBA Loan Types?

| SBA Loan Program | Max loan amount | Terms | Interest Rates | Best for |

| SBA 7 (a) Loans | $30,000 - $5 million | Up to 25 years | Between 2.25% - 4.75% plus base rate | A wide range of operational expenses like business expansion, inventory, staff wages, and debt consolidation |

| SBA 504 Loans | Up to $5 million | 10 - 20 years | 2.75% - 6% | For purchase and improvement of buildings, land, and new or existing facilities |

| SBA Microloans | Up to $50,000 | Up to six years | 8% - 13% | Small capital expenses (cannot be used to pay existing debt) |

| SBA CAPLines Loan | Up to $5 million | Up to 10 years | From prime rate plus 2.25% | Seasonal businesses, contractors, and builders |

| SBA Disaster Loans | Up to $2 million | Up to 30 years | 4% - 8% | A business that has suffered physical damage or disaster |

| SBA Express Loan | Up to $500,000 | 7 years for revolving line of credit | From prime rate plus 4.5% | Organizations that need fast funding, often within 36 hours |

| SBA Community Advantage Loans | Up to $350,000 | Up to 25 years | From prime rate plus 6% | Mission-oriented businesses in areas traditionally underserved by lenders |

SBA Loans for Small Businesses Pros and Cons

Pros

- Low interest rates - As SBA loans are backed by the government, lenders see this type of borrowing as low risk. This means you’ll usually find much lower rates than other types of business lending.

- Reasonable terms and conditions - Borrowers are often surprised to see just how generous the terms and conditions are with SBA loans. Most can be repaid over a 25 year period and other fees and charges are kept to a minimum.

- Business growth - SBA loans have been designed specifically to provide a boost to local economies. This means that any business looking to grow, hire new staff, purchase equipment, or benefit the local community will be more likely to be approved.

- More consistent cash flow - Many businesses have uneven cash flow through the year or long payment terms on accounts receivable. SBA loans are perfect to cover gaps in cash flow issues, such as maintaining payroll and other day-to-day expenses while waiting on client payments.

Cons

- Tougher eligibility requirements - It’s harder to get your hands on an SBA loan than other types of lending. You’ll need good to excellent credit, strong financial history, and evidence of high income.

- High amounts of paperwork - You’ll need to provide a substantial amount of documentation, including tax returns, balance sheets, business plans, and projected revenue. It can take several months to process and approve an SBA loan.

How Do SBA Loans Work

The US Small Business Administration Department doesn’t loan you the money itself. Instead, it sets guidelines for SBA loans and private lenders will work within these when assessing your application.

Up to 85% of the funding will be guaranteed by the federal government, although the exact amount will vary across platforms. Most SBA loans require significant paperwork and extra time to process, so we wouldn’t recommend them for anyone that needs emergency funding.

SBA loans also offer unique advantages when compared to other loans. Not only are the terms competitive, but some loans provide counseling and education to help support your business. Others may have low down payment options or more lenient overhead requirements. SBA loans were designed with you in mind, and they want to help your small business succeed.

How to Apply for an SBA Loan

To apply for an SBA loan, you start by submitting an application to one of the top SBA lenders mentioned above. It’s a fairly straightforward process, and many platforms will be able to present you with various options within minutes of submitting your application.

Here’s how long it takes to get an SBA loan >>

However, to complete the process, you’re going to need to submit a good amount of paperwork, and it could take several months to receive your funding. You should prepare the following documents:

- Proof of identity, usually a form of government-issued ID like a driver’s license

- Your personal financial information, including several years of tax returns

- Business financial information including

- Year-end profit and loss statement

- Year-end balance sheet

- Reconciliation of net worth

- Interim balance sheet and profit statement

- Projected financial statements

- Your business certificate or license

- Resumes of all principal owners of the business

- Business lease information

These are usually requested as a minimum and there might be additional documentation you’ll need to provide.

SBA Loan Rates for Small Businesses

SBA loans remain popular because the rates are typically much lower than you’ll find with other types of borrowing. While other small business funding can run into double-digit interest, the government has set caps on all SBA loans. For example, the most popular type of SBA product, the SBA 7(a) loan, has rates set at a maximum of 4.75% plus base rate, and many businesses will actually be offered even lower rates than this.

Another great example is a 504 loan, which is used for real estate lending. Rates are capped at 6% with repayment terms set over 25 years. This is much better than you’d find at a number of commercial mortgage providers.

Conclusion

If you’re looking for working capital to invest in marketing, advertising, new hires, or office space, a loan backed by the Small Business Administration can provide you with low interest rates and long repayment terms. If you qualify for an SBA loan, you’ll save significantly over what you’d pay with other types of loans online.

Frequently Asked Questions(FAQ)

This app literally changed my like. It provides a great experience. I absolutely love it!

Related Loan Picks

Startup Business Loans

Read MoreInvoice Factoring

Read MoreSmall Business Loans for Veterans

Read More